Constructing Low Volatility Strategies

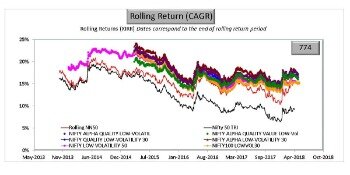

In contrast, an active manager can favor stocks with higher expected returns. Therefore, though many portfolios will deliver similar levels of volatility reduction, they will offer very different levels of expected return. Factor investing is an inve...