Table of Contents

- State Of The Market

- Bitcoin Sv

- Understanding Market Capitalization

- Total Market Capitalization Dominance, %

- Market Cap Doesnt = Value

To summarize, crypto market cap matters because it’s easy to understand and a decent starting point for analyzing a cryptoasset. It’s also important because so many players consider it to be important. As the crypto space matures, better tools will be developed that will provide market participants with in-depth, actionable information. When that happens, market cap will likely lose its place as the leading crypto indicator. The market capitalisation of the Top 10 cryptocurrencies fell by $57 billion in a month . The market capitalisation of the Top 10 cryptocurrencies grew by $4.34bn in a month .

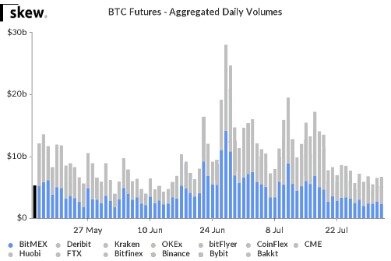

High trading volume is a sign of liquidity, which allows traders to enter and exit positions quickly. High volume signals that a market is healthy and worth investing in.

State Of The Market

Investors who purchase utility tokens believe in the project with which they’re associated and want to buy in before the price goes up. Bear in mind that the total supply of utility tokens is usually fixed. Coindesk hasfoundthat there are companies offering to fake volume for a fee. These outfits program bots to buy and sell a token continuously until trading volume is sufficiently inflated to earn a ranking on CoinMarketCap and other exchange aggregator sites. Most of the time, wash trading is engaged in by exchanges, but it can be done by token owners as well. Some exchanges encourage their customers to wash trade for them. These exchanges compensate wash traders with tokens or discounted fees.

Starting from square one may yield terrific long-term results, but the process is slow, costly, and difficult to execute. It is vital to distinguish hype from an idea with a real-world use case.

Bitcoin Sv

If the price per Bitcoin reaches $50,000 when the maximum supply is mined, its market cap will surpass $1 trillion. Considering that Bitcoin accounts for more than 60% of the crypto market cap, it means that the entire market will only be worth about $2 trillion. Although we can’t know for sure, we can make some assumptions based on present information and expert projections. If the crypto market cap reaches $200 trillion, it will mean that cryptocurrencies represent the majority of the world’s wealth.

Backing from well-known companies means more transparency and a more natural path for projects to establish themselves on the market. A large number of coins are designed with continuously expanding protocols.

When calculating the market cap of a particular cryptoasset, it is the circulating supply that should be taken into account. Circulating supply is the number of tokens that are currently available on the market. Circulating supply is a better metric than total supply because it excludes coins that are reserved or locked.

After the time of the fork, users could claim tokens on each side of the fork if they had previously held tokens on the old Bitcoin Cash chain. The total value of the top 10 cryptocurrencies is $200.79bn. This is a dramatic fall of $80bn since June where the total value stood at the $281bn mark. This month sees all the cryptocurrencies remaining in the same position in the Top 10. Whilst there is no change in rankings to report, its interesting to note that Ripple actually gained approximately $10bn during the month.

Understanding Market Capitalization

It’s used everywhere as a justification for investment decisions and a metric to measure the size and value of a cryptocurrency or token. Panel is the birth market capitalization of coins and tokens . The red solid line is the best linear fit of the tokens’ birth market capitalization. Panel plots the number of birth of coins and tokens , smoothed by a 180 day moving average. The horizontal blue dashed lines in the middle and lower panels are the 95% confidence intervals assuming a Poisson process for coins, whose mean is estimated on the full window . The number of births per day is shown in blue and red bars, against the right y-axis.

Will tether affect Bitcoin?

According to data collected by asset manager NYDIG and cited by JPMorgan analysts, around 50%-60% of bitcoin traded for USDT since 2019. Hence, a sudden loss of confidence in tether could end up triggering the crypto version of a bank run, destabilizing exchanges and causing a panic drop in bitcoin’s price.

Though stock and crypto investors use the same indicator, the calculation differs in some respects. In order to understand market cap, it’s important to consider its constituent parts – price and circulating supply. The general price is calculated as a composite of spot prices used on crypto exchanges. For index funds, which have recently become popular, the calculation is adjusted to include variation in trading pair prices.

Total Market Capitalization Dominance, %

Another reason is the fact that cryptocurrency comes with certain risks that don’t exist with stocks. To compensate, one must analyze market cap in a broader context. Traditionally, stocks are analyzed with metrics such as price-to-earnings (P/E) and earnings-per-share . Crypto projects don’t publish financial statements, but there is still a need for comparison. Over time, the simplicity of market cap has made it the most popular way to compare cryptoassets.

Projects that are ambitious in terms of the technology they’re developing or which hope to refine an existing concept have the best chances of disrupting the status quo and meeting with success. That said, it’s worth keeping in mind that the likelihood of finding a unicorn in the crowded cryptocurrency space is not as high as it once was. Sometimes referred to as “digital shares”, security or equity tokens are tokenized slices of securities in which holders have ownership rights. Security tokens can also provide holders with the right to receive dividends. For more on security tokens, check out our three-part audio documentary,Tokenize the World. For the same reasons, higher trading volume enables an exchange to charge higher listing fees.

The truth is that artificially inflating trading volume is profitable and easy. From a project owner’s point of view, inflating volume makes their project more appealing to investors.

Enterprise value is a measure of a company’s total value, often used as a comprehensive alternative to equity market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet.

As a result, small-cap share prices tend to be more volatile and less liquid than more mature and larger companies. At the same time, small companies often provide greater growth opportunities than large-caps. Even smaller companies are known as micro-cap, with values between approximately $50 million and $300 million.

Can You Compare Cryptocurrencies By Market Cap?

You can read more on Hosp’s summary of four key risks facing cryptocurrencies here. But the picture for Tether — which is closely linked to the Bitfinex cryptocurrency exchange — is murky to say the least. Julian Hosp — co-founder of cryptocurrency TenX— said the metric has some serious limitations. 7Note that here Bitcoin forks are treated as separate independent cryptocurrencies; however including them all together within the Bitcoin value provides similar results. where r is the drift and σ is the standard deviation, and W is a standard Wiener process. Parameters r and σ are assumed to be the same for all cryptocurrencies, but the Wiener process Wi is specific to each. Well, the BTC price would drop from $3,578 to $3,307 (only an 8% change).

Tether moves up to number eight whilst IOTA drops out of the Top 10 altogether. All the other cryptocurrencies are in the same spot as last month. To kick the month off we’ve had an extra $16B enter the market allowing Bitcoin to break past the previous resistance we’ve seen in 2019.

Market depth – Bigger networks usually have greater trading depth on exchanges, allowing users to convert larger quantities of a cryptocurrency without significantly affecting its price. The ratio is similar to P/E in the stock market, where earnings act as a proxy for the value that each shareholder receives. In place of earnings, NVT substitutes network transactions and divides market cap by daily transaction volume. High NVT indicates that an asset’s market value surpasses its actual value. It’s not clear on which transactions should be considered, and the fact that there are on- and off-chain transactions increases the difficulty of estimating total transaction volume. Despite all that, market cap continues to be used as a leading indicator of cryptoasset quality – even by experienced investors.

They have track records and enough trading volume to be considered liquid. If you choose to invest in a leading coin, follow the news for regulatory developments, policies that may ease or prevent mainstream adoption, and industry shifts. If you have the skills, you can also include technical analysis. That way, you’ll have a well-rounded strategy that minimizes risk. Whether your goal is to HODL for years or to speculate on short-term price fluctuations, established cryptoassets can be an excellent choice.

If you decide to invest in large-cap crypto, then your investment will mostly not experience any major growth. It will be considered a “safe” investment and a lesser volatile investment. So, while you may not be making any major gains, your investment may still have some slight conservative growth. Discover the main risks an benefits of investing in cryptocurrencies and digital assets. Market cap is meaningless, easily manipulated, and creates a false sense of value. It’s downright dangerous because it misleads investors and plays a role in the crypto panics and wild swings that so often impact the space.

But GoldHub’s figures offer a window into that collective value — albeit one that isn’t as straightforward to calculate as the market cap for bitcoin. Sign up for a brand new CoinMarketCap account, and save your portfolio and watchlist; or choose to go incognito without logging in at any time, saving your data locally.

Will ripple make me rich?

Yes. XRP can make you rich. Although it has seen a major drop recently, several factors imply that it is a good investment and that its price can increase in the future. XRP is being tested in selected banks as a replacement for SWIFT money transfers.

Think of them as the “artificial” way and the “natural” way. The “bad” way exists because market cap is an inefficient indicator and prone to manipulation. We’re going to focus on positive (or “natural”) ways to raise a project’s market cap. You can learn more about market cap alternatives in the followingessay. However, it is worth noting that crypto market cap, or any of its alternatives, represent a single way to evaluate the quality of a cryptoasset. There are other indicators that provide statistical data about the performance of cryptoassets and characteristics that might be detrimental to their long-term health.

Ravencoin Rvn

If you shy away from established coins like Bitcoin and Ethereum and favor projects that fly under the radar, always be sure to read the whitepaper. Tokens with vague whitepapers or whitepapers that have been copied and pasted from other projects should be avoided. It covers the project goal, the founder’s background, the development team, and the roadmap. They’re simply used to gamify platform engagement by rewarding use or loyalty.