Table of Contents

- Coinbase Pro Review Summary

- Fees On Limit Orders On Gdax

- Global Digital Assets Exchange (gdax)

- Coinbase And Occ

- Understand The Asset Trading Exchange Provided By Coinbase Themselves & Save Your Fees On Buying And Selling Allowed

- Compare Gdax To Other Exchanges

This eliminates any risk of slippage for the vast majority of investors. All customer funds are held separately from company funds and never used for operational purposes. Coinbase has set the standard for industry practices, when it comes to managing customer funds, and they’ve brought these practices to GDAX.

Here are some top tips and hacks to avoid or reduce Coinbase Fees. Coinbase, the first licensed U.S. bitcoin exchange and one of the most popular, was founded in 2012 and has helped to bring digital currencies to investors both in the U.S. and abroad. Faced with massive growth in its user base and trading volume in 2015, Coinbase decided to expand its bitcoin offerings to include other digital currencies like ethereum. The company set up separate exchanges catered to individual or “casual” investors and highly active traders. The latter of these was eventually rebranded as GDAX, standing for Global Digital Asset Exchange. The fees that you are charged to buy and sell cryptocurrencies depend on the amount that you trade over 30 days. The platform determines this by calculating your trading volume in USD.

Coinbase Pro Review Summary

Which for some reason is 2% on some days, 3% and 4% on others. Coinbase Pro on the other hand operates on a maker-taker fee model. You would be considered a “taker” if you place an order at the market price, and this order is filled immediately. On the other hand, you are a “maker” if the order you placed is not immediately matched by an existing order. In the case where only part of your order is matched immediately, you would pay the taker fee for that portion only. You would then pay the maker fee for the remainder of the total order when it is matched.

You can obtain Coinbase Pro API keys to make investing or trading easier. A simple way to differentiate between maker and taker is that a maker adds liquidity to an order book, while a taker takes away liquidity from the order book. Both maker and taker fees can be applied to buy or sell orders; you may even get a mix of both. The exchange was founded back in 2011 by Brian Armstrong and is credited with playing a big role in today’s cryptocurrency adoption levels. Here we discuss the difference between Coinbase and Coinbase Pro. There is no information on the minimum initial deposit at Coinbase Pro.

All USD balances on GDAX are covered by FDIC insurance, with a maximum coverage of up to $250,000 per customer. Coinbase also makes money when you buy or sell cryptocurrencies. When you enter the number of coins you want to trade, the platform will include a 1.49% fee on top of the current market price. For example, if you want to buy $200 worth of Bitcoin, then your account will be credited with $197.20 worth of coins. GDAX, found online at GDAX.com, is an online trading platform catered towards institutional investors and professional investors.

Fees On Limit Orders On Gdax

Coinbase Pro cryptocurrency exchange is one of the top platforms if you want to buy and sell bitcoin or simply trade cryptocurrencies. The platform is a branch of cryptocurrency exchange Coinbase and is designed for more experienced professional and retail traders. For example, if on average, if you trade once a month, then your trading costs will be essentially sixty times higher than if you trade once a month. Fees can have a real impact on your performance and that impact will become more obvious in future years if returns to cryptocurrencies are lower than historically.

Is GDAX cheaper than Coinbase?

Coinbase vs Coinbase Pro (GDAX) Comparison. Although Coinbase and GDAX are owned by the same company, Coinbase is more geared for beginner investors. On the other hand, GDAX has lower fees and more advanced trading options. Coinbase is recommended for beginner investors.

Instead of withdrawing their coins out of the platform, it is possible to keep them inside your Coinbase wallet. Furthermore, you can also transfer coins from your Coinbase account over to GDAX. To make things even more confusing, GDAX will charge you depending on whether you are a market ’Maker’ or a market ‘Taker’. The maker is the person that offers liquidity and sets the price and the taker is the person that buys or sells at that price. If you decide to fund your account using a debit or credit card, the standard Coinbase fees are 3.99%. Although this might sound expensive, the platform has to do this to protect themselves from a chargeback or fraudulent activity. GDAX offers a wide range of fiat and cryptocurrency pairs, including BTC/USD, ETH/USD, LTC/EUR, LTC/USD, ETH/BTC, LTC/BTC, BTC/GBP, and BTC/EUR, among others.

Global Digital Assets Exchange (gdax)

Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. To be successfully verified, you need to upload relevant official documents. Users from the United States would be asked to provide a driver’s license or state ID. You must complete address verification and also provide the last four digits of your Social Security number.

If you are not trading USD then GDAX will convert the trade amount into dollars. Coinbase Pro uses the maker-taker module to determine the trading fees it will charge investors. You’ll pay between 0 to 0.5% for each transaction, depending on the number of transactions you made in the month. If you’re making a transaction as a maker, you’re the one making the offers. You’ll have to select a buying price less than the selling price in the limit order, so you’ll be paying a maker fee for all this.

Users looking to deposit or buy digital currency with bank cards can make use of Coinbase Pro’s linkage with Coinbase. It means that Coinbase users with a verified account can, in fact, deposit any fiat currencies they have to Coinbase Pro without paying any fee. The same is true of withdrawals, although in this case, these are limited by Coinbase Pro’s daily withdrawal limit, which begins at $10,000. There is a workaround, though, as you can buy bitcoin or other cryptocurrencies with a credit or debit card via Coinbase and transfer it directly to Coinbase Pro for free. For every instant crypto purchase via bank card on Coinbase charges you 3.99% per transaction.

Bitcoin can be traded with all the fiat currencies; however, Ethereum and Litecoin can only be traded with the euros and dollar. Some of the pairs include ETH/USD, BTC/USD, BTC/EUR, LTC/USD, ETH/BTC, LTC/EUR, and more. If you typed “GDAX” on Google, you’ll end up with tons of results relating to Coinbase.

Coinbase And Occ

criticized for its low liquidity, both exchanges seem to have sufficient depth for the amount of activity they experience. Get daily crypto briefings and weekly Bitcoin market reports delivered right to your inbox.

Coinbase is one of the most established cryptocurrency exchanges in the United States and one of the largest in the world. But always consider the risks of trading these speculative currencies.

Taker fees can range from 0.1% to 0.3% depending upon the customer’s trading volume for the previous 30 days. Further, cryptocurrency deposits and withdrawals can be done for free, and there are no fees for either maintaining a GDAX account or for holding funds in an account. Accounts can hold assets indefinitely and will not be closed as a result of user inactivity. By comparison, Coinbase users in the U.S. pay at least $0.15 per conversion fees, or a rate of 1.49%.

Our team will be publishing reviews for every major exchange, so don’t miss these publications by joining our Telegram. Coinbase Pro is an advanced cryptocurrency trading platform owned and operated by Coinbase, Inc. It was launched in the year 2015 as GDAX, a professional trading platform for individual active traders and later rebranded in July 2018. Coinbase Pro enables high-volume cryptocurrency trading solutions to traders in the US and other countries. For users who have the expertise, we recommend buying and selling Bitcoin and other cryptocurrencies via Coinbase Pro to save on fees. Coinbase is simple and instant, however this comes at the cost of higher fees, especially for credit and debit card purchases.

By comparison, Coinbase Pro’s pricing model is more straightforward. With Coinbase Pro, deposits and withdrawals must be made through a bank account; no card purchases are allowed. Currently Coinbase offers 32 cryptocurrencies to U.S. customers to trade, and 36 on Coinbase Pro, a larger number than many other platforms. For example, eToro offers roughly half as many, and Robinhood and SoFi Active Investing less than that. 0.5% to 4.5% depending on payment method, cryptocurrency type, transaction size and platform.

Ultimately, it is a good idea to choose an exchange with high liquidity in order to take advantage of faster trading, lower trading fees, and better overall service. For the same reasons, it is important to look for an exchange that reports legitimate trading volumes – or an exchange that simply has a good reputation. Cryptocurrency only exchanges , like Binance and Bittrex, have 80+ cryptocurrencies. GDAX uses a maker-taker fee schedule, which can be seen in more detail here. This is lower or very competitive with all other major exchanges.

Now if Bitcoin goes up 10% and you sell, Coinbase has taken 10% of your profits instead of 90%. The main difference is that Coinbase appears to be very simple, while Coinbase Pro can appear fairly intimidating. But all trades take place on the Coinbase Pro engine, with Coinbase offering significantly higher fees for that simplistic interface. Over time paying those high Coinbase fees start to add up quickly and can eat into your crypto investment funds. Putting all of these things into consideration, it becomes clear why Coinbase Pro is one of the leading cryptocurrency exchanges in the industry.

- It’s important to note that the company holds the New York BitLicnese.

- Founded in 2013 LEAN has been built by a global community of 80+ engineers and powers more than a dozen hedge funds today.

- Combine this with their industry leading security and you can feel very safe using GDAX to trade cryptocurrency.

- Coinbase is the largest U.S.-based cryptocurrency exchange, trading more than 30 cryptocurrencies.

- All customer funds are held separately from company funds and never used for operational purposes.

- It is clear that Coinbase Pro is designed to cater to more professional traders.

America is in many ways the ruler of cryptocurrency right now. It has a very impressive number of cryptocurrency exchanges and a large part of the everyday cryptocurrency trading occurs on American exchanges or on other exchanges but involving American traders.

What Are The Fees On Coinbase And Coinbase Pro?

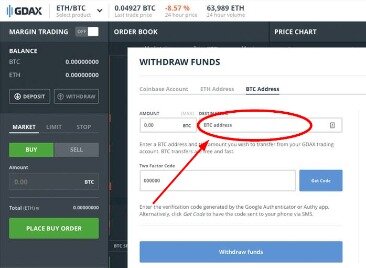

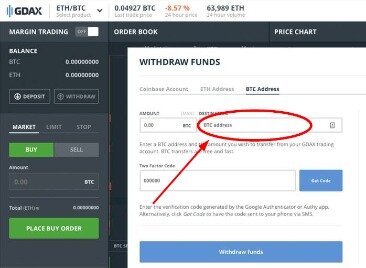

Once you are done, you are free to use the GDAX account almost instantly. You can deposit an unlimited amount from your existing Coinbase account into your newly created GDAX Account. As an individual, you can only withdraw $10,000 per day, and if you have an institutional account, you can withdraw up to $50,000 per day. It has a maker-taker system and the makers have to pay zero fees for all their ‘buy-orders’, while takers pay a varying fee ranging from 0.1% to 0.5% of the total amount. The fee structure is different when trading BTC/USD compared to ETH/EUR; the reason for this is liquidity. With less liquidity in some of the markets, it is hard to get an accurate price and so the exchange will look to cover itself on those where the volatility is very high. If Coinbase fees are too expensive for you, you can always use another exchange such as Binance or FTX Exchange.

all you need to know that their taker trading fee is 0.25% or 0.3% . Customer taker fee is based upon total USD trading volume across all Order Books over the trailing 30-day period. For example, a purchase of 1 BTC for $10,000 on the BTC-USD book will count as $10,000 towards your 30-day USD volume. Further, there will no longer be separate taker fees for each Order Book. Customers will be charged the same taker fee across all Order Books based on their total trailing 30-day USD volume.

Withdrawal fees apply in almost every exchange, and they usually represent a fixed amount of the currency to be withdrawn. Coinbase Pro’s Websocket feed enables traders to easily gain access to real-time market data.