Table of Contents

- Technical Indicators

- Take A Deeper Look At The Basics Of Forex Technical Analysis

- Market Analysis Team On Twitter

- Forex Position Summaries And Cot Data

- How To Find Fibonacci Turning Points On Intraday Forex Charts

- Ready To Trade Forex?

We will only note that it is important to follow rules date after day. If you trade today by three signals and the next day decide to enter into a trade by two signals only – you do not have a trading system and you just deceive yourself. It is not a surprise that following forecasts in the “whether it is raining or snowing” style an average trader makes losses, which is confirmed by facts. “Net loss of traders on Forex is more than RUB 200 million for the past 2 years. Technical Analysis in Forex relies on analyzing previous price behavior of currency pairs to determine potential price moves in the future. Continuation chart patterns are used to predict the continuation of the general trend.

Can you get rich by trading forex?

Can forex trading make you rich? Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

The dollar recovery on Thursday on the back of rising Treasury yields has trimmed Brent’s year-to-date advance down to 23% at the time of writing. Jerome Powell & Co. certainly have a fine line to tread in conveying their collective policy bias moving forward, as this high-stakes game of chicken heats up between the Fed and the markets.

Technical Indicators

The 7th time the price tests the support leads to a real breakout through that level. After breaking the support, the USD/CHF begins a sideways movement and eventually tests the already broken support as a resistance. Above you see the H4 chart of the Swissy (USD/CHF) for Feb – Mar, 2016. Note how the price action is squeezed between two well defined levels on the chart.

Given this kind of environment, the ingredients for higher equity markets remain in place. The higher bond yields move from here, the more challenging it becomes for growth stocks to resume their upward trajectory. Highly priced Tech stocks trading at elevated multiples compared to historic averages will likely remain under pressure in the short to medium term, so it makes sense to reduce their weight in portfolios.

For example, a percentage retracement zigzag could show that a currency typically retraces about 55 percent of a trending move on a pullback before moving in the trending direction again. A trader who notices such tendencies could improve the timing and location of entries and exits. The zigzag indicator draws lines over price waves of a certain size. These lines help filter out the noise of tiny movements so that traders can focus on the larger price moves where the bigger profits lie.

Take A Deeper Look At The Basics Of Forex Technical Analysis

In the process, you’re sure to build your confidence about your Forex trading. #forex bangla tutorial, #forex trading for beginners how to start, #forex indicators pdf, forex trading for dummies by lopez, how to trade forex beginner, xm forex broker, entry and exit points in forex trading. FOREX.com, registered with the Commodity Futures Trading Commission , lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. If you have the patience to learn how the forex market works and the incentive to develop an easy to follow and successful trading plan, then you might be able to make a career trading in the forex market. CedarFX offers access to a wide range of tradable securities, including stocks, futures, major and exotic forex pairs, cryptocurrencies and more. Though CedarFX could introduce a few additional educational resources, the broker remains a unique option for traders invested in giving back.

If you have at least 3 of the listed qualities, Forex trading is for you. If its author is able to analyze Forex trading in 15 minutes, we will also try. “People want to solve their problems without much pain, buying a dream.

Market Analysis Team On Twitter

From a technical perspective, Nike’s share prices are testing the upper limits of its Bollinger band, with momentum indicators turning bullish. Nike bulls would take heart from the stock’s ability to breach the $145 resistance region temporarily on Tuesday, posting a higher high from February’s levels.

Some of the most popular lagging indicators are the Moving Averages (simple, exponential, volume weighted, displaced, etc.), Parabolic SAR and the Moving Average Convergence Divergence . You can exit the trade in anticipation of a minor or major reversal off the resistance zone. A country’s retail sales data gives an accurate picture of how people are spending and the health of its economy at the lowest level. A strong retail sales figure shows that the domestic economy of a country is in strong shape; it points towards positive growth rates in the future.

Entry by the Forex system, marked with a vertical black line, is 19(!) bars further than the first entry by the ATAS strategy. 19 bars are equal to minimum 10 ticks of profit, 95 trading minutes and 2 additional potential entries into the buy by the ATAS strategy. Number 5 marks aggressive sells, which failed to break the support level, marked with a red line. This level worked during the whole day and it could have been used as a barrier for setting stops. Stop loss is 20 points and the position is closed at the next intersection of moving averages.

Forex Position Summaries And Cot Data

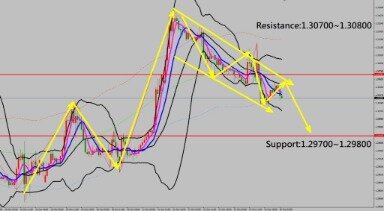

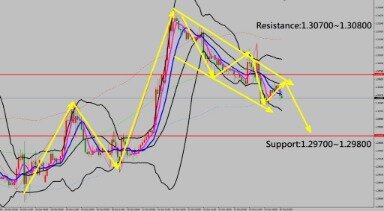

We have the resistance at the level of 1.0000 and the support at 0.9890. Let’s assume you are in a long trade in the GBP/USD, and the price is steadily increasing. Imagine you are in a short trade in the EUR/USD and the pair is decreasing in your favor. Suddenly, the price meets an old support level, which has been tested and has held on prior attempts. A price support level is a specific level on the chart, which the price tests while it is decreasing.

The Consumer Price Index is directly proportional to the prices of goods and services in the country. If the CPI index is too high , there is a high probability that central bank is most likely to lower interest rates to bring down the rate of inflation and stabilize the growth rate for the country’s economy. A high GDP growth rate signifies an increase in the total wealth of the country. This points towards the strengthening of the country’s currency and its value rises relative to other foreign currencies.

How To Find Fibonacci Turning Points On Intraday Forex Charts

They can offer long- or short-term forecasts, a view into the current state of a currency pair, or a look back at historical data. There are actually quite a few different forex indicators that are of use, several of which are detailed below.

You can find your trader’s path with Forex and moving averages, but in the process of gaining experience and in the course of time you develop understanding that it is not sufficient for constant efficiency. This result could be improved with an earlier trade opening and later closing. Every trader tries to improve this trading system for making a bigger profit and reducing risks. Let us create a similar strategy in ATAS with more advanced instruments of cluster analysis. There are two basic strategic approaches to forex trading – fundamental and technical. The bullish trend line is a straight line, which connects the sloping candle lows on the chart during an uptrend. In this manner, the bullish trend line is always located below the price action.

The art of successful trading is partly due to an understanding of the current relationships between markets and the reasons that these relationships exist. It is important to get a sense of causation, remembering that these relationships can and do change over time. It’s important to think critically about the tenets of forex market analysis. To illustrate, consider the case of the USD/CAD currency pair, which is one of the world’s most heavily traded pairings. Canada and the United States are close trading partners, which means that a large amount of foreign exchange takes place between them for reasons such as cross-border trade, travel, and investment. Currencies trade in pairs, with the exchange rates based on the price of one currency relative to the other.

For example, a five-day moving average is the average of the last five days; on the sixth day, the first day is dropped from the calculation of the average. If a moving average is climbing, the trend of the market is generally climbing; when a moving average is falling, the trend is usually declining. The Forex market is a global financial market where participants exchange one country’s currency for another country’s currency. The security that is traded among investors is a currency pair that fluctuates based on market sentiment. The currency markets trade actively 24 hours a day, six days a week across multiple time zones. Investors can use a number of different techniques to identify a trend in the Forex markets.

Is Technical Analysis enough for trading?

Yes, Technical Analysis works and it can give you an edge in the markets. However, Technical Analysis alone is not enough to become a profitable trader. A trading strategy with an edge. Proper risk management.

A few of the most popular are Fibonacci retracements/projections, moving averages, momentum oscillators and forex chart patterns. There is no “best” method of analysis for forex trading between technical and fundamental analysis. The most viable option for traders is dependent on their time frame and access to information. For a short-term trader with only delayed information to economic data, but real-time access to quotes, technical analysis may be the preferred method. Alternatively, traders that have access to up-to-the-minute news reports and economic data may prefer fundamental analysis.

How To Use Just The Macd Forex Chart

Day Trade the World™ is a registered trademark of Select Vantage Canada Inc. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, United States citizens or residents are kindly asked to leave this website. features a daily live trading broadcast, professional education and an active community. To become successful, you need to have the daily or weekly calendar in your fingertips. To achieve this, you need to check your calendar every week and note down the expected data for that week. Having this information will help you avoid being caught up in the release volatility.

- In the chart below, we are going to look at a particularly good price action signal for trading with trends; the inside bar strategy.

- Everything a trader needs to get started with trading Forex is right here.

- One of the old adages of technical analysis is ‘when in doubt, turn your chart upside down’.

- Mataf.net, Myfxbook.net, and Oanda.com all provide free forex correlation tables.

- The Bank of England met earlier today and left all their rates and policies unchanged as expected.

- We will increase the number of contracts here since we already made profit.

If the price meets a support on its way down, there is a good chance that the price will bounce off in a bullish direction. If you want to learn technical analysis, you should start with understanding what support and resistance is. These three strategies go hand-in-hand to help you come up with good forex trade ideas. All the historical price action and economic figures are there – all you have to do is put on your thinking cap and put those analytical skills to the test. The traders and investors come with their own thoughts and opinions on the market.

Fundamental analysis trading is generally more favored by long-term traders – those who buy and hold a currency pair for an extended period of time. Fundamental analysis is analysis that is based on economic conditions, both within specific countries and globally. Large companies that operate internationally are also substantially involved in forex trading, trading up to hundreds of billions of dollars annually.