Table of Contents

- Piercing Pattern

- Bearish Reversal Candlestick Patterns

- Candlestick Charts:

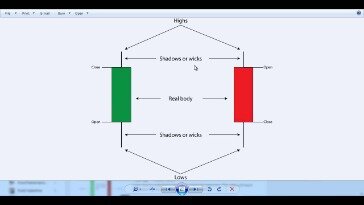

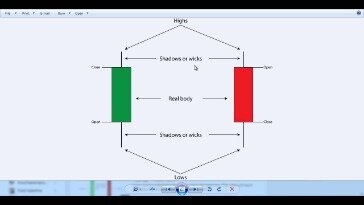

- Constructing The Candlestick Line

- Candlestick Positioning

Their potency decreases rapidly three to five bars after the pattern has completed. They only work within the limitations of the chart being reviewed, whether intraday, daily, weekly or monthly.

If a spinning top forms during a downtrend, this usually means there aren’t many sellers left and a possible reversal in direction could occur. If a spinning top forms during an uptrend, this usually means there aren’t many buyers left and a possible reversal in direction could occur.

Piercing Pattern

As with the dragonfly doji and other candlesticks, the reversal implications of gravestone doji depend on previous price action and future confirmation. Even though the long upper shadow indicates a failed rally, the intraday high provides evidence of some buying pressure.

In bullish candle, the opening price starts from the down of the candle and closing price up of the candle. In case of the inverted hammer, after a downtrend, it appears. This candlestick interprets that interest of buyers is high, so its trend is the reversal. This motivates bargain hunters to come off the fence further adding to the buying pressure. Bullish engulfing candles are potential reversal signals on downtrends and continuation signals on uptrends when they form after a shallow reversion pullback. The volume should spike to at least double the average when bullish engulfing candles form to be most effective.

Bearish Reversal Candlestick Patterns

This pattern occurs at the top of a trend or during an uptrend. It is a single candlestick pattern which has a long lower shadow and a small body at or very close to the top of its daily trading range. The name Hanging Man comes from the fact that the candlestick looks somewhat like a hanging man. The pattern appears in a prevailing downtrend where price are testing new lows or is already at the bottom.

On the other hand, short bodies represent small price changes which is an indication of price consolidation. Candlesticks progressively close at new lows, below the preceding day. The red body that is formed on the second day completely engulfs the white body of the preceding day.

It’s great to know these patterns as you can find high probability trading ideas that occur when the market is about to go upwards. We’ll also elaborate on what the candlesticks mean in terms of buying/selling pressure. These patterns become even more powerful when you use other market signals for confluence, such as support and resistance levels. By using the price action from the market these unique patterns will generate signals that can indicate whether the market will reverse or continue. The goal of this guide is to be the last destination you’ll need when it comes to learning the candlestick pattern basics.

Candlestick Charts:

The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. According to Bulkowski, this pattern predicts higher prices with a 49.73% accuracy rate. This is one of the particularly reliable bearish candlestick patterns. It is signalling that a top is in place and a trader should close any long positions or get ready to short the market. Another typical scenario shows a candlestick with two equally long shadows on both sides and a relatively small body.

The blue body that is formed on the second day is completely engulfed by the body of the first day. The blue body is formed on the second day completely engulfing the red body of the prior day. Forex.Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Forex Academy is among the trading communities’ largest online sources for news, reviews, and analysis on currencies, cryptocurrencies, commodities, metals, and indices. This is the vertical line between the low of the day and the open or close. This is the vertical line in between the high of the day and the open or the close .

Hammers are similar to selling climaxes, and heavy volume can serve to reinforce the validity of the reversal. Gravestone doji form when the open, low and close are equal and the high creates a long upper shadow. The resulting candlestick looks like an upside down “T” due to the lack of a lower shadow. Gravestone doji indicate that buyers dominated trading and drove prices higher during the session. However, by the end of the session, sellers resurfaced and pushed prices back to the opening level and the session low. Dragonfly doji form when the open, high and close are equal and the low creates a long lower shadow.

- Then, almost out of the blue, buyers enter the arena and obliterate the sellers by taking control and taking price higher than the open price three trading sessions ago.

- Here, you can see an upward trendline showing that the price is in an uptrend.

- Almost every candle has a wick that goes outside the body of the candle.

- The fifth and last day of the pattern is another long white day.

- The simplified name of this pattern is an insider bar, which exactly describes this 2-candlestick pattern perfectly.

- This powerful trading technique has helped legendary guru trader Larry Williams to turn $10,000 into $1 million in less than a year.

The beauty of reversal patterns is that they have a counter-pattern, which is the same setup but goes the other direction and flipped on its head. On top of this rule, each candlestick must be creating new higher highs and closing near these highs too. What this tells us is that in the current uptrend, the sellers that are taking the price lower are weak and will be easily overpowered when the buyers re-enter. With that said, the bullish harami works well with other market confluences, such as supply and demand levels. So when you master them, you can easily transition between candlestick formations. As you can see, it kind of combines 3 of the previous candlestick formations .

Each candlestick provides a simple, visually appealing picture of price action; a trader can instantly compare the relationship between the open and close as well as the high and low. The relationship between the open and close is considered vital information and forms the essence of candlesticks. Hollow candlesticks, where the close is greater than the open, indicate buying pressure. Filled candlesticks, where the close is less than the open, indicate selling pressure. The candlestick chart has become an invaluable tool in technical analysis.

Constructing The Candlestick Line

You can figure out the range by subtracting the lowest point of the candle from the highest point. Keep in mind that the wick of the candle is also referred to as its shadow. The wicks are very important because the display price extremes in a given time period. The wicks are much thinner than the bodies of the candles, thus making them easy to identify, and they make the strength of the candlestick patterns apparent. Using these charts, traders an determine the direction of the market by analyzing the color and shape of the candlestick.

The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. Candlestick charts are an effective way of visualizing price movements invented by a Japanese rice trader in the 1700s. Three inside up and three inside down are three-candle reversal patterns.

Long-legged doji have long upper and lower shadows that are almost equal in length. These doji reflect a great amount of indecision in the market. Long-legged doji indicate that prices traded well above and below the session’s opening level, but closed virtually even with the open. After a whole lot of yelling and screaming, the end result showed little change from the initial open. In order to create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display.

Short Body Candles

a small real body indicates a period in which the bulls and bears are in a “tug of war” and warns the market’s trend may be losing momentum. What we need to clarify in the end is that a candlestick can also represent a time span of 5 minutes, 1 hour, 4 weeks etc. Likewise, the considered period can be chosen at own discretion. After a few more considerations of price history, the principle is self-explaining. Especially if these prices are still changing, hence if you look at a market price in real time. The close of each day brings the market to new highs, signalling an uptrend is about to take off. The three candles are green, each consecutive candle opens within the real body of the previous candle.

Mitchell founded Vantage Point Trading, which is a website that covers and reports all topics relating to the financial markets. He has a bachelor’s from the University of Lethbridge and attended the Canadian Securities Institute from 2002 to 2005. Government regulations require disclosure of the fact that while these methods may have worked in the past, past results are not necessarily indicative of future results. While there is a potential for profits there is also a risk of loss. Losses incurred in connection with trading stocks or futures contracts can be significant.

I can see a huge improvement in my understanding of candles and in my trades as well. Thanks Dear for Giving the best knowledge to understand the basic candle patterns, My request to give more information it helps to prevent the losses of beginners. In the final example, we can see a classic pattern at the end of a trend. This is also often one of the building blocks to the trading strategy which you can learn in our pro area. Now that we have covered the individual elements, we can put things together and see how we can use our knowledge to dissect price charts. When the size of the bodies shrinks, this can mean that a prevailing trend comes to an end, owing to an increasingly balanced strength ratio between the buyers and the sellers. The greater the imbalance between these two market players, the faster the movement of the market in one direction.

It consists of two candles, the 1st one is the big and bullish candle, 2nd candle opens with a gap but closes below the 1st candle midpoint. Bearish indicates price decrease, the top of the body shows the opening price and bottom of the body shows the closing price. They are reversedly categorized, the bottom indicates the opening price and top body indicates the closing price. Generally, the green candle represents bullish and red candle represents bearish. There are different time frames in the candlestick charts, it can be changed from 1 min to 1 month. A hanging man candlestick signals a potential peak of an uptrend as buyers who chased the price look down and wonder why they chased the price so high.

The length of the lower shadow is at least twice as long as the body. Then, we see a short candlestick on the second day that gaps in the direction of the prevailing downtrend. This pattern consists of a large red body on the first day followed by a small blue body the next day that is completely inside the range of the red body.

The candlestick sandwich is also a bullish reversal pattern over three days action. Long shadows are on of the more reliable candlestick patterns. The candlestick pattern shadow can be any length but the open and close are at or near the low of the day. So the candlestick looks like an inverted cross, a simple cross, or plus sign. The doji conveys an even struggle between the forces of the market, both side pushing with no net gain is achieved.

Introduction To Candlesticks

The ORB pattern is defined as a trade taken at a fixed value of the opening range. This powerful trading technique has helped legendary guru trader Larry Williams to turn $10,000 into $1 million in less than a year.