Table of Contents

- Election Psychology & Markets

- Fear And The Psychology Of Bear Markets

- Trading Psychology: How To Get Into A Successful Mindset

- Market Wizards

- Pure Color

Andrew Odlyzko is one of my favorite financial history writers, and this excellent article demonstrates why. In this piece, he looks at the role of gullibility in bubbles, and our habit of getting ensnared by “beautiful illusions” during a bubble. This is a very insightful look at human nature and our gullibility. One of the other common themes in terms of investor behavior across history is the increased risk taking when credit is cheap. Because most people prefer having something to do rather than just thinking, they then asked, ‘Would they rather do an unpleasant activity than no activity at all? Participants were given the same circumstances as most of the previous studies, with the added option of also administering a mild electric shock to themselves by pressing a button. “Most people are just not comfortable in their own heads, according to a new psychological investigation led by the University of Virginia.

Their results show that these speculative margin loan holders largely follow the herd by buying at the top, and selling out at the bottom. In addition, these loan holders weretwice as likelyto ‘buy new shares of overvalued companies’ at peak prices. We see similar scenarios unfold in modern times with retail investors piling into flashy but overpriced IPOs. I cannot overstate how important this book is for investors, and that everyone should read it.

Election Psychology & Markets

Michael Boyle is an experienced financial professional with 9+ years working with Financial Planning, Derivatives, Equities, Fixed Income, Project Management, and Analytics. Ponzi mania was the investor sentiment Bernie Madoff’s 2008 Ponzi scheme, when everyone raced to question the credibility of their money manager. Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions.

‘We collect every single stock transaction with buyer and seller identities for three large British companies during the classical 1720 South Sea Bubble. In May 1720, the Bank of England grants its shareholders the right to borrow cash by collateralizing their shares. Our data documents the daily equity transactions of about 50% of the British market capitalization over the course of the bubble and five years before. Now, obviously performance chasing is nothing new, but I do think that the pandemic and shelter-in-place mandates have exacerbated the already prevalent behavioral biases in investors. The perfect example is found in shares of Hertz rallying afterthe company declared bankruptcy, or shares of Nikola rocketing despite reporting only $36,000 of revenue in its first quarterly report.

Fear And The Psychology Of Bear Markets

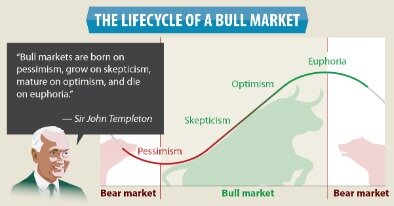

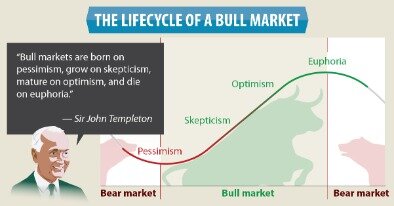

Emotional stock market investors are the ones who tend to hold on to a stock forever, irrespective of factors which negatively impact the stock and make it less favourable as compared to its peers. Talk through how, as the market cycle slides to the low point, mental traps can also account for why investors may resort to taking on more and unwarranted risk. Reinforce how emotions such as greed or fear tend toward extremes at the high and low points of the cycle, and how this shows why so many people are compelled to buy at market tops and sell at market bottoms. I want to share with you how I’ve approaching the recent selloff. I’m continuing to make contributions every two weeks to my 401, which is 100% invested in stocks. I also cannot, I repeat cannot, touch this money for 25 years. I am under no illusions that this is the bottom, but long-term returns get more attractive as short-term pain gets more acute.

- Understanding how your consumers react to different price levels shows your awareness of your price point, consumer demand, and your operating marketplace.

- Once the stop price has been reached, the order’s executed.

- Many curveballs will come your way throughout the course of a trade.

- In a survey, people were asked to choose the color they associated with particular words.

- Basically, the easier something is to read, the less risky it seems and the better it will resonate with your customers.

- In 2016, Nial won the Million Dollar Trader Competition.

Capitulation within capitulation marks ever-smaller data components of markets such that tick data and monthly data exhibit similar capitulation characteristics. Market psychology refers to the manner in which the market reflects its participants’ collective emotional state. If you’d like to learn about the psychology of trading, you should first work to understand trading practices, techniques, and lingo before reading this book, so you can fully grasp the topics covered. Written by Mark Douglas, this is a must-read for anyone who is struggling to attain consistency in the market. The author provides a roadmap for overcoming many trading issues. Finance is a term for matters regarding the management, creation, and study of money and investments. From Newton, Goethe, Itten, Hering, Young-Helmholtz, Birren, orMüller, the lowly color wheel has been considered and reconsidered again and again.

Trading Psychology: How To Get Into A Successful Mindset

This book includes addressing personal inclinations to seek short-cuts, being easily swayed by fear or greed, and getting distracted. These traits often cause traders to act irrationally even when they know better. In simple language, the book explains why and how these issues occur, and how to approach them to keep them from happening. Trading is as much about psychology as it is about developing a solid strategy. Without the mental fortitude to stick to a plan, the most well-conceived strategy in the world won’t do you any good. The key to enduring success in trading is to develop an individual, independent system that exhibits the positive qualities of studious, non-emotional, rational analysis and highly disciplined implementation. The choice will depend on the individual trader’s unique predilection for charting andtechnical analysis.

While there are multiple answers, this article that I wrote last year focuses on the Momentum factor. Instead of just recognizing the behavioral flaws in investors, the Momentum factor provides an investable strategy for arbitraging human nature. From the end of 2019 through September, institutions cumulatively bought almost 80 million shares, according to FactSet, while the stock price was rising roughly sevenfold. That took institutional ownership from less than 52% in December to 55% in September. Well, in 2020, this idea of sitting in a room alone is all too familiar for investors around the world as the COVID-19 pandemic continues.

Market Wizards

It is sadly true that sales in the stock market are the one type of sale that no one seems to enjoy, with the exception of us dedicated value investors. Yet, on the Robinhood app used by millions of individual traders, Zoom was only the 49th widest-owned stock this week, according to the online broker’s tally of most-popular holdings. In fact, of the 25 stocks with market values above $10 billion that have the hottest returns so far this year, only two— ModernaInc. This report is very important to Forex traders, as it shows the overall average positioning of market participants.

It is clear that emotional responses from previous rounds carried over to subsequent rounds. The X-system’s output is often unchecked, or at least checked only too late, by the C-system. My favourite example of this is to imagine I place a glass box containing a snake on the table in front of you. If the snake rears up suddenly, you will naturally jump back, even if you have no fear of snakes. In fact, it appears that the X-system reacts about three times faster than the C-system.

Whats Trading Psychology?

In broader terms, they can be classified into ‘Optimists’ and ‘Pessimists’. Optimism fuels a bull run in the stock market, whereas pessimism leads to a bear market.

How do I stop being greedy?

How to Overcome Greed: 15 Ways to Develop Generosity 1. It is more blessed to give than to receive.

2. Remember those who have been generous to you.

3. Remember those who have not helped you when you were in need.

4. Do not live only for yourself.

5. Think about your loved ones who might be needing others’ help.

6. Know that you cannot bring your wealth when you die.

More items•

The MAP is steeped in personal psychology and uses one of the most widely accepted assessments to measure personality. Pushing how they are innovative will simply give you that extra marketing edge.

Pure Color

A trader’s best decisions will be made when he or she has a written plan that spells out under exactly what conditions a trade will be entered and exited. These conditions may very well be driven by the crowd, or they may occur regardless of the direction in which the crowd is moving. And there will be times when the trader’s system issues a signal that is exactly opposite to the direction in which the crowd is moving. It is the latter situation of which a trader must be extremely wary. So the ideal situation for any trader is that beautiful alignment that occurs when the market crowd and one’s chosen system of analysis conspire to create profitability.

The psychology of losing something weighs more on a person’s subconscious than when something is won. This leverages the theory of Commitment & Consistency, which explains that people feel obliged to behave consistently with their commitments.

A square is similar to a rectangle palette, but the two sets of complementary pairs are colors evenly spaced around the circle. A rectangle is a color combination made of four colors that are made up of two complementary pairs.

If market reality jibes with the tenets of the trader’s system, a successful and profitable career is born . The trend-following quantitative trading strategies employed by hedge funds are an example of investing techniques that rely in part on taking advantage of shifts in market psychology. Technical analysis focuses on the trends, patterns, and other indicators that drive the prices of a stock higher or lower. Fundamental analysis seeks to choose winning stocks by analyzing the company’s financials within the context of its industry. Market psychology has little place in this number-crunching.

How do you master trade?

Master these skills and then you’ll get a genuine shot at being a trading master. 1. Skills #1 and #2 – Research and Analysis.

2. Skill #3 – Adapting Your Market Analysis to Changing Market Conditions.

3. Skill #4 – Staying in the Game.

4. Skills #5 and #6 – Discipline and Patience.

5. Bonus Skill #7 – Record Keeping.

6. In the End.

More items

Those who were late getting on the train are rethinking their grand design on making tons of cash. Everyone starts to dump the positions to whoever will take them, but buyers are few and far between.

“This article examines the knowledge frame in which financial investing became a popular, socially legitimate, and desirable activity in England and France in the nineteenth century. The empirical basis underlying the arguments of the article is provided by investor manuals, newspaper reports, advice brochures, stock price lists, financial charts, and novels from the period. The analysis focuses on the instruments and processes making possible a financial knowledge that could be legitimately acquired and utilized by separate, unrelated, individual actors dispersed over the territory.