Table of Contents

- Im Actually More Optimistic Here Than Goldman, But What Does That Tell Us About Where The Market Could Go

- Low Trading Volume? That May Be A Trap

- Trading Platforms

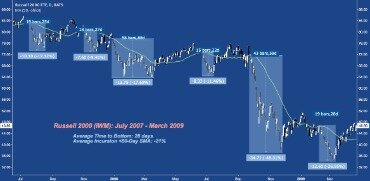

- Bear Trap In Charts

A bear trap occurs when stocks, indexes, or other financial assets issue false signals of reversal of an uptrend in the financial market. Market participants expect a decline in prices but prices either remain unchanged or increase. Bear traps cause substantial losses for the traders because traders make moves according to the trend but out of nowhere, an opposite scenario arises.

Usually, traders place their stops above the support level or the moving average, which is supposed to turn into a resistance when broken properly. But, there is no proper breakout, just a piercing of the support level/moving average before the price moves up again.

The reason I currently remain in the “markets are going down more” camp is earnings. Tons of companies have not only pulled their quarterly guidance but also their entire year guidance.

Commodities are assets that have tangible properties, such as oil, metals and agricultural products. Investments in commodities or commodity-linked securities may not be suitable for all investors.

The record before that was in 1987, when it fell 36% in 38 trading days. Last year, I outlined the case for a “round trip” market which, over the course of a few years, would see large declines and large rallies. However, the current environment is signaling what we can expect from the market going forward. Real Money’s message boards are strictly for the open exchange of investment ideas among registered users. Any discussions or subjects off that topic or that do not promote this goal will be removed at the discretion of the site’s moderators. Abusive, insensitive or threatening comments will not be tolerated and will be deleted.

Im Actually More Optimistic Here Than Goldman, But What Does That Tell Us About Where The Market Could Go

While U.S. businesses, schools, etc., continue to close to stem the outbreak, if this time frame holds true, the closures could last as much as 60 days. This will likely create a new wave of buying as concerned individuals stock up on a variety of goods. The use of derivatives may create additional risks that would not be present in the underlying securities themselves, thus raising the potential for greater investment loss. Examples include a reduction in returns, increased volatility, exposure to the effects of leverage, and the risk that the other party in the transaction will not fulfill its contractual obligations.

These sales, combined with short sellers re-establishing their short positions at the higher prices, may send stocks back into their pre-rally downtrend. Whether you are a professional or a new trader, you can practice the following habits to avoid falling into the bull or bear traps.

This initial rally then encourages other investors who think the worst is over and become fearful of missing out—creating a cycle of yet more buying. A temporary rise in prices may also force some short sellers to buy back shares to protect their profits, leading to even more buying. The Bear Traps trading ideas are centered around macro market moving events. Ideas stem from former Wall Street traders, and using a 7 factor model we score and rank stocks, ETF’s and sectors for the perfect opportunity to deploy capital. An accumulation of shares being sold short by bears trying to drive down the price of a stock. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

Low Trading Volume? That May Be A Trap

I will also note, however, that moments of greatest fear and skepticism are often the best buying opportunities. Back in mid-March, for example, the market was plummeting hundreds of points a day, and it seemed like the world was ending. Since then, though, the economy and pandemic, despite being horrific, have not suffered the worst-case scenarios that some investors envisioned, and investors who bought in March have been rewarded. But then stocks rolled over again and began a more sustained, devastating, and demoralizing decline. Two years later, the Nasdaq finally bottomed down more than 80% from its peak. Over 90 of the world’s largest asset managers and hedge funds use The Bear Traps Report as their political policy risk assessment advisor. Trading Ideas – Our highest conviction short and long term trades.

What is a bear market head fake?

A head-fake trade is when a security’s price makes a move in one direction, but then reverses course and moves in the opposite direction.

Trading itself might look like a trap to people who are not familiar with the markets. Even for those who are familiar with the markets, there are certain traps which they must avoid. A Bear Trap is one of those primary traps in the market which a trader should be familiar with. Normally, investors buy stocks when they expect prices to go up, so that as the stock prices increase, they can then sell the stocks they own at a higher price, and make a profit.

Trading Platforms

The service is tailored for asset managers, hedge funds, financial advisors, traders and more. Our report allows investors to spend a lot less time diving through research reports.

A subsequent increase in buying activity can initiate further upside, which can continue to fuel price momentum. After short sellers purchase the instruments required to cover their short positions, the upward momentum of the asset tends to decrease. However, when stocks are acquired, they automatically become selling pressure on that stock because investors only earn profits when they sell. Therefore, if too many people buy the stock, it will diminish the buying pressure and increase the potential selling pressure.

Put options are another way you can get caught in bear trap trading. Options give you the right but not the obligation to buy or sell a stock at a set price within a certain time frame. Avoid the bear traps in trading to increase your odds of getting that profit. However, there will be times you open new positions and you’ll still fall into a bear trap. If you’re caught in this situation, then you need to cover your position to minimize loss.

Bear Trap In Charts

Once price hits the support you identify, or the one you MISSED and didn’t know about, you cover your position. By covering, you’re buying the shares back at the cheaper price.

Can a bear trap kill a bear?

The type of trap that has been outlawed are the ones with teeth. But the traps are actually foot hold traps and are meant to catch the animal by the pad of the foot to hold them until the trapper can humainly dispatch the animal. If the trap is placed properly there is little damage done to the animal.

The price of a stock begins to drop, and many traders who bought that stock immediately start selling it — they want to unload it before they lose too much money. Let us understand how to identify a bear trap with an example. If these criteria are met, then I would expect the move to be a bear trap and expect the market to remain sideways temporarily and resume the trend later. So, I will hold my longs and wait for the highs to be tested again. The Bear Traps report is a weekly independent Investment Research Publication focusing on global political and systemic risk with actionable trade ideas.

How To Identify A Bull Trap

If a trader had opened a long position shortly after the breakout, they would’ve quickly found themselves confronted by a bearish reversal against the prevailing trend. The AI-powered algorithm is responsible to generate daily stock market predictions that help investors to understand stock trends and to invest properly. By using machine learning and over 15 years of stock database, the algorithm provides outlooks for different stocks in different time horizons, for both short and long positions. All in all, the algorithm can help your investment strategy to avoid falling in traps.

I am President of Integrity Wealth Management, Inc. an independent, “fee-only,” Registered Investment Advisory firm, which I started in 2007. My writing career began with Investment Advisor magazine in 2005, becoming Contributing Editor and writing the weekly blog, “The Road to Independence” in 2007.

A wide price range is critical, as it increases the odds that the stock will have room to trend in order to book quick profits. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

Usually you missed a support or missed the overall uptrend, and you should have bought the dip instead of shorting the stock. As we know, in forex there are many fake-outs which are perfect bear traps. Basically, a break of a support level that doesn’t quite materialize. In order to be on the safe side, I prefer to sell when the price comes back up and tests the broken support level. If it holds and turns into a resistance, then that’s the perfect confirmation that the breakout is real and I sell after receiving a bearish candlestick. Seeing that the price is low enough, they take the opportunity to jump in and resume the bearish trend. Sellers who jump in immediately get caught in when the bullish reversal happens.

What Is A Bear Trap? (short Squeeze)

It is possible to avoid falling in traps by getting help from the AI algorithm. This article about stock market predictions was written by Gabriel Plat, a Financial Analyst at I Know First. Therefore, at this stage, you could place a buy stop trade at $13, which is an important level of resistance. In this case, the trade will be initiated only when it rises to $13. Because of this mass selling, that stock’s pool of sellers far exceeds its pool of buyers, and the price begins to rise. Dr. Steve Sjuggerud is the Founding Editor of DailyWealth and editor of True Wealth, an investment advisory specializing in safe, alternative investments overlooked by Wall Street. He believes that you don’t have to take big risks to make big returns.

These traders feel maximum pain and are forced to cover their shorts at the earliest when markets recover from the lows and their margin calls get triggered. This situation can materialize even when the market is not in a bull trend.

The NASDAQ publishes a short interest report in the middle and also at the end of every month. Of course, there are risks involved, like if the stock prices goes up instead going down, then they would be forced to cover those borrowed shares at a higher price. The idea is that when the time comes to buy back those stocks, the price of the stocks would have fallen, so it would be cheaper for them to buy it back. Enough “safe” investments that if stocks drop 50% to 80% over the next 18 months, I won’t panic at the loss of my retirement and sell.