Table of Contents

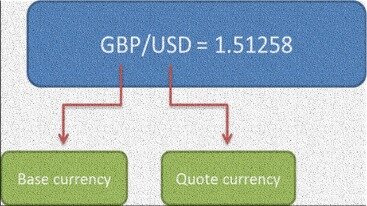

Add base currency to one of your lists below, or create a new one. The meaning of this hypothetical quote is that 1 USD equals .7352 EUR. If you divide 1 by .7352 the result is 1.36—the two results look different, but the relationship between the two currencies remains the same. Understanding these terms in a little more depth can help you as you get ready to set up your initial trades.

In general, markets with high liquidity exhibit smaller spreads than less frequently traded markets. The most traded pairs of currencies in the world are called the Majors. They constitute the largest share of the foreign exchange market, about 85%, and therefore they exhibit high market liquidity.

Factors That Impact Currency Pairs

Traders also tend to go long when the currency price comes down to a well-defined support level or a price floor. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Currency pairs compare the value of one currency to another—the base currency versus the second or the quote currency. It indicates how much of the quote currency is needed to purchase one unit of the base currency. Currencies are identified by anISO currency code, or the three-letter alphabetic code they are associated with on the international market. In forex, the base currency represents how much of the quote currency is needed for you to get one unit of the base currency. For example, if you were looking at the CAD/USD currency pair, the Canadian dollar would be the base currency and the U.S. dollar would be the quote currency. The exchange rate shows you how much of the quote currency you need if you want to buy 1 unit of the base currency. In forex trading, currencies are always quoted in pairs – that’s because you’re trading one country’s currency for another.

More Definitions Of Base Currency

The base currency can be used to represent all profits and losses of a company. This currency also functions as a company’s domestic currency for accounting purposes. European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U.S. dollar. There are as many currency pairs as there are currencies in the world.

- If you’re correct and the value of the base currency rises, you can close out your trade then at the current market price and take a profit.

- If you’re a time freak like me, the when is important to you, too.

- Firstly, it depends on what type of account you open, what the leverage for that particular account type is, and how much leverage you need.

- An indirect quote uses the domestic currency as the base currency (i.e., Sf/d).

- In all the previous currency trading quotes you see that a currency is measured against the US dollar.

- Thus, the selling price of the currency pair is the amount one will receive in the quote currency for providing one unit of the base currency.

For instance, if you deposited USD 10,000 into your account and you also made a profit of USD 3,000, your equity amounts to USD 13,000. The profits that you make by trading will be added to your account balance – or, if there are losses, they will be deducted.

How To Trade Forex

The world economy is increasingly transnational in nature, with both production processes and trade flows often determined more by global factors than by domestic considerations. Likewise, investment portfolio performance increasingly reflects global determinants because pricing in financial markets responds to the array of investment opportunities available worldwide, not just locally.

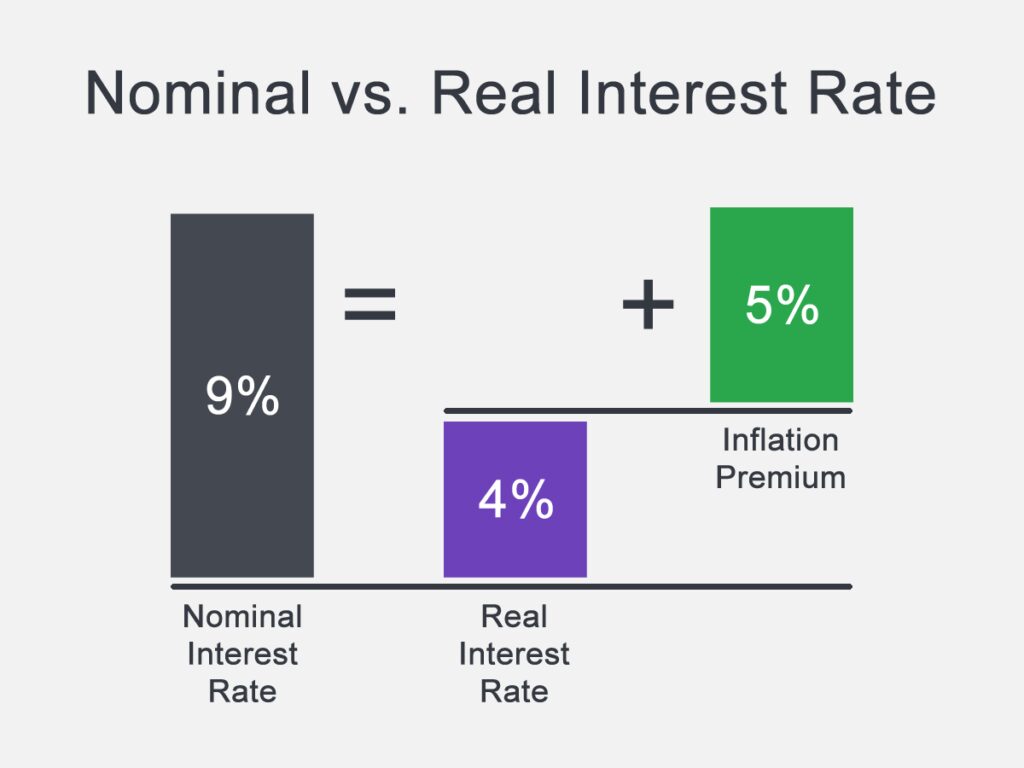

A quotation then defines how many units of the counter currency are needed to buy one unit of the base currency. The quotation of a currency pair usually consists of two prices, much as with stocks traded on an exchange. The “Bid”, usually lower than the “Ask”, is the price at which a market maker or a broker is willing to buy the base currency in exchange for the quote currency. Ask or Offer, usually higher than Bid, is the price at which a broker is willing to sell the base currency in exchange for the quote currency. If the Bid price for a EUR/USD pair is 1.2750 and the Offer price is 1.2752, the difference, 2 “pips” in forex trader slang, is referred to as the “spread”. Most forex brokers derive their trading profits from the spread, so it is beneficial to review broker spreads before transacting trades. Investors purchase and sell currencies, this accounts for the reason why currency pairs are indicated as pairs.

Managing Risk

In other words, if a currency quote goes higher, the base currency is getting stronger. When USD is the base currency and the quote goes up, that means USD has strengthened in value and the other currency has weakened. The table below shows the exchange rate versus the U.S. dollar by country for the last five years.

What coins can you buy on Kraken?

Cryptocurrencies available on KrakenNameCode on Kraken.comCode on Trade.Kraken.comBasic Attention TokenBATsameBalancerBALsameBitcoinXBTBTCBitcoin CashBCHsame52 more rows

The elasticities approach focuses on the effect of changing the relative price of domestic and foreign goods. This approach highlights changes in the composition of spending. The absorption approach focuses on the impact of exchange rates on aggregate expenditure/saving decisions.

An increase in the real exchange rate (Rd/f) implies a reduction in the relative purchasing power of the domestic currency. Individual currencies are usually referred to by standardized three-character codes.

What is a PIP in fruit?

1 : a small fruit seed especially : one of a several-seeded fleshy fruit. 2 : one extraordinary of its kind. pip.

It all starts with a currency pair, which tells you the currencies involved in the trade. In foreign exchange trading , as in all market trading, to go long means to buy with the expectation that your purchase will rise in value. It’s the opposite of going short, which is when you expect the value to fall. In forex, the purchase you are making is a currency, and when you go long, you profit when the value rises; when you go short, you profit when the value falls. Currencies from developing or emerging market economies that are paired with a major currency are called exotic currency pairs.

Major currencies are considered currencies that are most often traded against the U.S. dollar, such as EUR/USD, AUD/USD, and USD/CAD. Clients maintaining a margin account may change their base currency at any time through Account Management and may effect deposits or withdrawals in a non-Base currency. Base Currencies are available in AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZD, RUB, SEK, SGD or USD. In addition, IB-India accounts are required to maintain a Base Currency of INR. The term Base Currency is used for accounting purposes to refer to the currency in which an investor maintains its book of accounts. If the client elects to maintain a cash or IRA account then they are restricted to holding only long cash balances regardless of the currency of denomination. IRA accounts are further restricted in that deposits and withdrawals may only be made in the Base Currency.

It is an order that you give to buy above the current price or an order to sell below the current price when you think the price will continue in the same direction. It is the amount of money in your trading account with which you can open new trading positions. It is the total amount of money in your trading account, including your profit and losses.

These pairings are known to be more illiquid and come with wider spreads; thus, making them riskier. The currency pairs that do not involve USD are called cross currency pairs, such as GBP/JPY. Pairs that involve the euro are often called euro crosses, such as EUR/GBP.

These codes in a currency pair can be marked differently by using a slash or replaced with a period, a dash or nothing. Currency pairs are generally written by concatenating the ISO currency codes of the base currency and the counter currency, and then separating the two codes with a slash. Alternatively the slash may be omitted, or replaced by either a dot or a dash. A widely traded currency pair is the relation of the euro against the US dollar, designated as EUR/USD.

He has a background in management consulting, database and administration, and website planning. Today, he is the owner and lead developer of development agency JS Web Solutions, which provides custom web design and web hosting for small businesses and professionals. As you can clearly see, all Forex major currency pairs include USD and another very common currency. Together these amount to about 75% of all trades – hence the name. In our example, USD is considered the base currency, and CAD is the quote currency.