Table of Contents

- Risk Graph

- chart #4: Stacked Area Chart For % P&l Trends & Breakdowns

- Strip Options: A Market Neutral Bearish Strategy

- The Best Trading Software For Options Reviews

- Chart #5: Scatter Plot Of Income Statement Changes Vs The Previous Period

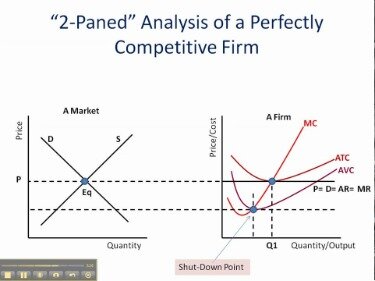

The risk graph below shows the potential payoffs for a long call spread in KC futures, where both the potential profit and loss from the strategy are capped. The seller of the call has the obligation to sell the underlying shares of stock at the strike price of the call. Therefore, a short call has unlimited risk, because the stock price can rise indefinitely. The profit potential, however, is limited to the premium received when the call was sold.

The difference between a contract and an option contract is in the options that a buyer has a right to exercise in the contract, which makes the contract a bit more flexible. From the above graph, it becomes crystal clear that X Ltd. will earn more profits than Y Ltd. against a demand below Rs. 1,50,000 sales since the BEP has been reached sooner in case of X Ltd. Moreover, at volume of Rs. 1,50,000 both the firms will earn equal amount of profit. But as the rate of earning profit in case of Y Ltd. is more in comparison with X Ltd. for a Volume above Rs. 1,50,000, Y Ltd. will earn more profit than X Ltd.

Risk Graph

The horizontal line to the left of 40, the strike price in this example, illustrates that the maximum profit is earned when the stock price is at or below $40. To the right of 40, the profit-loss line slopes down and to the right. Profits are earned until the short call line crosses the horizontal axis, which is the stock price at which the strategy breaks even.

Each additional line shows the trade at progressively higher levels of volatility, in increments of 2.5%. The line legend on the right indicates the exact increase each line represents. Revenue, cost and expense illustrated in detail by dynamic pie charts. In the case of the 20% loss, the option holder can strike out for over 16 months and still not lose as much as the stockholder. If we look at the call option it makes no sense to its holder to exercise it, because strike price is higher than the price in the stock market.

One is to remember that the use of units is needed as different prices are compared. Now, points are plotted for profits and fixed costs which are connected by a straight line which again intersects the sales line at the horizontal axis. While constructing this graph, different lines for, costs and revenues are omitted here since profit points are plotted only. The solid line is the profit/loss for this position at V+0, which means with no change from the current level of volatility. The next line up shows the probable profit/loss if implied volatility increases 2.5% by that date.

chart #4: Stacked Area Chart For % P&l Trends & Breakdowns

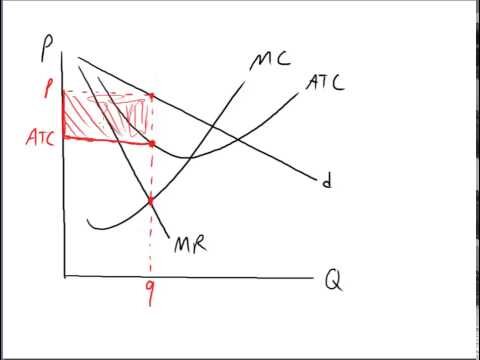

The above Short Straddle position is a neutral strategy profitable if the underlying price remains the same. Maximum profit is the combined prices of the call and put options and maxiumum loss is unlimited. The above graphs show the profit and loss at options expiration for selling a call or put. Basically it means, hey look, if the stock price is here versus here at expiration, do you make money or do you lose money? The line in the middle of the chart or the red line in our payoff diagram, this is your strategy P and L.

What is T&L P&L?

The place on the x-axis that represents the current stock price should be where the P&L is zero i.e at the time and stock price of purchase you have not made or lost anything. The payoff line at the same point on this chart is the premium, or price, of the option.

When the graph line is on $25 , note that the profit and loss value is $0.00 . As the stock price moves higher, so does the profit; conversely, as the price moves lower, the losses increase. The figure shows the position breaks even at $25 and as the stock’s price increases (moving right along the x-axis) the profits correspondingly increase. As time goes by and volatility decreases, the purple line showing the immediate profit/loss tends to slowly move higher, eventually matching the blue line.

Strip Options: A Market Neutral Bearish Strategy

In order to show the relative profitability, the position of two separate firms can be taken into consideration. From this discussion we have made so far about the P/V Graph, we have found that a P/V Graph helps us to determine the BEP and its impact on profits at various levels of activity. It also highlights relative profitability under conditions of high or low demand for a product, for different product prices etc. A P/V graph expresses the relationship between profit and volume.

This is an example of a short put option, so you can see how the diagram shifts and changes based on the different strategies that we’re going to choose. Now you have potentially an unlimited amount of risk if the stock price continues to move higher and higher and higher. Again, remember that this black line here in the middle of the graph, this is the current stock price. We turned this chart into a stacked bar chart with a net line and CAGR column to solve this problem. In this chart, you can see the relationship between the revenue, cost and net income in a specific year, but you can also easily see the trend.

The Best Trading Software For Options Reviews

Risk graphs can be drawn to show the potential payoffs for single options as well as for spreads or combination strategies. Risk graphs can also be constructed for short positions, or for complex strategies such as butterflies, straddle, condors, or vertical spreads. Graph 2 shows the profit and loss of a call option with a strike price of 40 purchased for $1.50 per share, or in Wall Street lingo, “a 40 call purchased for 1.50.” Let’s warm up with a basic profit-loss diagram of a normal, purchased stock, because this will get us loose before diving into options diagrams. For options, profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing. When completed, a profit-loss diagram shows the profit potential, risk potential and breakeven point of a potential option play.

What payoff means?

(Entry 1 of 3) 1a : profit, reward. b : retribution. 2 : the act or occasion of receiving money or material gain especially as compensation or as a bribe.

Although it is about a slightly different version of this chart, it does a great job of explaining the issues I have with it and why I don’t use it. What I particularly like about this post is not so much the final chart itself, but mainly the reasoning and thinking process that lead authors to their final design.

This strategy has an unlimited upside potential as long as the stock price continues to increase. Now you know my choice of the seven best charts for presentation and analysis of a profit and loss statement.

A chart plotting the potential profits or losses from an option strategy. On a profit graph, the x-axis represents different prices for the underlying asset and the y-axis represents the profit or loss that will result from the option being exercised at a given price. An option is considered a wasting asset, and as the expiration date, or dates, of the options comprising your position move closer to expiration, the value of the option and the position decreases. Before the option contract expires you will either close your position by selling the option, buying or selling the underlying asset, or allowing the contract to expire worthless. Options strategies are designed to take advantage of the elements that affect the value of an option by limiting risk and optimizing reward. They are used to manage risk and protect your overall positions. Position risk graphs help you to assess the impact of these factors.

- In the case of the 20% loss, the option holder can strike out for over 16 months and still not lose as much as the stockholder.

- Although a waterfall graph is good at visualizing differences, it sucks in visualizing trends for items in time.

- The red hash marks indicate the break-even prices for this particular strategy.

- We will start at the beginning by showing how to create a risk graph using a position in the underlying – buying 100 shares of stock at $50 a share – as an example.

- Selling the Underlying also is known for stocks is known as shorting the stock .

The natural flow pattern does not work well for visualizing losses. Great for bird’s eye view comparison of different businesses or business segments. Key highlights of the Sankey diagram are understandability and a high-level overview of P&L relationships. For the same reasons that I just mentioned, Sankey is not a very good tool for analytical deep-dives into individual parts of P&L. But you can still use it internally to compare different business segments or product P&Ls and have an overview of how they are similar or dissimilar. For each chart, I try to explain in which situation I would use it and why. If you are in a hurry, you can just skim through the chart examples and strength & weakness summary that I included at the end of each chapter.

Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street lingo, “a 40 call sold for 1.50.” Let’s look at the journal entries and financial impacts for two types of derivatives designed to take some of the risk out of business. One is a futures contract and the other is an interest rate swap. A futures contract is a financial agreement to buy or sell the underlying asset at a future date. A long position is to buy the underlying asset while a short position to sell. Under the circumstance, a profit chart depicts the effect on BEP for charging different prices for a product.

For instance, you want to buy Microsoft stock and it is trading at $50 a share. Instead of buying the stock, you decide to purchase a “right to buy the stock at 50” which will expire on 1/15/01. You would be willing to pay $3 for this right to buy Microsoft before 1/15/01 at $50. You have the right to purchase the TV for the sale price up to 1 month regardless of how much the TV goes up or down in price during that period.

Plus, the stock has to move more than that 6.2% to even start to make a cent of profit, profit being the whole purpose of entering into a trade. For an extreme example, a 50% loss means a trader has to make 100% profit on their next trade in order to breakeven. Likewise, if the stock moved up, irrelavent by how much it moved upward, then the option trader would still lose the $0.44 paid for the option. The vertical axis (the y-axis) represents the potential profit and loss values for the position. Option traders use profit and loss diagrams to evaluate how a strategy may perform over a range of prices, thereby gaining an understanding of potential outcomes.

If you have questions, ask them in the comment box right below. If the stock were at $37, we would lose a little over $200 on this trade. Right now, as long as the stock stays basically between 26 on the put side, and 35 on the call side as far as a price, so the underlying security, we can make at expiration, about $164. Again, it can kind of give you an idea of where the stock, or if the stock trades at X point, how much money you would make or lose at that point in expiration. Now you have limited risk to the downside and limited risk to the upside. This option strategy might be a little bit different for you. In this case with the short put option, you want the stock to move higher.

Do you want to earn a higher rate of return on your investment but want to do it in a safe and less risky way? Read on to find out more about money market funds and how they can help you earn a higher rate of return in a low risk way.

There are issues with visualization of losses or negative changes in revenues and positive changes in expenses. Sankey diagram also does not work well for showing trends in time and differences between periods. It might theoretically be well-positioned to be used to show differences between periods, but doing that does not work well because of the weakness mentioned above. Another quite problematic issue is when you need to visualize the P&L of a company or business segment that is loss-making. It is solvable, by showing this loss as inflow with some distinct color, but it complicates Sankey’s otherwise natural and straightforward flow. Roblox shares launched on the stock market on Wednesday, March 10. The USD/CAD pair edged lower during the European trading hours but didn’t have a tough time reversing its direction in the second half of the day.