Table of Contents

- Learn Stock Trading Summary

- Investopedia Stock Simulator

- Day

- Stock Trading Demystified: Your Guide To Understanding Stocks

- Open A Stock Broker Account

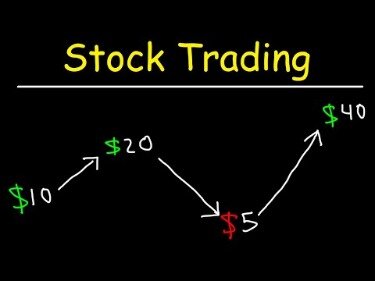

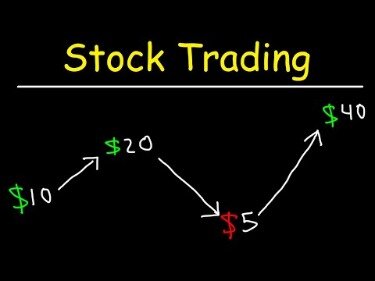

Most investors would be well-advised to build a diversified portfolio of stocks or stock index funds and hold on to it through good times and bad. But investors who like a little more action engage in stock trading. Stock trading involves buying and selling stocks frequently in an attempt to time the market. The stock market refers to public markets that exist for issuing, buying, and selling stocks that trade on stock exchanges. For companies, it provides a means to acquire capital as a way to fund and expand their business.

I have talked through the process many times before to a lot of young people. I disagree with the notion each trade needs to 1k or more.

This article was made for beginners and advanced alike to benefit from stock trading games. GreenKey Technologies’ AI for trading uses speech recognition and natural language processing technology to save traders time searching through conversions, financial data and notes. With the company’s platform, financial professionals are using AI to sift through, and access, notes, market insights and trending companies in real-time. When it comes to understanding the stock market for beginners, learning how to read stock charts can be one of the more intimidating challenges. Once you understand the key concepts of chart reading and why you should use stock charts, you’ll find it’s not that hard to view charts to time your buys and sells.

Learn Stock Trading Summary

You will get one year of access to their chat room, real-time trading simulator, small group mentoring six times per week, and their masterclass suite of courses. Finally, you’ll also get one-on-one mentoring sessions of an hour each. We’ve reviewed some of the best day trading courses available, along with some tips on how to identify a great day trading course. Whether you’re new to day trading or you’ve been trading for years, few things will help your career quite as much as holding a current and comprehensive education on full-blown trading strategies. Enroll now in a top machine learning course taught by industry experts. Beginner, intermediate and advanced machine learning courses for all levels. The best online accounting classes for beginners to accountants with advanced knowledge.

You have to have at least $25,000-$30,000 in your brokerage account to be able to open accounts with them. Well, recently SpeedTrader has started allowing you to open an account with 5k. Take our Interactive Brokers Platform course if you need more help setting up your account. TD Ameritrade is probably the best overall broker if you’re new to the trading world. We also feel that their charting platform overall is second to none. Their charting platform is one of the best ways to learn stock market trading. It’s important to choose the right broker when you first get started with learning stock trading for dummies.

Investopedia Stock Simulator

ETFs and mutual funds are similar in that they both represent a collection, or “baskets”, of individual stocks or bonds. For example, day trading can be expensive since you are trading frequently. Furthermore, since your trades are less than a year in duration, any profits are subject to short-term capital gains taxes. More recently, in May 2019, Uber went public, listing its shares on the NYSE. As of today’s close, UBER’s stock trades for $43.99 per share and the company boasts a market cap of $74.59 billion. Each publicly traded company lists their shares on a stock exchange.

How can I turn $100 into $1000?

Here are 10 ways to turn $100 into $1,000 or more.

Free Printable Library 1. Start a business.

2. Use a high-yield savings account.

3. Invest in yourself.

4. Invest in a 401(k) or IRA.

5. Pay credit card debt.

6. Enroll in a course.

7. Buy and sell.

More items•

If you want to invest in individual stocks, you should familiarize yourself with some of the basic ways to evaluate them. There we help you find stocks trading for attractive valuations.

Day

We looked at the types of courses offered and the levels of education provided. We also looked at whether the classes involved any sort of live instruction, community involvement, or if they were self-paced or self-led. You can sign up for interactive courses—which include quizzes—for as low as $49. If you want to spend a bit more and get ongoing instruction, some courses offer plans for $99 a month, which can include online communities, live chats, and even 1-on-1 instruction. Quite a few of today’s online brokerages allow for fractional investing, too, making it easier to invest in a small piece of the names you know and love, sometimes for as little as $1. And if you really want to simplify your investing efforts without feeling a big pinch, you can choose a platform that rounds up your everyday purchases and invests that spare change for you.

As IBD founder William J. O’Neil has written, “You can begin with as little as $500 to $1,000 and add to it as you earn and save more money.” Most Wall Street pundits will tell you it’s impossible to time the stock market. While it’s unrealistic to think you’ll get in at the very bottom and out at the very top of a stock market cycle, there are ways to spot major changes in market trends as they emerge. And by spotting those changes, you can position yourself to capture solid profits in a new market uptrend and keep the bulk of those gains when the market enters a downturn. All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed.

Stock Trading Demystified: Your Guide To Understanding Stocks

If you don’t have a TD Ameritrade account and you’re seeking an in-depth approach to investing, you can enroll in brokerage and investment firm Morningstar’s free Investing Classroom. There’s no need to have any money invested with them to gain access to a comprehensive online catalog of over 150 courses. This diary of events and observations sets the foundation for a trading edge that will end your novice status and let you take money out of the market on a consistent basis. Study the basics oftechnical analysisand look at price charts—thousands of them—in all time frames. Do not stop reading company spreadsheets because they offer a trading edge over those who ignore them. However, they won’t help you survive your first year as a trader.

- The Chicago Mercantile Exchange does this for futures and the Chicago Board Options Exchange does the same for those wanting to learn about options trading.

- The remainder should be in fixed-income investments like bonds or high-yield CDs.

- Free resources may provide generic strategies that worked at one time, but no longer work.

- Investors should assess their own investment needs based on their own financial circumstances and investment objectives.

- This cookie is used to enable payment on the website without storing any payment information on a server.__stripe_sidSession30 minutesThis cookie is set by the Stripe payment gateway.

- But you will make a lot of friends who ultimately will be here for you to keep things positive and allow you to flourish in an environment where you can succeed.

The first thing to consider is how to start investing in stocks. Some investors choose to buy individual stocks, while others take a less active approach. Stock trading is a risky investment and it is only wise to learn all the ropes before starting out to avoid making mistakes that might cause you your investment. “How to avoid the next stock market crash” is the latest publication from Liberated Stock Trader, this book will help you protect your investments.

Even turning on CNBC for 15 minutes a day will broaden your knowledge base. Don’t let the lingo or the style of news intimidate you, just simply watch and allow the commentators, interviews, and discussions to soak in.

If you’re looking to become a professional day trader then the DAS platform is the top in the industry. DAS Trader also allows you to use their platform with Interactive Brokers as well. You want that Direct Access routing and hotkeys to be an active, professional day trader.

Learn To Read: A Market Crash Course

Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an Options Regulatory Fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions.

Is now a good time to invest in stocks?

Overall it increased 22% last year. However, with lower share prices, now could be a good time to pick up some bargains. “Any extra cash could be an opportunity to invest in assets while share prices are low.” Some investors have already taken advantage of cheap stocks and shares.

There are no short-cuts, but you can teach yourself by learning from the wealth of books, videos, podcasts, and training courses available. T he intricacies of trading stocks can be confusing and intimidating, especially when you’re first starting out. The stock market has a lot of moving parts, but when you get down to the basics, it’s really pretty easy to understand. If you find yourself thinking, ‘I want to learn how to trade stocks,’ the best thing that you can do is start studying. By becoming more familiar with the types of trading, effective strategies, and lingo, you can ensure that your trades are successful and profitable.

Once subscribed, you’ll also find the consulting firm’s activity feed accessible. While you’re not getting classes and quizzes with this subscription, you are gaining access to a high-performing portfolio. Priced at $39 a month, this course is definitely on the affordable side. We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Entrepreneurs and entrepreneurship have key effects on the economy, learn how to become one and the questions you should ask before starting your entrepreneurial journey. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

A stock market crash is an unfortunate and historically inevitable part of trading, as are tsunamis to the natural world. Just like tsunamis, stock market crashes devastate those involved. There certainly is a lot to consider when building out your investing strategy. There are core questions such as should you use a day trading strategy versus a buy and hold strategy. Is Value investing like Warren Buffet for you or is the more time and nerve intensive swing trading more your style. The past, where access to the stock market was limited to a Stock Broker, who would call you on the phone and convince you that the latest hot stock was worth investing in, and you would believe him.

We develop high quality free & premium stock market training courses & have published multiple books. We also thoroughly test and recommend the best investing research software, books, brokers and have partnerships with companies whose products we love. Make no mistake; advisory brokers make money when you execute a trade. This means they will always be recommending that you sell a particular stock and buy another one. They make most of their money on the trade costs and not on the profit because the transaction cost is guaranteed, and the future profit of a particular investment is not. OurFirstrade and Interactive Brokersreviews also highlight that they are also excellent for active traders, meaning those that trade often and hold stocks only for the short term.

TRADEPRO offers an Elite Trading package for $219 per month. It’s for advanced traders who want access to daily trade updates, analysis of trades and to learn more about the psychology of trades. You also get access to forums and monthly group coaching sessions. Need a refresher or want some extra tips to jumpstart your trading? These intermediate courses are best if you already have some stock trading experience. TD Ameritrade and Fidelity are also really good brokers for long term investing. So, if you’re looking to be an aggressive day trader then we’d still recommend using Interactive Brokers over TD Ameritrade, Fidelity, and E-trade.