Table of Contents

- Trailing Stoploss Reversal Level

- Pivot Points From Prior Days

- Wait For The Price To Move Towards A Pivot Point

- Learn To Trade Stocks, Futures, And Etfs Risk

- Sports & Health Calculators

- Interpreting And Using Pivot Points

Price crossing the pivot on an up move is a bullish event; a cross below the pivot on a down move is a bearish event. Once a bullish indication has registered the study offers two resistance levels for the price to test. If the first resistance is penetrated price can be expected to test the second resistance. The same idea holds true for the support levels on a downward cross of the pivot point. Most traders use 38.2%, 61.8% and 100% retracements in their calculations and, therefore, Fibonacci Pivot Points represent three support and three resistance levels. To calculate Standard Pivot Points, you start with a Base Pivot Point, which is the simple average of High, Low and Close from a prior period.

What’s another word for pivot?

In this page you can discover 40 synonyms, antonyms, idiomatic expressions, and related words for pivot, like: change, shift, turn, move, rotate, shaft, veer, whirl, swing, pin and hinge.

In other words, the stock had to have a tall high-low trading range. To get its meaning, we should find a sum of high, low, and close prices and divide the result by 3. No matter what type of pivot points you use, there are always support, resistance, and central lines.

Trailing Stoploss Reversal Level

When prices are above the pivot point, the stock market is considered bullish. If prices fell below the pivot point, the market is considered bearish. A trader can only suppose that the past trend will continue to develop in the same direction for some time in the future and make appropriate trading decisions. As all the other technical analysis indicators, the PPMA indicator works well only when certain factors influence the market. Weekly pivot points are used for trading on H1, H4, and D1 charts.

The other major point to reiterate is that you can quickly eyeball the risk and reward of each trade. Therefore over time, you will inevitably win more than you lose and the winners will be larger. If you are the type of person that has trouble establishing these trading boundaries, pivot points can be a game-changer for you. If you are a trader just starting out in pivot points and want to get a handle on things, you will want to start with these large-cap stocks.

Which pivot points are best for intraday?

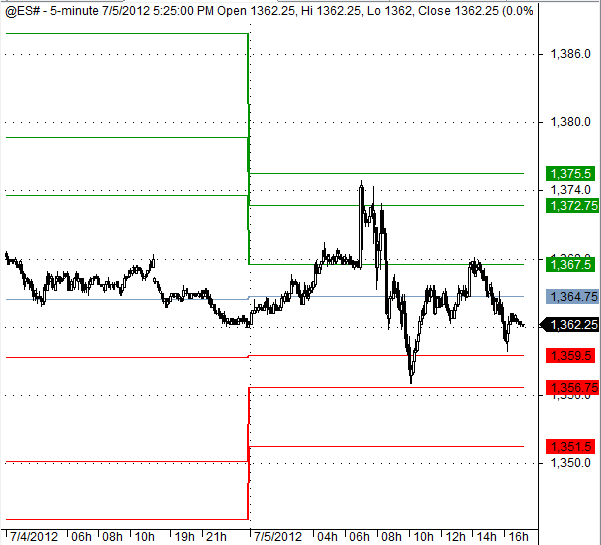

Since the data the pivot point gives is only applicable to one trading day, it becomes highly specific. So, it is suitable for only short time frames. Short time frames like 1-minute, 2-minute and 5-minute are the best for pivot point indicator. This makes pivot points more preferable to day traders.

A correction occurs afterwards and the MACD lines almost cross in bullish direction. However, there is no bullish reading coming from the MACD and the trade should be held. The next hesitation in the bearish trend leads to a bullish cross in the MACD, which should be taken as an exit signal. This trade would have generated profit of 235 pips in about two days. Notice that few hours after the bullish MACD cross, the price switches above the main pivot point. There are two matching signals coming from the PP and the MACD. This looks like a good long opportunity which could be traded.

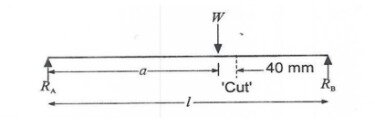

However, this time we will stress the cases when the price action bounces from the pivot levels. The first trade is highlighted in the first red circle on the chart when BAC breaks the R1 level.

Pivot Points From Prior Days

Alternatively, a trader might set a stop loss at or near a support level. He has over 18 years of day trading experience in both the U.S. and Nikkei markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. When Al is not working on Tradingsim, he can be found spending time with family and friends. Since the pivot points data is from a single trading day, the indicator could only be applied to short time frames. The daily and the 30-minute chart would not work, because it will show only one or two candles. As you can see in the chart, there are a number of resistance levels near our closing price on the day.

You absolutely need to start using a pivot point strategy as a complementary tool to your support and resistance strategy if you’re not doing it already. We employ a multiple take profit strategy because we want to make sure we give the market the chance to reach for deeper support levels. The best time to trade the pivot points strategy is around the London session open. However, it can be used for the New York session open with the same rate of success. Pivot Points are derived based on the floor trading guys that used to trade the market in the trading pit. It’s important to know this fact to appreciate the value pivot points can bring to your trading.

Another method is to look at the amount of volume at each price level. If you are long and are eyeing an S1 level to stop the selling pressure you can also see how much volume is at a certain level. Therefore, you will likely have a large number of stops right at the level. Therefore, if you place your stop slightly beyond this point, you will likely avoid being stopped out of the trade. For example, if you have an S1 level at $19.65, then you will want to place your stop at $19.44. 50 cents is a big mental price level for stocks under $20 bucks.

Wait For The Price To Move Towards A Pivot Point

The system trades the price moving toward—and then bouncing off of—any pivot points. These prices are generally taken from a stock or futures contract’s daily chart, but the pivot point can also be calculated using information from hourly charts.

They are drawn from left to right based on the demand points in an uptrend and supply points in a downtrend. The objective is to find points along the TD line that are most likely prone to a breakout move. Pivot points are used by forex traders to locate potential support and resistance areas. They are levels where price interaction may cause a reaction. In addition, Pivot points help traders gauge the bias and sentiment in the market over a given time interval.

Learn To Trade Stocks, Futures, And Etfs Risk

If the price is trading below the central pivot point, it is considered a bearish signal. Traders using the pivot point system will attempt to identify the movement of an asset’s price, and whether that movement is likely to continue or “pivot” in a different direction. TradingPedia.com will not be held liable for the loss of money or any damage caused from relying on the information on this site. Trading forex, stocks and commodities on margin carries a high level of risk and may not be suitable for all investors.

When the “Use Daily” options is selected, you can then specify how many bars back you would like to base the calculation of your pivot levels. For instance, if you chose 1 bar back, you would see yesterday’s pivot levels. Conversely, if you specify -1, you would see tomorrows pivot levels. You will only be able to view tomorrows pivot levels if you pivot level calculations do not rely on the current days data . This historical option also works with weekly and monthly options.

There will be times when certain types of pivot points adhere to price action better than others. But as a matter of preference, I generally like to use the Standard Pivot Points, as those are levels that most traders have marked and keep a close eye on. In any case, you should test each and see which works best for your preferred trading instruments. The calculation of the Standard Pivots starts with the baseline Pivot Point . You can simply calculate by taking the high, low, and close and diving that by 3. This is the center or mid-point from which the two support levels and the two resistance levels are calculated.

The origin and the precise way to calculate these pivot points are unclear. The most important is that these pivot points work for all traders and help in setting the right stop-loss and take-profit orders. The given rules are used to calculate Camarilla pivot points. The floor pivot points, presented in the first column of the calculation results table, are the most basic and popular type of pivots used in Forex trading technical analysis. The pivot point is interpreted as the primary support/resistance level— the point at which the main trend will be born.

Pivot points are calculated using the daily high, low and close of the Forex pair. MACD lines cross downward and we get the first signal for an eventual downtrend. Few hours later we see the price breaking through the main pivot point, which is the second bearish signal in this case.

In trading stocks and other assets, pivot points are support and resistance levels that are calculated using the open, high, low, and close of the previous trading day. The pivot point bounce is a trading strategy or system that uses short timeframes and the daily pivot points.

Add in a .618 fib level as well and it becomes a very key price level to watch. The more layers of overlapping price levels, the more fortified that specific pivot point becomes. It is prudent to spot triple fortified pivot point levels when possible. The reason pivot points are still some of the most valuable tools in forex trading, is because they provide a simple way of understanding which direction the market is heading in. Additionally, if prices are under the pivot point they may meet support at S1 and bounce back up towards the pivot point. When the prices go below the pivot point, then the market is bearish and prices will probably move towards a downward direction.

You can just as easily invest in a stock that has the wind to its back and you can ride the wave higher. The S&P 500 has been on a wild ride since the March bear market.In March, the S&P 500 lost the 38.2% Fibonacci retracement.

Moving forward, we’re going to give you our introduction to pivot points and show you how to calculate the pivot points. Last but not least, give you a couple of examples of how to trade with pivot points. Also, read Personality Strengths and Weakness in Forex Trading. Pivot point trading is also ideal for those who are involved in the forex trading industry.

In the last hours of the trading session, BAC increases again and reaches R3 before the end of the session. This is the 5-minute chart of Bank of America from July 25-26, 2016. The image illustrates bullish trades taken based on our pivot point breakout trading strategy. Then the R1, R2, and R3 levels could be colored in red, and S1, S2, and S3 could be colored in blue. This way you will have a clear idea of the PP location as a border between the support and the resistance pivot levels.