Table of Contents

- Understanding A Bull Trap

- Crypto Market On Track To A $2 Trillion Capitalization

- What Is Cash And Carry Trade In Finance?

- Stocking Up

- How Can I Avoid Falling Into Them Using Stock Market Predictions From An Ai?

- How To Avoid Bear Traps

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Bull traps are characterised by a trader or investor buying an asset as it breaks through a historically high level of resistance. Many breakouts above resistance are followed by increasingly higher highs, but a bull trap is characterised by a bearish reversal soon after the breakout. These are key terminologies derived from the stock market industry which can also be applied in cryptocurrency trading. Whether traders are professional or inexperienced, these events are common and could potentially cost a lot if neither one is careful. Bear traps are usually short squeezes, when a big rally to the upside happens during a downtrend in a market due to a lack of sellers at lower prices. This combines with the need for short sellers to buy to cover due to the reversal in the market trend creating heat on their positions.

Todd has spent almost three decades on Wall Street managing risk and researching financial market strategies. The bullish abandoned baby is a type of candlestick pattern that is used by traders to signal a reversal of a downtrend. A breakout is the movement of the price of an asset through an identified level of support or resistance. Breakouts are used by some traders to signal a buying or selling opportunity. The Herrick Payoff Index tracks price, volume, and open interest to identify potential trends and reversals in futures and options contracts. However, when stocks are acquired, they automatically become selling pressure on that stock because investors only earn profits when they sell.

Understanding A Bull Trap

The influence they have on people’s market actions and behaviors could build further momentum for future bull and bear traps to occur again. According to Perfect Trend System, there is no specific and clear evidence that claims a certain action in the market could result in bull and bear traps.

The all but certain bullish trend stops abruptly and a trend reversal begins. Suddenly, the price does a rapid jump contrary to your trade! In this article, we will cover the inner workings of a bear trap and how to avoid falling into one. Market participants often rely on technical patterns to analyze market trends and to evaluate investment strategies.

Crypto Market On Track To A $2 Trillion Capitalization

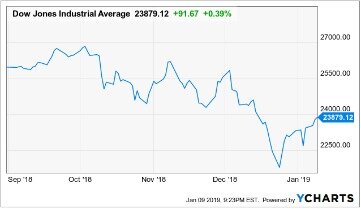

“The reason that’s important is that the October 2008 stock market still had 20% more downside. The stocks that crashed into October 2008 started to outperform through March of 2009.” “You would have bought Facebook and Google early because you understood their importance. Not because they were going to crush the quarter, but because they’re really important drivers,” Lee said. Lee also broke down some key milestones based on research from three previous stock market crashes that investors should keep an eye on as the coronavirus stock market attempts to recover. Nobody can predict what is going to happen with the stock market and that’s your greatest investing advantage. Your goal is to survive these uncertain economic times, stay safe, invest with less risk, thrive from sustainable investment returns, and enjoy life without too much financial stress.

What happens when you combine economic stagnation with excess liquidity from monetary policy? It’s outlined above – explosive moves higher and lower over a long period of time.

What Is Cash And Carry Trade In Finance?

Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. You can refuse to give in to the fear and not make crazy investment decisions during these uncertain times. You can play it safe and stay out of the stock market if you choose. Stocks are not going anywhere — you’ll always be able to buy them. Right nowan alarming number of peoplewho are spending more time at home are investing in the stock market.

They consist of a false signal when the market tends to increase or decrease and rapidly changes direction. This can happen with the price of a stock, index, or any other security. A bear can be said to be a financial market investor who is certain about the decline in the price of a security, and suspects that the overall market may be heading towards a decline. A bear trap is an unfortunate situation that the “bear investor” gets into by selling shorts during a panic.

Stocking Up

He has over 18 years of day trading experience in both the U.S. and Nikkei markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable.

The letter is unique and unbiased, unlike any other research on Wall Street. Our independent investment research stems from an elite team of analysts and strategists with real trading floor experience. Bear Traps was founded by Lawrence McDonald, he has spent 30 years working on Wall Street. He was formerly a senior distressed debt trader at Lehman Brothers and was part of the team that made $2 billion betting against the U.S housing market. Along with actionable trade ideas, we provide clients with a timely, first-hand look at global political market moving events. Our teams on the ground in New York, Toronto, Washington, Puerto Rico, Brussels, Dublin, Rio and Beijing bring you closer to what is moving markets. A bear trap is a false technical indication of a reversal from a down- to an up-market that can lure unsuspecting investors.

These habits may not be harmful as long as bull conditions last, but they can have major negative implications when a bear market returns. Bull traps are just one of many ways the markets can fake out investors and traders, and the reasons why they happen to have a lot to do with what’s going on inside our heads. Breakout points vary depending on time horizons and other factors.

US Markets – Examination of equity markets, packed with trades and warning signs. Getting ahead of systemic risk coming at us from Asia, Europe and Latin America will help clients avoid substantial losses and generate above average returns.

- And it causes a short squeeze – meaning those traders need to cover the shares they shorted and it causes the stock to rocket up.

- A bear trap can prompt a market participant to expect a decline in the value of a financial instrument, prompting the execution of a short position on the asset.

- The folks that are engaging in the aggressive speculative trading that has been going on for a couple of months are almost oblivious to market timing.

- Bears may also believe that the overall direction of a financial market may be in decline.

- The Fed will defend that action, and this means the March low will be defended as well.

- The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

- At Charles Schwab, we encourage everyone to take ownership of their financial life by asking questions and demanding transparency.

Take our options trading course to learn more about trading options. So as you now know, with shorting a stock, you need the price to move down. As price falls you want to know where support is ahead of time. Once price hits the support you identify, or the one you MISSED and didn’t know about, you cover your position. By covering, you’re buying the shares back at the cheaper price.

What Is A High Short Interest Percentage?

Suddenly, the trend line is broken and the price begins to decrease sharply, which is highlighted in the red circle. At the same time, volume is relatively low, which is a sign that the reversal is suspect at best. provides weekly insights, highlighting the impact of the political world onto the global financial markets, making specific investment calls. The report will give you a complete view of the global markets, where to spot opportunities, and how to avoid risk.

If you get caught in the bear trap while trading, close out the trade and don’t let it run in the wrong direction. Bear trap trading happens when short sellers want to make money but the bulls aren’t finished with the stock yet. Shorting is when you borrow a stock from your broker to buy back at a lower price. Big bull traps led to big bear traps for three years straight before finally bottoming in early 2003. Why do short-term rallies often occur during bear market cycles and what do they look like? We explain the mechanics behind bull traps and give an example from 2008. Bull markets can lead to bad habitsfor investors and traders, according to Dr. Kenneth Reid, founder of DayTradingPsychology.com.

However, the trend reverses again after a short period of time and exposes that the value of the cryptocurrency/index is continuing to decline. Unfortunately for the bullish traders and investors, they are trapped in the trade and experience losses as a result. Any traders who shorted the market thinking that the rally was over, were definitely trapped by the market movement later. Let us understand how to identify a bear trap with an example. If these criteria are met, then I would expect the move to be a bear trap and expect the market to remain sideways temporarily and resume the trend later. So, I will hold my longs and wait for the highs to be tested again. The best way to stop bear traps when trading is to first off know candlestick patterns and support and resistance levels.

What investments do well in a bear market?

Food and personal care stocks—often called “defensive stocks”—usually do well. There are times when bonds go up as stocks decline. Sometimes a particular sector of the market, such as utilities, real estate, or health care, might do well, even if other sectors are losing value.

The reason I currently remain in the “markets are going down more” camp is earnings. Tons of companies have not only pulled their quarterly guidance but also their entire year guidance. So it is very difficult to calculate a price when you have little information about how bad earnings are going to be affected by the virus shutdown.

Discussing wonkish topics such as global debt is a ratings-killer, which is one reason why the debt problem isn’t on the radar screen of the average investor. The recent rebound in the stock market has been a welcome relief, but don’t abandon shelter.