Table of Contents

- What Is Technical Analysis Of Stocks ?

- Ranging Market

- Common Technical Indicators

- Basic Technical Analysis Concepts And Terms

- Basic Of Charting And Stock Market Analysis

- Trend Trading: The 4 Most Common Indicators

Straightforward Technical Analysis for Beginners is facilitated by a forex and cryptocurrency trader. The class begins with a brief overview, followed by segments on candlesticks, support and resistance levels, popular chart indicators and chart patterns.

And, I consider, the extra important a part of the dealer’s arsenal. When hunting for patterns it’s critical to use good charting software.

What Is Technical Analysis Of Stocks ?

Since we’ve already mentioned helps, resistances and pattern traces, lets now flip our consideration to chart patterns and candlestick patterns. Many technical merchants use indicators along with horizontal and pattern line assist and resistance traces. There are two varieties of technical evaluation indicators primarily based on the timing of the alerts they provide. All that is required to increase the probability of a good trade is to chart your stock properly, and pay attention to the trends. There are no guarantees, and that’s why proper trading risk management and always using helpful TA tools is critical.

All trades, patterns, charts, systems or products etc. discussed or sold in this website are for illustrative purpose only and not construed as specific advisory recommendations. All ideas and material presented herein are for information and educational purpose only. Trading and investment in any market securities contain substantial risk and is not suitable for every investor. An investor could potentially lose all or more than the initial investment. Past performance is not necessarily indicative of future performance. You are requested to consult with their own independent financial advisor with respect to any investment and trading decision. Richard W. Schabacker was a financial editor in Forbes, through his pioneer research he developed the concept of technical analysis of Charles Dow.

Ranging Market

While charts look very mathematical, they’re really based on plotting and giving a visual representation to investor emotion and market psychology, depicting moves in prices over time. One of the biggest factors technical analysts examine is the price of the security. In fact, price action is the primary measure considered when conducting technical analysis.

- The wicks can come out of the candle on either end of the candle.

- There are many great charting companies out there, but these are our personal preference.

- The information provided by StockCharts.com, Inc. is not investment advice.

- The industry is globally represented by the International Federation of Technical Analysts , which is a federation of regional and national organizations.

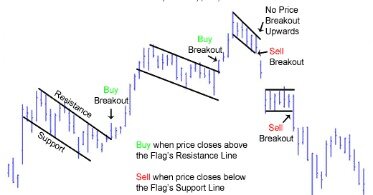

- A flag pattern is a continuation pattern which is described as a short sloping rectangle bounded by two parallel trend lines.

- Chart patterns- Chart patterns are a subjective form of technical analysis where technicians attempt to identify areas of support and resistance on a chart by looking at specific patterns.

Masterclass 2 will teach you how to plan for max profit and loss before it happens. You’ll learn how to maximize your knowledge to become a more efficient trader. You can implement your new skills in any stock index, cryptocurrency or forex. Whether you’re interested in trading small cap or large cap companies, you’ll be able to find a powerful trading training you can rely on and trust. Pick a class taught by a trader who has current strategies and knowledge that you can implement into your own trading. RSIs close to 30 or lower indicate that the crypto is currently undervalued and you should expect a rise in price.

Common Technical Indicators

It is best not to use any single analysis method alone as this will give you limited information. If you were to rely just on technical analysis, you would not get any insight into sentient or news, which are part of fundamental analysis. The most popular type of graph crypto traders use for technical analysis is a candlestick chart or graph. It can seem intimidating at first but is fairly easy to understand once you get the hang of the chart.

In this type of chart, the different time frame is available from 1 minute to daily, weekly and monthly. Depends on the different trading strategy, traders use the different time frames. Stock information like price, volume is placed on the chart and applying various patterns and indicators to assess the long term price movement and short term price movement. Major aspect of financial markets & mathematics and statistics and their techniques are fastest taking over. Once you get the knowledge of technical analysis, you can easily understand how to do technical analysis of stocks.

Basic Technical Analysis Concepts And Terms

Technical analysis isn’t applicable only in the realm of equities, of course. It’s used to identify trading opportunities in futures, commodities, cryptocurrencies and other areas. Wilder’s DMI consists of three indicators that measure a trend’s strength and direction.

A closed-end fund (unlike an open-end fund) trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. In this study, the authors found that the best estimate of tomorrow’s price is not yesterday’s price (as the efficient-market hypothesis would indicate), nor is it the pure momentum price .

In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. Other pioneers of analysis techniques include Ralph Nelson Elliott, William Delbert Gann, and Richard Wyckoff who developed their respective techniques in the early 20th century. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. Continuation chart patterns are used to foretell the continuation of the overall pattern. The preferred among the many continuation chart patterns are flags, triangles and rectangles.

Heavily-traded stocks allow investors to trade quickly and easily, without dramatically changing the price of the stock. In addition, low liquidity stocks are often very low priced , which means that their prices can be more easily manipulated by individual investors.

Bitcoin And Crypto Technical Analysis For Beginners

After breaking the trending line price has reached the lower end of the channel forming a higher low. If this trend line is broken with heavy volume then any retest to trend line will provide us good shorting opportunities. Reliance made low of 867.25, above the high of 2008, and bounce form that level as the high of 2008 act as support to the current price. The below chart is an example of a chart with the use of the MACD and RSI indicator. Money flow index– the amount of stock traded on days the price went up. Trix– an oscillator showing the slope of a triple-smoothed exponential moving average.

The inexperienced circles level out the legitimate oversold alerts. That is the hourly chart of the USD/CAD Foreign exchange pair for Nov 18 – Nov 25, 2015. On the backside of the chart we’ve hooked up the Stochastic Oscillator.

Basic Of Charting And Stock Market Analysis

Technicians try to isolate and profit from trends using technical analysis. The intent of a person plays a crucial role in deciding the type of analysis used for buying a stock or product. However, if you are buying property for short term for the investment you will look at supply, demand, and price benefit analysis for the short term. Anybody who wants to make effective investment in equity market should have knowledge on basic technical analysis and the most important fact is that it is not so tough. If you love the charts then the chart will tell you the secret of unlocking them. As more technical analysis strategies, tools, and techniques become widely adopted, these have a material impact on the price action. Although this is an interesting question, a true technical analyst doesn’t actually care as long as the trading model continues to work.

Those who sell short use the support price as their trading point. Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of the future direction of price.

Crypto traders have several tools to assess the cryptocurrency market. Using this method, traders can get a better understanding of the market sentiment and isolate significant trends in the market.

It is speculated that this anomaly is due to central bank intervention, which obviously technical analysis is not designed to predict. If you’re saying to yourself, this all makes sense, but I have no clue how to do the technical analysis basics. We have $3,000 worth of free trading courses, a free live trading room, and a great community for support to help you along on your journey. Technical analysis tools are essential to use to hunt for these technical analysis patterns.

If you start from the left-hand side of the chart and move forward with the price action, you will notice the clear structure of lower highs and lower lows. Another method traders use is based on the price ability to move minimum percentage points beyond a certain level. Many technicians use the closing technique to confirm a valid breakout. Simply stated, the price must close above or below a specific level on the time interval being analyzed to confirm a valid breakout.