Table of Contents

- Volume And Open Interest: Definition

- What Does Volume Mean When Trading Stocks?

- What Does Average Daily Trading Volume (adtv) Tell You?

- Stock Volume

JSTOR®, the JSTOR logo, JPASS®, Artstor®, Reveal Digital™ and ITHAKA® are registered trademarks of ITHAKA. The Volume Oscillator can be used to confirm a support or resistance break. A support break on increasing volume indicates a stronger move than a support break on low volume.

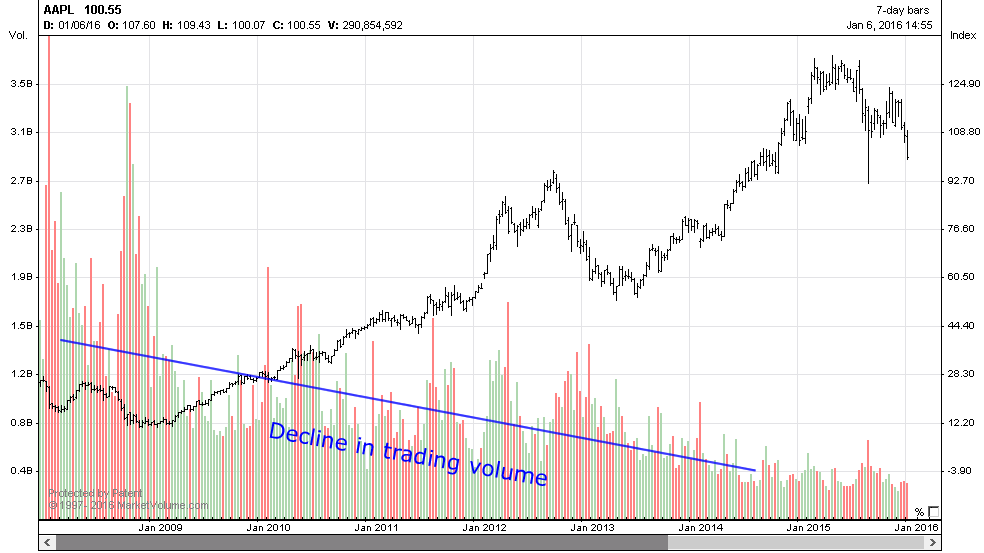

The red and green bars reflect daily volume, while the black line is the 20-day average volume. The average is less affected by single day events, and is a better gauge of whether overall volume is rising or falling. When volume is well above average, it sometimes indicates a climax of the price move. So many shares have changed hands in a certain price area that there may be no one else to step in and keep pushing the price in that direction. Steep price moves coupled with steep volume increases can often be a sign of an imminent price reversal. Downtick volume is the number of shares that trade at a price lower than the previous transaction price. Analysts use bar charts to quickly determine the level of volume.

Volume And Open Interest: Definition

Another thing to note, the value for volume can be found on an option chain. “Foreign financial regulatory authority” is defined, as in the proposed rule, to have the same meaning as in Section 3 of the Exchange Act, 15 U.S.C. 78c. Preceding 6 full calendar months has the same meaning as in § 41.11 of this chapter. Weighting of a component security of an index means the percentage of such index’s value represented, or accounted for, by such component security. For which the sum of the weight of such securities is equal to, or less than, 25% of the index’s total weighting. Narrow-based security index has the same meaning as in section 1a of the Commodity Exchange Act.

For example, if XYZ has a total trading volume of 100,000 shares at $5, then the dollar volume is $500,000. Money managers use dollar volume metrics to determine whether a stock has enough liquidity to support a position. Dollar volume can also be used to get an idea of money flow when scanning for stocks breaking out or breaking down that are generating the highest dollar volume during the day. Volume levels can also help traders decide on specified times for a transaction. Traders follow the average daily trading volume of a security over short-term and longer-term periods when making decisions on trade timing.

What Does Volume Mean When Trading Stocks?

An extreme volume spike is where volume trends up more than normal for that time or period could indicate the end of a trend. These are termed exhaustion moves—when enough shares change hands that no one remains to keep pushing the price in the trending direction, it will often quickly reverse. Increased volume typically shows that something has happened with the stock. Typically, a news release or active traders that have become worried or euphoric about the stock’s potential suddenly influence volume trading. Such days usually have volatility and large price moves either up or down. If most of the volume takes place at the bid price, then the price will move lower and the increased volume shows that sellers are motivated to get rid of the stock. The average volume statistic shows how many shares change hands in investments on a normal day.

The CFTC has decided not to allow a designated contract market or registered DTEF to immediately treat an index that has switched from narrow-based to broad-based as a broad-based index. Instead, all markets must continue to treat former narrow-based indexes as narrow-based indexes during the three-month grace period provided for in 41.14. The CFTC notes that indexes that switch from being narrow-based to broad-based may still be in a transitioning period.

With some practice, you’ll be able to decide when you see unique volume “footprints” from the past, and you can watch for them in the future, even though what happened in the past doesn’t necessarily play out the same way in the future. The average daily trading volume of common shares during the trailing 12 months. On any given day, a security may experience higher or lower volume for a variety of reasons. Investors can use average daily training volume to compare against its current volume. If the average daily trading volume is significantly higher or lower than the current volume, it is a clue that something may be happening that is creating buying or selling demand.

Such entity must be active in the foreign currency markets as a source that quotes rates for the purpose of buying and selling foreign currencies. The Federal Reserve Bank, as in the proposed rules, would be an acceptable source.

What Does Average Daily Trading Volume (adtv) Tell You?

Higher volume stocks are those where there’s more investor interest in buying and selling them, which sometimes results from a news event. A stock’s current volume compared to its historical volume allows investors to spot changes or make comparisons to the performance of other stocks. Volume also confirms price trends and gives a heads-up about potential reversals. When investor sentiment begins to lean into a particular stock, its volume has concrete implications for its liquidity. Shifts in trade volume can make observed price movements more significant.Higher volume for a stock is an indicator of higher liquidity in the market. For institutional investors who wish to sell a large number of shares of a certain stock, lower liquidity will force them to sell the stock slowly over a longer period of time, to avoid losses due to slippage. The volume of trade is the total quantity of shares or contracts traded for a specified security during a set period of time.

How do you know if buying or selling volume?

If the price and volume go up then the volume is considered a buy vol. Likewise, if price comes down, and vol increases it is considered a sell volume.

The total cost for all of the 11 exchanges to maintain one terminal on an annual basis thereafter is estimated to be $283,800. The SEC notes, however, that for those exchanges that already have such third-party vendor terminals in place, there should be no additional costs associated with obtaining the required data to comply with the new rules. This commenter noted that a single compiler of the lists will result in consistent treatment of futures on security indexes. Furthermore, this commenter indicated that it will need to hire two additional staff personnel to calculate market capitalization and dollar value of ADTV for securities comprising an index on which future contracts trade.

Several commenters addressed the issue of competition with respect to the proposed rules. In particular, the SEC received a few comments stating that exchanges will face unregulated competition because eligible contract participants trading futures over-the-counter will not be subject to these new rules.179 The SEC points out that the Congress, in adopting the CFMA, provided for a differing scheme of regulation for eligible contract participants. In complying with new Rules 3a55-1 through 3a55-3 under the Exchange Act, a national securities exchange, designated contract market, registered DTEF, or foreign board of trade will incur certain costs. Thus, the costs of complying with the new rules primarily are attributable to the implementation of the new provisions of the Exchange Act pertaining to the definition of narrow-based security index. National securities exchanges, designated contract markets, registered DTEFs, and foreign boards of trade trading these products are responsible for assuring their own compliance with the newly-adopted rules and thus will incur various costs in determining the market capitalization and dollar value of ADTV for component securities of a security index. In capital markets, volume, or trading volume, is the amount of a security that was traded during a given period of time. In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day.

Stock Volume

Looking at how the volume of a particular stock changes over time is more important. You can see that with volume charts that show the historical data for a stock’s volume.

Using AAPL again as an example, with an average 5 day volume of 4 million. What if you needed to know relative volumes during the trading day? It measures current volume in relation to the “usual” volume for this time of the day. A large percentage change in option price along with above-average volume is a good indication that the market is moving in the direction of the price change.

Market Volume

The volume of trade is a measure of the market’s activity and liquidity during a set period of time. 1) Relative volume or RVol, is a ratio that calculates current volume to average volume for the same time of day. Based on the intraday distribution curve, the average cumulative volume for AAPL for this time of the day is 1 million. The difficulty is in figuring out the average cumulative volume for this time of the day. U.S. trading day means any day on which a national securities exchange is open for trading. Preceding 6 full calendar months means, with respect to a particular day, the period of time beginning on the same day of the month 6 months before and ending on the day prior to such day. If reported transactions in the security have taken place in the United States, the price at which the last transaction in such security took place in the regular trading session of the principal market for the security in the United States.

Compared to prior volume, relatively high volume has been found to be more suitable for traders. When it comes to low volume, this indicates a lack of interest and little price movement. In day trading, there are buyers and sellers which mean buyers will purchase shares sold by the sellers. This happens when long term technical and fundamental factors are present.

Rule 41.11 under the CEA and Rule 3a55-1 under the Exchange Act Rules 41.11 under the CEA and 3a55-1 under the Exchange Act establish a method for determining the dollar value of ADTV of a security for purposes of the definition of narrow-based security index under the CEA and Exchange Act. This method requires the inclusion of reported transactions outside the United States in calculating dollar value of ADTV for purposes of Section 1a of the CEA and Section 3 of the Exchange Act.20 It also requires aggregating the value of trading volume in a depositary share21 that represents a security with trading volume in its underlying security. Average daily trading volume can be one part of a trader’s technical analysis for a security. It can help them minimize risk by pointing out securities that have a committed group of buyers and sellers, allowing traders to quickly enter or exit a position they may take. It is not, however, a stand-alone measurement and should always be secondary to price movement when deciding whether or not to trade a given security. In any rally, prices will reach a level where buyers take a breather. In order for prices to continue to go higher, there has to be significant volume.

How do you use price/volume trend?

The Volume Price Trend Indicator Formula

On days when a stock’s price declines, multiply volume by the percentage price decrease between today’s close and the previous day’s close and then add the result to the previous day’s PVT value.

It includes the total number of shares transacted between a buyer and seller during a transaction. When securities are more actively traded, their trade volume is high, and when securities are less actively traded, their trade volume is low. Market timers often use volume as an indicator of future price change. For instance, some traders believe that a surge in trading volume on a stock is a precursor to a rapid change in price. The theory is that important news does not reach everyone at the same time, so an unexpected increase in volume suggests important news has been leaked.

As they funnel their money in over time, it could mean the trend has staying power. How you interpret volume has a lot to do with your trading preferences. If you’re a day trader and are watching a stock you think is going to break out of an intraday pattern, then you might consider looking for a spike in volume to accompany a price move. It might be a merger or acquisition, earnings, or any other event, and once it’s over and the breakout is complete, price may continue moving higher even without a continued increase in volume. An important takeaway for investors who want to use annual daily trading volume in their trading is that an increase in average daily trading volume does not always directly correlate with price.

It is also a measure of how much a particular security has been traded within a specific period of time. As a powerful tool, it’s used as an indicator when it comes to trading. The term volume means how much of a given stock was traded in a particular period of time.