Table of Contents

- Nfp Trading In Forex And A Strategy For Trading

- Volatility Caused By Nfp

- Nfp Forex Trading Strategies

- What Is Nfp?

- Trading The Nfp

- What Is The Best Nfp Forex Broker?

The first doesn’t trigger because the price doesn’t drop below the consolidation low. For multiple examples of this approach see How to Day Trade Forex in 2 Hours or Less. The only difference is that following news we typically have bigger price waves than when there is no news.

This can be a great way to gain insight into the impact of previous NFP figures, predictions for the future and how non-farms are traded by others. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nfp Trading In Forex And A Strategy For Trading

Released by the Bureau of Labor Statistics, the employment report contains information related to unemployment, job growth, and payroll data, among other key statistics. Data-wise, the most important stat that traders should take note of is the non-farm payroll figure. The results of the NFP data can help you determine or confirm a specific direction for a currency pair. For example, if you are already bullish on the Dollar, and the market expects a headline NFP number that is 100K and instead the actual release shows 200K, the dollar is likely to gain traction. You can then use that information to further bolster your trade conviction, and position yourself to find an appropriate trade entry after the initial volatility begins to level off. Given the volatility surrounding a payroll report, there are a number of ways professional investors can trade around this report. Trading prior to the Non-farm payroll report is generally stable and active, but immediately after the report, markets that are effected can become very volatile.

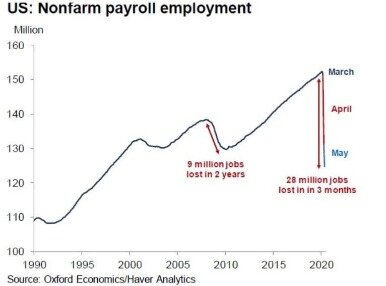

If the NFP numbers are weak, the opposite will occur and the Fed will be dovish and lean toward adding stimulus. Job growth is essential to generating a robust U.S. economy, and therefore this report can drive market sentiment for days, weeks or even months. The NFP news report is a time series that is reported by the Bureau of Labor Statistics , and is considered to be one of the best guides to total employment in the United States. The Non-farm payroll numbers are based on a monthly sampling of specific corporate businesses. Then the government interprets these numbers in a few days against quarterly numbers that are less timely. The monthly payroll figures involve some forecasting by the BLS.

Volatility Caused By Nfp

Hence, the lower the Continuing Claims data figure, the better for the economy and the more bullish for the currency. With the advanced strategy, we need to be more in tune with what the market is telling us. We are viewing the initial move or a reversal as our trend direction. We wait for a pullback and then take a trade when price starts moving in the trending direction again. Our trade trigger could be a consolidation breakout or a small trendline or pattern break.

What time is NFP UK?

Non-farm payroll times in the UK

The non-farm payrolls are usually released at 1.30pm (UK time), or 8.30am (EST) on the first Friday of every month and offer trading insights into month-on-month and year-on-year data.

They can also enter a trade as soon as the bar moves past the high or low without waiting for the bar to close. Non-farm payrolls are an important economic indicator related to employment in the U.S.

Nfp Forex Trading Strategies

As with all aspects of trading, whether we make money on it is not assured. Trading news releases can be very profitable, but it is not for the faint of the heart. This is because speculating on the direction of a given currency pair upon the release can be very dangerous. Fortunately, it is possible to wait for the wild rate swings to subside.

Why does oil price affect Canadian dollar?

When oil prices are high, the amount of U.S. dollars Canada earns on each barrel of oil it exports will be high. Therefore, the supply of U.S. dollars flowing into Canada will be high relative to the supply of Canadian dollars, resulting in an increase in the value of the Canadian dollar.

The reason for this is pretty clear, because these indicators allow a trader to identify both minor and major trends with regard to economic growth. With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. If there is not enough momentum or deviation in the NFP release, the market could quiet down after the initial reaction.

What Is Nfp?

He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director of the CMT® Program for the CMT Association. Overnight trading refers to trades that are placed after an exchange’s close and before its open. Fade refers to a contrarian investment strategy used to trade against the prevailing trend.

- Most of the central banks around the world would like inflation to grow at an annual basis of around 2% to 3%.

- It accounts for +/-80% of the workforce who produce the entire GDP of the U.S. and is a statistic researched, recorded, and reported by the U.S.

- A call options is the right but not the obligation to purchase a currency pair at a fixed strike price on or before a specific date.

- I had 3/4 trades take profit because of NFP pair crossing today.

- BinBotPro is holding their final round of beta testing and is currently looking for people to help out in testing their software.

- trading the non farm payroll news can be really profitable, the thing is, you’ve got to get the direction right.

Therefore, it is recommended to wait for the release before opening a new trade. Or, another way to trade the NFP number is to focus on a bigger time frame analysis. If the trading decision is the result of a trading analysis on a monthly, weekly, or even daily chart, then the number can be ignored.

Trading The Nfp

spread increase, which means your trading costs go up as time comes new to the non farm payroll news release. It depends completely on your trading method and on how well you know the market that you are trading. In my example system , you do not need to know which direction the market will move, only whether it will move significantly or not. You cannot just randomly place trades around when the report comes out and expect to win . In this article, I will teach you one simple system you could use to trade the NFP. You may be able to use it as is, or you may decide to make changes to it to make it work better for you.

The NFP report provides keys statistics for currency traders. There can be substantial volatility in the forex market after the NFP release, which can cause large gyrations for major currency pairs. In addition during these volatile periods it may difficult to obtain tight bid ask spreads from you FX Broker, or even execute your forex orders in the market efficiently. On the same day the BLS reports the NFP, they also report a separate employment report called the household survey. The U.S. unemployment rate is defined as the number of individuals actively searching for a job calculated in terms of the percent of the entire labor force. This figure is calculated separately from the non-farm payroll report. Each month, the BSL announces the total number of unemployed as well as employed individuals based on the number of employed and unemployed people in the United States for the previous month.

Nfp Report Could Flag Slowing Jobs Recovery; May Accelerate Dollar Slide

Trade on a short-term basis on daily basis, to avoid the risk of being dragged by volatility, caused by the release of NFP data. Just imagine, in less than 1 hour, the price upheaval after the release of the US Non-Farm Payroll could reach pips.

You might think, “Great, the unemployment rate dropped,” and expect that to reflect optimistically in the markets, but you would probably be wrong. Since the decline was so much less than what experts expected, the mild decline could be seen as disappointing, and could actually shatter confidence in the recovery of the economy. In that case, you would be completely wrong about the significance of the news. The figure released is the change in nonfarm payrolls , compared to the previous month, and is usually between +10,000 and +250,000 during non-recessional times. That number is meant to represent the number of jobs added or lost in the economy over the last month, not including jobs relating to the farming industry. We have designed a simple, yet powerful Non-Farm Payroll forex strategy that’ll help traders profit from the biggest monthly NFP economic news event. Even though the payroll increase hit that target threshold, the lower-than-expected results can spark worry that unforeseen challenges are hitting the U.S. economy, which could trigger a USD sell-off.

Extended trading is conducted by electronic exchanges either before or after regular trading hours. Volume is typically lower, presenting risks and opportunities. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

What you see in that situation is a massive spike in the unintended direction, taking 99% of traders out, followed by a reversal to the intended and predetermined direction of the Market Makers. Price was going to go, where it was supposed to go by the entities that control the Forex market. Governments, Central Banks and Market Makers control currency prices. The data that gets released for Non Farm Payrolls and other Forex News does not matter. Price moves to wherever Governments, Central Banks and Market Makers choose to move it to, regardless of the forecasted and actual data that gets released. An increase in user spending has always been a factor behind USD performance, even if its impact is often understated.

American employers resumed hiring in January and the unemployment rate fell to a pandemic low as California ended its lockdown and viral rates fell across the country. Nonfarm payrolls add 49,000 positions in January as forecast. Big surprise – albeit not for all – in the US Nonfarm Payrolls report for February.