Table of Contents

- Top Online Courses

- Forex Trading Tips

- Social Trading

- Online Trading Courses

- Introduction To Trading With Technical Analysis

This is a big benefit and all you do isuse my affiliate link before signing up for your free account. My intent is to make thisWealthy Affiliatereview worthwhile so that you can also take advantage of the many wonderful options it offers. I signed up for afree accountat Wealthy Affiliate and then immediately upgraded to paid Premium membership. After 1 year atWealthy Affiliate, I wanted to write aWealthy Affiliatereview whether this is a good program to sign up with or not. We have developed our own trading style and systems that we want to share with you. My wife and I both love the company, and we buy most items through Amazon online, and we also subscribe to Prime to get free shipping. We traded all the IPOs as they went public live, and we were the first to use Level II software from Cybertrader.

Within the curriculum, the instructors do mention options and their role in the financial markets, and you will be able to use this knowledge for developing your own options trading strategies. This course is suitable for students of all experience levels, as it requires no prerequisite knowledge of financial markets. However, this class is not specific to options trading, so it’s best suited for those who want to learn about the financial industry as a whole, rather than just options trading. Options trading is a type of investing which allows investors to see quick and effective results with limited investments.

What’s nice about that is, when you feel you’ve consumed enough knowledge, your trading account is set up and ready to go. Because TD Ameritrade doesn’t charge commissions on trades, you can start out as small as you want. Investopedia offers its own stock trading class as part of the Investopedia Academy, but to maintain objectivity, we opted to exclude it from this roundup.

Top Online Courses

For example, business news or data can generate very strong price jumps. Very short-term trading with a trade duration of usually a few minutes to seconds. In linguistic usage, one uses several different terms for the types of trade. Most traders are universal and adapt to the market, so the boundaries of the types of trade often blur. Roughly speaking, trading types can be divided into short-term and long-term investing. Every trader should find out for himself what he likes best. As a trader today, you can participate in the financial markets with any size of capital.

It’s difficult to say whether you will really be able to constantly achieve 3-4% monthly returns with these options trading strategies as advertised. However, one thing is for sure – the course instructor is good at what he does, and his strategies are based on evidence and analysis, rather than random speculation. If you can master the material contained in this options trading course, you will be one step ahead of the competition, and one step closer to easy passive income. Because of the reasons mentioned above, we consider this to be one of the very best options trading courses for advanced spread strategies. You decide whether you’re going to take a trade if an alert setup fires off. Practice trading our watch lists after taking our online options trading course.Check outour stock picks service.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade. All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website. Controlling fear – Even the supposedly best stocks can start plummeting. Fear then sets in and many investors liquidate their holdings.

Forex Trading Tips

More specialized seminars—often conducted by a professional trader—can provide valuable insight into the overall market and specific investment strategies. Most focus on a specific type of asset, a particular aspect of the market, or a trading technique. Some may be academic, and others more like workshops in which you actively take positions, test out entry and exit strategies, and other exercises . It usually involves the use of a stock market simulator that has the look and feel of an actual stock exchange’s performance. Make lots of trades, using different holding periods and strategies, and then analyze the results for obvious flaws.

With this type of account, the stockholder holds their securities in an online account rather than physically holding the stock certificates. Invest no more than you can afford to lose, and begin with “blue chip” stocks, which are the most secure. The SEC and other financial advisors warn that day trading, while neither illegal nor unethical, is not only very risky but also very stressful and expensive.

Your baby steps forward as a new trader needs to recognize this challenge and address remaining issues with money and self-worth. Buying the dipoffers a classic example, with traders jumping into a strong uptrend when it sells off in a lower period. The best way to examine this three-dimensional playing field is to look at each security in three time frames, starting with 60-minute, daily and weekly charts. Your experience with charts and technical analysis now brings you into the magical realm of price prediction. Theoretically, securities can only go higher or lower, encouraging a long-side trade or ashort sale.

Social Trading

Calls mean that you believe that the stock is going up and puts mean that you believe the stock is going down. Obviously, you don’t want to just guess the direction that a stock is going to move. Technical analysis plays an important role in determining the direct that an options contract is going to move.

It is essential to choose a broker who is a registered member of all the stock exchanges and is certified by the SEBI. Build your confidence and learn how to trade forex with a wealth of educational tools and online resources. Master the art of trading with Benzinga’s signature course, “How to Trade Stocks.” Learn how to read charts and make winning trades in the market through simple, actionable strategies. Successful day trading requires understanding market psychology, experience, skill and proficiency. Check out the best technical analysis courses and the best online finance courses now. Profound option traders, Pete & Jon Najarian, have created a name for themselves in the finance community through years of success through their knowledge and overall strategies.

Online Trading Courses

In a few weeks, the price of the stock has indeed fallen to $90 per share. You purchase your 10 shares back at $90 and return them to the lender.

Each position carries a holding period and technical parameters that favor profit and loss targets, requiring your timely exit when reached. Now consider the mental and logistical demands when you’re holding three to five positions at a time, with some moving in your favor while others charge in the opposite direction. Fortunately, there’s plenty of time to learn all aspects of trade management, as long as you don’t overwhelm yourself with too much information.

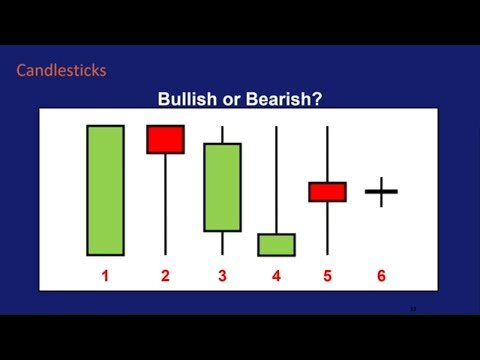

Introduction To Trading With Technical Analysis

Its founder, Kunal Desai, has been an active day trader since 1999. Desai intended to make this trading course a more personalized experience for members, and the Live 60-Day Boot Camp has become the cornerstone of his offering. That’s why Bulls on Wall Street makes our list as the best stock trading course for live training. There are less expensive stock trading courses available, but if you want to ensure you have access to all the learning resources you’ll need to succeed, you’ll pay just a little bit more. That’s why Bear Bull Traders makes our list as the best value for stock trading courses.

If you’re already trading, then may be our Fierce Freebie weekly updates will be the edge that you’re looking for. We’re talking about another kind of market, one that doesn’t sell fresh produce or the latest fashion lines.

The best day trading courses deal with specifications and attempt to appeal to a niche audience. Some day trading courses aimed at beginners may only teach the very basics, while others aimed at more advanced traders can cover more complicated topics. Luckily, you don’t need to go back to college and begin a new degree in economics to learn to trade effectively.

Whether you are an everyday investor or an institutional hedge fund managing hundreds of millions of dollars in client money, anyone can trade. With your online broker account setup, the next step is to simply take the plunge and place your first stock trade (instructions further down!). News sites such as CNBC and MarketWatch serve as a great resource for beginners. For in depth coverage, look no further than the Wall Street Journal and Bloomberg.

- The complete opposite strategy would be day trading, which is when you buy shares then sell them the same day before the market closes.

- They are actionable trade alerts, which include entries and exits.

- This gives you an opportunity to practice leveraging the market without much risk.

- For a broad overview of finance, this is the very best options trading course.

- The bottom line is that you definitely do not need money to start your forex trading education journey.

The pleasant part of the adventure and journey of learning how to trade, was all the friends I made through the years and the camaraderie we have developed. Students from Europe and Asia that I have become friends with and actually met up with them while traveling is another highlight.

This means that you sold shares, that you didn’t have, for $1,000 total and have now replaced them for $900, netting yourself a $100 profit. There is also a combination of stop and limit orders called a stop-limit order. When the price of the security passes a certain threshold, this order specifies that the order become a limit order rather than a market order . Some specific patterns are also detectable in stock charts. The most common one is known as “head and shoulders.” This is a peak price then drop, followed by a taller peak then drop, and finally followed by a peak similar in height to the first. This pattern signals that an upwards price trend will end. Coaches need to recruit students – this is how they make money, so sales pitches abound across media sources.