Table of Contents

- the Trend Is Your Friend In This Trading Strategy

- My Top 21 Stock Market Strategies & Tips

- Drawbacks Of Day Trading

- Using Technical Analysis Indicators

- Tip #17: Treat Trading Like A Business

- Martingale Trading Strategy: How To Use It Without Risk Too Much

Since the level of profits per trade is small, scalpers look for more liquid markets to increase the frequency of their trades. And unlike swing traders, scalpers like quiet markets that aren’t prone to sudden price movements so they can potentially make the spread repeatedly on the same bid/ask prices. Some actually consider position trading to be a buy-and-hold strategy and not active trading. However, position trading, when done by an advanced trader, can be a form of active trading. Position trading uses longer term charts – anywhere from daily to monthly – in combination with other methods to determine the trend of the current market direction.

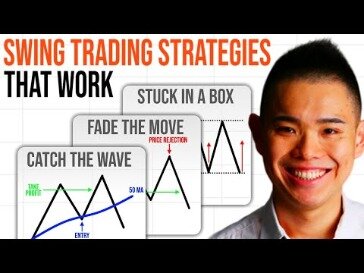

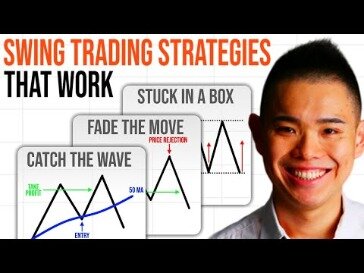

At the end of a trend, there is usually some price volatility as the new trend tries to establish itself. Swing traders buy or sell as that price volatility sets in. Swing trades are usually held for more than a day but for a shorter time than trend trades. Swing traders often create a set of trading rules based on technical or fundamental analysis. Active trading is the act of buying and selling securities based on short-term movements to profit from the price movements on a short-term stock chart. The mentality associated with an active trading strategy differs from the long-term, buy-and-hold strategy found among passive or indexed investors. Active traders believe that short-term movements and capturing the market trend are where the profits are made.

the Trend Is Your Friend In This Trading Strategy

Warrior Trading is a 1-stop-shop for new and seasoned traders. Accredited by the Better Business Bureau with an A+ rating, it offers educational courses, resources and community support to help you attain success as a day trader. To date, the platform boasts an impressive following of over 500,000 active followers and 5,000 premium members.

Can you learn trading by yourself?

Yes, you can learn to trade by yourself, without a course, if you are patient and understand that it will take a lot of time! Trading is a competitive industry, and to succeed you will have to pave the path for your own success.

I recommend new traders study and paper trade before trading real cash. Watch my video lessons and YouTube channel and build your knowledge account.

My Top 21 Stock Market Strategies & Tips

Even if you can only commit 30 minutes a day, it can still change your life. There will be new trade opportunities around the corner. If the big percent gain is caused by a paid promotion or media mention, I like to ride the hype and momentum.

Which is better stop or limit order?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price

While there are many strategies to become a successful trader, there are 10 pivotal ways that traders can have to build a winning portfolio. Bull swing traders that purchase stocks could enter their trades using a buy-stop limit order. That’s an order to buy a security at a specified price . But if you’re trading in-the-money options, it’s possible you’ll use a contingent buy order, which involves a simultaneous execution of at least two transactions. Savvy swing traders can do this by isolating the counter trend move. To start, they’ve got to figure out their entry point. It’s their starting line, or the price they pay to buy an investment.

Drawbacks Of Day Trading

When you’re a new trader, you don’t have hundreds of thousands of dollars to play with. Trading consistently requires a lot of discipline and the right mindset. When traders become undisciplined and try to beat the market, that’s when the biggest losses occur.

There is also no need to wait for a pullback later in the trading day, such as with swing trading. Whether it’s at opening bell in the US stock market or after-hours with forex, turtle trading has a flexible timetable. If traders want to try out their strategies before investing capital, backtesting day trading could be best. Day trading strategies can be tested on TradingSim before they’re implemented in real life. Simulated trades can help traders analyze how well or badly their trades are doing. Testing out trades can help determine which strategy is best for day trading. For example, if an investor wants to backtest day trading Coca-Cola stock, they can use charts like the TradingSim chart below.

Using Technical Analysis Indicators

Active trading is a popular strategy for those trying to beat the market average. Brett Yoder, CMT®, joined Fidelity in 2010 as a trader in our Service function.

If your system counts tick changes then you must implement the difference adjusted rollover method. On the other side if you calculate your system performance P&L as percentage of returns you must use a the ratio adjusted method. A Limit-on-close order will be submitted at the close and will execute if the closing price is at or better than the submitted limit price. A pegged-to-market order is designed to maintain a purchase price relative to the national best offer or a sale price relative to the national best bid . Depending on the width of the quote, this order may be passive or aggressive.

This strategy doesn’t use any indicators and is simply based on price movement across all time frames. As explained earlier, there are only two trends to watch out for — price action to the upside or price action to the downside. A look at price action for a set period of time shows price levels where the momentum faces a breakout to upside — support — and when momentum faces a breakout to the downside — resistance. Various research platforms offer you the ability to quickly collect and review information relevant to day trading opportunities you identify in the financial markets.

There’s no need to take an either-or approach to these; it’s OK to mix and match. Whichever you pick, do your homework and be disciplined. Access all the information you need to know about stocks in one place. Find the best stock research tools for you with our comprehensive selection. Benzinga takes an in-depth look at the best stock market apps for 2021. Put the power of investing into your hands with the right app.

Consider talking to a financial advisor about which investment strategy is best for you. Finding the right financial advisor who fits your needs doesn’t have to be hard.SmartAsset’s free toolmatches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors who will help you achieve your financial goals,get started now. There are numerous active trading strategies, all of which require much closer attention than passive investment. Some strategies are more challenging – and potentially lucrative – than others.

As an individual investor, you may be prone to emotional and psychological biases. Professional traders are usually able to cut these out of their trading strategies, but when it’s your own capital involved, it tends to be a different story. Decide what type of orders you’ll use to enter and exit trades. When you place a market order, it’s executed at the best price available at the time—thus, no price guarantee. Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Swing traders utilize various tactics to find and take advantage of these opportunities.

Several trend-following tools can be used for analysing specific markets including equities, treasuries, currencies and commodities. Trend traders will need to exercise their patience as ‘riding the trend’ can be difficult. However, with enough confidence in their trading system, the trend trader should be able to stay disciplined and follow their rules. However, it’s equally important to know when your system has stopped working. This usually occurs due to a fundamental market change, therefore it’s important to cut your losses short and let your profits run when trend trading. The above is a famous trading motto and one of the most accurate in the markets.

This strategy describes when a trader uses technical analysis to define a trend, and only enters trades in the direction of the pre-determined trend. A day trader can make use of local and international markets and can open and close many positions within the day. Many traders look to trade European markets in the first two hours when there is high liquidity. Otherwise, traders usually focus between 12pm – 5pm GMT when both the UK and US markets are open.

Trading strategies are based on fundamental or technical analysis, or both. Scalpers open several small positions with a less defined criterion in comparison to other strategies, therefore there a lot of opportunities to trade on. Scalpers do not hold overnight positions and most trades only last for a few minutes at maximum. A prevailing trend may offer various opportunities to enter and exit a trade.

Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Scalping is one of the quickest strategies employed by active traders. It includes exploiting various price gaps caused by bid-ask spreads and order flows.

Trading volume is a measure of how many times a stock is bought and sold in a given time period—most commonly known as the average daily trading volume. A high degree of volume indicates a lot of interest in a stock. An increase in a stock’s volume is often a harbinger of a price jump, either up or down. Don’t consider it if you have limited time to spare.

The relatively recent advent of online trading platforms and brokers that support them has given rise to a new generation of day traders eager to profit from market fluctuations. Day trading or intra-day trading is suitable for traders that would like to actively trade in the daytime, generally as a full time profession.