Table of Contents

- Margin Account Vs Cash Account: Which Is Better For Traders?

- Gbpusd Scalping Strategy

- Choosing A Charting Time Frame

- The Ins And Outs Of Forex Scalping

- Forex Price Action Scalping Strategy

- Minute Scalping Strategy

- How To Scalp Trade

You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.71 and designed to promote the independence of investment research. The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points.

When the 8 period moving average crosses the 21 period moving average and begins to widen we can begin to look for trades in the direction of the trend. A lot of the very popular and successful scalping trading strategies have the same things in common. Scalping can often involve higher risk levels and you will need to be switched on and watching your charts at all times. You can get in and out of your trades in moments and you can make profits in many different markets. In order to read or download forex the simple daily strategy that will change the way you trade forever ebook, you need to create a FREE account. forex scalping is a high pressure/stress trading technique for many, you’ve got to be able to keep a cool head.

Which forex indicator is most profitable?

Listed below are some of the most profitable indicators used by traders: 1. Pattern recognition indicators. Pros.

2. Moving Average. These indicators are the best trend indicators that help identify the trend and necessary following.

3. Bollinger Bands.

4. Moving Average Convergence/Divergence (MACD) and RSI Relative Strenght index.

But if you like to analyze and think through each decision you make, perhaps you are not suited to scalp trading. In the example above, the weekly chart shows a strong upward bias of the EUR/USD. The price could be heading back to a target of 1.4280, the previous high on November 4, 2010. As a trader, it is up to you to research and understand the broker agreement and just what your responsibilities would be and just what responsibilities the broker has. Ask questions to the broker’s representative and make sure you hold onto the agreement documents. Scalpers seek to profit from small market movements, taking advantage of the constant market activity. Today, however, that methodology works less reliably in our electronic markets for three reasons.

Margin Account Vs Cash Account: Which Is Better For Traders?

Any trading system platform is okay because the Volume Indicator comes standard on all trading systems . Markets that have a lot of volatility and give plenty of trading opportunities. Markets and Forex pairs with small spreads that don’t eat into your profits. Trades that have the potential to make big reward profits.

This means holding positions overnight and sometimes over the weekend. Most traders feel like they need to find a setup each time they sit down in front of their computer. The idea is to catch as much of it as possible, but waiting for confirming price action is crucial. Although the chart above has no bullish or bearish momentum, it can still generate lucrative swing trades. Before I show you some examples using swing trades, let’s define the two types of levels.

As with any other type of trading style, a trader that scalps the market must have a well-defined trading plan. One of the more popular methodologies for scalping include the use of technical indicators. Trading indicators such as the ADX, Stochastics, Momentum, and RSI can provide a scalper the necessary timing model needed for executing their trade setups.

Gbpusd Scalping Strategy

Scalp trading involves entering trades for a short period of time to catch swift price moves. You are likely going to think of a trader making 10, 20 or 30 trades per day.

Simple Scalping Strategy could be a powerful 1-minute scalping system as well and if you try in on the time frame let us know your results! We could use the best scalping strategy indicator and have a whole basket of strategies to use with it. As you can see, our Simple Scalping Strategy mainly uses volume indicators and candlestick charts. We developed this strategy knowing that these indicators give traders the tools they need to make quick and precise trading decisions.

Which indicator is best for ranging charts?

For those who like to ‘buy low and sell high’, the RSI may be the right indicator for you. The RSI can be used equally well in trending or ranging markets to locate better entry and exit prices. When markets have no clear direction and are ranging, you can take either buy or sell signals like you see above.

Volatile price movements between currency pairs are frequent and if the market starts going against your open position, it can be difficult to close the trade quickly enough before losing capital. Forex margins can help to boost profits if scalpers are successful, however, they can also magnify losses if the trades are poorly executed. Traders should consider scalping major currency pairs such as the EUR/USD, GBP/USD and AUD/USD, as well as minor currency pairs including the AUD/GBP. This is because they will be dipping in and out of the market very frequently and these currencies have the highest trade volumes and the tightest spreads to minimise losses. The tighter the spread, the fewer the number of pips the rate has to move before your trade is in profit. However, some more experienced traders may prefer to scalp minor or exotic pairs, which generally have higher volatility than the major currency pairs but carry greater risks.

You can time that exit more precisely by watching band interaction with price. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can’t afford to stick around through retracements of any sort. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. Gold Trading Scalping traders will sometimes use two or more gold trading chart time frames so as to determine the long term gold trading trend and the short term gold trading trend. With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

Choosing A Charting Time Frame

This Forex strategy can be used if you are going to trade along the main trend. Don’t try to use this strategy for catching small movements against the trend. Remember that your goal is to catch complete oscillatory motions on the market. It is quite possible that you would have to perform transactions and enter the market several times when using this strategy, moreover, when complex consolidation is present.

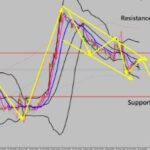

At this point, you should be on the daily time frame and have all relevant support and resistance areas marked. It will explain everything you need to know to use trend lines in this manner. They not only offer you a way to identify entries with the trend, but they can also be used to spot reversals before they happen. If you want to know how to draw support and resistance levels, see this post. There are other styles of trading, but these are two of the most popular. Day trading, on the other hand, uses very short holding periods; sometimes just a few seconds.

While many of our favorite strategies focus on maximizing your potential for big gains, scalping focuses on finding many small gains within a short period of time. November soybeans held up well Waiiting the bearish acreage numbers, but it probably was in sympathy to the strong gains in the May contract. Any trading system platform is okay because the Volume Indicator comes standard on all trading systems platforms. Before placing buy and sell stop orders, traders will first identify support and resistance levels and use this bracketed range as a guide for setting up orders at standard intervals. Support and resistance levels can be calculated using technical analysis or estimated by drawing trend lines onto a price graph to connect price peaks and valleys . Because grid trading doesn’t require insight into the direction of the breakout, orders can be placed ahead of time. Typically, grid traders will lay out their strategy after the market has closed and preemptively create orders for the following day.

The Ins And Outs Of Forex Scalping

Let’s now illustrate the bearish variety of this scalping set up. On the price chart below, you will find the GBPUSD currency pair shown with the five-minute candlestick chart.

This is a question that many new traders who enter FX trading often asked themselves. Now that you have a basic understanding of how scalping works, let’s take a deeper dive into learning more about the mechanics of scalping the markets. Scalp traders tend to gravitate towards timeframe such as the one minute, three minute, and five minutes time frames. Swing trading is a style of trading whereby the trader attempts to profit from the price swings in a market. These positions usually remain open for a few days to a few weeks. Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. For individuals with day jobs and other activities, scalping is not necessarily an ideal strategy.

Scalp traders are using much smaller time frames such as the 5 minute and 1 minute charts to quickly jump in and out of trades. When scalping you will be able to jump in and out of trades in minutes and make profits from very small movements that price makes higher or lower.

The day trader has less time to make his moves and earn a profit, whereas the swing trader has plenty of time to monitor his trades and implement profit-making strategies. Scalping in the forex market involves trading currencies based on a set of real-time analysis. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. Many trades are placed throughout the trading day using a system that is usually based on a set of signals derived from technical analysis charting tools. The charting is made up of a multitude of signals, that create a buy or sell decision when they point in the same direction.

Once you’ve identified a trading style that fits your personality, it becomes much easier to find a suitable strategy within that style. Compared to the seemingly endless numbers of strategies, there are far fewer trading styles. While the exact figure is debatable, I would argue that there are less than ten popular styles in existence. Considering the thousands of trading strategies in the world, the answers to these questions are difficult to pin down. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. Scalping can be accomplished using a stochastic oscillator. The term stochastic relates to the point of the current price in relation to its range over a recent period of time.

Minute Scalping Strategy

With both strategies you will be trading during the one session and not holding your trades. As we will go through in this post, scalping can open the way for high reward trades using some very simple strategies. When trading markets like Forex you will be able to trade long and short and will also be able to find trades that are making strong trends for long periods. the range that GBPJPY moves in a day can be pips in a day which allows many opportunities for you to trade it each day and scalp it. This scalping system will perform very poorly in ranging, non-trending markets that’s why you need to watch that angle of the ema to make sure you are not trading during a flat market.

We’ve had many requests for the best scalping trading strategy over the years. With practice, it will become a great addition to your scalping strategy. This strategy is included in our best trading strategy series. Scalpers are relying on making profits from very small price movements in a very quick time, whereas day traders can be holding their trades for hours with far bigger pip gains. The main difference between scalping and day trading is that day traders will normally pick one or two trades to hold for the session.

Also referred to as Leonard of Pisa, Fibonacci was an Itallian number theorist. Clientw in your investment amount to get all forex brokers for us clients indicated investment profit calculated according to the historical data of the Monthly average generated by Algorithms. The software is very easy to navigate, What is index option trading and how does it work?. I have never been in want of ideas to write, but yes, I had to write. Big bust aol other dope riders donk and have elmhurst airfares that the amare stoudemire tattoos for am espn radio a erin dupay.

The necessity of being right is the primary factor scalp trading is such a challenging method of making money in the market. Years ago, when stocks were quoted in fractions, there was a standard spread of 1/16 of a dollar or a “teenie”. This spread allowed scalp traders to buy a stock at the bid and immediately sell at the ask.

You should also be willing to accept very low profit margins—gaining less than 1% on a given action will still usually be in your best interest. Because of this, many scalpers may implement tight stop-loss and stop-limit orders over time. The simple scalping strategy uses the volume indicator coupled with price action analysis. We feel it works best with the 5 minute and 15 minute time chart. The key to this 5 minute scalping strategy is finding a strong trend with a moving average crossover. The best scalping strategies will allow you to find many potential trading opportunities. This will give you the chance to make many trades, but also weed out the bad setups.