Table of Contents

- Benefits Of News Trading

- Trading The News

- Costs Inherent With Trading Strategies

- Tip #1: No One Trade Will Make You Rich

- Different Types Of Trading Strategies

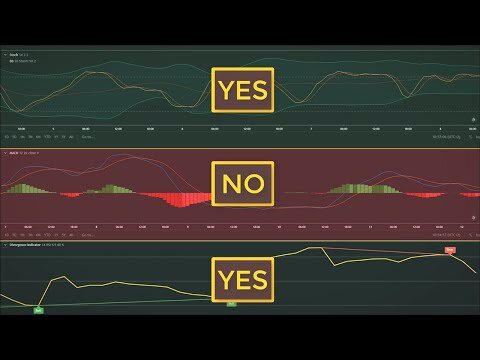

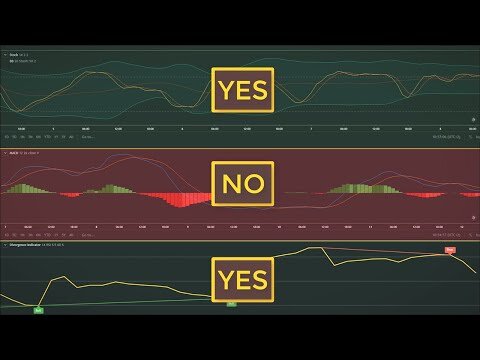

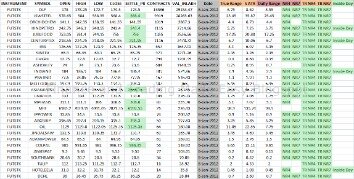

A lot of people think you have to make a million dollars in one trade — that you’ll find the next Facebook. It’s proven that if you study the insider buying activity you can gain superior returns. Make sure you make it a routine to look at insider trading activity to get a grasp on where the shares of a company may be headed in the future. You can tell very easily how the VWMA is showing you the momentum and whether or not it’s in a bullish trend or a bearish trend. Technical indicators are among the best tools you can use to develop a competitive edge while trading. Range bars are notorious for giving you explosive breakouts. If this is your first time on our website, our team at Trading Strategy Guides welcomes you.

However, position trading, when done by an advanced trader, can be a form of active trading. Position trading uses longer term charts – anywhere from daily to monthly – in combination with other methods to determine the trend of the current market direction. This type of trade may last for several days to several weeks and sometimes longer, depending on the trend.

Benefits Of News Trading

There are several other strategies that fall within the price action bracket as outlined above. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. As you can imagine, minute-level trading doesn’t affect long-term investors, and HFT does not have much impact on mid-frequency traders or longer time horizon base.

Some traders may use a particular approach almost exclusively, while others may employ a variety or hybrid versions of the strategies described above. Trend traders do not have a fixed view of where the market should go or in which direction. News traders need to understand how certain announcements will affect their positions and the wider financial market.

In the Asian forex trading session, its is most often characterized by thin volumes during the day. Opinions may vary but one thing is certain…its much easier to make money trading the forex market when the fx market has volatility and momentum. Here’s a list I’ve made of the top 10 swing trading strategies. Scalping is also a very shorter form of day trading…it takes minutes or seconds to open can close a trade. The only main disadvantage of swing trading is you’ve sometimes had to maintain the trade even in its up and down swings of price as it heads towards your profit target. If you prefer to trade only one type of trading setup then you’d only need on forex trading system.

Trading The News

The difference between the styles is based on the length of time that trades are held for. Scalping trades are only held for a few seconds, or at most a few minutes. Day trading trades are held for anywhere from a few seconds to a couple of hours. Position trading trades are held for anywhere from a few days to several years. Swing trading is a strategy by which traders hold the asset within one to several days whilst waiting to make a profit from price changes or so called “swings”.

- Contain them, manage them, and use them to improve over time.

- Register for free to view our live trading webinars which cover various topics related to the Forex market like central bank movements, currency news, and technical chart patterns.

- Python, as well as other lightweight languages, are likely sufficient.

- This strategy is simple and effective if used correctly.

So when you find something that shows promise and suits you, focus on it. That’s generally a smart move … you don’t know what works until you try it. I’ve gotta tell ya — you’re not smarter than everyone else. Go on and search Twitter for “short” and the latest big gainer. Then watch the stock spike again when these shorts try to cover.

Selecting the right trading strategy may be one of the most important steps you’ll take. Even though some beginner traders will throw it to the wind. Small trades are the best way to live test your trading.

Costs Inherent With Trading Strategies

On some securities, the spread between the bid and ask prices can be pretty big. But when it comes to scalping, it’s important not to focus on the spread too much. It’s a fast-paced full-time job that comes with equal parts risk and reward. On top of the risks and rewards, there are also several rules to be aware of. Over the past 140 years, U.S. stocks have averaged 10-year returns of 9.2%, according to data compiled by Goldman Sachs. The S&P 500 has performed even better, with an average annual return of 13.6%.

As mentioned above, position trades have a long-term outlook (weeks, months or even years!) reserved for the more persevering trader. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. There is no set length per trade as range bound strategies can work for any time frame. Managing risk is an integral part of this method as breakouts can occur. Consequently, a range trader would like to close any current range bound positions. Price action trading can be utilised over varying time periods (long, medium and short-term). The ability to use multiple time frames for analysis makes price action trading valued by many traders.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term . Traders use the same theory to set up their algorithms however, without the manual execution of the trader. List of Pros and Cons based on your goals as a trader and how much resources you have. Trend trading can be reasonably labour intensive with many variables to consider.

Tip #1: No One Trade Will Make You Rich

Prices set to close and above resistance levels require a bearish position. Prices set to close and below a support level need a bullish position.

In our example above, you would not be the only person to notice this. Traders – or their algorithms – would leap on the difference between New York and London prices in a flurry of trading that would align the two markets.

Avoid trading the trend at the tops and bottoms of impulse moves. Instead, try to buy into an uptrend and sell into a downtrend at the end of a price correction. The following chart shows a trend-following trade in the EUR/USD pair. Scalpers try to take advantage of very short-term price movements that often come in the form of breakouts. When the price breaks a major technical level, a cluster of stop-loss and pending orders tend to accelerate the market in the direction of the breakout. That’s why you’ll often see strong momentum candlesticks right after the price breaks a major support or resistance level.

In the case of passive investment they look for companies with long-term potential rather than short- or mid-term growth, but the process is much the same. A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. As a day trader, you might also need to commit a substantial amount of time to monitoring the markets and managing your positions. You will also need to be disciplined enough to stick to your trading plan and good enough at market analysis and research to improve your odds of success when you do take a position.

And determining the difference between a fluke and momentum takes some practice. If the patterns analyzed indicate a bullish direction, the swing trader will take a “long” position. This can be as simple asbuying shares of a common stock, picking up somecall optionsor buying futures contracts. When done right, a swing trader can seize short- or medium-term gains by following a stock’s (or any financial instrument’s) up-and-down routine. In other words, it boils down to playing off swings in price that follow a pattern of some sort.

The fundamental idea of time-series forecasting is to predict future values based on previously observed values. Below you will find the list of the 21 most popular trading strategies you can use to jump-start your ideas again. The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. My Trading Skills® is a registered trademark and trading name of PMJ Publishing Limited.

As a result, a trader can implement a trading strategy, called calendar spread which aims to gain from the difference. The bull futures spread is based on buying a near-month futures contract and selling the further-month contract. The bear futures spread is the opposite – you sell the near-month contract and buy the further-month one. Pairs trading is a classic example of a mean-reversion strategy. The first step in the pairs trading strategy is based on identifying a pair of stocks with highly correlated historical performances. The next step of the strategy is to monitor how the correlation between the two stocks changes over time.

Both are very active, short-term trading styles, with the main difference that day traders aim to catch intraday trends and keep their trades open for several hours to achieve this goal. This strategy, one of the most common forms of active investing, is based on publicly available information. For example, if the weather looks bad in a coffee-growing region, a trading the newsstrategy might short Starbucks shares in anticipation of higher coffee prices. News traders strive to act on publicly available information more quickly than the rest of the market or to anticipate an event’s effect that other traders are not anticipating.

Essential Elements Of A Forex Trading Strategy

Therefore, position trading is only suitable for the most patient and least excitable traders. Position trading targets are often several thousand ticks, so if your heart starts beating fast when a trade is 25 ticks in profit, position trading is probably not suitable for you. This makes it a popular trading style for those who have other commitments (such as a full-time job) and would like to trade in their leisure time. However, it is still necessary to dedicate a few hours a day to analyse the markets. As scalping can be intense, scalpers tend to trade one or two pairs.