Table of Contents

- How We Find Stocks For Our Strategies

- Stop Looking For A Quick Fix Learn To Trade The Right Way

- Question: What Is The Best Trading Strategy For Intraday?

- Becoming A Consistently Successful Day Trader Can Take Years, But It’s Possible

- Minimizing Risk Capital

- What Is A Sideways Market?

Understand the risks and challenges of becoming a day trader. A professional day trader is someone who day trades for a living and is licensed to trade. If you’re looking to become a professional day trader and work for a brokerage firm or something similar, make sure it’sregistered with the SEC. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. But that means traders have to be willing to realize a loss, which is hard for many traders to accept, even though it’s essential to long-term survival. As to the best time to trade for profitability, theories abound, but what can’t be disputed is the concentration of trades that bookend the regular market session. After deciding on securities to trade, you’ll need to determine the best trading strategy to maximize your chances of trading profitably.

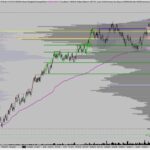

As long as the price does not go below, the asset has shown equal lows or slightly higher lows and higher highs. This is a little less bullish but holds the upside structure. If the high breaks, we expect the price to pullback to the broken high, stall and continue to move up. Then you look for the continuation in momentum to the upside. When a high breaks, the pullback for the buy the dip strategy can stall at one of two levels if the upside should continue.

Why is scalping illegal?

It isn’t illegal everywhere. But in those places where it is illegal, the problem is normally that scalpers move in and artificially deplete the supply of tickets on day-one, then mark up the price of the tickets sufficiently that they recoup their money, even if they don’t actually sell all of their tickets.

In addition, some day traders also use contrarian investing strategies to trade specifically against irrational behavior from day traders using the approaches below. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy and hold and value investing strategies. Trend-following is one of the most popular trading strategies among day traders for a reason – it works. Trend-following refers to taking trades only in the direction of the established trend.

How We Find Stocks For Our Strategies

While you are holding positions for a longer period of time, there are some risks associated with position trading. You may garner more in profits because of the duration of the trade, you can also lose more for the same reason.

How much money do I need to invest to make 2000 a month?

To cover each month of the year, you need to buy at least 3 different stocks. If each payment is $2000, you’ll need to invest in enough shares to earn $8,000 per year from each company. To estimate how you’ll need to invest per stock, divide $8,000 by 3%, which results in a holding value of $266,667.

Not all markets are tradeable, and the key is knowing when the odds are placed in your favor and not hesitating in taking the shot. They understand that “no trade” is better than a losing trade. They specialize in the style of trading and the template of price action they are most successful with and stick to it.

Developing a process that you use every day, will assist you in finding the exact plan that will be needed for you. Last but not least, consider creating a portfolio of trades to reduce your risk. Portfolio work on any timeframe, even for day trading. For example, if you’ve already taken three trades that are long the US dollar, consider adding a fourth trade that is inversely correlated to the first three trades that you’ve taken . This will prevent that a single trade or a couple of trades create large damage to your trading account. Trailing stops are especially popular among trend-following day traders.

While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. Best time EntryOne of the most important strategies is the right time entry. The most efficient day trading entry tactic is sturdy support and getaway of strong resistance. The lowest risk entry point with the highest return opportunity is when the stock price hits strong support demand zone. Day Trading also takes an immense amount of focus, trying to process thousands of peices of information is impossible, you simply won’t be successful. When you follow a plan that works and you stick to it, positive results will magically appear.

When the volume is increasing that is a sign that the price will drop or go up. After you choose a stock you want to trade you have to learn how to recognize the entry point. Since there are thousands of stocks in the market to choose from, the main question is how to do that? Look, some traders can find a new stock every single day.

Many of the tips I’ve offered here involve doing research, studying the market, and being tactical in your approach to every trade. But none of it will do you any good if you don’t stick to your plan. Don’t focus on getting rich; focus on gaining experience and expertise.

So what’s the point in trading anything less than the best? If you trade B and C quality setups, your accuracy decreases, you lose money, and you lose confidence. Lastly, I look for stocks that have a strong daily chart, meaning they are trading above the 9ema, 20ema, and have room to the 200ema or are above the 200ema.

Stop Looking For A Quick Fix Learn To Trade The Right Way

They might also need quick reactions to take advantage of rapid intraday market movements. This popular type of trading strategy tends to suit more experienced short-term traders who prefer to avoid running open positions while they aren’t actively watching the market. There are times when the stock markets test your nerves.

Another thing to note is that you can tell that the previous signal that formed in the range was not reliable, because the trend line did not change direction. Moving out of a down trend the green trend line was above both the 20 MA and 60 MA. When the signal was a clear one, the trend line dipped below the two moving averages.

Question: What Is The Best Trading Strategy For Intraday?

The infographic data has 2 additional salaries recorded, but the average salary is still coming in at 89k. Therefore, if one of your goals is to make money, you are looking in the right industry. As you can see in the infographic above, the key to making serious money is to start managing multiple funds. You somehow pull that off, and you will make on average 576k a year. A simple way of thinking about this is the 7 gives you the right to trade on a federal level, and the 63 allows you to work within the boundaries of state laws. The Series 63 is the next exam you will need to take after the Series 7.

FINRA has specific requirements related to this for pattern day traders. One of the reasons that I started this site was to give day traders an honest, reliable, and affordable, way to start day trading.

Complicated analysis and charting software are other popular additions. These types of systems can cost from tens to hundreds of dollars per month to access. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads . On the other hand, traders who wish to queue and wait for execution receive the spreads .

Becoming A Consistently Successful Day Trader Can Take Years, But It’s Possible

Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. Though its trading options and account types are limited, even an absolute beginner can quickly master Robinhood’s intuitive and streamlined platform. On the other hand, more advanced traders might be frustrated by Robinhood’s lack of technical analysis tools, a feature that’s now nearly universal across other platforms. To get you started with some good ideas you can incorporate into your own trade plan, several popular day trading strategies are described in further detail below. The best day trading strategy is the Market Opening Gap strategy. Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

You need to have a sense of what other traders are doing because crowd mentality can move the markets. I’m an open book, and I teach students all the details of my strategies. If you are in our Day Trading Chat Room, you can learn everyday by watching me trade, and you can surround yourself with over 2000 active traders. You always want to surround yourself with the type of people you want to be like, or that you want to become. Learn everything we are doing to profit from the market.

A key thing to remember is that the best traders are adaptable and can change their trading strategy based on opportunities. Therefore, it’s a good idea to learn about each individual trading strategy and by combining different approaches to trading, you will become adaptive to each situation. A day trader only opens short-term trades that usually last around 1 to 4 hours, which minimises the likelihood of risks that may exist in longer-term trades. Swing trading can offer a good risk-reward ratio if a plan is followed. However, swing traders need to be flexible and must be aware of when their strategy is not working effectively. When trading based on news releases, it’s vital that the trader is aware of how markets operate.

However, you will be doing what you love, which will make you a much happier person to be around for your family and friends. For argument’s sake, let’s assume you are spending 50 hours a week trading and researching your strategy and only take off two weeks per year. As your account value increases, the commissions paid as a percentage of your profits will decrease. Lastly, most brokerage firms will offer lower commissions to clients depending on their account value. This sort of unique offering begins at 250k, so you would easily qualify. In other words, you will be trading a lot of shares depending on your strategy.

A strategy doesn’t need to win all the time to be profitable. However, they make more on their winners than they lose on their losers. Make sure the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written down. A limit order, meanwhile, guarantees the price but not the execution. Limit orders help you trade with more precision, wherein you set your price for buying as well as selling. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as well.

Minimizing Risk Capital

You have to choose the ‘weapon’ that you are more comfortable with and that is easier for you to handle because it will be better for you in the long run. Choose the type of trading that you will be best at, Forex trading system that works for you. The profitable forex trading strategy that we highlighted in each type of trading, if mastered, will be one of the greatest tools in your Forex knowledge base.

Keep an especially tight rein on losses until you gain some experience. Then, We cancheck the candle stick chartto find an entry point on the first pull back. A majority of buyers get into the market here, and the stock moves up sharply. As the price begins to move up quickly, you must be able to find the best entry point at the time that it is happening. When you use these strategies, you find that there is something similar about stocks that are moving.

What Is A Sideways Market?

The trading world was recently rocked by an unusual development involving shares of GameStop, a brick-and-mortar video game retailer. The P/E ratio of a company can give you insight into a company’s growth potential compared to competitors in the same industry. It is determined by the current trading value of a stock compared to its earnings per share over the past 12 months.