4 Common Active Trading Strategies

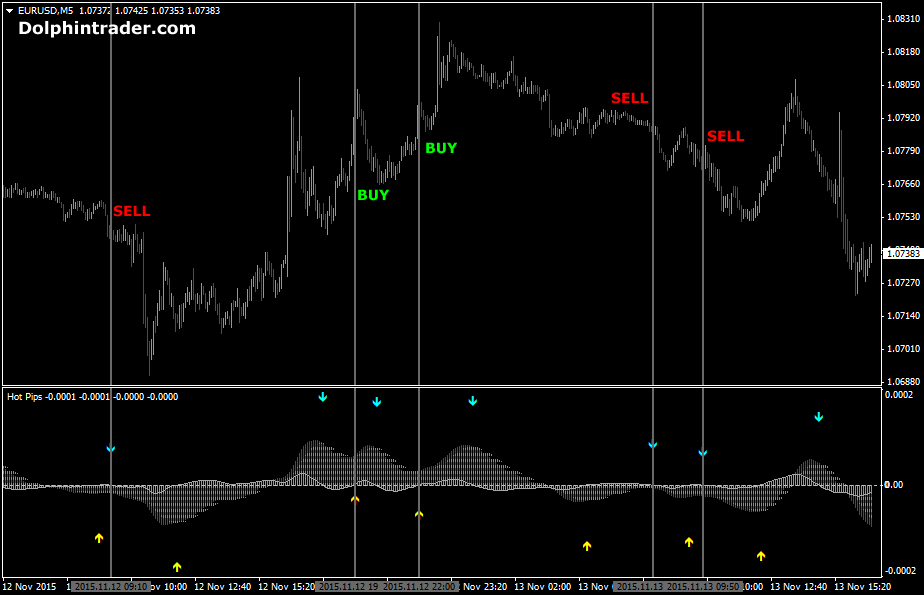

Profit targets should be placed near recent highs/lows, S/R zones or other important technical levels. When trading the range, the first thing you need to care about is whether the market is actually trading in a range . If there’s an absence of high...