Table of Contents

- What Is An Iron Butterfly Option Strategy?

- Applications Of Risk Reversal Strategy

- Disadvantages Of Risk Reversal:

- Option Greeks: The 4 Factors To Measure Risk

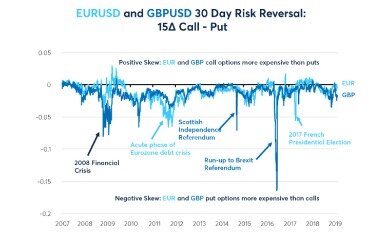

- The Dynamics Of The Risk Reversal

When used for hedging, a risk reversal strategy is used to hedge the risk of an existing long or short position. Finally, whenever you have an existing short or long position and desire some protection, you can use a risk reversal strategy as a way to hedge the position. By executing a risk reversal strategy, a trader is in effect reversing their volatility skew risk. The basic way to deploy a risk reversal strategy involves the simultaneous selling of an out-of-the-money call or put option, whilst simultaneously buying the opposite option.

The September 620 put can be sold for around $123.80 per contract. Those proceeds can then be used to purchase a September 700 call option which was trading around $119.70 per contract yesterday. As the sold put is slightly higher than the bought call, the trader receives a credit into their account of $4.10 per contract or $410 in total.

For this reason, the risk reversal strategy is very popular withy experienced traders as they can earn impressive profits while taking minimal risk. This strategy also has the advantage of have an unlimited profit potential. Option traders have a far better feel for any stock in question, because they have so many more “clues” as to where and when the stock might be moving in price in the future. Mere stock traders are clueless to the “intel” germinated by the options markets. Yet, it is the option trading world that is labeled as a “loser’s game”. The true losers are those ignorant of options and the variety of tactical uses they offer to the knowledgeable and seasoned stock trader.

What Is An Iron Butterfly Option Strategy?

Since out-of-the-money puts trade with a greater implied volatility compared to out-of-the-money calls, you’re essentially selling high volatility and purchasing cheap volatility. While using the risk reversal strategy comes with some risks, you have the potential to gain unlimited profit and lower risk overall. With a positive risk reversal, the put options are cheaper than the call options. Having upside protection in this scenario is relatively expensive. In addition, there’s a greater demand for call options, making investors more bullish in this regard. With options, if you think stock is going up, you could buy a Jan 51 call, say for $1.

The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. I have even added my own Secret tools to Risk Reversal Options TradingStrategy, Which will make it a safe Strategy to trade and earn easy money.

Exercise is automatic for these products, so that a profit or loss is added to or taken from the trading account immediately upon expiration. The beauty of the trade is that you can own upside exposure and get paid if the stock goes nowhere. If the stock falls, you end up taking ownership for a price less than when the risk reversal was initiated.

Applications Of Risk Reversal Strategy

If the trader is in a short position with an underlying asset, he can hedge by a long risk reversal. This can be done by purchasing a call option and writing a put option on the underlying instrument. Risk Reversal can be used in case of concerns regarding the stock price of a short position that is trading at a higher price.

During unprecedented times, there are often unprecedented outcomes when it comes to investments. Just think how this strategy would have performed during recent selloffs. With MSFT last traded at $41.11, the $42 calls are 89 cents out-of-the-money, while the $40 puts are $1.11 OTM. At that point, the MSFT October $42 calls were last quoted at $1.27 / $1.32, with an implied volatility of 18.5%.

Note that a risk reversal can also be used to double down on a directional bet, which we will touch on later in the article. Most traders who fail, do so because they make large bets without adequate risk management. A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. There are chances of doubling down on bullish or bearish positions. This will be risky in case there is a wrong prediction for the movement of the trade.

Disadvantages Of Risk Reversal:

Therefore, risk reversals are typically used a signal of potential future trading activity. Accordingly, the use of risk reversals can be implemented as part of a broader strategy. When there are material changes in the risk reversal this can indicate changing market expectations in the future direction of the underlying foreign exchange spot rate.

- This article will cover the basics of the risk reversal strategy and how an investor can use it in their investment playbook.

- We pick the short put strike around the 25 delta which provided us with a credit of $76 per contract.

- There are chances of doubling down on bullish or bearish positions.

- The beauty of the trade is that you can own upside exposure and get paid if the stock goes nowhere.

- I have even added my own Secret tools to Risk Reversal Options TradingStrategy, Which will make it a safe Strategy to trade and earn easy money.

- You may have even created your own “solutions” to manage them.

While the written option reduces the cost of the trade , it also limits the profit that can be made on the underlying position. On the other hand, if there is a fall in prices, the trader can turn profits in the short position in the underlying. However this can only be done to the level of the strike price of the written put.

Option Greeks: The 4 Factors To Measure Risk

In fact, if we chose the $110 put we would have eliminated all but $1 of risk. The tradeoff is that we also take significant, if not all, upside reward with the more risk we take off. In our current DIS example we collected $1.80 for the sale of the 115 call in March, now which put should we buy? Either we can buy the 110 strike which gives us near full protection or we keep a little risk on in the position and buy the 105 strike instead.

When those bets go against them, they end up losing all the money in their account. This form collects information we will use to send you updates, reminder and special deals.

The price action at these extreme levels is referred to as “fat tails”. This is because when the price of the asset starts to rise, the call option will climb higher and at the same time, the put option declines to zero by the end of its expiry period.

There is no limit to the profit potential of Risk Reversal when used for leveraged speculation and since no money is paid for the position, the return on investment is infinite. You own 100 shares of XYZ stocks and wish to hedge it without paying any extra money . In other words, for a given maturity, the 25 risk reversal is the vol of the 25 delta call less the vol of the 25 delta put. The 25 delta put is the put whose strike has been chosen such that the delta is -25%. If the options are relatively overpriced, the conversionis used instead to perform the arbitrage trade. A large percentage of the Steady Options community consists of do it yourself investors who prefer to manage their own trading and long-term investing accounts. This is a great way to gain firsthand experience about how markets work, but at times it may be beneficial to get professional input on investing and other personal financial planning decisions.

The majority of traders will readily place a CALL option on a bullish asset. But, you need to consider the PUT option as well to ensure that you make a profit. You, therefore, open two opposite positions on the same asset as this reduces chances of getting at a loss. Risk reversal strategy is a financial binary options technique that significantly reduces trading risks.

As such, you should choose the strike prices which are selling for almost the same price instead of aiming for equidistance. Risk reversal can also be used to reverse risk out of short stock positions by buying OTM call and selling OTM put. Even though using risk reversal for leverage results in a position that ideally requires no capital outlay upfront, it does involve margin as the short leg of the position is a naked write.

Now our maximum profit is $270 vs. $580 with the covered call or versus the ‘unlimited’ upside with the stock. In contrast with stock-only positions, if the price falls, there is no offset for this decline. So in the case of short puts, even if the company goes bankrupt overnight, you will have lost less than our stock trading colleagues. Since we took in a $1.80 credit for selling the call, we don’t have enough money from the call to purchase the 110 put for $2.75 and therefore would have to pay $0.95 for the protection. This is a bit steep, so let’s go for the 105 strike put instead. Collared stock, or, simply ‘collars’, are very similar in their approach to a covered call. It’s important to note that the call is only valid until March expiration .

In such a scenario, the investor can use an upside call and cover up the cost by selling a downside put. However, don’t go thinking that this is the most the trade can lose.

You can mitigate this risk by trading Index options, but they are more expensive. Since the call option is OTM, the premium received will be less than the premium paid for the put option. Under this scenario, Sean is protected against any price moves below $10, because below this, the put option will offset further losses in the underlying.