Table of Contents

- Forex Scalping Strategy M1 , M5 , M15 Time Frame Best Secret Tric

- A Scalping Strategy With Two Moving Averages (ema)

- A Trustworthy Broker With Suitable Trading Conditions

- Best Scalping Strategies

- Scalping Indicators For Forex

The green line of the indicator crosses the gray line above level 10 from bottom to top. The green line of the indicator crosses the gray line below the level of -10 from top to bottom. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Dips in the trend are to be bought, so when the RSI drops to 30 and then moves above this line, a possible entry point is created.

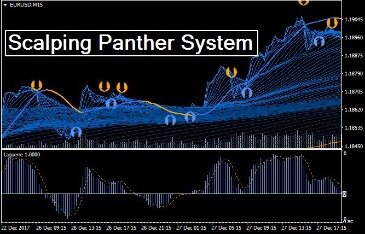

It’s recommended that scalpers start with a large amount of capital. Opening and closing larger positions allow you to reduce the marginal costs of trading and maximize potential gains. In order to find the opportunities for scalping, you will need to begin by selecting a few key technical indicators. These indicators can help you determine when short-term price gaps are likely to happen. The peak indicator will repaint the level of the peak but not the peak itself since it waits until the bar is closed to paint it. I’m not a big fan of repaint indicators either but I do like the peak indi. This system implies the M15 and M5 timeframes of Metatrader 4.

Forex Scalping Strategy M1 , M5 , M15 Time Frame Best Secret Tric

Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The current weekly candle should be a bullish candle, which will mean that the asset being traded has an upward trend. Any currency pairs can be used, but it is best when using such strategies to focus on trend ones, in which there are movements, primarily on the majors. 79% of retail accounts lose money when trading CFDs with this provider. TMA True – Shows a NON-REPAINTING TMA channel and it can be widened/narrowed based of an ATR multiplier. The middle line can be a great place to take some or all of your profit.

Forex scalping indicators are based on concept of opening and closing large number of transcations within short time.The goal is to achive small but multiple winnings. MT4 Forex Spectrum system is an intrady trading strategy trend following based on the retracement on the HP-M15 indicator. The Channel Scalper M1 M15 Indicator for MT4 can detect when there is a compression in price just before a big move happens and alert the trader so that the trader can take advantage of the big move. Such compressions can usually be spotted when the Bollinger Bands contract towards each other for a period of time. The DeMarker indicator is an oscillator designed by Tom Demark that also finds use when traders are trying to determine potential overbought and oversold regions in the market.

The trading using the Channel Scalper M1 M15 Indicator for MT4 must first watch to understand how the system works before using real money to try out trading with the system. Yes, I want to receive emails with explanations regarding the tool and the newsletter. Depending on your trading preferences, you can resort to the trailing stop. The color of its attached histograms changes to red or blue when price gets bearish or bullish respectively. Start using this cryptocurrency strategy in just 5 minutes.Click hereto get started now.

I am finding that the London session is too volatile but the New York session seems to be giving me better results. The M15 (15-minute) Forex day trading strategy uses a combination of three indicators and works best for day trading currency pairs. You no longer have to wait for days for trade setups to occur, scalping will allow cryptocurrency traders enter multiple positions in a single day based on when we get a buy or sell from our system. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed.

Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. A novice scalper has to make sure to keep costs in mind while making trades.

It can increase your discipline, find mistakes, and master your trading style. The trading conditions provided by the broker influence the results of scalping tangibly.

A Scalping Strategy With Two Moving Averages (ema)

Discover the range of markets and learn how they work – with IG Academy’s online course. A change in the position of the dots suggests that a change in trend is underway. Select Chart and Timeframe where you want to test your forex system. To determine our trend, we will be using the Volatility Quality – Zero Line GZ Filter. As the OsMA reflects the first positive bar, we get a BUY signal. As the OsMA reflect the first negative bar, we get a SELL signal.

Scalping involves numerous trades—as many as hundreds during a trading session. Frequent buying and selling are bound to be costly in terms of commissions, which can shrink the profit. The broker should not only provide requisites—like direct access to markets—but also competitive commissions. Scalp trades can be executed on both long and short sides. Many traditional chart formations, such as cups and handles or triangles, can be used for scalping.

Paying attention to volume indicators makes it possible to take advantage of these movements before they actually occur. Because scalpers focus on short-term positions with low-profit margins, the best scalping strategies require some leverage.

A Trustworthy Broker With Suitable Trading Conditions

If the volume indicator increase, so will the price action. This is because there is a plethora of interest in that currency pair. Volume and price have a very strong, short-term relationship, but changes in trading volume usually happen before sustained price movements.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The primary task here is to place the Simple Moving Average combination on the 2-minute chart, in order to determine strong trends, which can be purchased or sold short on counter swings accordingly. You also need to be aware of the warnings of imminent changes in trends, that are inevitable on a typical market day. This should be considered when looking for the best Forex indicator for scalping. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

If the kg-wave-minor indicator pops up a blue histogram above the 0.00 horizontal alert level during a bearish trend, a bullish reversal is said to be imminent, therefore an exit or take profit will do. If the kaufman-bands custom indicator pops up a deep sky blue signal dot on the sienna line during a bearish trend, it is indicative of a weaning bears power, therefore an exit or take profit is advised.

Best Scalping Strategies

Set stop loss at least 5 pips + spread below the recent highest high/lowest low. By setting to these points, the strategy just has maximum stop loss of pips .

- This means you are not seeing the entire volume that is being traded at the time like you would with stocks.

- Also, be careful, in this strategy your usually trading the pullback against the trend as that is what the peak indicator usually really displays.

- Such compressions can usually be spotted when the Bollinger Bands contract towards each other for a period of time.

- Based off of what you now know, make a good trading decision based off of the current price action.

- on a five minute chart; short trades can be taken when the price moves below the SAR dots, and longs when the price is above them.

The 15 minutes would be where the trader actively looks for trends and compressions of the Bollinger Bands. The Channel Scalper M1 M15 Indicator for MT4 is a complete Meta Trader 4 based trading system designed specifically for scalpers who are only looking for quick moves. These quick moves will usually be tiny trends within a bigger timeframe trend. This is the reason why the Channel Scalper M1 M15 Indicator for MT4 incorporates both the 15 minutes timeframe and the 1-minute timeframe. If forex-mt4-trend-indicator pops up a blue upward pointing arrow during the course of a bearish trend, a bullish reversal is said to be imminent, thus an exit or take profit is duly recommended.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom-tuned to very small time frames.

Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. In addition, it takes the view that smaller moves are easier to get than larger ones, and that smaller moves are more frequent than larger ones.

For both of these indicators, set the MA method to Exponential. With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

The Forex Osma Oscillating Scalping Strategy With Volatility Quality Filter

Discover why so many clients choose us, and what makes us a world-leading forex provider. Discover how to trade – or develop your knowledge – with free online courses, webinars and seminars. In the second example, the long-term MA is declining, so we look for short positions when the price crosses below the five-period MA, which has already crossed below the 20-period MA. Scalping can be adopted as a primary or supplementary style of trading. We’ll cover any topical theme on trading and investing if you find it useful.

The indicators used are the TMA, TMA Size, CTF, Currency Power Meter, SSRC, HP DIFF. In our blog, we have a detailed article about this strategy. Choose your strategy based on your preferences and test it well on a demo account before trading for real. To decrease expenses from a large number of trades, choose assets with minimal spreads.

The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. Second,high-frequency trading now dominates intraday transactions, generating wildly fluctuating data that undermines market depth interpretation. Finally, the majority of trades now take place away from the exchanges in dark pools that don’t report in real-time. Since the QQE Flat M15 strategy involves closing the position on the opposite signal and is scalping in itself, we recommend using small volumes of deals.