Table of Contents

- Strategies For Trend Trading

- Risk Management

- A Simple Trend Trading Strategy

- How To Use Trend Trading Strategies With Buy And Sell Signals

- The Trend Following Trading Strategy

- Trend Trading

- Trade With Our Recommended Broker

If the price moves at the same level as you are at risk consider switching your stop loss to breakeven. After the candle closes you can open a short position by placing a sell stop below the low price of the trendline candlestick about 1 pip. After the candle closes you can open a long position by placing a buy stop order about 1 pip above the highest price of the trend line intersection candlestick. When you see a price breakout of a trendline, it is usually an early signal that the trend is changing. Now you are waiting for the right moment to enter a breakout trade.

Like motion and velocity, the trend does not exist in the now. Keeping this in mind, it becomes possible for us to compute and utilise trends. Irrespective of where the market is located, all you need is price histories.

Strategies For Trend Trading

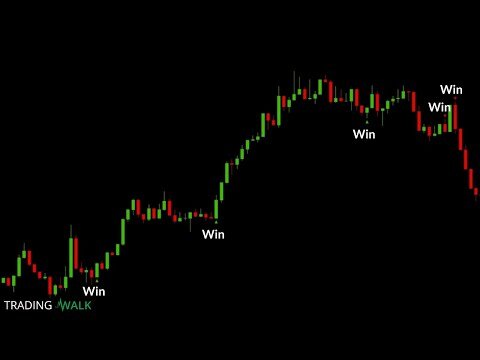

It determines whether price has invalidated a particular line and automatically removes it from your chart. By following the above points we could have achieved similar returns similar to Dunn, which is one of the most effective aspects of trend trading. Once you’re in a trend, you can ride it as long as the price remains in a trend.

And, a reversal doesn’t necessarily mean the start of a new trend, in the opposite direction. As a rule of thumb, the bigger the timeframe, the stronger the trend. The Qstick Indicator is a technical analysis indicator developed by Tushar Chande to show buying and selling pressure over time.

Risk Management

Trend traders have a scientific attitude to the extraction of profits from market trends. They are concerned with identifying and segregating profits from trends. The tradable asset’s momentum in a given direction is the object of study. There are a number of ways in which this analysis might be performed. Trend traders are proficient in trading psychology and risk management. Analysing a number of market indicators in the furtherance of trader’s goal of profit extraction is possible through a handful of analytical tools. The article brings out some top trend trading strategies for beginners.

The second method of using the RSI is as a breakout condition. When calculating volatility breakouts you can measure volatility by using the Average True Range indicator. ATR refers to how much price moves outside the previous bar’s range. This is explained in detail in this post on the uses of Average True Range. The Donchian Channel breakouts are breakouts from a previous high / low range. For example a 50 bar Donchian Channel is formed by looking back over the last 50 price bars and finding the highest and lowest price over the past 50 bars.

By using this breakout trendline strategy, you’re putting yourself in a position to profit from them when they occur. The first trendline trading strategy that you can implement is the breakout strategy. Each type of trendline trading strategy is outlined and analysed below. The Auto TrendLine trading indicator won’t clog up your chart with unnecessary lines.

A Simple Trend Trading Strategy

The system gets you in to ride the trend as long as it remains in place. They are applied to a broad range of securities or instruments and so need to be simple and robust to work effectively. Once you understand the concepts and codify them into a mechanical trading system it becomes a matter of simply running your system scans each day and executing to the rules. Your positions must also be small so you can hold a highly diversified portfolio of instruments. With greater diversification there is a better chance you will catch a large trend in one of your positions. The flipside of this is if you diversify too broadly your positions will be so small that when you do catch a large trend you will not make much money.

As the name suggests, a moving average indicator finds the average price of an asset over a given timeframe. By doing so, it creates a smoothing effect on the price data, producing a single line that can help traders identify trends. There are popular choices, such as the 50-day and 200-day moving averages, but ultimately the choice will depend on the individual. Trend trading is a strategy that involves using technical indicators to identify the direction of market momentum. Simple Trend Retracement Forex Trading Strategy is a combination of multiple Exponential Moving Averages used to plots crossover signals for both trade and trends of the market. You can call it a universal trading strategy since it works on all kinds of forex currency pairs and supports all sorts of trading styles. Besides, it can be applied to trade on any timeframe chart you like within the MT4 forex trading platform.

Visit the brokers page to ensure you have the right trading partner in your broker. Trends can be attractive since a bias has been witnessed in that particular market. If you only take entries that come near to previous important highs or lows, and use those as initial stop levels, you may have a better chance of staying in the trade. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our current or past students. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

How To Use Trend Trading Strategies With Buy And Sell Signals

Alternatively, you can join IG Academy to learn more about financial markets. there are couple of ideas I have in my mind that I think could make this a better system. These are ideas only that need to be tested and should not be taken as recommendations. (If I knew how to code trading systems, that would be so awesome to verify if my ideas are good or bad…anyway,this is not about that). In my experience, price action is the way to go if you want better entries.

You can’t wait for the market, you need to close losing trades as soon as possible. When doing this bear in mind the asset’s support and resistance levels. The more frequently the price has hit these points, the more validated and important they become. Start small – Whilst you’re finding your feet, stick to a maximum of three stocks during a single day.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment. For more information on trends as they unfold in real-time, stay tuned to the Live News Feed at FX Leaders.

You can either place a buy limit order, an instant market order or use a buy stop order to get into a trade at this resistance turned support level. You can either place a sell limit order, an instant market order or use a sell stop order to get into a trade at this support-turned-resistance level. So knowing how price behaves when this happens, trading rules are made based on that. This previous resistance level at times will act as a support level from which price can bounce back up from. Now this previous support level at times can act as a resistance level from which price can hit it and fall back down again.

This means that you can wait for a good signal from an indicator even if the candle is not yet closed, or you can wait for the close of the candle. Waiting until the close will reduce risk but may not produce as much reward. Therefore, this is completely dependent on your preferences. Trigger line refers to a moving average plotted on a MACD indicator that is used to generate buy and sell signals in a security. Learning to trade on indicators can be a tricky process. If a particular indicator appeals to you, you may decide to research it further. Most importantly, it’s a good idea to test it out before using it to make live trades.

The Trend Following Trading Strategy

On a downtrend occurring, you may place a short trade in the vicinity of an overbought condition. When the price breaks out a tad bit, you can take the chance to go short or long. Click Here and you can enjoy a full FREE report of this strategy. This will include more detailed information and a vast amount of examples. If you found this strategy intriguing then I am offering you something very special. Make sure you remember to only be risking no more than 2% of your account!

- Any trend following strategy is based on the technical analysis of market cycles and tend to move upwards or downwards over time.

- The trend trader knows how big the actual picture is but remains collected in the face of surprises.

- You know the trend is on if the price bar stays above or below the 100-period line.

- The strategy is very simple, if the trend is right, the profit you get will be very significant and usable for all currency pairs and all time frames.

- Let’s analyze the chart by using some simple technical rules and find out how he was able to achieve it.

To do so, they have to anticipate price action before it becomes defined. We can see on the GBP/USD monthly chart below that the pair has been trading in a tight range after a downtrend. There are two monthly pin candles that show that there is strong buying pressure around 1.48-49 level. In addition, there is divergence on all three indicators, MACD, Stochastics, and RSI. These elements all serve as confirmation that a new trend is forming. The price continues to oscillate around the moving average, with no clear trend direction.

Trend Trading

Since the strategies are very reliable guides to trend trading plans, we understand that entry/exit criteria are pretty straightforward. ABinvesting can help you test out the various strategies before you go live. When MACD lines are at an elevation above zero for a certain time period, there’s a likely uptrend in the offing. On the other hand, when the MACD lines lie below zero for a given period of time, the trend is almost definitely down. With this strategy’s aid, there are buy signals on the MACD moving above zero and sell signals on the MACD moving below zero. The weakness of support or resistance is inversely proportional to the frequency of the testing of moving averages by a price.

It doesn’t really matter if you’re a swing trader, or a scalper, or a day trader. Trend trading is a methodology that aims to make a profit through the examination of an instrument’s momentum in a particular direction. When the predominant price move is showing a particular direction, either up or down, that is called a trend.

It is worth noting that the market can remain overbought or oversold for extended periods of time. A trend trader would enter into a long position when the fast EMA crosses the slow EMA from below, and enter a short position when the fast EMA crosses the slow EMA from above. eventually it comes back down to touch the moving average lines (it can only touch one or touch both…it does not really matter, as long as price touches at least one). Now use the same techniques as above for stop loss placement on this 3rd trade. The most important part of this strategy is how to exit.Remember…you are entering multiple trades in the prevailing trend direction.

This high and low value is plotted on the chart at the current price bar. A breakout occurs when the price today rises above yesterday’s upper Donchian Channel line or drops below yesterday’s lower Donchian Channel line. Trend following strategies are simple systems that mechanically identify when a trend is in place.

The ATR is a volatility calculator, showing you how far an asset moves on average during a specified time frame. You can use the ATR to determine when to issue a stop-loss order, which is usually placed some multiple of the ATR below the entry price. The OBV puts together information about trading price and volume and compiles it into a single line indicator to measure cumulative buying/selling pressure. The volume of a trading instrument with a higher closing price bar gets added to the OBV, while the volume of a lower closing price bar is subtracted from the OBV. You can then use the running total of volume to see when buyers are overcoming sellers and vice versa, which can then tell you when prices are likely to surge or drop. The correct approach to each of these trading system components for a good trend trading system is described in our trading systems section.