Table of Contents

- Gdax Transfer Limits

- Low Fees

- About Gdax

- Is Coinbase Pro Safe?

- Exchanging Crypto On Gdax

- Trading Platform

If the traded volume is high and more people are buying and selling, this spread will be very minimal. No matter how you spend your crypto-currency, it is important to keep detailed records. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Bitcoin.Tax offers a number of options for importing your data. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions.

Bitbuy.ca is a Canadian owned and operated digital currency platform. Originally founded as InstaBT in 2013, the company’s mission is to provide convenient, dependable and secure access to bitcoin and other digital currencies. Customer service, ease of use, and quick turnaround times for deposits and withdrawals are pillars of this platform. They cater to beginners as well as experienced traders, and are one of Canada’s quickest growing buy/sell platforms. A great choice for users looking to buy and hold crypto, or users looking for a reliable on-ramp to turn their fiat into crypto quickly and easily. Today there are a host of platforms to choose from, but not all exchanges are created equal.

Gdax Transfer Limits

We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Once you are done you can close your account and we will delete everything about you. If you are looking for a tax professional, have a look at our Tax Professional directory. Our support team goes the extra mile, and is always available to help.

Founded in 2011, Kraken is the largest cryptocurrency exchange in euro volume and liquidity and is a partner in the first cryptocurrency bank. Kraken lets you buy and sell bitcoins and trade between bitcoins and euros, US Dollars, Canadian Dollars, British Pounds and Japanese Yen.

Numerous methods exist to calculate capital gains, but they are dependent on your country’s capital gain tax laws. Using FIFO, capital gains would be realized on the 1 BTC you sold on January 10th, 2018 using the 1 BTC you bought on January 1st, 2018.

Low Fees

For withdrawals and deposits, we recommend you send a small test amount first before making any large transactions just to make sure everything is ok first. To add to the security of user funds with Coinbase Pro, the platform offers insurance protection. Coinbase keeps 98 percent of customers’ digital currency in cold storage. Additionally, all USD balances in accounts have coverage from FDIC insurance, with a maximum coverage of $250,000 per customer.

No matter your level of experience or where you are in the world, Xcoins.com is a safe and reliable way to get your hands on cryptocurrencies. In order to calculate your crypto gains, we need the transaction history from each exchange where you’ve bought, sold, or traded cryptocurrency. If this is your first year working with us, then we need these exchange reports going all the way back to your very first crypto purchase. This is because we have to start with “year zero” and then roll the numbers forward all the way to the present. This is the only way to get an accurate calculation of your crypto gains. Accounting jargon could be tricky for normal people or beginners. Cost basis is equivalent to the purchase price for a given quantity of assets and total proceeds are the selling price for a quantity that you disposed of in a trade.

Creating an order at GDAX would reserve the money invested, thus your total balance would be smaller by the amount of money stacked in open orders you have created previously. Unfortunately, you are required to undergo extensive verification process while registering an account at GDAX. Without complete identity check completed, you will not be able to make order nor can you use other services from GDAX.

It is designed for more experienced retail and professional traders and allows a range of advanced, high-volume trades. Its trading fees are not the lowest out there, but Coinbase Pro doesn’t charge anything for cryptocurrency deposits or withdrawals. All of this makes a very good exchange for both retail and institutional traders, and the latter can open a dedicated corporate account at Coinbase Prime.

Does GDAX have fees?

GDAX operates on a maker-taker fee model. Taker fees can range from 0.1% to 0.3% depending upon the customer’s trading volume for the previous 30 days. Further, cryptocurrency deposits and withdrawals can be done for free, and there are no fees for either maintaining a GDAX account or for holding funds in an account.

Bitcoin.Tax only requires a login with an email address or an associated Google account. We don’t hold or store any other information about you/ If you decide to upgrade, you can pay woth a credit card or anonymously with Bitcoin.

Complete our online inquiry form and a TT representative will contact you to discuss onboarding. The BST Fund is designed to capitalize on those price increases and to provide the investors with substantial returns as well as their investment capital in a short time frame. At this stage, you can trade dxFeed only with Bookmap simulator . If you have a specific preference for a specific execution platform please let us know. Devexperts provides data feed solutions for various big brokers like TD Ameritrade. The equities market data feed is very reliable and has 99.99% uptime during trading hours.

United States customers must upload a state ID or driver’s license. You must also provide Coinbase Pro with your residential address as well as the final four digits of your Social Security number. UK residents must upload a government ID document, passport, or driver’s license and answer verification questions based on the national identity databases.

About Gdax

Coinbase is a San Francisco headquartered company founded in June 2012. Besides being a convenient platform for cryptocurrency trading, it doubles up as your digital wallet which has helped them gain over 10 million users over time.

GDAX only allows USA, UK and European citizens to trade in all the cryptocurrencies available on their network. Citizens of Singapore, Canada and Australia only have Ethereum and Litecoin available for trading. The second disadvantage is that it does not allow the government-issued currencies of all countries to be deposited in the user accounts. The citizens of Australia, Canada and Singapore are only allowed to trade in cryptocurrencies, or they must deposit USD, Euro or Pound Sterling if they wish to trade using Fiat currencies. Navigate to the different trading platforms available to start buying and selling crypto coins of your preference. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. BitDegree.org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency.

The maker is the person that offers liquidity and sets the price and the taker is the person that buys or sells at that price. When it comes to trading, GDAX fees are some of the cheapest in the industry. It can get a little confusing, though, so let me explain how it works. Alternatively, Coinbase also allows you to deposit using a cryptocurrency. If you decide to do this, the only charge you will have to pay is the blockchain transaction fee. One of the best benefits of using Coinbase is that they have a facility that allows users to deposit funds using real-world fiat currency. If you are located in Australia, Canada, Singapore, the United States, or most European nations , then you can fund your account using either a debit/credit card, or bank account.

Is Coinbase Pro Safe?

A stop order is a market order that executes when a certain price is reached. If there is a large sell wall at $12,000, and you think the price of Bitcoin will rise substantially once it breaks though, you may want to consider a stop-buy at $12,000.01. If the price of Bitcoin never hits $12,000.01, your order will not execute. If the price does hit $12,000.01, your order will execute at the next best price.

Your gain or loss can be determined by subtracting the basis from proceeds for a given quantity of cryptocurrency. All in all, Coinbase Pro is pricier when it comes to trading cryptocurrency, but charges slightly cheaper fees when it comes to crypto and fiat deposits and withdrawals. Coinbase Pro has one of the largest cryptocurrency trading volumes in terms of USD, which makes it a great option for selling cryptocurrencies. Cryptocurrency traders can buy and sell bitcoin on Coinbase Pro. Also, you can trade altcoins like bitcoin cash, litecoin, and ethereum, as well as other new coins listed on Coinbase Pro in a seamless and secure way. UNHASHED is not responsible for any financial losses or gains you may have when investing in cryptocurrency. Always use your best judgement when investing any cryptocurrency and when using any cryptocurrency exchanges, wallets, or other products.

What Cryptocurrencies Does Coinbase Pro Support?

John recognizes a $1,000 (8, ,000) capital gain from this transaction which gets reported on IRS Form 8949. In this guide, we’ll discuss exactly how you can get your tax reporting done when using Coinbase Pro. a regulated business that offers security and has built trust through its connection with Coinbase. If you do not have any open orders at the moment of your balance inquiry, you will find that all funds are available to you.

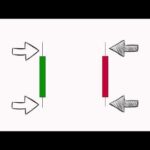

With Stop orders, you select the amount, the stop price, and the limit price. If you select the price chart, on the top right corner of it, you will see the open, high, low, close, and volume values for any point that you hover over. When you hover over a point, you will also see the specific time on the horizontal axis and the specific price on the vertical axis. The default chart type is a candlestick chart, although you can change it to a line chart if you prefer. On the right side of the screen, taking up just over half of the page’s width, you will find the price chart.

Exchanging Crypto On Gdax

By using the limit order feature, users can choose a certain price that they want to buy or sell a cryptocurrency. For example, if Bitcoin was priced at $6500, but you thought it was going to go down the next day, you could set a limit order at $6200. If and when the price went down to $6200, the exchange can automatically buy the coin for you.

Why is trading disabled on Coinbase pro?

Sometimes buys and deposits can be disabled if your account is not yet recognized as a trusted payment source. Coinbase uses an automated system to help us protect the community and our site from fraud.

Depending on the price you set, the order can execute instantly, like a market order, and you will pay a fee. Well, you will never pay more than the price that you’ve entered.

GDAX stands for Global Digital Asset Exchange and is a sub-company developed and owned by Coinbase. The main feature of the platform is that GDAX offers margin trading functions and marketplace, something Coinbase lacks. Thus, one can say that the exchange looks to fill out the gaps left by Coinbase. This example may seem far-fetched, but some order books are very thin, especially for small market capitalization altcoins.

You can also quickly upgrade your existing Coinbase account to Coinbase Pro. Those in Canada, Singapore, and Australia can use Coinbase Pro to access cryptocurrencies without any access to fiat. To build out your necessary crypto tax forms, you need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. Essentially, if you have any cryptocurrency activity outside of Coinbase Pro, the exchange will be unable to give you reports detailing your gains and/or losses. Simply possessing cryptocurrencies like bitcoin does not subject you to tax liabilities. Rather, it’s the income that you generate from investing in them that is a form of taxable income. Apart from margin trading services at GDAX, there are several other options out there in the cryptocurrency world for you to seek out.