Table of Contents

- Moneta Markets

- Trade Yearn Finance (yfi)

- Yfi Cryptocurrency: How It Works And Where To Buy

- Origins Of Yearn Finance (yfi)

- What Are The Fees To Use Yearn Finance?

- What Is Yfi?

As such, many are beginning to ask the question “what is yearn.finance”. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment.

Capital pools that automatically generate yield based on opportunities present in the market. Vaults benefit users by socializing gas costs, automating the yield generation and rebalancing process, and automatically shifting capital as opportunities arise. End users also do not need to have a proficient knowledge of the underlying protocols involved or DeFi, thus the Vaults represent a passive-investing strategy. Users can also deposit a mix of YFI and yCRV into Balancer in exchange for the Balancer Pool Token .

But essentially, the system can be summarized as 1 YFI token equals one vote. Curve depending on which asset pool is offering the highest yield.

But these days with yEarn’s growing popularity, shuffling around millions of dollars to various protocols can have profound effects. APRs can drop quickly (like from a 10% return to 5%) when large amounts of money are transferred. So the smart contract not only has to assess liquidity so it can quickly move tokens when necessary. But it also has to assess what will happen to the APR when large amounts of capital are dumped into a protocol. NewsBTC is a cryptocurrency news service that covers bitcoin news today, technical analysis & forecasts for bitcoin price and other altcoins. Here at NewsBTC, we are dedicated to enlightening everyone about bitcoin and other cryptocurrencies.

Moneta Markets

Under the proposal, 33% of the new tokens would be set aside for key contributors. Which contributors the allocation would be for and how much each would get is unknown. There will be some sort of staking set up so contributors only get their allocations for sticking around, but none of that has been decided. Yearn Finance is a collectively designed robo-advisor for yield that is fast becoming a portal into all of DeFi. It’s governed by the token YFI, which is worth slightly more than $30,000, as of this writing. Yearn.finance raised the bar in terms of returns and features within the DeFi market. It’s no surprise to see that this platform continues to gain popularity.

Which Cryptocurrency will grow the most in 2020?

Top 10 cryptocurrencies to explode this year:Ethereum (ETH)

Basic Attention Token (BAT)

Binance Coin (BNB)

Ripple (XRP)

Chainlink (LINK)

Stellar (XLM)

Polkadot (DOT)

Dogecoin (DOGE)

More items

There are even multiple Yearn Ecosystem Index tokens launched such as YETI by Powerpool and YPIE by PieDAO. During the weeks of 24 November until 3 December 2020, Yearn Finance announced the Merger and Acquisition (M&A) of multiple protocols, essentially forming an alliance revolving around YFI. He is vocal on Twitter with his ethos of fair token launch and having a bias on launching experimental projects before audits, which gave birth to one of the DeFi main activities “Aping”. For example, one of the delegated vaults is yETH, where users can deposit ETH and expect to have more ETH when they withdraw. The ETH is sent to Maker DAO as collateral in order to draw DAI where the DAI will be invested into the DAI vault, with subsequent earnings used to buy back ETH. Other than simple yield farming, Yearn Finance also released a product named delegated vault.

Trade Yearn Finance (yfi)

Delegated vaults basically use any assets as collateral to borrow stablecoins and recycle the stablecoins into a stablecoin vault. Any subsequent earnings are then used to buy back the asset. Yearn Finance is a suite of products in Decentralized Finance that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain.

These factors have earned Yearn Finance a reputation as one of the most decentralized projects in cryptocurrency. End users also do not need to have proficient knowledge of the underlying protocols involved or DeFi, thus the Vaults represent a passive-investing strategy.

Yfi Cryptocurrency: How It Works And Where To Buy

While simple on paper, this can potentially be quite complex and lucrative though, as evidenced by the decision to receive a pay a cut of the service fees to token holders. The service doesn’t come for free though, as performance fees and other costs are extracted along the way. These fees can be paid to YFI token holders as dividends, in an amount the community of token holders agrees on. On November 30, Yearn said it had merged its protocol development with Akropolis’s development. Yearn said that it would use Akropolis as the “front-of-house institutional service provider” for its lending protocol.

The current state of the DeFi sector is volatile and speculative. Investors purchase these tokens with the hopes that they can resell the tokens at a later date for a higher value. This dependence on arbitrage trading places the entire market at risk. The next-gen DeFi platform Yearn.finance continues to make waves across the sector. This decentralized ecosystem was built to eliminate the most pressing issues facing the market. Today, Yearn Finance has a reputation for providing users with the highest annual percentage yields on their deposited cryptocurrencies in the industry.

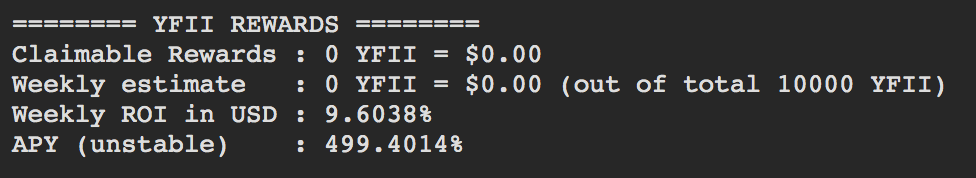

And if you’re interested, you can earn YFI by providing liquidity to yEarn’s ecosystem. The purpose of using Curve is to increase rewards in yEarn tokens. They can then supply yDAI to Curve to earn trading fees in addition to yield rewards. The protocol takes a small cut that is only available to YFI token holders. Yearn Finance is a Yield aggregator built on the Ethereum network that is able to maximize yield by dynamically allocating liquidity to a number of different DeFi protocols. It is an Ethereum DAPP that automatically allocates supplied liquidity to different pools in the DeFi ecosystem. It can be seen as an automatic yield farming protocol that searches the market for the best return opportunities and supplies the pooled liquidity to said opportunities.

The main goal of yearn.finance was to simplify the DeFi investment process and activities such as yield farming for the wider investor sector. The target market of yearn.finance are investors who want to optimize their profits as much as possible. Investors with a shortage of time to devote to researching the increasingly complex DeFi are also the target audience. To provide investors with profit maximization, the platform uses various tools for its operation, thanks to which it acts as an aggregator for DeFi protocols such as Curve, Compound and Aave. There will be a maximum of 30,000 tokens yearn.finance in circulation. At the time the token sale was launched , the total supply was 0 YFI and the employees did not receive any bonuses.

Origins Of Yearn Finance (yfi)

Yearn Finance has passed a proposal to increase the maximum supply of its YFI token, according to the project’s governance pages. 2,222 YFI tokens will be given to the leading contributors, while 4,444 YFI tokens will be handed over to the treasury. Yearn Finance will mint 6,666 YFI tokens, reaching a total of 36,666 YFI tokens in total. Get daily crypto briefings and weekly Bitcoin market reports delivered right to your inbox. These settings can be changed to block the automatic handling of cookies in the settings of your web browser or inform about their placement on your device each time. Parameters are configurable for the cryptocurrency calculator. In the case of the chart, it is not possible to add many parameters .

Exchange rate yearn.finance in the last 30 days decreased by -15.4%. Considering that Bitcoin has started to show signs of a more sustained uptrend, in the near term, the DeFi market could benefit positively from it as a result. Whale clusters appear when whales purchase Bitcoin at a certain price point and do not move their BTC afterwards. The clusters often indicate price points where high-net-worth investors accumulate Bitcoin. In the past 72 hours, the Bitcoin price has recovered convincingly from around $17,600 to $19,200. SushiSwap recovered from a controversial phase involving its creator and merged with Yearn.finance.

Yearn makes this dream a reality via this next level protocol. When a user deposits a stablecoin into the Yearn.finance, the network converts the coin into an equivalent amount of ytokens. Ytokens are also called “yield optimized tokens” in the network. It’s these funds that Yearn.finance automatically shuffles between Compound, Aave, and DyDx pools with the highest yield. Yearn Finance changed the game via its unique toolset that leverages proprietary protocols to increase investor yields. The platform provides unmatched security and an open-source code that has been vetted by the community. Reported Volume calculates volume from all exchanges with market pairs, but due to factors such as wash trading, it is considered an unreliable metric.

When a user deposits tokens they are converted to “yield optimized tokens” such as yUSDC, yUSDT, and yDAI. This allows the user to earn not only the usual lending fees but also the trading fees off of Curve. yEarn routes liquidity to different sectors across the DeFi space and yPools have earned some of the best lending rates in 2020.

This process is similar to staking crypto in exchange for block rewards. Except they are staking Curve and Balancer tokens in yEarn in exchange for YFI and governance rights. YFI is an ERC-20 token that governs the yearn.finance ecosystem. The protocol distributes YFI to liquidity providers who supply certain yTokens.

What Are The Fees To Use Yearn Finance?

Despite the pullback, throughout November, protocols like Yearn.finance, SushiSwap, Aave, and Uniswap demonstrated resilience. Learn more about the RUNE cryptocurrency with this beginner’s and buyer’s guide. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. Trade bitcoin, Ethereum and more at a US-based exchange where payments can be made in USD.

You can expect to see more users adopt this unique platform as its benefits continue to become common knowledge in the industry. For now, Yearn.finance offers features and convenience not found anywhere else in the market. Yearn.finance is the brainchild of the well-known cryptographic programmerAndre Cronje. The Yearn.finance journey began when Cronje began working closely withCurve FinanceandAaveto create the iEar protocol.

Anyone who can simplify the process and provide a better user experience stands a better chance at gaining mass adoption. And while any Yield Farming strategy involves a high level of risk, yEarn has provided some nice returns this year with relatively limited risk.