Table of Contents

- Commonly Used Currency Pair

- Checking Your Browser Before Accessing Forexfactory Com.

- Fx Derivatives Trader School By

- Energy Versus Gravity Plus Resistance

- Market Participants

- What Are The 10 Fatal Mistakes Traders Make

In early 2007, the Chicago Mercantile Exchange and Reuters launched the world’s first centrally cleared global forex market place called FXMarketSpace. The rate at which the currency is exchanged is called aForward Exchange Rate. The market in which the deals for the sale and purchase of currency at some future date is made is called aForward Market. The spot transaction is when the buyer and seller of different currencies settle their payments within the two days of the deal. Here, the currencies are exchanged over atwo-day period, which meansno contractis signed between the countries. The exchange rate at which the currencies are exchanged is called theSpot Exchange Rate.This rate is often the prevailing exchange rate. The market in which the spot sale and purchase of currencies is facilitated is called as aSpot Market.

If the preferred route is blocked or not working, your signal is re-routed through the next best available route. The selling pressure becomes overwhelming, so the exchange issues a short sell ban. All trademarks and registered trademarks appearing on oreilly.com are the property of their respective owners. Build your Forex trading strategies using a visual programming environment without writing any code. As I’m going to discuss in a future post, it has been argued that the intraday version of the plot above can hold indications on how the ForEx price will move during the next day. This has been explained for instance in this Medium post by Ivan Delgado.

Commonly Used Currency Pair

Take positions only for less than 10% of the equity to avoid over trading and margin call. USD is considered as the main major and EURO, GBP, CHF and YEN are considered as other majors. They are traded against USD and are called major pairs – EURO/USD, GBP/USD, USD/CHF and USD/YEN. It is important that you read and consider the relevant legal documents associated with your account, including the Terms of Business issued by FXCM Markets before you start trading. FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders.

Bulls are on the path towards a weekly resistance which could lead to near term shorting opportunities on the 4HR time frame. Retail broker in order to participate on the Interbank market must make a deal with large bank who is willing to give him liquidity. Banks which is willing to accept broker orders will offer different order price compared to price which bank will get on the Interbank market. Major banks that are involved in the interbank market are JPMorgan, UBS, Barclays, Deutsche Bank and HSBC. On the picture below is a small example how that looks like on the list of pending orders. This list becomes very helpful if you base your trading strategy on order flow where you look for possible movement of the price based on the trading volume. So, if you need to exchange large amount of U.S.$ for EUR you would like to easily find who can give you opposite side of the trade in that amount at rate you will pay.

Admiral Markets is a leading online provider, offering trading with Forex and CFDs on stocks, indices, precious metals and energy. The trend can be best captured by trend channels and a long-term moving average like 100, 150, or 200 sma, or Fibonacci MAs, such as 89 and 144 ema. To avoid becoming a statistic it’s important to manage your Forex trading by doing things like keeping a Forex trading journal and creating a Forex checklist before investing your hard earned money. Coexisting on the second tier of our ‘how Forex trading works’ diagram, we have the Hedge Funds and Commercial companies. The key difference is they don’t manipulate the prices that you see by adding spreads to the ‘ask’ price (well they claim they don’t). This will protect the broker from any losses your trade may attract.

Checking Your Browser Before Accessing Forexfactory Com.

In decentralized system general set rules must be followed in order to participate. Forex market structure consist of several levels where each level represent one type of the traders. Generally, all traders do same thing, trade on the market by buying and selling currencies.

Free-floating currencies are those whose relative value is determined by free market forces, such as supply-demand relationships. A fixed float is where a country’s governing body sets its currency’s relative value to other currencies, often by pegging it to some standard. Free-floating currencies include the U.S. dollar, Japanese yen, and British pound, while examples of fixed floating currencies include the Chinese Yuan and the Indian Rupee. Don’t become addict to trading, trade only when good opportunity is seen in the market.

Understand how to trade market structure and you can trade any market. The weekly chart shows that there is an upside target to the prior support structure which is expected to turn to resistance. The price of GBP/CAD has been caught in a long term consolidation between support and resistance n the monthly charts for many months. Market symmetry is a pattern that allows our traders to prepare for the next likely market possibilities once particular setups emerge and can be validated. Once the symmetry appears, as a trader you should be able to anticipate the most likely scenarios following.

Fx Derivatives Trader School By

You have to understand that overall, this long-term trend is still intact. And once again, eventually when they do cut their losses it would fuel further price decline.

By now you’ve hopefully come to grips about the importance to keep your charts neat and clean, away from unnecessary indicators while embracing the power of reading market structures in a proper way. You have also gained enough knowledge to ultimately, through your own analysis based on a rules-based approach, find these low-risk areas to enter trades. Additionally, the clusters of levels from your trading timeframe must also be marked. If you’ve followed me this far, you will by now understand that a new cycle would be confirmed if we can break and have two hourly closes outside the range, right?

Energy Versus Gravity Plus Resistance

In this chapter, we will learn about the structure of the forex market. If S&R wins, then the price will stop at S&R and revert into the other direction or go sideways. Generally speaking, the more confluence a support or resistance level has, the stronger the zone will behave.

What are the 4 types of market?

Summary. There are four basic types of market structures: perfect competition, imperfect competition, oligopoly, and monopoly.

When a firm that has had this much experience acquiring and integrating firms, buys one in an up-and-coming field, it’s a good idea to take a closer look and try to work out the logic of the acquisition. Founded in 1999 on the basis of some key insights into what technologies and standards would be necessary to advance electronic trading, ION grew rapidly and drew the attention of sophisticated investors. ION levered its early advantages via a long string of strategic acquisitions. The Greenwich Exchange is a source for connecting treasury professionals to peer data and insights. Through this membership, senior decision-makers globally speak with us about their client experience and the quality of the products they receive from their banks and non-bank.

When bank wants to exchange large amount they turn to level one, Interbank market and make exchange. Another example that characterizes this level is exchange you encounter everyday, one to one, you and the bank. If you want to exchange currency in the bank office you are forced to exchange currencies at rate they offer you. If you are not satisfied with exchange rate you are free to choose another bank and try to find better exchange rate. If you understand how big companies buy and sell products on the world market then you know that they need to have foreign currencies to trade. If you do not understand how it is done then read further and you will find out.

This gives us a different information with respect to the previous diagrams. It tells us what price levels have been visited more frequently over the past $5,000$ trading days. As you can see, there are prices that have been avoided pretty thoroughly, while other prices have been visited quite frequently – the latter being represented by the spikes in the distribution. It is telling us that the ForEx market is effectively not biased towards the buy or sell side. In other words, if you were to buy this currency pair at the beginning of each trading day and close the trade at the end, in the long run you would end up with zero profit . I downloaded GBP/USD daily price data for the past $5,000$ trading days, which cover in excess of $15$ years of trading. This is a large dataset which includes several of the major systemic economic shocks of the past two decades, namely the 2008 financial crisis, Brexit, and the 2020 COVID-19 crisis.

Market Participants

You have a huge amount of brokers that all offer various prices. This means brokers will mostly be competitive and cause prices to be the best for trading. CFDs are leveraged products and as such loses may be more than the initial invested capital. Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. There are various tools, such as trading indicators, which you can use to identify the trend. Examples of such indicators include the moving average and Fibonacci channels among others.

Most investors won’t have to pay the traditional fees orcommissionsthat you would on another market. Visualize and plan well before hand how you handle the positions when the market moves in your favor or against. Equity management in the earning process is very important rather than the imaginations of whether the market will rise or drop. Never chase and take positions – buy during quick rise or sell during quick fall, they are trap moves the market make before the reversals.

If you want to trade outside of those hours, tough luck, without the central exchange there is no one to facilitate your trade order. In some financial markets all participants access a centralized market or exchange anonymously on the same terms. The FX derivatives market, however, is an over-the-counter market, meaning that there is no centralized exchange and a clear distinction exists between banks and their clients. Note that “banks” here refers to large international banks with FX derivatives trading desks.

How many dollars is 50 pips?

So, if you enter long at 1.6400 and the rate of GBP/USD moves up to 1.6450, you have made 50 pips, or 0.0050.

to the importers so as to facilitate the smooth flow of goods and services from country to country. Such as an Indian company wants to purchase the machinery from the USA, can pay for the purchase by issuing a bill of exchange in the foreign exchange market, essentially with a three-month maturity. These brokers function as a link between the central bank and the commercial banks and also between the actual buyers and commercial banks. These are the persons who do not themselves buy the foreign currency, but rather strike a deal between the buyer and the seller on a commission basis. For instance, bull flag chart patterns indicate that the price is much more likely to continue with the trend, especially, if the price manages to break flag resistance with strong candlesticks . Trend is an important aspect of reading the chart as it offers traders the ability to understand which direction is stronger because the trend is likely to continue unless there are visible reversal patterns .

What Are The 10 Fatal Mistakes Traders Make

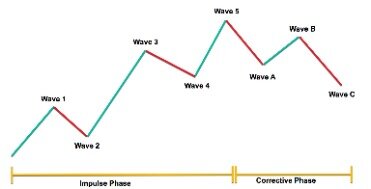

The chart is considered to be trending when the price is moving up or down , whereas sideways movement is known as a range, or non-trending chart. The price is approaching a respected and recent S&R level for the first or even second time. This article offers a simple 3-step guide on how to approach and dissect the market structure of any Forex, CFD, or commodity graph.

- Market structure is simply support and resistance on your charts, swing highs, and lows.

- The bear trend is the price action of lower lows and lower highs.

- Market symmetry also implies that emotions in the market have “proportion” which is why fibonacci measurements are relevant to technical analysis.

- This course will teach you deep, expert and advance Forex Trading Strategy.

So, what are support and resistance levels and the way to draw them on our charts? Professional traders understand how trending markets move; they always patronize the start of an impulsive move and take profits at the top of it. It may be that ION sees an opportunity to extend the MarketFactory model into Treasuries. In credit markets, streaming prices which Greenwich Associates identified as one of the top trends of 2019, are on the cusp of market acceptance. This and new trading protocols on the platforms are also beginning to lend themselves to comparisons with FX markets.

It might take effort and time to learn how to interpret price movements, but the benefits outweigh the costs in the long run. As prices of these major currencies keep changing and so do the values of the currency pairs change. These pairs also represent countries that have financial power and are traded heavily worldwide.