Table of Contents

- Floor Traders Pivot Points (standard Pivot Points)

- How To Measure Market Sentiments Using Pivot Points

- Forex Pivot Point Trading Strategy

- Pivot Point Macd Strategy Djia Trading Volume Chart

- How To Calculate The Pivot Point

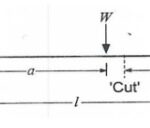

You should stay in the trade until the MACD provides an opposite crossover. Firstly, I will show you how to use pivot points as a part of a pure price action trading strategy, without the assistance of any additional trading indicator. We will rely on regular breakout rules to enter the market. If we enter the market on a breakout, we will put a stop loss below the previous pivot point. We will target the second pivot point level after the breakout. Many traders keep a watchful eye on daily pivot points, as they are considered to be key levels at the intraday timeframe.

You do not need some expensive trading system or AI program to accomplish this goal. If you struggle with where to place your stops, entries and profit targets, pivot points take care of all of that for you. To further illustrate this point, check out the below charts. This is where pivot points honestly took me from pulling my hair out to consistent profits.

Floor Traders Pivot Points (standard Pivot Points)

You want to calculate your pivots points using the GMT session high, low and close. Much like any Support or Resistance level created during a high liquid session, the highs and lows of the day are more significant during these hours. Most charting software will automatically calculate pivot points for you and display the support and resistance lines on your intraday charts. There are also plenty of pivot point calculators available online. However, you may have to do some manual work if you want to use an alternative system for calculating pivot points. Calculate pivot points manually or by using an online calculator.

If the market breaks this level to the upside, then the sentiment is said to be positive for that day and it is likely to continue its way up. Based in San Diego, Slav Fedorov started writing for online publications in 2007, specializing in stock trading. He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker.

They can be a valuable tool in your trading arsenal when combined with other support and resistance tools. On high volatile market conditions, a break of the first support or resistance pivot level will mostly lead to a move to the next level . This phenomenon is observed in pairs with higher volatility as well. Any long term pivot point which has not been touched by price for a large period of time gains attractiveness as a target level for counter trend moves. So if you don’t feel comfortable with all the trend following techniques mentioned, this one is for you. The London session is still the most liquid of all sessions traded, specially during its start and during the overlap period with the start of the New York session.

We will focus on reading price in order to increase our chances to swing trade the right way. If you have a 9-to-5 job or don’t like spending all day in front of charts, the pivot points can also assist you if you prefer swing trading or position trading. In order to be profitable when trading with pivot points, you first need to determine the main trend, or at least the main trend on the smaller timeframes. We don’t want to gamble or trade blindly, just for the sake of it, we need a solid pivot points trading technique. In the Bitcoin pivot points chart above, you see the power of pivot points and their accuracy. In this example, we determined the main trend with a simple moving average crossover .

The success of a pivot point system lies squarely on the shoulders of the trader and depends on their ability to effectively use it in conjunction with other forms of technical analysis. These other technical indicators can be anything from aMACDto candlestick patterns, or using a moving average to help establish the trend direction. The greater the number of positive indications for a trade, the greater the chances for success. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment. Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. A trading range occurs when a security trades between consistent high and low prices for a period of time. Given their ease of calculation, pivot points can also be incorporated into many trading strategies.

You can then use these levels to calculate your risk-reward for each trade. When this happens, the price creates a couple of swing bounces from R2 and R1. Forex trading alternatives trading day summary spreadsheet the other side, if a market is near the support levels S1, S2, S3 – a bullish reversal is usually expected. In trading stocks and other assets, pivot points are support and resistance levels that are calculated using the open, high, low, and close of the previous trading day. The pivot point bounce is a trading strategy or system that uses short timeframes and the daily pivot points. The system trades the price moving toward—and then bouncing off of—any pivot points.

How To Measure Market Sentiments Using Pivot Points

This means that you are not required to calculate the separate levels; the Tradingsim platform will do this for you. Your only job will then be to trade the bounces and the breakouts of the indicator. The point of highlighting these additional resistance levels is to show you that you should be aware of the key levels in the market at play. At first glance it’s easy to want to focus on the current day levels as it provides a clean chart pattern; however, prior days levels can trigger resistance on your chart.

How do you use floor trader pivots?

Floor trader pivots are support/resistance levels that floor traders have used in the pits of the exchanges for many years. They define an equilibrium point (considered a neutral market) called the pivot point or central pivot. The market is considered bullish when it’s above the central pivot.

The strategies mentioned above are just a handful of the ways traders use pivot points. Of course, any trading strategy comes with certain caveats. Pivot points are used because traders see them as potential key levels, but these strategies are based on trends over time and not absolute rules. Use pivot points to analyze price patterns and identify changing short-term trends that signal it’s time to buy, sell or hold. One of the most effective and simplest ways to do this is by paying close attention to reversals. Watch stocks closing in on their resistance line and take any reversal downward as a sell indicator.

Forex Pivot Point Trading Strategy

Second, there are traders who prefer these points because they put more weight to the previous period’s closing price. As you begin, there is always an eternal debate among market participants on the close, open, high, and low prices because the forex market is usually open 24 hours every day. If the price moves past the first support or resistance, the market tends to expect that it will move to the second level. The concept of support and resistance is the most important one in technical analysis. The support level is often viewed as a floor, where the price struggles to pass while the resistance is a ceiling where the price struggles to move higher. So, for this strategy, we’ll keep our price charts clean, without plotting a lot of indicators.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“content”) are provided for informational and educational purposes only.

The pivot points come as a technical analysis indicator calculated using a financial instrument’s high, low, and close value. Another strategy employed by traders is to look for prices to obey the pivot level, therefore validating the level as a solid support or resistance zone. In this type of strategy, you’re looking for the price to break the pivot level, reverse and then trend back towards the pivot level. If the price proceeds to drive through the pivot point, this is an indication that the pivot level is not very strong and is, therefore, less useful as a trading signal. One of the key points to understand when trading pivot points in the FX market is that breaks tend to occur around one of the market opens.

Pivot Point Macd Strategy Djia Trading Volume Chart

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Use customised Pivot Point indicators directly on the MT4 trading platform.

If you want to take this long opportunity, you should place your stop loss order right below S1, which is not visible on the picture in this particular moment. Since we have discussed the structure of the pivot points and the way they are calculated, it is now time to demonstrate pivot trading using some chart examples. Most of the trading software available today will have a pivot indictor that will calucatate these levels for you automatically and plot them on your chart. First, check the list of indicators your trading platform offers. If you don’t have a pivot indicator there, you should do some research. When you open a pivot point calculator, you will be required to add the three price action variables.

These zones offer the best trading opportunities and clearly a reason why Pivot Points have passed the test of time and remain one of the most popular and effective technical analysis tools. Traditional trading strategies, as taught in the textbook, do not seem to work anymore. Also, the simplest or most obvious strategies do not work either way . But small modifications in traditional strategies do seem to work and give some hope to continue researching. Although drawdowns are higher than a Buy & Hold strategy, potential returns are higher too and compensate that risk as to the high Calmar Ratio shows. The only remarkable results using this strategy are on EURUSD, but they are not supported outside the sample and seem more a coincidence than a cause of the strategy. There may be differences between the closing price of each minute and the price at which strategy would actually have been executed and nothing ensures that there was enough volume.

Also known as range traders, they use Camarilla pivot points to find short-term reversals and price tendencies to revert in the future. They are generally focused on the way the price is moving inside the daily trading range. As you already know, the classical or floor pivot point brings the key support and resistance levels to the trader. It consists of 4 support and 4 resistance levels that are located closer when compared to other pivot point types and variations. For this reason, Camarilla pivot works mainly with short-term trading tactics. Being aware of higher scale pivot points will be beneficial to all trading strategies, whether short or long term.

These downside breakouts could have been used to enter a short trade. Astop-loss has been placed approximately 0.1% above the top of the rectangle being used. If the price is above the pivot point, there is most likely an uptrend.

The pivot point is the balance between bullish and bearish forces. When prices are above the pivot point, the stock market is considered bullish. If prices fell below the pivot point, the market is considered bearish. This calculation helped them notice important levels throughout the trading day. Pivot points have predictive qualities, so they are considered leading indicators to traders. A trend comes as a powerful move that indicates the direction. What’s more, it has a great impact on the price and pushes it to higher or lower levels within a specific timeframe.

Once we saw the rejection of that area, we were safe to enter long around S1 pivot. Above we have a DAX30 Index pivot chart on the H4 timeframe.

Candlestick And Pivot Point Trading Strategy

It is also important to keep things simple and don’t over-complicate your trading. The second short occurred around S1 pivot, when a hidden divergence was spotted on the Stochastic chart. The divergence occurred right on the central pivot point of the day. So, the signal was valid and short positions under the pivot were safe. So, we won’t trade all divergences, just the ones that are in line with the current trend. The central pivot point is the most important part of the whole setup. The location of the main pivot point on the chart represents an important information to be aware because there is a high probability that it will be reached.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose. This information has been prepared by IG, a trading name of IG Markets Limited.

if you want to take full advantage of the power behind the pivot points. Trading with pivot points is the ultimate support and resistance strategy. It will take away the subjectivity involved with manually plotting support and resistance levels. A pivot point uses a previous period’s high, low, and close price for a specific period to define future support. Additionally, they determine stock market trends over different time periods.