Table of Contents

- Using Bullish Candlestick Patterns To Buy Stocks

- Double Japanese Candlestick Patterns

- Trading Indices With Ig

- Top And Bottom Currency Trading

- Candlestick Components

- How To Read Candlesticks: Charts, Patterns & Pro Tips

- Japan 225 News And Strategies From Ig

Put simply, if the previous candles are bullish, you can anticipate the next one will be a bearish reversal. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. With an extremely small body due to the same opening and closing price and long shadows, they’re hard to miss. Japanese candlestick charting techniques are the absolute foundation of trading. They tell the important story of support and resistance and that’s the most important part of trading.

For example, the evening star starts with a bullish candle followed by a small bearish/bullish star followed by a bearish candle longer than the first bullish sign. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Using Bullish Candlestick Patterns To Buy Stocks

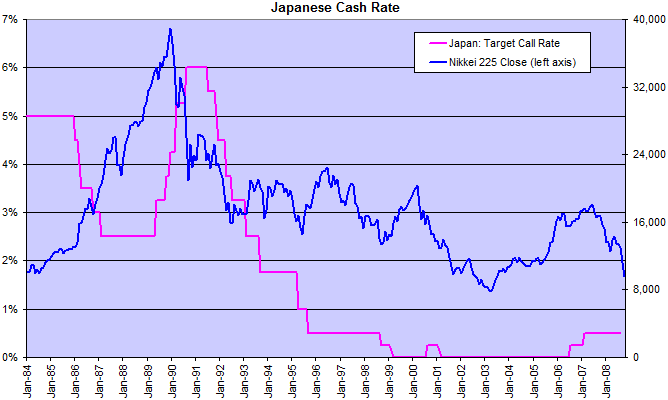

Everything else about the pattern is the same; it just looks a little different. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white. Candlesticks can also show the current price as they’re forming, whether the price moved up or down over the time phrase and the price range of the asset covered in that time. Hong Kong stocks fell on Friday to post weekly losses, weighed down by weakness in tech firms on worries about the latest Sino-U.S. The Japan NIKKEI 225 Stock Market Index is expected to trade at 29119.47 points by the end of this quarter, according to Trading Economics global macro models and analysts expectations.

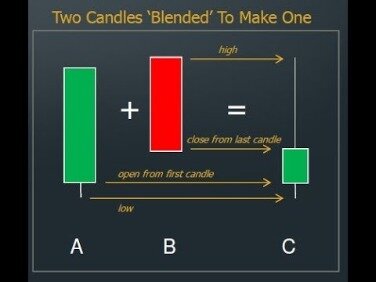

For example, when the bar is white and high relative to other time periods, it means buyers are very bullish. Engulfing Japanese Candlestick patterns indicate that a market trend is being overpowered or consumed by the other in the opposite direction. Two adjacent candles display it, indicating which movement, between bullish and bearish, dominates the other. For instance, a bullish engulfing candlestick will have a bearish candle followed by a bullish candle with a larger body. Candlestick charts have become the preferred chart form for many traders using technical analysis. Learn to identify candlestick patterns with this introduction. Candlesticks give an excellent view of the Open, High, Low, and close price.

Double Japanese Candlestick Patterns

The hammer can be either filled or hollow; the Japanese say the price is hammering out a bottom. What is important here is that at the end of a down move, the buyers and sellers test out an extreme low ; however, the price has returned higher by the closing bell.

The classic Japanese candlestick reference, updated with all-new insights and tools to improve your predictive accuracy. Candlestick Charting Explained takes the subjectivity out of Japanese candlestick analysis by providing you with standardized, straightforward coverage of 89 powerful candlestick charts patterns. You will learn what they indicate about current trader behavior and how you can use each to instantly improve your market knowledge and analytical precision. The key to reading candlesticks is to understand the candle body length and fill. A long hollow body means the stock price surged on a greater demand. A long-filled body means a strong fall in stock price on increased selling. Long wicks mean that there was an extreme high or low that failed indicating a short-term trend reversal.

- Most of the largest and best capitalized Japanese stocks can be bought and sold through American Depository Receipts .

- Jack Schwager in Technical Analysis conducted fairly extensive tests with candlesticks over a number of markets with disappointing results.

- We also thoroughly test and recommend the best investing research software, books, brokers and have partnerships with companies whose products we love.

- Entry and exit points may vary slightly compared to using a candlestick chart, since the price on an HA chart may be slightly different than on the candlestick chart.

- The Open and Close prices are very close, yet there is a longer distinguishable wick.

- The conventional short-sell triggers form when the low of the engulfing candle is breached and stops can be placed above the high of the harami candlestick.

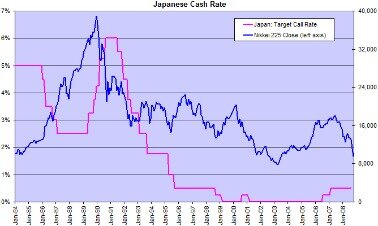

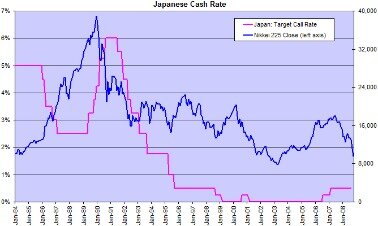

By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. The difference between them is in the information conveyed by the box in between the max and min values. The Nikkei 225 fell 424.7 points or 1.41% to 29792.05 on Friday; closing slightly lower on-week as a continued a surge in US bond yields sapped appetite for riskier assets. The BoJ also noted that it would buy ETFs only when necessary, instead of at a set pace.

Trading Indices With Ig

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world. You may want to change a couple things on the chart.You can rename the equity on the chart . Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply.

The width of the volume candlestick represents volume that has been normalized to show its percentage of a “look back” period. For example, if you used a four-month lookback, then the width of each daily candlestick represents the day’s volume as a percentage of the four-month volume. The result is that the x-axis of the volume candlestick chart, representing time, is not regularly spaced, even though the y-axis, price, is. Candlesticks consist of the body and an upper and a lower shadow . The wick illustrates the highest and lowest traded prices of a stock, and the body represents the opening and closing trades. If the stock went up, the body is white, with the opening price at the bottom of the body and the closing price at the top. If the stock went down, the body is black, with the opening price at the top and the closing price at the bottom.

Japanese candlesticks and the patterns they create represent a visualization of financial data that is very popular with financial traders and technical analysts. A candlestick on crypto exchanges can represent price movement on various timeframes, as small as one minute, and as long as one month or more. The preceding green candle keeps unassuming buyers optimism, as it should be trading near the top of an up trend. The bearish engulfing candle will actually open up higher giving longs hope for another climb as it initially indicates more bullish sentiment. However, the sellers come in very strong and extreme fashion driving down the price through the opening level, which starts to stir some concerns with the longs. The selling intensifies into the candle close as almost every buyer from the prior close is now holding losses.

Top And Bottom Currency Trading

Japan NIKKEI 225 Stock Market Index – data, forecasts, historical chart – was last updated on March of 2021. What I like so much about late day fades is their ease of predictability. And some days I can’t get to my laptop until the afternoon which means I miss the opening runners.

The day was extremely uneventful, with the market participants backing away from the higher prices. Volume was lower than the previous day suggesting traders pausing for breath. The Morning Star pattern signals a bullish reversal after a down-trend. The second candlestick gaps down from the first and is more bullish if hollow.

Candlestick Components

For some reason, the buyers thwarted a potential shooting star and lifted the candle to close at the upper range of the candle to maintain the bullish sentiment, often times artificially. However, the truth hits when the next candle closes under the hanging man as selling accelerates. If the preceding candles are bearish then the doji candlestick will likely form a bullish reversal.

Additional information and insights present different interpretations of candlesticks based on intraday instead of end-of-day events and action, improving signal reliability. The author’s unique candle pattern filtering concept, instrumental in answering the “how” question, is updated to utilize today’s larger universe of stock data. An all-new chapter provides practical application and perspective traders need to view candles in the context of today’s computer-driven marketplace. The Candlestick wick also runs through the bottom of the candle. Ultimately this created a long lower wick and is a bullish signal. Three of our review winning stock market chart analysis software vendors have functionality that can do a better job of identifying and analyzing candlesticks than humans can. Bullish patterns indicate that the price is likely to rise, while bearish patterns indicate that the price is likely to fall.

The overall Smart Investing & Trading Score is 100 (0-bearish to 100-bullish) which puts Japan index in short term bullish trend. To create a Candlestick series explicitly, call the candlestick() method. You can also make a full technical analysis with Chartoasis Chili, see details here. Example stock chart from Japan (TOYOTA MOTOR CORP.) created with the free software Chartoasis Chili. A slight variation of this pattern is when the second day gaps up slightly following the first long up day.

Weigh the pros and cons of each broker to make an informed decision. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Either by opening a trading account with a Japanese brokerage firm or through American Depository Receipts . When you decide to sell your Japanese stock, you are obligated to report the amount of profit or loss on the Japanese annual earning declaration (). The amount you made or lost is considered by the tax office that then decides how much tax you have to pay. This is an important step with regard to your tax liability, so you should not ignore the official requirement to report gains or losses on your stock transactions.

The doji is a reversal pattern that can be either bullish or bearish depending on the context of the preceding candles. The candle has the same open and closing price with long shadows. A doji is a sign of indecision but also a proverbial line in the sand. Since the doji is typically a reversal candle, the direction of the preceding candles can give an early indication of which way the reversal will go. It is used to determine capitulation bottoms followed by a price bounce that traders use to enter long positions.