Table of Contents

- Learn To Trade Stocks, Futures, And Etfs Risk

- A Simple Day Trading Strategy

- Stock Trading Timetable

- Become A Successful Trader

- Tick Charts And Tradingview

- The Complete Tick Chart Guide + Heikin Ashi Candlesticks

Last week I received a good question from a reader of my personal trading blog SystemsOnTheRoad.com. Secondly, the more periods you take into consideration on the tick index, the more reliable the signals. As a result, in the beginning of December, the NYT price begins to decrease. In the green circles, the price action of General Motors mirrors that of BAC.

This differs from more traditional charts that show price changes over a fixed time periods. Range bar charts represent when a pre-determined amount of price movement has occurred. Getting complete volume data has always been a problem for Forex. The CME futures contracts for Forex are the answer.

This bright-red block tells us that a maximum volume of contracts was traded at this price level at a certain moment of time and sells dominated over buys. However, the sellers failed to protect their positions by the moment of closing this bar and the price sharply increased leaving them in the loss-making positions.

Learn To Trade Stocks, Futures, And Etfs Risk

While ‘open’ is an indication of when the trade opened, close, on the other hand, is an indication of when the trade closed. Tick Charts will never match between different data providers.

The honest truth is that most day trading companies are out there to take your money, not bill williams fractals thinkorswim quantconnect indicator minutes you how to day trade. Together, the body with the shadows of a candlestick are critical elements in defining relevant patterns. Line charts can be a good type of chart to begin understanding technical analysis. Best trading platform by the independant site Rankia. The subscription product offers t rend analysis, alerts, and progress across various securities like equities, ETFs, forex, and cryptocurrency.

The good news is a lot of day trading charts are free. Trading software offers traders the power to control and manage open positions. In the classic time-based view, the volume shows only the number of securities exchanged during a given period. The vertical scale, or Y-axis, of a chart represents the price of a stock. You have to look out for the best day trading patterns. The most recent event was the Options Forum which provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency.

A Simple Day Trading Strategy

This reduces whipsaws and allows more “continuous” analysis between days, with trades setting-up pre-open on a Tick Chart. Please be advised that trading futures and options involves substantial risk of loss and is not suitable for all investors. This matter is intended as a solicitation to trade. For every unique advantage that a tick chart provides, it also comes with a caveat. Tick charts may provide clear analysis but only on the transactional level.

A tick chart can show you the progression of each tick or group of ticks. The ES (S&P 500 futures) ticks by a quarter point or 0.25. So if the ES is trading at 2,950.00, then one tick above would be 2,950.25. Note that one full point in the ES equals four ticks. But what if your short-term goal was to trade on the smallest “transaction” level?

Stock Trading Timetable

The relative size of the volume histogram shows us the average trade size. You are probably wondering why we just don’t use a 5 minute chart now, so let me explain.

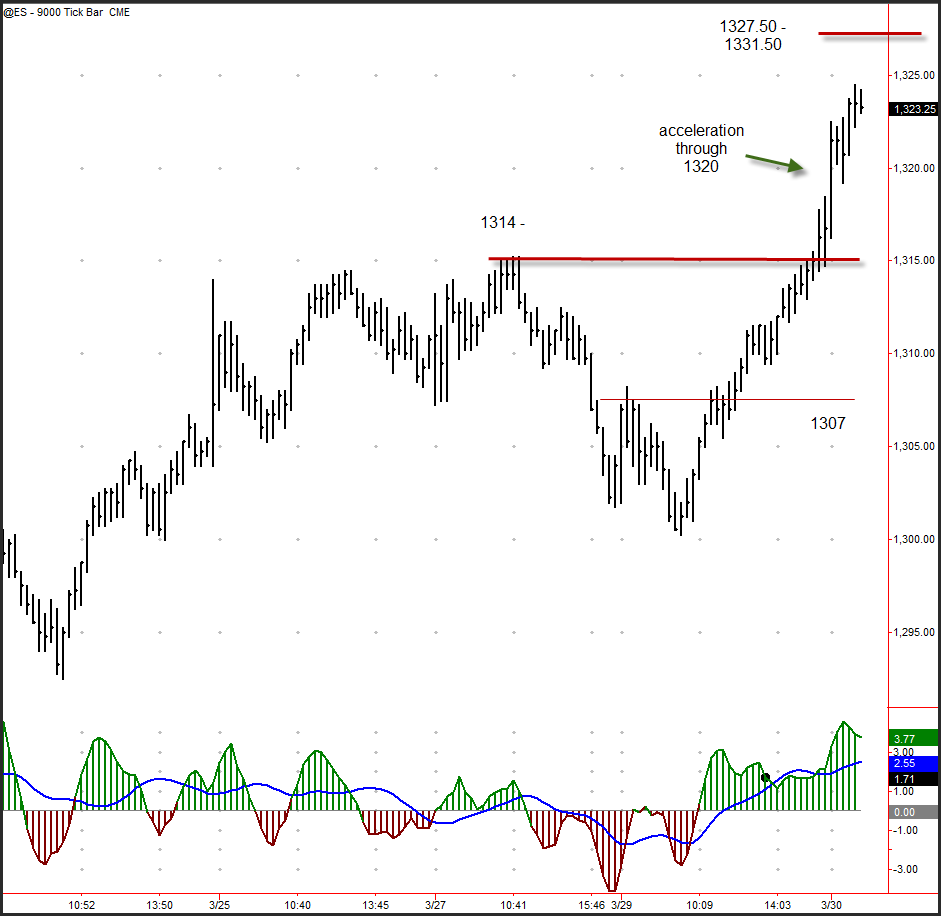

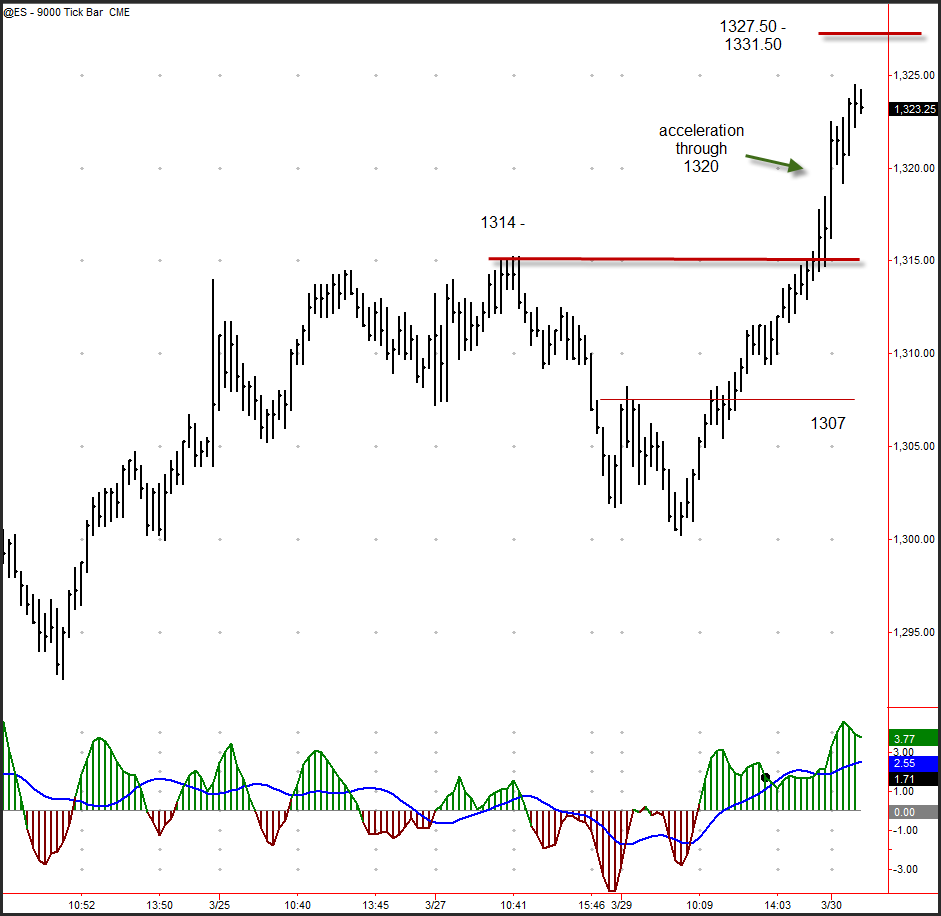

Before the change my Emini chart setup used 233, 699 and 2,097 Tick Charts. 233 is a Fibonacci number and that’s why it was my starting point. After the change I switched to my current chart settings of 500, 1,500 and 4,500 Ticks. The 2,097 Tick Chart above has some of the high value bars highlighted – these show large average trade sizes or Professionals. As you can see, you want to follow the Professionals. They were buying the dips and shorting the rallies. I much prefer Tick Charts over conventional, time-based charts.

Become A Successful Trader

The bars on a tick chart are created based on a particular number of transactions. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. When the volatility increases, a tick chart shows more price waves and traders are able to properly identify proper support and resistance levels. The advantage of a tick chart is that compresses low-activity trading periods. On the time-based charts, you may see useless candles, while the tick chart may offer you only relevant ones. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products.

What is tick volume?

“Tick volume” measures the number of times the price ticks up and down. This is an excellent indicator of the strength of activity in any given bar. But also, the correlation between tick volume and actual volume traded is incredibly high.

Well I consider myself a little bit of an expert on tick charts, so here goes. I usethinkorswim® for my charts , but most charting packages have Heikin Ashi candlesticks built in as well as the capability to view the chart’s X axis in ticks instead of time. Furthermore, they help in allowing a trader to make specific market trends to capitalize the most on such trends. During pre-market hours and in after hours, the volume traded is thin and specific, however, combined. With the use of tick bars, this momentum can get a pattern and significance, so that you can trade and to make specific gains as well.

When you set this, each bar will represent the mentioned time period. Working with traders around the world I’ve noticed a common theme. They plot dozens of indicators on their trading screen and then fail to enter trades with confidence. In this article you will learn how to have confidence in your trading decisions by using a simple day trading strategy that only relies on two indicators.

If you use a one-minute, two-minute, or five-minute chart, then a new price bar forms when the time period elapses. Finding the right financial advisor that fits your needs doesn’t have to be hard. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. You can’t consolidate assets held at other financial institutions to get a picture of your overall assets, though.

A 5-minute chart is an example of a time-based time frame. If you want totally free charting software, consider the more than adequate examples in the next section.

Only in one example, highlighted in red, did the price action not correlate between the two securities. This is the daily chart of General Motors from October 2015 through March 2016. On the chart you see six green circles and one red circle. These are the exact moments and dates we discussed on Bank of America’s chart. make the right decisions because you’ve seen it with your trading simulator, TradingSim. Notice how +1000 and produced decent intra-day reversals in the S&P 500. The higher the tick readings, the more powerful the reversal signals.

What did you think of this tutorial on tick chart vs candlestick time charts? Enter your answer in the COMMENTS section at the bottom of this page. Was this video on tick chart vs. candlestick time charts helpful to you? Leave a message in the COMMENTS section at the bottom of this page. Some prefer charts with 33, 133 or 233 ticks, others choose from fibonacci numbers like 13, 21, 34, 55, 89, 144, 233, etc.

Different traders use different strategies on tick charts that suits them best. You just have to test different settings and select the one you feel most comfortable trading with. Tick charts are becoming more and more popular among traders, as they provide a different perspective on trading than traditional charts. Many traders are using tick charts in combination with the common time-based charts for a better chart analysis.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Be very careful when trying out charts without a time base. It changes the very foundation of how you build your charts. Hence, it has wider implications than adding any one indicator.

Unlike time-based intraday charts based on a set amount of minutes , tick chart intervals can be based on any number of transactions. Frequently, the interval of tick charts is derived from Fibonacci numbers, where each number is the sum of the two previous numbers. Popular intervals based on this series include 144, 233 and 610 ticks. While time-based charts measure the price movement within a specific increment of time , tick charts “move” only when price ticks up or down. Fewer bars form when there are fewer transactions, warning a trader that activity levels are low or dropping.

The clearly feasible method was to do draw daily charts as end-of-day market data was more readily available. And traders back then could wait for the market to close, and update their charts leisurely for analysis. While these trends are being formed, don’t forget to look for the 133 tick charts to form candles the same color as the 1 minute trend. So, there are different types of technical charts with different purposes, such as tic or tick charts, line charts, bar charts, and charts of points and figures. Brokers, websites and online platforms offer a huge amount of graphs and charting tools based on different criteria, some of them in time, brands, price range or volume. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

The Complete Tick Chart Guide + Heikin Ashi Candlesticks

Secondly, Tick Charts are not yet available on TradingView. This feature has been requested many, many times and TradingView has promised it is in the works. However, as of March 2020, Tick Charts are not available on TradingView.