Table of Contents

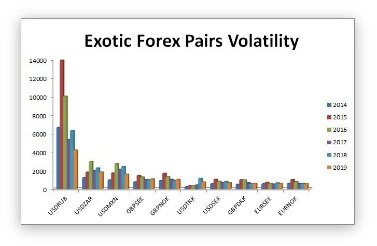

In view of these announcements, the peruser may reason that trading the colorful currency pairs or cross rates guarantees enormous benefits. The instability of the significant currency pairs is a lot of lower. As per that standard, we can infer that outlandish currency pairs are the most unstable ones in the Forex market in light of the fact that their liquidity is frequently lower than that of significant pairs. There are also many forex tools available to traders such as margin calculators, pip calculators, profit calculators, economic trading calendars, trading signals and foreign exchange currency converters.

This can be valuable information to the trader regardless of the strategy employed. So traders can conclude, as a general rule, that the lower the spread, the higher the liquidity and daily trading volume of that pair. The EUR/USD can be quoted at 1.1358, the EUR/JPY can be quoted at 140.10 and the NZD/USD can be quoted at 0.6866. Just remember that if all three pairs moved up 10 pips each only the two digits on the right would change. the EUR/USD would then be 1.1368 and the NZD/USD would be 0.6876. Currency pair characteristics for causing price movement are pretty simple.

Top Pros Top Picks (daily)

They likewise show a normal week by week, every day and hourly instability of the pair. There are times when the currency value stops or moves inside an exceptionally limited reach. For this situation, we talk about the low instability on the lookout. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market.

The 2nd major influence on the price of GBP was Brexit, the name given to the 2016 vote that would separate Britain from the European Union. Brexit caused the value of the GBP to lose almost 10% overnight and 20% in the months following the vote as investors abandoned the pound for more stable currencies in the wake of negotiations. America’s fiscal neighbor to the north and one of their most important trading partners, it should come as no surprise that the values of CAD and the USD are closely related.

We offer the highest number of forex pairs to trade in the industry, with over 300 currency pairs available on our platform, so the forex market is full of opportunity for traders worldwide. Whether you are trading minor, exotic or the most traded currencies, there is a forex trading strategy to suit every personality and trading style in order to make the most of market liquidity.

Usd To Jpy

The ADR indicator has a very simple output and in most cases, you will see an additional text with the output values on your chart after you apply the indicator. The ADR indicator should show you a number for the n-periods ADR value. Fortunately, you do not need to manually do this yourself, because the ADR indicator within your trading platform will perform this calculation. The only thing you are required to do is to select the period input you want the ADR to take into consideration. Before we dive into how we can use the ADR to trade, we should take a moment to understand the composition of the indicator.

The AUDUSD and NZDUSD have a similar structure, since the Sydney market is fairly small, and activity picks up when Tokyo opens a couple hours after Sydney. This allows investors to trade on the EUR/USD not only in the spot market, but also to use derivatives such as futures, options, CFDs. It means that the average streak is slightly more than one and a half day long. AUD/USD is clearly the most trending pair on a monthly chart when using an SMA 50. The USD/CAD and GBP/JPY pair are placed at the second and third place in the ranking list.

How Much Does Trading Cost?

They are held out as commodity currency pairs, as their prices are closely correlated with gold and oil. Australia is a large producer of gold and therefore the price of AUD/USD, as a rule, is highly dependent of gold prices. Similarly, Canada is one of the largest oil producer in the world, and therefore the price of USD/CAD are heavily reliant on oil prices. In particular, Euro/dollar value depends on the monetary policy of the US Federal reserve and the European Central Bank, as well as from the difference in key interest rates by the FRS and the ECB. The overall economic situation in the US and the EU, statements of large corporations, dynamics of raw materials and commodity markets also affect the Euro/dollar pair trading. In addition, analysis of the most popular currency pair EUR/USD is impossible without taking into account geopolitical factors.

The price movement is 90 pips on the AUD/USD alone in one trading session. The most frequently traded currency pairs are the EUR/USD, USD/JPY, and GBP/USD, which are all forex major pairs. The choice of the best Forex currency pairs to trade is not a walkover, as it might seem at first glance. The main factors to consider when choosing the best currency to trade include volatility, spread, trading strategy and the level of difficulty of forecasting the course. The EUR/GBP and EUR/JPY currency pairs, with the averages of 1.88 and 1.72, take up the second and the third rank. Similarly to the weekly charts, GBP/USD performed worse than nearly every pair, except for USD/CHF, which stands last with an average number of mere 1.35.

Upward momentum is mitigated at resistance levels as sellers attempt to move prices lower. Study macroeconomic analysis and economies of the countries, the currencies of which you trade.

Minor Pairs

You are on the right website if you are interested in learning more ‘secrets’ of pairs and currencies. Forex ADR can also be used as a gauge to show us the movement potential of every pair so it can help us to choose the best pairs to trade during a day. Generally, if a pair hasn’t passed its ADR level, there could be more opportunities to take advantage. Since the outbreak of the financial crisis, currencies are generally split between the so called “safe haven” currencies and the “risk currencies”.

Why does the spread change on forex?

When there is a wider spread, it means there is a greater difference between the two prices, so there is usually low liquidity and high volatility. The spread for forex pairs is variable, so when the bid and ask prices of the currency pair change, the spread changes too.

In 2016, oil prices fell to prices not seen in over a decade, and the Canadian dollar also suffered, slumping to an exchange rate of 1.46 CAD to 1 USD. Yen is considered to be held under a “dirty float” regime thanks to the Japanese government’s policy of active stability intervention. This means that the value of yen sees a number of daily fluctuations, but the central banks of Japan frequently buy and sell the currency en masse to keep exchange rates under control. The euro is a stable currency that represents the European Union and is the official currency of 19 of the 28 members of the European Union. Some of the countries that use the euro include Spain, France, Finland, Latvia and most of the countries in western Europe. If you are located in the United States, your base currency is probably USD. Keep up to date with our news and analysis section of the website, which can provide insight and predictions into future movements in the forex market.

Out of these 8 currencies, the three most actively traded and most liquid currencies are the USD, EUR, and JPY. Currencies like the CAD, NZD and AUD are commodity based currencies are correlated to the movements in the prices of oil and gold. The other currencies are more reserve based currencies, which are held in large quantities by governments and banks. Due to their close proximity, the NZDUSD has similar intra-day volatility as the AUDUSD.

The abundancy of their developments doesn’t surpass 60 focuses every day. Concerning the cross rates, GBP/NZD, GBP/AUD, GBP/computer aided design, and GBP/JPY are the pairs with the most noteworthy unpredictability. Every one of them proceed onward normal for in excess of 100 focuses every day. The table shows that today the most unstable Forex pairs are intriguing ones. Every one of them proceed onward normal for in excess of 400 focuses every day. In the event that you have ever traded in the Forex market or possibly watched value developments from the sidelines, you may have seen that the costs move non-directly on the diagram. Generally, unpredictable pairs are influenced by similar drivers as their less-unstable partners.

Other great benefits of MT5 include a multi-threaded strategy tester, fund transfer between accounts and a system of alerts to keep up to date with all the latest market events. Traders can also communicate through the embedded MQL5 community chat to network with other traders and share tips and strategies. MetaTrader 5, or MT5, is the newest and most advanced online and free trading platform. Trading on MT5 via FXTM gives you even greater access to financial markets including foreign exchange, commodities, CFDs, stocks, futures and indices. With the MetaTrader 4 platform, you’ll enjoy easy-to-read, interactive charts that allow you to monitor and analyse the markets in real-time. You’ll also have access to more than 30 technical indicators which can help you to identify market trends and signals for entry and exit points.

For day trading spreads, some pairs are better than others, and drawing conclusions on tradability based on the size of the spread (large vs. small) is not useful. You can choose any pair and see the measurements over various periods. As a leading global broker, FXTM are committed to providing services tailored to the needs of our clients. As such, we’re s proud to offer our traders the choice of two of the industry’s leading forex trading platforms; MetaTrader 4 and MetaTrader 5 . In a line chart, a line is drawn from one closing price to the next.

If trading on a short time frame, I recommend using an ECN broker that has a near zero spread. This will allow you to more efficiently exploit opportunities during the hours of your choosing since the spread won’t be of concern. I developed a good strategy with Renko and range-bound pairs adjusting the bricks width with Center of Gravity. I think if I use it with trendy pairs it will make more success with some adjustments. Traders should use relatively bigger stop-loss levels when trading the NZD/USD, GBP/JPY, and EUR/JPY pairs. Notably, so far in all the tables provided above, the GBP/JPY currency pair occupies one of the top three ranks.

Consequently, the Russian rouble is ‘lighter’, which means it became cheaper. Currency pairs could be a part of diversified portfolios for investors. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

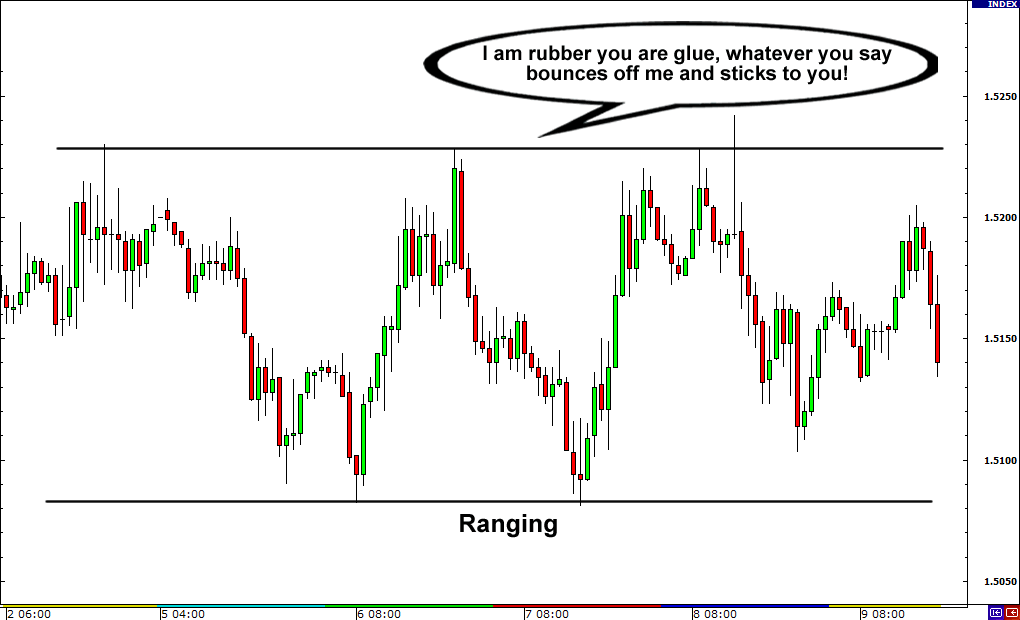

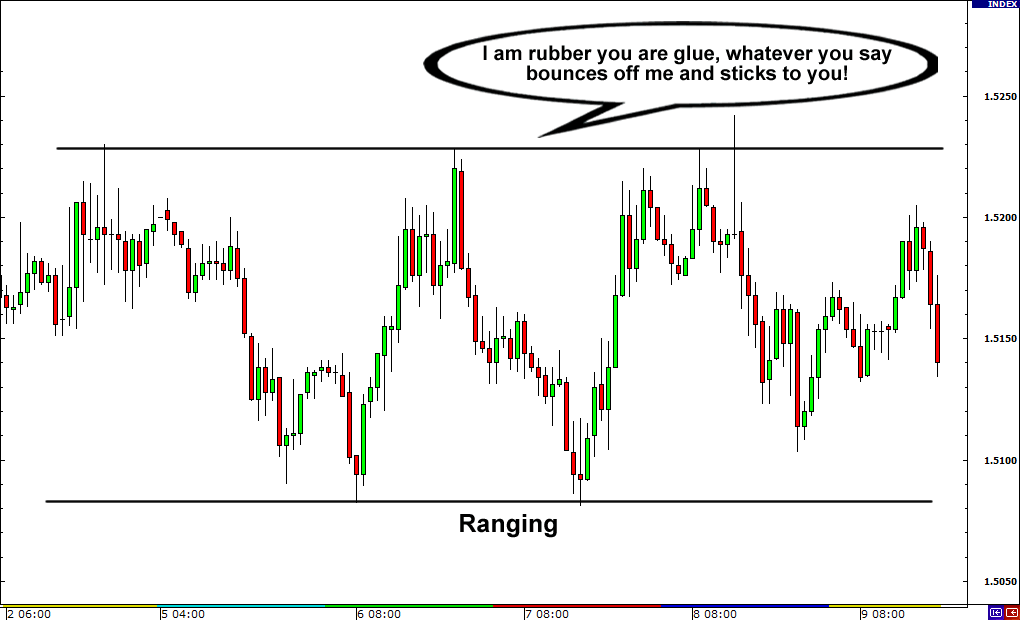

Trying to apply a volatility-based strategy at sedate times of the day isn’t efficient. Just as trying to implement a range-trading type strategy during volatile trending times is likely to result in frustration. GBP/USD (British pound/US dollar) currency pair – is the third level of liquidity Forex instrument. Operations account for about 12% of the total trading volume on the foreign exchange market. The pair pound/dollar is characterized by high volatility and instability of prices. Therefore, it is popular and the most traded currency amongst professional traders focused on short-term aggressive strategies. The pair quotes are sensitive to fundamental factors and statistical data on the state of the British economy and the actions of the Bank of England, as well as to macroeconomic data in the USA.

On the basis of results in Table 1, we move on to rank each of the 22 currencies. The sterling has lost 8.018% against the dollar, the euro has plunged 13.521%, while the ruble has depreciated by 70.913% during the examined period. The AUDUSD is therefore also known as a “risk off-risk on” currency pair. With risk-on the AUDUSD price goes up, with risk-off the USD is in demand and the AUDUSD goes down. Understanding the product you are trading in more depth than others gives you home court advantage.

It would become easier for you to analyse and forecast the currency pair after you gain some experience. Usually, when building forecasts on currency pairs, fundamental factors are taken into account. Exotic pairs are the domain of experienced and very experienced traders, since there could be sharp exchange rate fluctuations, high trading commission fees, low liquidity, etc. On the other hand, there could be strong movements, especially when news are published, which could bring significant profits.

Check outBenzinga’s article on Best Forex Chartsfor a more detailed breakdown of chart options. Security.The best forex brokers offer a number of layers of security and allow you to enable two-factor authentication to ensure that you’re alerted every time you log into your account. Work only with well-known forex providers to lessen the chance that you lose money in a hack or breach. Investors who invest in CHF do so most to protect their assets in times of turbulence. In 2007, the GBP reached an all-time high trading at £2.10 per $1 USD—only to crash to a shockingly low £1.40 per $1 USD in 2008, causing many investors to cash out their pounds in exchange for the dollar. Though the pound would recover in the coming years, it would eventually even out to around £1.60 per $1, never again reaching the high of 2007. Two major events that have significantly influenced the price of the GBP in the last decade.