Table of Contents

- Hanging Man Candlestick

- Reversal Or Continuation?

- Limitations Of Using Engulfing Patterns

- How Does The Engulfing Pattern Look In Real Life?

- How To Trade Engulfing Candlesticks

- Where To Get Engulfing Alerts

A hammer candlestick forms at the end of a downtrend and indicates a near-term price bottom. The hammer candle has a lower shadow that makes a new low in the downtrend sequence and then closes back up near or above the open. The lower shadow must be at least two or more times the size of the body. This represents the longs that finally threw in the towel and stopped out as shorts start covering their positions and bargain hunters come in off the fence.

So, if you are a scalper, engulfing might be good enough to trade on. Engulfing is also a good candidate for TA-based bot trading automation. The trigger of the inside bar pattern exists once the third candle breaks either the low or the high of the small candle. A later and more accurate signal is given when the third bar breaks the range of the larger first one. In today’s lesson we won’t go into that much detail, but by comparing these candle values with each other it’s quite easy to detect any variation of these patterns that you desire.

Hanging Man Candlestick

I am a Partner at Reink Media Group, which owns and operates investor.com, StockBrokers.com, and ForexBrokers.com. It’s built as a step-by-step visual guide of all the skills you should master to reach profitable trading. A rule of thumb is to ensure your winners are as big as your losers; two times bigger is best. Measure the distance between your entry point and where you placed the stop loss. A downtrend is indicated by lower-swinging lows and lower-swinging highs in price. Take only short positions when there’s a downtrend, selling a borrowed asset to buy and return it later when the price goes down. An uptrend is indicated by higher-swinging highs and higher-swinging lows in price.

What is bullish and bearish candle?

Bullish Candle: When the close is higher than the open (usually green or white) Bearish Candle: When the close is lower than the open (usually red or black)

A kicker pattern is a two-bar candlestick pattern that predicts a change in direction of an asset’s price. This can leave a trader with a very large stop loss if they opt to trade the pattern. The potential reward from the trade may not justify the risk. It is advisable to enter along positionwhen the price moves higher than the high of the second engulfing candle—in other words when the downtrend reversal is confirmed.

Reversal Or Continuation?

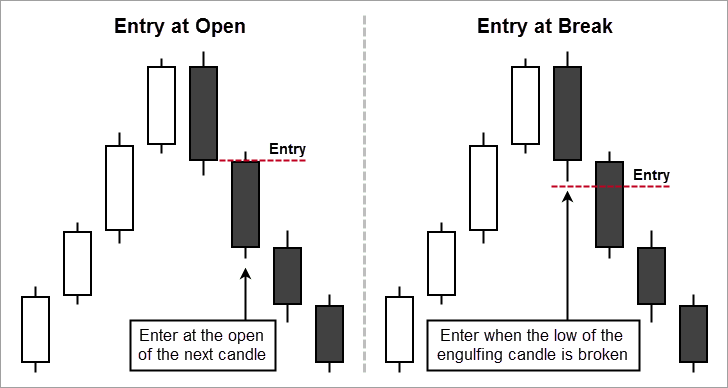

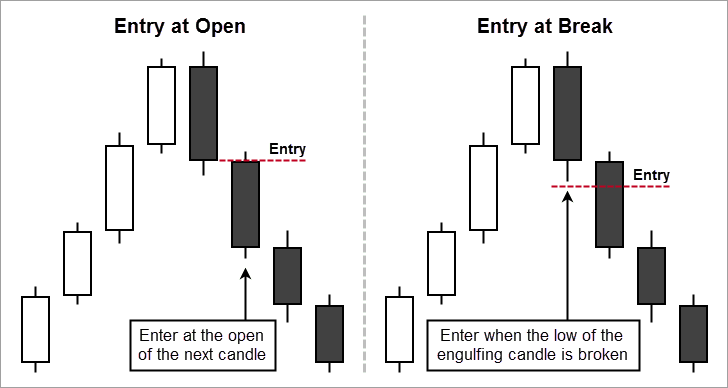

This includes support/resistance breakouts and trend or channel breakouts. If you spot a chart/candle pattern which is contrary to your trade, you may want to close your position. The best place for a stop loss order in an Engulfing trade is beyond the Engulfing pattern extreme. This would mean that if the Engulfing setup is bullish, the Stop Loss order should be placed under the lower candlewick of the engulfing candle. If the Engulfing setup is bearish, then the Stop Loss order should be located above the upper candlewick of the engulfing candle. If the Engulfing scenario is bullish, the price breakout should come through the upper level of the engulfing candle’s body.

You should only trade with funds that you can afford to lose. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next ��) to reach profitable trading ASAP. It means for every $100 you risk on a trade with the Engulfing pattern you make $10.4 on average. In other words, the red candle was engulfed by a large bullish candle, leading to a new upward trend. As you will find out, there are many of this patterns in the market but not all of them are relevant. We will look at what these patterns are and how you can use them in the financial market. In the EUR/USD example above the price has to overcome a strong resistance line.

We have just covered several patterns, including morning and evening star, dark cloud cover, and hanging man among others. If you wait for two or three bars to complete, this will help you to assess which side the strength is on. If the next couple of candles give up more than half of engulfing candle then it’s probably wise to wait. To create a reliable trading rule we need to look for other indications that sentiment is turning bullish.

Using an engulfing candle day-trading strategy for stocks, currencies, or futures is one way to get into trending moves just as momentum is picking up. Engulfing patterns are most useful following a clean upward price move as the pattern clearly shows the shift in momentum to the downside.

Limitations Of Using Engulfing Patterns

The price range of the forex pair is starting to narrow, indicating choppy trading, and there is very little upward price movement prior to the patterns forming. A reversal pattern has little use if there is little to reverse. Within ranges and choppy markets engulfing patterns will occur frequently but are not usually good trading signals. The bullish engulfing pattern is a two-candle reversal pattern. The second candle completely ‘engulfs’ thereal bodyof the first one, without regard to the length of the tail shadows.

Now the tweezer tops and bottoms derive their name from the pliers that we use to pick up small unreachable objects. When you think about it, the candlesticks do look like tweezers.

How Does The Engulfing Pattern Look In Real Life?

The trade should be closed as soon as the price action breaks this resistance and closes a candle above. As you see, this creates a higher top on the chart, which implies that the bearish run might be interrupted. The black horizontal line on the image is the very strong psychological resistance of the Swissy at the parity rate of 1.0000 Swiss Franc for 1 Dollar. After a strong price increase, the USD/CHF meets this resistance level and tests it two more times afterwards. The third time the price tests the resistance, it creates a relatively big bearish candle, which engulfs the previous bullish candle. If the price action approaches a resistance area and at the same time a bearish Engulfing pattern appears around that zone, this creates a very strong bearish potential on the chart. If the price action approaches a support level and at the same time a bullish Engulfing pattern appears on the chart, this creates a very strong bullish potential.

A bearish engulfing pattern consists of two candlesticks that form near resistance levels where the 2nd bearish candle engulfs the smaller 1st bullish candle. Typically, when the 2nd smaller candle engulfs the first, price fails and causes a bearish reversal.

Investors recognize this pattern and use this opportunity to capitalize on the imminent change in the trend direction. The price action then pushes higher to record two swing highs, and ends up in ultimately trading at higher levels. However, as other candlestick patterns, engulfing formations have their own limitations. While they are quite powerful when they occur at the end of a strong trend, they are almost non-tradeable when they appear in choppy trading. When you couple that with moving average lines, RSI and MACD, you have tools to help you trade. These indicators are not a crystal ball to help you see into the future.

- Regardless of your favorite channel tool, there are 4 ways to trade.

- The lower shadow must be at least two or more times the size of the body.

- First we started withThe Fundamentals of Reading Candlestick Patterns.Next we moved on toHow to Read Single Candlestick Patterns to Identify Potential Market Moves.

- The second candle in the engulfing pattern completely engulfs the previous one – it is the opposite to the inside bar and, therefore, sometimes referred to as outside bar.

- In other words, a bullish engulfing pattern tells us that the buyers have overwhelmed the sellers in the market, thus engulfing the entire previous day’s open and closing prices.

Grid trading is a powerful trading methodology but it’s full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples. I’ve grown to appreciate the Parabolic SAR for detecting trend-changes, personally, but I’ve been experimenting to see how it can be improved with other indicators, like moving averages. In the tables I’ve only shown the difference between the up/down probabilities on the two sides. The difference between these probabilities can be big but that doesn’t necessarily mean that there’s a big asymmetric difference in upward and downward correction sizes. In fact it could be that the average difference is quite small.

In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. If you’d like a primer on how to trade commodities in general, please see our introduction to commodity trading. The most popular blog posts are about gold, food prices, and pay gaps. If you don’t have time to read the entire article, you can always bookmark it for later. Find out more about precious metals from our expert guides on price, use cases, as well as how and where you can trade them. Precious metals have many use cases and are popular with commodity traders.

The first candle is a green-colored bullish candle which is a part of an uptrend. After few such green candles, one may observe that a bearish red candle larger in size than its immediately previous red candle is formed. This first green candle can even be any doji candle which has zero or very little body length. Dual candlestick patterns are generally considered the best price action analysis tool. A bullish harami candle is like a backwards version of the bearish engulfing candlestick pattern where the large body engulfing candle actually precedes the smaller harami candle. The Bullish Engulfing pattern reveals when the buyers have stepped in.

Instead, traders will need to use other methods, such as indicators or trend analysis, for selecting a price target or determining when to get out of a profitable trade. Astute traders consider the overall picture when utilizing bearish engulfing patterns.

For a perfect engulfing candlestick, no part of the first candle can exceed the shadow of the second candle. This entails that the low and high of the second candle entirely covers the first. Based on this experiment, the bullish engulfing pattern seems to be a slightly stronger signal than the bearish. If there’s one downside to trading engulfing candles it would be not being able to trade them on the daily chart. If you have placed a trade based on a bearish engulfing candle, when the market makes a lower swing low you move the stop to your entry point of your trade.

Engulfing candlesticks are just one part of a technical analysis strategy. They are usually used alongside volume indicators – such as the RSI – that can show the strength of a trend.

Due to the gradual nature of the buying slow down, the longs assume the pullback is merely a pause before the up trend resumes. The harami is a subtle clue that often keeps sellers complacent until the trend slowly reverses. It is not as intimidating or dramatic as the bullish engulfing candle. The subtleness of the bullish harami candlestick is what makes it very dangerous for short-sellers as the reversal happens gradually and then accelerates quickly. A buy long trigger forms when the next candle rises through the high of the prior engulfing candle and stops can be placed under the lows of the harami candle. It is one of the most widely followed candlestick pattern. It is used to determine capitulation bottoms followed by a price bounce that traders use to enter long positions.

Right in front of us are illustrations of the bullish and bearish candle engulfing patterns. With the bullish pattern, you can see the white bullish engulfing candle eclipsing the small black bearish candle.

Most of the time, you do not need a bullish engulfing indicator since you can just eyeball it. However, if you are using MT4, there are a few user-made indicators you can download. Some platforms have that built-in and there is third-party software you can download. For a bearish engulfing candle in a downtrend , the stop-loss is placed just above the high of the engulfing candle. While its appearance signifies a sharp short-term change in direction, many of these patterns aren’t of concern.