Table of Contents

- 4 Over 70 Technical Indicators

- Bitcoin Is Now too Important To Ignore, Deutsche Bank Says

- Candlesticks

- Cryptojacking

- Best Crypto Charting Platform

Notice it is possible for the low price to be the same as the Open Price, Close Price, or even the High Price. Candlesticks are a powerful tool to gauge price action and determine the balance between buyers and sellers. An example of an imperfect tri-star top for BTC-USD is shown below. Notice that three Dojis formed consecutively before a large drop in the price. As a result, in a market environment where participants are uncertain, the market can continue to fall under its own weight.

We can see there was a long run of continuously green candlesticks. This occurrence represents an increasing price for the asset. After each green candlestick, the price of the asset was higher than when it began the candlestick. In fact, the candlesticks themselves do not include the trading volume, so we will only need to concern ourselves with the Open, High, Low, and Close elements for the candlestick. The Volume aspect of OHLCV charts is typically displayed underneath the candlesticks. In the screenshot at the top of this article, you can see the Volume on Coinbase Pro is displayed as faint spikes at the bottom of the chart section.

To speak of a pattern, you need to analyse the relationship of at least two candles but usually the relationship of more candles than two yields a clearer analysis. Here, if you zoom in slightly, you can take a closer look at the blue and red shapes that make up the price movement of the Bitcoin to Euro (BTC/EUR) trading pair. In a general sense, these shapes are the present-day form of the Japanese trading candles. The price chart shows candles over a time period of two days, from the 16th to the 18th of March. Careful study of candlesticks reveals a number of details on price action or the movement of a trading pair over a given time period, such as hours, days, weeks, months and so on. Here are 5 simple candlestick patterns that indicate a bullish price movement that every crypto trader should know. There are simple bullish Japanese candlestick patterns that every Bitcoin and cryptocurrency trader should know — here are 5 of them.

4 Over 70 Technical Indicators

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Our platform integrates two tools that automatically generate signals that highlight patterns on your diagram as soon as they occur. The majority of other information websites display prices of a single source, most of the time from one retail broker-dealer.

What time is Cryptocurrency most active?

A market’s peak trading hours is typically 8 a.m. to 4 p.m. in its local time. These are the trading hours that usually drive the highest trade volume in each region. Although a market can be “closed,” there might be huge movements in the global market depending on news and speculations.

Where the main body of the candle begins is the opening price for the day. If the candle is green, the opening price will be the bottom of the candle body.

Bitcoin Is Now too Important To Ignore, Deutsche Bank Says

If you need a bit more help understanding charts and determining how to make the best trade, a broker may be worthwhile. Check out this list of top regulated brokers that are trustworthy and regulated to help you maximize your profits in every trade. They are very popular among traders, and a large number watches the same levels. As a result, the resistance and support levels become stronger, even self-fulfilling, due to collective market sentiment. This indicator is best used for mid to long-term trades, as it needs a fair bit of price history to be relevant.

These can occur when there is a pump or flash sale in the Bitcoin market. An overbought asset will usually depreciate in the near future. An undervalued asset will go up in price as its intrinsic value is realized. This rule states that a market in motion will remain in motion until a trend reversal occurs.

Developing the right skills on how to read crypto charts is an art. This new skill will help you not only track the price of your favorite coin, but the crypto candlestick charts will actually tell you a lot about the trend of the market as well. A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. Each “candlestick” typically shows one day, thus a one-month chart may show the 20 trading days as 20 candlesticks. Candlestick charts can also be built using intervals shorter or longer than one day.

Candlesticks

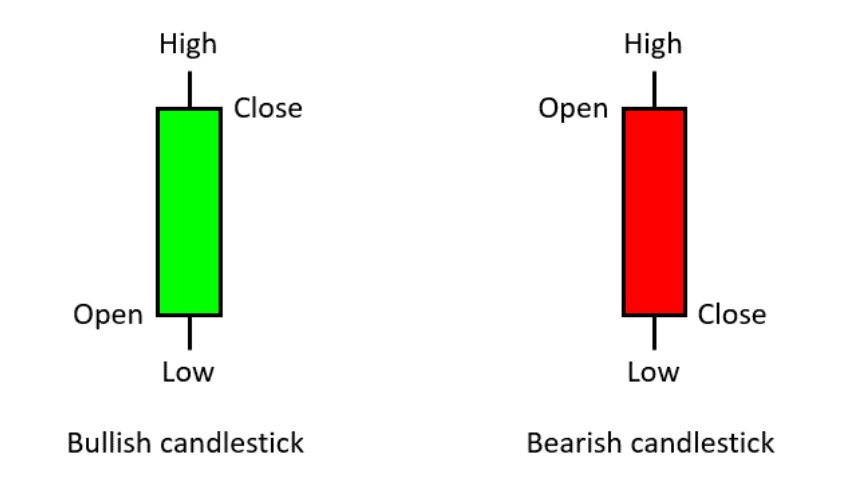

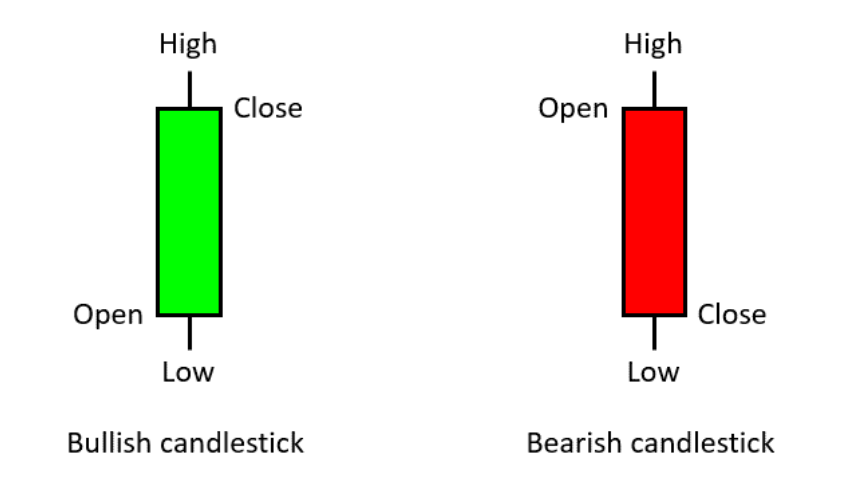

As shown in the graphic below, the top wick of a candlestick indicates the highest price reached during the time period . The “candle” part of the chart shows the opening and closing prices for the time period. Two of the most reliable candlestick patterns are the Morning Star and Evening Star indicators. They rely on three days’ worth of pricing to identify a trend that may signal a reversal. Engulfing patterns are also fairly reliable since they compare two-day trends.

Trends can help you determine the right time to buy or sell for profit, although not very accurately. Why should anyone learn how to read cryptocurrency charts? When hovering over the trendline, a tooltip will indicate the price, market cap, and 24h volume. On the upper left side users can choose a chart based on given time periods. For specific timeframes, you can also set a custom date . Candlestick charts provide more information than regular line charts.

Cryptojacking

By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. The difference between them is in the information conveyed by the box in between the max and min values. Figure L showcases the pattern highlighting the 5-wave impulse and the ABC corrective wave.

Put your newly-discovered knowledge about charts into practice by opening an an account with Bitwala. A head and shoulders pattern can signify either a continuation or a reversal in price action, depending on the type of head and shoulders to be observed.

In the illustration to the right, we demonstrate an example of a candlestick that has the Open Price and Low Price as the same. This suggests the first trade in the candlestick period was the lowest price of any trade in the period.

Best Crypto Charting Platform

Ayondo offer trading across a huge range of markets and assets. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. This is a language I can talk — not how revolutionary blockchain is.

How do you read a wick?

How do I measure the wick percentage? 1. The total size of the candle is the candle high minus the candle low.

2. The wick percentage of the top wick is top wick size divided by total candle.

3. The wick percentage of the bottom wick is bottom wick size divided by total candle.

Yes – the candlestick is different from the bar chart, but they share some similarities because they both display the same amount of price data. However, most traders agree that candlestick charts are easier to read. Unlike the previous two patterns, bullish engulfing is made up of two candlesticks.

Most often, this volume is displayed in terms of the base currency. That means for a trading pair like BTC/USDT, the volume would be in terms of BTC. The relation of the Close Price to the Open Price also determines the color of a candlestick. When the closing price is higher than the opening price, the candlestick is colored green. If the closing price is lower than the opening price, the candlestick is colored red. Before we can read a candlestick chart in full, we must first understand the components of a single candlestick.

Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. That means greater potential profit and all without you having to do any heavy lifting. Run through the process of verifying your account with the email link provided and begin to familiarize yourself with the platform.

How To View Candlestick Charts

Community App Predict, learn and earn Bitcoin with zero risk Find out. For example, many traders tend to focus on the price at which they bought an asset, and if it declines, they want to sell when it reaches break-even. The best part is, it is decentralized, with no server or central authority.

If you choose to view an hourly candlestick bitcoin chart for a particular day, the candlesticks will express the price action per hour. Thus, the perpendicular length of each candle will correlate to the hour in question, shown on the horizontal axis of the chart. Below, we explain the information derived through a candlestick. A bar comes in two classic color styles , green/red or black. Just like with candlesticks, a green bar means the closing price was higher than the opening price , and a red bar means the opposite. With a classic black bar, you must determine whether it is bullish or bearish based on the position of the left and right arms. The left arm shows the opening price, and the right arm shows the closing price.