Table of Contents

- Bull And Bear Market: The Key Differences

- Bullish Vs Bearish: Whats The Difference?

- Things You Must Know About Bull Markets

- Stock Market Update: Better Not Look Down

Post-WWII. The years during and following WWII were exemplary of a bull market as the U.S. economy prosperedwhen millions of soldiers returned home. Not only that, but the average total return from a bull market period is 472%. More people are confident that the market will continue to go up, so most major indices will also rise. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current recommendations or opinions. CMG is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A diversified investment portfolio is designed to meet pre-defined investment goals.

Who is the big bull of stock market?

Ace investor Rakesh Jhunjhunwala, fondly known as Big Bull, opines that the commodity cycle has turned.

The ensuing bear market cut fast and deep, but bottomed out in late March. About a month after its nadir, the market returned to bull-market territory and just kept chugging along. This new bull market could mint thousands of new millionaires and these stocks could hand you bigger profits than FANG stocks, cryptos or pot stocks. For example, instead of saying “I am long on that stock,” a trader may say, “I am bullish on that stock.” Both statements indicate this person believes prices will rise.

Bull And Bear Market: The Key Differences

Get an email alert each time I write an article for Real Money. A narrow rectangle that forms above support is a strong bear signal. Sellers are preventing a rally and support will most likely fail. Short-term whale clusters can provide some context as to where BTC price may go in the near future, typically within a span of a week or two. While Bitcoin is battling a crucial support area, BTC/USD is perfectly in line with the popular Stock-to-Flow price model, which puts the year-end target at $100,000.

The start of a bull market is marked by widespread pessimism. The feeling of despondency changes to hope, “optimism”, and eventually euphoria, as the bull runs its course. This often leads the economic cycle, for example in a full recession, or earlier. Bull Trends is powered by our highly popular cloud analytics product, ETLRx, and uses our proprietary financial machine learning algorithms to present ticker trends in real time.

Bullish Vs Bearish: Whats The Difference?

You gotta check out our brand-new Breaking News Chat feature. Two highly skilled stock market pros help members find the news that can move stocks fast. Investor confidence increased and in 1962, the stock market rallied.

- The market looks forward; it always has and it always will.

- As the late, great Kenny Rogers told us, you’ve got to know when to hold them and know when to fold them.

- And there is nothing wrong in waiting for better picture to appear.

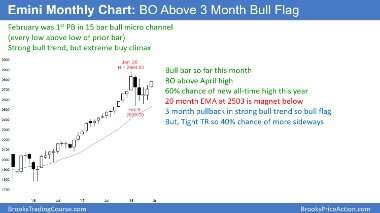

- While this trend line is much too steep to last indefinitely, it does give you an idea of what is normal on the upside.

- Five different technical indicators are all giving strong bearish signals on daily timeframes, but because the higher timeframes remain bullish, any downside is likely only a breather for Bitcoin.

- To this end, I wrote a paper entitled,The Merciless Math of Loss.

As you see, both bullish and bearish trends look the same. Then, if a stock begins to increase, you need to hold the trade as long as the price is on the upper side of the trend.

Things You Must Know About Bull Markets

A bear market is also a good indicator of a recession — a long-term period of negative growth. When a bull market occurs, it’s typically here for a long time. Morningstar conducted a studythat took a look at market trends from 1926 to 2017 and discovered that the average bull market lasted NINE years. Let’s take a look at bull vs bear markets, examples of each, and the impact they have on your financial strategy, to set the record straight. The technology sector drove the bull market from and remains one of the longest and strongest ones in U.S. history. It was a time when triple-digit profits from start-up Internet stocks were the norm. Investors actually shied away from steady double-digit index performers (S&P 500, Dow Jones Industrials) to participate in the unprecedented run-up in technology stocks.

Each of the below arrows depicting the direction of the trend change, and also acts as a trendline that when broken marks where momentum began to shift. Previously when the cryptocurrency fell to the middle-line, there was a bounce to another high.

And, of course, stocks have only gone up over the long term. Since the financial climate is hopeful, investors are more hungry to buy shares during a bull market and hold onto them, confident they will continue to rise. Both bear and bull markets will have a large influence on your investments, so it’s a good idea to take some time to determine what the market is doing when making an investment decision. Remember that over the long term, the stock market has always posted a positive return.

Stock Market Update: Better Not Look Down

But, in my opinion at least, investing for net worth places you at the mercy of long term secular trends . Investing for income over net worth, especially when doing so intelligently and creatively (i.e. Buy and Hold and Cheat), on the other hand, works well in all secular markets.

For our purposes – and with the benefit of hindsight – we’ll date the current bull run to the market bottom of March 23. The S&P 500 is up a remarkable 52% since then, to which the consumer discretionary sector says, “hold my beer.” Later, tech stocks tend to lead mid cycle, and commodity-linked sectors, including energy and materials, often outperform at the end stages of the economic cycle. Volatility is back, and while most investors are fearful and more importantly, losing money, options sellers are confident and making money.

Stock Market Update: The Key To The Highway

However, some analysts suggest a bull market cannot happen within a bear market. A bull market occurs when the market is expected to continue higher over an extended period of time. Bull markets are primarily described when discussing stocks, but it can be related to bonds, commodities, futures, or forex markets. Bull markets occur when the demand for a security or group of securities outweighs the normal laws of supply and demand. A secular bull market is pretty self-explanatory – a long period of time in which the trend is fairly consistently higher stock prices. Sure, there may be pullbacks and corrections, but the dominant trend is that of increasing share prices.

At the beginning stages of a secular bull market, investors are mistrustful of the market and simply unwilling to pay much for each dollar of corporate earnings. to make is between secular bull markets and secular bear markets. The terms bear market and stock market correction are often used interchangeably, but they refer to two different magnitudes of negative performance. A correction occurs when stocks fall by 10% or more from recent highs — and a correction can be upgraded to a bear market once the 20% threshold is met. The tides are turning, and the recent bull trend is beginning to wane. Technicals show extreme exhaustion was reached days ago, and now the momentum is fading as prices begin to fall. Five different technical indicators are all giving strong bearish signals on daily timeframes, but because the higher timeframes remain bullish, any downside is likely only a breather for Bitcoin.

Gauging Market Changes

The negative share balance must be brought back to zero at some point by buying back the 100 shares. Most people think of trading as buying at a lower price and selling at a higher price, but that’s only part of what traders do. Traders can also sell at a high price and buy back at a lower price. Being short, or shorting, is when you sell first in the hopes of being able to buy the asset back at a lower price later. As an example, assume Suzy goes long 100 shares of ZYZY stock at $10.00, costing her $1,000. Several hours later, she sells the stock for $10.40 per share, collecting $1,040 and making a $40 profit.

Normally used in reference to the stock market, bullish trends can also occur in real estate, commodities or forex trading. Furthermore, markets also tend to follow the adage “a rising tide lifts all boats,” and bull markets can spread across multiple sectors of the economy. That’s against an average loss of 36% during a bear market.

Are We In A Bull Market Or A Bear Market?

A rising inflation, higher interest rates and recession can all contribute to the death of a bull market. Other market participants will say that you can’t truly confirm a bull market until you exceed the previous all-time highs. By that measure, the bull market started on March 23, 2020, but wasn’t confirmed until Aug. 18, 2020, when the S&P 500 eclipsed its previous high set on Feb. 19, 2020. Note that by that measure, a bull market comes to an end when the S&P 500 falls 20% from its peak. Rather, market trackers at S&P Dow Jones Indices define a bull market as a 20% rise in the S&P 500 from its previous low. By that measure – a 20% gain off the low – the current bull market began on April 8, 2020. After all, when most stocks are gaining day after day, it’s easy to look smart.

Who is India’s big bull?

Rakesh Jhunjhunwala (born 5 July 1960) is a business magnate. He manages his own portfolio as a partner in his asset management firm, Rare Enterprises.

Rakesh JhunjhunwalaBorn5 July 1960 Hyderabad, Andhra Pradesh (now in Telangana), IndiaEducationChartered Accountant6 more rows

The S&P 500 grew significantly between 2016 and 2020, spurred on by President Trump’s combination of monetary and fiscal policies that promoted market growth. In 2008, the housing market crashed and ruined the finances of millions of families. The government spent $1 trillion to push interest rates down and help the economy gain footing. Real Money’s message boards are strictly for the open exchange of investment ideas among registered users.

The price of assets such as stocks is set by supply and demand. By definition, the market balances buyers and sellers, so it is impossible to have “more buyers than sellers” or vice versa, although that is a common expression. In a surge in demand, the buyers will increase the price they are willing to pay, while the sellers will increase the price they wish to receive. The peak for the U.S. stock market before the financial crisis of 2007–2008 was on October 9, 2007. The S&P 500 Index closed at 1,565 and the NASDAQ at 2861.50. The market has simply reached the highest point that it will, for some time .