Table of Contents

- Bearish Harami Candlestick

- Anatomy Of A Candlestick Chart

- Dragonfly Doji

- Candlestick Chart In Excel

- The Engulfing Candlestick Pattern

- Need For Candlestick Patterns

- How Do I Read A Candlestick Chart?

Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. Three inside up and three inside down are three-candle reversal patterns.

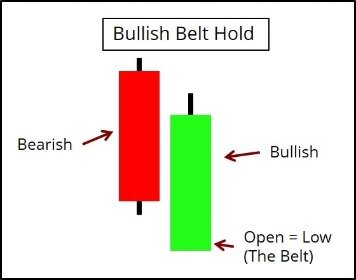

The next day, the GBPJPY price penetrated above the high of this Engulfing Bullish Candlestick, which confirmed that there would be additional bullishness in the market over the next few days. At this point, some beginner traders may recognize the bullish setup and immediately enter a buy order. Once again, remember that regardless of the complexity, the location of all these simple and complex Candlestick patterns is one the most vital aspects of reading forex charts while using Candlesticks. On the other hand, a Doji Candlestick represents a neutral or tentative market condition. While there many different patterns, we will discuss some of the most popular Candlestick patterns that can help in reading a price chart like a professional trader. Before you can read a Candlestick chart, you must understand the basic structure of a single candle. Each Candlestick accounts for a specified time period; it could be 1 minute, 60 minute, Daily, Weekly exc.

Bearish Harami Candlestick

Candlestick patterns are a form of technical analysis and charting used in the stock market, forex market and all other markets. You may have of some common candlestick chart patterns or candlestick terms like bullish engulfing pattern, doji pattern, dark cloud cover pattern, hammer pattern and shooting star pattern. This section discusses only a few of the scores of candlestick chart patterns. There are many important candlestick patterns and trading tactics not discussed in this basic introduction.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

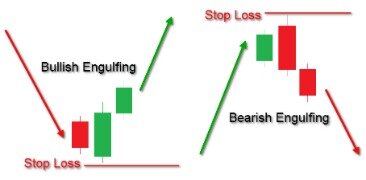

Anatomy Of A Candlestick Chart

Price action that happens outside the opening and closing prices of the time period are represented by the wicks or shadows above the body of each candle. Upper wicks represent price action that occured above the open and the closing prices and the lower wicks represent price action that occurred below the opening and closing prices. Unlike simple line charts, candlestick charts carry much more information and are a very useful tool for traders. However they of course have many limitations in isolation and are often used in combination with technical indicators such as RSI or Moving Average. Likewise, three black crows are 3 large black bodies at the top of an uptrend, with each candlestick lower than the preceding one and indicates the beginning of a downtrend. The opening and close of an engulfing candlestick is both higher and lower than the opening and the close of the day before.

Which technical analysis is best?

The Moving-Average Convergence/Divergence line or MACD is probably the most widely used technical indicator. Along with trends, it also signals the momentum of a stock. The MACD line compares the short-term and long-term momentum of a stock in order to estimate its future direction.

Let’s take a look at some charts with examples of some of the various candlestick patterns converted into my price action setups. The hammer is a bullish signal that occurs during a downtrend. The lower shadow should be at least twice the length of the real-body. When a hammer occurs during an uptrend it is known as a “hanging man” and is a bearish signal. Because of the bullish long lower shadow however, this pattern needs bearish confirmation by a close under the hanging man’s real body.

Dragonfly Doji

Business address, 200 West Jackson Blvd., Suite 1450, Chicago, IL 60606. IG is a registered RFED and IB with the Commodities Futures Trading Commission and member of the National Futures Association . Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

- In addition, because candlestick charts use the same data as bar charts , all Western technical signals used on a bar chart can easily be applied to a candlestick chart.

- The black body opens above the upper shadow of the white body and closes within the range of the white body, signifying a reversal to a downtrend.

- Inverted hammer The close price is lower than the open price, and the close price equals the low price.

- Like the previous soldier pattern, this forceful pattern doesn’t always present a good trading opportunity.

- Three black crows is a bearish candlestick pattern that is used to predict the reversal of a current uptrend.

- Stay on top of upcoming market-moving events with our customisable economic calendar.

- At that point, they would look for a reversal signal of the prevailing trend.

While originally plotted by hand, computer technology enabled them to be created quicker and more efficiently. Stock market traders utilize a wide arsenal of tools to enhance their performance. One of the most essential tools are candlestick stock charts.

Candlestick Chart In Excel

The same difference between price and value is valid today with currencies, as it was with rice in Japan centuries ago. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. While the real body is often considered the most important segment of the candlestick, there is also substantial information from the length and position of the shadows. For instance, a tall upper shadow shows the market rejected higher prices while a long lower shadow typifies a market that has tested and rejected lower prices.

Black The open price is lower than the close price, and both are lower that the high price and upper than the low price. Hammer The open price is lower than the close price, and the close price equals the high price. Inverted hammer The close price is lower than the open price, and the close price equals the low price. Spinning top white This pattern indicates the indecision between the buyers and sellers. If a spinning top forms during an uptrend, this usually means there aren’t many buyers left, if a spinning top forms during a downtrend, this means there aren’t many sellers left.

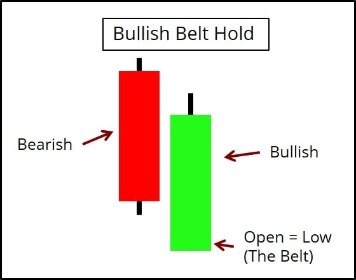

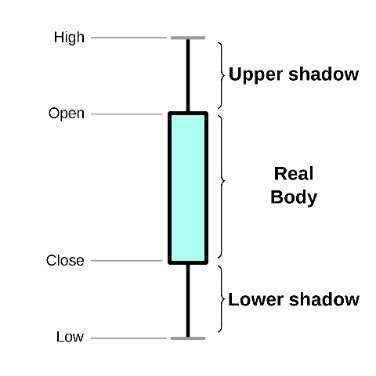

The Engulfing Candlestick Pattern

In practice, any color can be assigned to rising or falling price candles. Generally, the longer the body of the candle, the more intense the trading. The area between the open and the close is called the real body, price excursions above and below the real body are shadows .

Securities trading is offered to self-directed customers by Robinhood Financial. Robinhood Financial is a member of the Financial Industry Regulatory Authority . The 3-minute newsletter with fresh takes on the financial news you need to start your day. Marubozu are even stronger bull or bear signals than long lines as they show that buyers/sellers have remained in control from the open to the close — there are no intra-day retracements. A long black line shows that sellers are in control – definitely bearish.

candle is updated to accept data input as a matrix, timetable, or table. If a filled marubozu occurs at the end of an uptrend, a reversal is likely. If a hollow marubozu occurs at the end of a downtrend, a reversal is likely. Read, watch, and learn about our products, team, and the latest trends. Information is provided ‘as is’ and solely for education, not for trading purposes or professional advice. You should not simply see this pattern and rush to go purchase.

However, the truth hits when the next candle closes under the hanging man as selling accelerates. You can practice reading candlestick charts by opening a demo trading accountor playing around with candlesticks on free web-based charting platforms. Set the chart type to candlestick and select a one-minute time frame so you’ll have lots of candles to look at. For example, if the trader set the time frame to five minutes, a new candlestick will be created every five minutes. For an intraday chart like this one, the open and close prices are those for the beginning and end of the five-minute period, not the trading session. A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. Each “candlestick” typically shows one day, thus a one-month chart may show the 20 trading days as 20 candlesticks.

If a hammer shape candlestick emerges after a rally, it is a potential top reversal signal. The shape of the candle suggests a hanging man with dangling legs. It is easily identified by the presence of a small real body with a significant large shadow. All the criteria of the hammer are valid here, except the direction of the preceding trend.

As the bearish harami candlestick closes, the next candle closes lower which starts to concern the longs. When the low of the preceding engulfing candle broken, it triggers a panic sell-off as longs run for the exits to curtail further losses. The conventional short-sell triggers form when the low of the engulfing candle is breached and stops can be placed above the high of the harami candlestick. The distance between the top of the upper shadow and the bottom of the lower shadow is the range the price moved through during the time frame of the candlestick. You can see the direction the price moved during the time frame of the candle by the color and positioning of the candlestick. The close is the last price traded during the candlestick, indicated by either the top or bottom of the body. This centuries-old charting style was developed in the rice markets of Japan.

For traders with a tighter timeframe, such as trading the fast-paced forex markets, timing is paramount in these decisions. Forex candlestick patterns would then be used to form the trade idea and signify the trade entry and exit. Technical analysis using candlestick charts then becomes a key part of the technical trader’strading plan.

How Do I Read A Candlestick Chart?

A candle shows the opening, closing, high, and low price for a certain time period. When a candle goes up in a time period, it is colored green and if it goes down, it is colored red. If the asset price closes higher than it opens (referred to as “Bullish”), the wax part of the candlestick will not be filled in. Alternatively, if the asset price closes at a lower price than it opens , the wax will be a solid color.

Regardless of the time period, a Candlestick represents four distinct values on a chart. Hello sir, I am beginning to hate all those technical indicators because price action strategy makes trading easiest (not “easier” this time around).

As you may already know, Candlestick charts were invented and developed in the 18th century. The bullish engulfing pattern consists of large white real body that engulfs a small black real body in a downtrend. The bearish engulfing pattern occurs when the bears overwhelm the bulls and is reflected by a long black real body engulfing a small white real body in an uptrend. This candle has a very long upper or lower shadow and a small real body. If the opening and closing price are the same the candle has no real body and is then called a Long-Legged Doji.

Price action drives the price up, but it meets selling pressure. It has to be at the top of an upward trend to be considered a shooting star. It rises progressively with brief periods of pullback and consolidation.

Many algorithms are based on the same price information shown in candlestick charts. Candlesticks show that emotion by visually representing the size of price moves with different colors. Traders use the candlesticks to make trading decisions based on regularly occurring patterns that help forecast the short-term direction of the price.

With bulls having established some control, the price could head higher. Over the years, Japanese traders had developed various Candlestick patterns based on historical price movements. Every trader should invest their time and learn these patterns as it will provide a deeper knowledge and understanding of reading forex charts in general. Candlestick patterns can help you interpret the price action of a market and make forecasts about the immediate directional movements of the asset price.