Table of Contents

- Related Terms

- Learn The 40 Most Common Stock Market Terms For Beginners

- Stock Trader

- What Are The Most Used Stock Market Terms?

- Examples Of Stock Markets

But this exposes the trader to the risk of the market moving against them while those trades are being executed. Once you’re up to speed with 40 of the most common stock market terms, reading about the stock market will no longer have you scratching your head. By learning stock market terms, you’ll have the basic building blocks to help you climb the ladder of success step by step, tackling new trading concepts and techniques along the way. A price quote is a stock’s price at a certain point in time. Traders will often want up-to-date price quotes to better analyze stocks and find decent trading set-ups. A stock exchange is an entity where stocks are bought and sold. The most well-known stock exchanges are the New York Stock Exchange and the Nasdaq.

This creates an extreme buy/sell imbalance and can lead stocks to making % moves intraday. Traders who are “short” on a stock are short selling shares and creating a negative share balance. As soon as they sell the shares they turn a profit from the sale, BUT, they must buy back the shares. The shares have been borrowed from the broker to sell in advance, with the intention of buying the shares back in a short period of time.

Related Terms

This is where an investor or trader buys more shares of a stock as the price drops, lowering the average price paid for the position. A trader goes short by borrowing shares from a broker, selling them, and hoping to buy them back and return them to the broker after the price has dropped. For example, a trader could place a limit buy order to purchase 100 shares of a stock at $10.20.

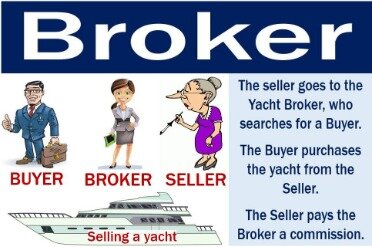

They also make sure that the best price is always maintained, that all marketable trades are executed, and that order is maintained on the floor. Many market makers are often brokerage houses that provide trading services for investors in an effort to keep financial markets liquid. Institutional buy-side traders have much less latitude for market trading. Buyside traders are responsible for transactions on behalf of management investment companies and other registered fund investments.

Learn The 40 Most Common Stock Market Terms For Beginners

In the US, the stock market is regulated by the SEC and local regulatory bodies. The stock market works as a platform through which savings and investments of individuals are channelized into the productive investment proposals. In the long term, it helps in capital formation & economic growth for the country. While individual stock exchanges compete against each other to get maximum transaction volume, they are facing threat on two fronts. Other methods include the Stochastic Oscillator and Stochastic Momentum Index. “IBM Investor relations – FAQ | On what stock exchanges is IBM listed ?”.

Buy and hold traders may continue to hold a stock throughout a recession and ride out the storm, believing the stock will appreciate on the other side of the economic downturn. A day trader is commonly used to describe someone who enters and exits multiple positions in a single day.

Stock Trader

As a result, the markets are regarded as an important economic indicator, in addition to providing an opportunity for traders and investors to generate a return on their capital. The stock market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly. This allows businesses to be publicly traded, and raise additional financial capital for expansion by selling shares of ownership of the company in a public market. The liquidity that an exchange affords the investors enables their holders to quickly and easily sell securities. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. Investment is usually made with an investment strategy in mind.

I can already see what mistakes I’ve made and now I’m going back and fixing them. Trading on margin can be dangerous because, if you’re wrong about the direction in which the stock will go, you can lose significant cash. You must often maintain a minimum balance in a margin account. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

What Are The Most Used Stock Market Terms?

Many different academic researchers have stated that companies with low P/E ratios and smaller-sized companies have a tendency to outperform the market. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically.

- However, the whole notion of EMH is that these non-rational reactions to information cancel out, leaving the prices of stocks rationally determined.

- There are two main types of markets for products, in which the forces of supply and demand operate quite differently, with some overlapping and borderline cases.

- View our latest in market leading training courses, both public and in-house.

- These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

- If a trader places a market order to buy 500 shares, the first 100 will execute at $20.

- Courtyard of the Amsterdam Stock Exchange by Emanuel de Witte, 1653.

Understanding how one asset moves based on price will open your eyes to a whole new world. You cannot unsee it after that and you will be able to read any assets chart.

Those points can indicate prices where large institutional investors see a good value or have the desire to sell, which can be useful information for other investors deciding when to make their own trades. A company may raise money from investors by offering shares, even after the company’s shares are traded on a stock exchange. It’s when a company goes through the process of selling shares on the stock market for the first time. Pre-market trading is trading in the stock market, which occurs before the opening of the regular market session (usually 1 to 1.5 hours before the market opens). Such trading activities are watched by many of the investors and traders to judge the strength and the direction of the market so that regular trading session could be anticipated. Day traders buy and sell shares of stocks within the same day.

Similarly, stock markets make it feasible for business owners to ultimately cash out their positions for profit, by selling their shares into the open market. The economic benefits of stock exchanges and stock trading are untold, and without the facility in place for trading equity in this way, companies would find expansion much more challenging. The stock market is a collection of markets across the globe where traders and investors buy and sell shares of companies. In the present case, expectations of the investors are missed, so the price of the stock will probably decrease. The secondary purpose the stock market serves is to give investors – those who purchase stocks – the opportunity to share in the profits of publicly-traded companies.

Return on Equity is a measure of a company’s profitability that takes a company’s annual return divided by the value of its total shareholders’ equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity. Shares offered in IPOs are most commonly purchased by large institutional investors such as pension funds or mutual fund companies. The NYSE eventually merged with Euronext, which was formed in 2000 through the merger of the Brussels, Amsterdam, and Paris exchanges.

This is the price the trades are executing at with your broker. Traders who are issued a margin call are in debt to their broker. The broker will require you to repay the debt and can force you to sell other assets to come up with the money. Price average is the average price of the stock that you paid. Meaning if the stock was first bought at 10.00, then rises to 11 and you double your position, you will have a cost average of 10.50. To enter or to exit a position a trader may “scale.” This technique, when used to scale in, means buying a partial position at 5.50, and adding with a 2nd position at 6.00. Due to scaling in with equal sizes, the trader has a cost average of 5.75.

Examples Of Stock Markets

Orders entered during premarket trading may be executed when regular trading hours begins. Also, orders entered during the regular trading day may be executed during after-hours or premarket trading. In 1991, the NYSE responded to around-the-clock global trading by allowing trading after regular market hours. Markets in the most literal and immediate sense are places in which things are bought and sold. In the modern industrial system, however, the market is not a place; it has expanded to include the whole geographical area in which sellers compete with each other for customers. Market, a means by which the exchange of goods and services takes place as a result of buyers and sellers being in contact with one another, either directly or through mediating agents or institutions. A futures contract is an agreement to deliver or receive a certain quantity of a commodity at an agreed price at some stated time in the future.

What is the importance of trading?

Trade increases competition and lowers world prices, which provides benefits to consumers by raising the purchasing power of their own income, and leads a rise in consumer surplus. Trade also breaks down domestic monopolies, which face competition from more efficient foreign firms.

In many cases, these investments are traded on a daily basis. Examples of highly organized capital markets are the New York Stock Exchange, American Stock Exchange, London Stock Exchange, and NASDAQ. Securities can also be traded “over the counter,” rather than on an organized exchange. These securities are usually issued by entities whose business fundamentals do not meet the minimum standards of a formal exchange, which forces investors to use other avenues to trade the securities. Stock markets were initially developed as a mechanism for capital investment to fund commercial operations and expansion. Stock markets determine the price of underlying assets, by matching the prices willing to be paid by both buyers and sellers to identify the market price of an asset at any particular time.

CFD trading enables you to sell an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price move. If your prediction turns out to be correct, you can buy the instrument back at a lower price to make a profit. If you are incorrect and the value rises, you will make a loss. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.