Table of Contents

- Bearish Candlestick Patterns: Made Simple

- The Top 5 Bearish Candlestick Patterns

- What Are Floor Traders And What Did They Do?

- How To Trade The Bearish Rectangle: Method 2

- Quiz: Understanding Three Drives Pattern

- The 5 Most Powerful Candlestick Patterns

This is the same JP Morgan chart from the previous example, but this time we have placed a stop loss order below the bullish stick sandwich candlestick pattern. Now, shifting gears back to our stick sandwich candlestick pattern. Since it is a three-candle formation, it is considered more reliable than the two or one candlestick patterns.

The third long black candlestick provides bearish confirmation of the reversal. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations.

A long black candlestick that gaps below the low of the doji. After meeting resistance around 30 in mid-January, Ford formed a bearish engulfing . The pattern was immediately confirmed with a decline and subsequent support break.

Over the past decade, he’s found 18 recommendations that soared 1,000% or more. And he just went public with what he predicts will be his next 1,000% winner. If you’ve ever wondered how legendary investors find stocks that shoot up 10X – and how you can do it too – click here. Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is not an indication to buy or sell that stock or commodity. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our current or past students.

Bearish Candlestick Patterns: Made Simple

The gap above 91 was reversed immediately with a long black candlestick. Even though the stock stabilized in the next few days, it never exceeded the top of the long black candlestick and subsequently fell below 75. A small white or black candlestick that gaps above the close of the previous candlestick.

Let us now calculate the results from five consecutive trades using this money management strategy starting with $10,000 in capital. There is a common saying that equity traders should not risk more than 2 to 3% of their capital in a single trade – which I whole-heartedly believe. After the confirmation of the pattern, the stock begins an impulsive move higher, resulting in a 71 cent increase. After the pattern completes, the price reverses sharply over the next couple of hours. In this case, the stock reached the target but look what happened. As I mentioned, my tests showed price continuing rising past D the vast majority of the time, and this is an example. If the pattern works as it’s supposed to, the stock will peak at 11.73.

The Top 5 Bearish Candlestick Patterns

Once the hanging man pattern was formed during an uptrend, the stock reversed its trend and started moving down. Once the Bearish engulfing pattern was formed after an uptrend, the stock started moving down. The pattern seems like an inverted ‘U’ shape and can indicate an opportunity to go short. After a rally upwards, the price consolidates for an extended period, forming the rounding top. Usually, there would be an increase in volume during the advances and decrease in volume during the sideways price action.

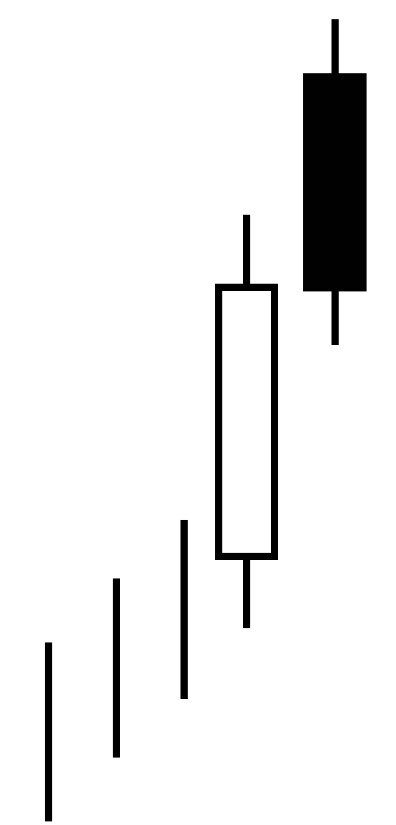

Three Black Crows Consists of three long black candlesticks with consecutively lower closes. When it appears at the top it is considered a top reversal signal.

What Are Floor Traders And What Did They Do?

The day after D, the stock dropped to a low of 65.10 before resuming its upward move. As of 4/10/19, the stock peaked at E, dropped to about 67, and wobbled up to 76.

After a sharp advance from 37 1/2 to 40.5 in about 2 weeks, Citigroup formed a dark cloud cover pattern . This pattern was confirmed with two long black candlesticks and marked an abrupt reversal around 40.5. Use volume-based indicators to assess selling pressure and confirm reversals. On Balance Volume , Chaikin Money Flow and the Accumulation/Distribution Line can be used to spot negative divergences or simply excessive selling pressure. Signs of increased selling pressure can improve the robustness of a bearish reversal pattern. Engulfing patterns are most useful following a clean upward price move as the pattern clearly shows the shift in momentum to the downside.

How To Trade The Bearish Rectangle: Method 2

Now that you have placed your stop, you can then use a simple moving average or price action to keep you in the trade. Price may dip after point D, in fact it’s likely that it does so (86% do), but the drop usually doesn’t amount to much (14% average). Eighteen percent of chart patterns see price decline no more than 5% below D. This article describes my analysis of the bearish bat pattern as described by publicly available information and common sense rules to determine valid patterns. I tested the pattern using only the below identification guidelines.

So the question becomes, which indicator or indicators are best for divergence trading? In the example below, you can see a bearish Island reversal pattern. After a series of bullish days, a reversal candle occurs, usually in the form of a Doji. However, it stands in some distance, much like the island is divided from the mainland. The following bearish candles are also distanced from the reversal one by the same gap. The gap, itself, represents the indecision among the traders and the lack of clear dominant force.

Quiz: Understanding Three Drives Pattern

The size of the upper shadow should be at least twice the length of the body and the high/low range should be relatively large. Large is a relative term and the high/low range should be large relative to the range over the last days. Use oscillators to confirm weakening momentum with bearish reversals. Negative divergences in MACD, PPO, Stochastics, RSI, StochRSI or Williams %R indicate weakening momentum and can increase the robustness of a bearish reversal pattern. In addition, bearish moving average crossovers in the PPO and MACD can provide confirmation, as well as trigger line crossovers for the Slow Stochastic Oscillator.

- Once the price slows down or starts moving in the wrong direction, make sure to head for the exit.

- This means that we have a confirmed bullish divergence on the chart, which provides an opportunity for a long trade on the GBP/USD Forex pair.

- Hanging Man A black or white candlestick that consists of a small body near the high with little or no upper shadow and a long lower tail.

- Now, shifting gears back to our stick sandwich candlestick pattern.

- After an advance, black/white or black/black bearish harami are not as common as white/black or white/white variations.

Subsequently, we see the market falling but since the predominant trend is upwards there is a pull-back. Since the bearish-engulfing pattern denotes a falling market, we put the stop-loss order at the extreme top of the pattern . Bearish engulfing patterns are suited for traders looking for day moves and want to take advantage of full-day swings. The validity of the stop-loss order should last until the end of the day.

However, it is important to trade it only if all of the above mentioned conditions are met. In trading, there are two distinct types of mindsets while trading–the Bears and the Bulls . To put it plainly, Bears think things are going to get worse (i.e. bearish) and therefore enter the market with a sell. After entering a bearish position in the market, you’re what is called “short”. Price movement from this point up or down will change a bear’s account value in increments of the chosen market. Indicators like RSI and MACD tell you when a stock is overbought, oversold or moving into bullish or bearish territory.

The pattern is formed when there is a clear uptrend occurring and a small bullish candlestick is subsequently engulfed by a larger bearish candlestick. In particular, the bearish engulfing pattern is a time-tested and proven signal for capturing when an upward trend is reversing. On the other hand, the pattern is still a technical indicator.

Candlestickcharts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open-high, low-close bars or simple lines that connect the dots of closing prices. Candlesticks build patterns that predict price directiononce completed. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Shooting star is a bearish pattern that is made of two candles.This pattern appears during an uptrend and signals an upcoming reversal to bearish bias. The second candle would be a green or red candle which has a long upper wick and small body . The top of the body of the second candle would be higher than the body of the first candle.

There are several precious metal derivatives like CFDs and futures. Commodity exchanges are formally recognized and regulated markeplaces where contracts are sold to traders. Our broker guides are based on the trading intstruments they offer, like CFDs, options, futures, and stocks. Not only does a single candle tell a story but the real bodies and wicks also form those key support and resistance levels. When you couple that with indicators like moving average lines, RSI and MACD you get pretty good tools. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.