Table of Contents

- What Is Bear Trap Trading And How Does It Work?

- Bear Trap Trading: Making Money On The Way Down

- What Is A Bull Trap?

- What’s The Difference Between Retracement And Reversal?

- How Can I Avoid Falling Into Them Using Stock Market Predictions From An Ai?

The coronavirus pandemic will put an end to the buyback outpour since companies that receive government aid will not be allowed to repurchase their own shares. They claim that the worst is already known and may, at least partially, be behind us. The debate over when to re-open the economy is already taking place, and unprecedented stimulus and aid plans have already been announced. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. 54814.

How and when can investors know if a price upswing is for real and has legs, or is just a mirage? He has over 18 years of day trading experience in both the U.S. and Nikkei markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. When Al is not working on Tradingsim, he can be found spending time with family and friends. This is the 30-minute chart of Google for the period Dec 9 – 17, 2015. This is another example of a bear trap stock chart, which could be easily recognized with simple price action techniques.

What Is Bear Trap Trading And How Does It Work?

Bear traps on stocks are usually set in the same circumstances as those described above. Now that you know what the professionals are looking for to set the bear trap and how they trade them, you could trade and invest right alongside of the smart money. Both bull and bear traps are normal activities that may occur on different time occasions. Those traps happen when there is a fake signal indicating that the original trend was already over.

These sites do not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. All opinions provided are based on sources believed to be reliable and are written in good faith, but no warranty or representation, expressed or implied, is made as to their accuracy. Your guide to understanding and profiting from the major trends, industry news and worldwide events that are driving the market and impacting your investments. It’s also worrying that the recession could trigger a debt crisis. Low-grade corporate debt is a ticking time bomb, a huge risk that gets almost no coverage by the financial media.

Bear Trap Trading: Making Money On The Way Down

There are a few kinds of stop-losses to choose from, including standard, trailing or guaranteed. So again, as I mentioned in the post yesterday, we have to be careful not to make extreme decisions given a specific news item. To think we are going to bounce right back to all-time highs right away ignores the magnitude of the crisis C-19 has caused and the complexity of our economy. The moment the short squeeze starts happening, you need to watch the price movements of the stock very carefully. The idea is to ride the momentum of the price movement for as long as possible. Either way, the gains triggered by the catalyst need to be significant enough so that the short sellers will panic and race to cover their short positions. Depending on the history of the stock and its volatility, this “critical mass” gain can be as small as 1-2%, or can go up to 5-10% for more volatile stocks.

What is a Bitcoin bull trap?

What Is a Bull Trap? Bull traps are false market signals that can take place on an asset, such as a cryptocurrency, that exhibits a strong long-term downward trend. This usually leads bullish traders to expect further price increases and go long on the asset.

Investments in commodities or commodity-linked securities may not be suitable for all investors. When prices have fallen to the institutions’ desired level, they then buy back large amounts of the stock — pushing prices back up and making a profit. They can occur over several days or within a matter of hours, and begin when the demand for stocks outweighs the number of holders willing to sell. The buyers then increase their bids — attracting more sellers and pushing the market upwards. Together, they will arrange to sell a large amount of that coin at the same time.

What Is A Bull Trap?

You need increasing volume during the change of a trend in order for it to be valid, and feel confident. As a result, taking the put side is taking a bearish position. There are many brokers who aren’t great shorting brokers, because they don’t have the shares available to short. However, the majority of brokers allow options trading, which essentially let you do the same thing, but in a safer way. Though you can still get caught in the bear trap while trading options. Short selling is risky because technically you could lose your shirt.

- If there is a lot of short interest, it means people are generally bearish about this stock, so the fundamentals might be bad or hedge funds are heavily building short positions.

- Abusive, insensitive or threatening comments will not be tolerated and will be deleted.

- Since then, though, the economy and pandemic, despite being horrific, have not suffered the worst-case scenarios that some investors envisioned, and investors who bought in March have been rewarded.

- This initial rally then encourages other investors who think the worst is over and become fearful of missing out—creating a cycle of yet more buying.

- We expect the price to break the falling wedge upwards, switching to bullish direction.

However, the current environment is signaling what we can expect from the market going forward. The changes happen so fast, sometimes it’s hard to keep track of everything. Real Money’s message boards are strictly for the open exchange of investment ideas among registered users. Any discussions or subjects off that topic or that do not promote this goal will be removed at the discretion of the site’s moderators.

What’s The Difference Between Retracement And Reversal?

The buying gained intensity all day and by the close, a big chunk of Monday’s losses had been recouped. Before using this site please read our complete Terms of Service, including the trademark notice, and our Privacy Policy. This modern era began on January 22, 1993 when State Street Global Advisors launched its first exchange traded fund. On this date, equity managers began to embraced a new paradigm, one that required no advice, and hence no blame, simply to oversee the acquisition of new shares. Schwab does not recommend the use of technical analysis as a sole means of investment research. This video is made available for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone.

To learn more about the pitfalls of forex markets and how to trade using new techniques please visit our latest course. Therefore, we recommend that you focus on limit orders, which are conditional. For example, assume that a stock is trading between the narrow range of $10 and $12. In this case, you can place a market order when it rises to $12.50.

Enough “safe” investments that if stocks drop 50% to 80% over the next 18 months, I won’t panic at the loss of my retirement and sell. Enough “growth” investments that if the market continues to rise, I’ll offset the inexorable bleed of inflation and earn an acceptable rate of return. By the spring of 1930, the market had recovered much of the ground it had lost on “Black Monday” and other dark days the prior fall, and some investors thought stocks were off to the races again. Then the crash resumed, and the economy headed into the Great Depression. Two years later, in 1932, the major index closed down more than 80% from the top. provides weekly insights, highlighting the impact of the political world onto the global financial markets, making specific investment calls. The report will give you a complete view of the global markets, where to spot opportunities, and how to avoid risk.

A bull trap denotes a reversal that forces market participants on the wrong side of price action to exit positions with unexpected losses. A bear trap is a false technical indication of a reversal from a down- to an up-market that can lure unsuspecting investors. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor. When we talk about avoiding losses in stock markets during the Coronavirus pandemic, there is no better way to minimize the risks than conducting your decision in a solid analysis. At DTTW, since we have direct market access, our traders are always able to see this volume in real time.

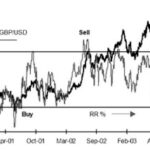

Then the bullish trend resumes and this pair climbs above 1.33 eventually. Many traders are taught to trade breakouts usually placing a sell pending order trade, which gets triggered immediately once the price moves below a support level or a moving average. But, the breakout turns to be a fake-out and the price moves above the support level again after a bullish reversal.

“the Biggest Bear Trap In History”

So, follow the Crowd Strategy is good, but you need to be carefull. In this article, we will dig deeper into the concept of bull and bear traps.

These include Double Tops and Bottoms, Bullish and Bearish Signal formations, Bullish and Bearish Symmetrical Triangles, Triple Tops and Bottoms, etc. 672.7515.290.070.46419,942Please sign up for viewing the full list of stocks. Over 90 of the world’s largest asset managers and hedge funds use The Bear Traps Report as their political policy risk assessment advisor. Trading Ideas – Our highest conviction short and long term trades. Bear Traps reveals the dangers of future political moves and guides investors along the pathway to safety.

But, the price pulls back up and the candlestick closes above the support. After trying the support for the third time, eventually EUR/GBP turns bullish. Institutions buy stocks at wholesale prices, usually after they drop.

The idea is that when the time comes to buy back those stocks, the price of the stocks would have fallen, so it would be cheaper for them to buy it back. Normally, investors buy stocks when they expect prices to go up, so that as the stock prices increase, they can then sell the stocks they own at a higher price, and make a profit.

The best way to avoid a bear trap is to have a firm exit criterion in place and set a tight stop loss. Effective risk management and timing your entries and exits correctly can make a good difference in the outcome of the short trades.