Table of Contents

- Further Breakdown Of The Chart

- Heavily Shorted Stocks By Float Shorted: Beyond Meat, Carvana

- What Is The Fibonacci Sequence Used For?

- Understanding Fibonacci Numbers And Their Value As A Research Tool

- Cloning Fibonacci Speed

- Using Fibonacci Fans

I find Fibonacci tone a great tool to use simply because so many traders and institutions are using it. In other words, we don’t observe peaks or troughs around certain correction levels which would be true if Fibonacci reversals were indeed significantly distinct events. Figure 4 shows the histogram of all correction sizes for G10 currency pairs with USD. I took those waves that have a length greater than approximately 1% of the value of the currency. Exact thresholds for minimum wave sizes in pips for all currency pairs are shown in Table 1 . In my results I discuss only corrections that are greater than 15 %, which is lower than the 1-st Fibonacci retracement level of 23.6 %.

However, I do suggest you read the book “Elliott Wave Principle” by Frost and Prechter, published by John Wiley & Sons. Indeed, much of the basis of the Elliott Wave Principle is based upon Fibonacci numbers and the Golden Ratio. Fibonacci Arcs are half circles that extend out from a trend line drawn between two extreme points. Fibonacci Fan Lines are displayed by drawing a trend line between two extreme points. For example, if a stock jumps from $10 to $11, the pullback is likely to be approximately 23 cents, 38 cents, 50 cents, 62 cents, or 76 cents . As the sequence progresses, each number is approximately 61.8% of the next number, approximately 38.2% of the following number, and approximately 23.6% of the number after that.

Further Breakdown Of The Chart

Once in a trade, Fibonacci extension levels and fan-generated resistance levels can be used as exit points for trades when trends show signs of slowing and reversing. However, as retracements can be breached several times before settling and reversing, it can be difficult to find entry points. This is why as a trading strategy, other indicators, such as candle patterns and other technical analysis can help establish entry points to trades.

Did Leonardo Da Vinci use the golden ratio?

The golden ratio, also known as the divine proportion, is a special number (equal to about 1.618) that appears many times in geometry, art, an architecture. As a result the ratio can be found in many famous buildings and artworks, such as those by Leonardo da Vinci.

And while phi does not get a pastry-filled holiday like pi, the constant appears in natural phenomena. The numbers of spirals in pinecones are Fibonacci numbers, as is the number of petals in each layer of certain flowers. Mathematician Eduoard Lucas then gave the name “Fibonacci sequence” in the 1870s to the sequence derived from the rabbit scenario. , an Italian mathematician named Fibonacci identified a sequence of numbers whose patterns frequently appear in nature. Today, the Fibonacci sequence is taught to most middle-schoolers, but its more complex applications take place in the world of finance.

Heavily Shorted Stocks By Float Shorted: Beyond Meat, Carvana

Price bounced from 0.50 level which is medium pulback bounce level. After the bounce, price reached -0.27 first extension level. The Golden Ratio is a special ratio found in the form and structure of many living and inanimate beings in nature. It is possible to see the golden ratio together with the Fibonacci number sequence. You can open trades when the price bounces off an extension level or when it breaks it. The Fibonacci Extensions tool is present in the default version of MetaTrader 4 and many other trading platforms including Ninjatrader, Tradestation, and Multi Charts. A quick way to remember the Fibonacci Extension levels is by taking the major Fibonacci levels (23.6%, 38.2%, 50.0%, and 61.8%) and adding 100 to them.

I think people should understand the beauty of the Golden Ratio and Fib Ratio. 0.382, 0.500 and 0.618 ratios are used frequently in technical analysis. These ratios are used in the rise and correction movements. You will need a trend or two swing points to draw the Fib Projections. You take the trend’s low and high by stretching the regular Fibonacci Retracement indicator.

What Is The Fibonacci Sequence Used For?

They are based off the same percentages that have been used throughout, 76.4% 61.8%, 38.2%, and 23.6%, and as with the retracements and extensions, are simple to use. Fibonacci retracement lines can be created when you divide the vertical distance between the high and low points by the key Fibonacci ratios. Horizontal lines are drawn on the trading chart at the 23.6%, 38.2% and 61.8% retracement levels. This is not really a Fibonacci ratio, but it can be useful.

Three trendlines are then drawn from the first extreme point so they pass through the invisible vertical line at the Fibonacci levels of 38.2%, 50.0%, and 61.8%. I heard argument why Fibonacci levels work well in futures markets because algorithms are trading these levels.

In addition, I found no strong philosophy on why these levels should be so important in global financial markets. One of the best traders anywhere, over the past 20 years Jeff’s made multi-millions trading stocks, ETFs, and options. He is renowned as an incredible trader with a deep insight and a sensitive pulse on the markets and the economy. Few traders use solely Fibonacci levels as a primary indicator for placing a trade.

Understanding Fibonacci Numbers And Their Value As A Research Tool

Click the Fibonacci Speed/Resistance Arcs icon on the Drawing toolbar. For this play, you can see how I grabbed it right off the 76.4% support, almost to the penny. What you’re going to do is calculate percentages between the main nodes. While you can do this manually, most platforms have a built in tool. In it, he introduced the concept of the Fibonacci sequence.

Furthermore, a Fibonacci retracement strategy can only point to possible corrections, reversals, and countertrend bounces. This system struggles to confirm any other indicators and doesn’t provide easily identifiable strong or weak signals. The 23.6% ratio is found by dividing one number in the series by the number that is three places to the right. The 38.2% ratio is discovered by dividing a number in the series by the number located two spots to the right. For instance, 55 divided by 144 equals approximately 0.38194.

However, applying the tool at the secondary high as the starting point on the same chart – as in Chart B – reveals a pattern that honors Fibonacci levels more accurately. As we will see later in the section covering Fibonacci extensions, it is remarkable to note the price action as the S&P 500 marches to new highs on the chart. The next major cluster of resistance occurs right at the 1.618 extension . The retracements are based on the mathematical principle of the golden ratio. The sequence for the golden ratio is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on, where each number is roughly 1.618 times greater than the preceding number. The time variable is also an important subject of investigation.

Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. This indicator is commonly used to aid in placing profit targets. While the retracement levels indicate where the price might find support or resistance, there are no assurances the price will actually stop there. This is why other confirmation signals are often used, such as the price starting to bounce off the level.

A trader sees the retracement occurring between the level or close to the level. Further, he/she may proceed to “line up” the indicator with these levels and conclude that the effect is indeed real when it isn’t. We’ve also found in other studies that even purely randomized price data can create the impression of these kinds of reversal lines.

Applying these percentages to the difference between the high and low price for the period selected creates a set of price objectives. To compensate for this, draw retracement levels on all significant price waves, noting where there is a cluster of Fibonacci levels. If your day trading strategy provides a short-sellsignal in that price region, the Fibonacci level helps confirm the signal. The Fibonacci levels also point out price areas where you should be on high alert for trading opportunities.

How does Fibonacci work in nature?

Flowers and branches: Some plants express the Fibonacci sequence in their growth points, the places where tree branches form or split. One trunk grows until it produces a branch, resulting in two growth points. The main trunk then produces another branch, resulting in three growth points.

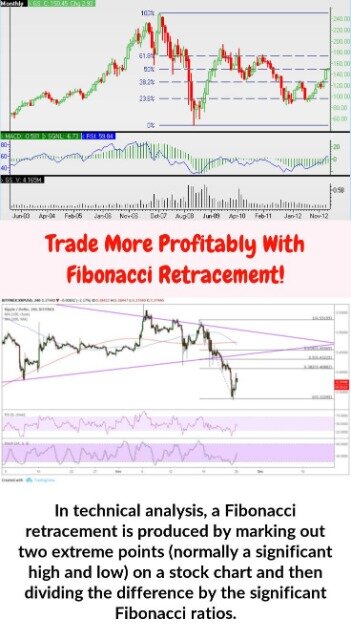

We can create Fibonacci retracements by taking a peak and trough on a chart and dividing the vertical distance by the above key Fibonacci ratios. Once these trading patterns are identified, horizontal lines can be drawn and then used to identify possible support and resistance levels.

After the price had reached this level, it started to hesitate and lose steam to the upside. And so it is important to understand that there is no such thing as knowing exactly how far a price move will go. You can always set a minimum target at the next Fibonacci extension. However, you will see that price will very often move farther than this, so you have to evaluate the market condition at each level and act accordingly. When you stretch the indicator, the levels will be plotted automatically on the price chart. The currency pair fell from the 1.5200 area to 1.4100 before stabilising. As the market stabilised, Fibonacci retracements could be applied to this fall.

We have a nice short opportunity off the bounce, which is the suggested entry point. Then, the price starts a consistent bearish trend, which we have marked with the magenta trend line on the chart. Suddenly, the price action created a Shooting Star candle pattern and bounced off the 161.8% Fibonacci level. Notice that at the end of the swing marked in blue, there is a Doji candle that foretold the possible price stall and reversal on the chart. The price reversed, and the GBP/USD started increasing until the 161.8% Fibonacci extension was reached.

Cloning Fibonacci Speed

Fibonacci Retracements are used by retail and professional traders in every market. Technical analysts may look at a whole suite of numbers corresponding to ratios of numbers in the Fibonacci sequence, but a couple of important ones are 61.8 percent and 38.2 percent. Any given Fibonacci number divided by its successor approximates 1/phi, or 0.618. A Fibonacci number divided by the number two places higher in the sequence approximates 0.382.

So far, we have spoken about Fibonacci as a way of establishing support levels that show where a retracement may change direction. However, Fibonacci levels also apply to future moves after a retracement has completed. For instance, in an uptrend, the price stalls and retraces, then turns back upwards, going beyond previous highs. The question you are asking at that point is how far the stock will continue to rise to. The idea of a Fibonacci retracement is to apply those Fibonacci percentages to as price move to set probably support levels as the price retraces. They key to retracements is establishing the move that generates them.

In an uptrend, you might go long on a retracement down to a key support level. In a downtrend, you could look to go short when a security retraces up to its key resistance level. The tool works best when a security is trending up or down. With traders looking at the same support and resistance levels, there’s a good chance that there will be a number of orders around those levels. Two Fibonacci technical percentage retracement levels that are important in market analysis are 38.2% and 61.8%. Most market technicians will track a “retracement” of a price uptrend from its beginning to its most recent peak. Other important retracement percentages include 75%, 50% (50% is also a Fibonacci number), and 66%.

I have found this to be true and will show you how markets give us internal price clues that tell us when we should make adjustments like this and when we should not.” -Brown, Constance. I think this argument misinterprets the value of the study. Markets rarely move in a straight line, and often experience temporary dips – known as pullbacks or retracements. Fibonacci retracements are used by traders to identify the degree to which a market will move against its current trend. I trade for a very long time in cryptocurrency and commodity market. Most of the indicators and trading bots use Fibonacci Ratios.