Table of Contents

- The Psychology Of Support And Resistance Zones

- How Is The Fibonacci Number Sequence Used In Forex?

- Experience Level

- Advantages Of The Fibonacci Forex Trading Strategy With Reversal Candlesticks

This Fibonacci number sequence begins with 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, and so on until infinity. He did this by publishing a book in 1202 entitled Liber Abaci, in which he explained a certain number sequence, called the Fibonacci sequence. Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. In addition our range of platforms for Apple and Android mobile devices will seamlessly allow you to access and trade on your account from your smartphone or tablet with full account functionality.

The most popular Fibonacci retracements levels are 61.8% and 38.2%. These are used by drawing horizontal lines across a chart at those price levels to define zones of market retracement, before resuming the general trend formed by the initial large price movement. Those can be very exponential when a market has reached a major price support or resistance level.

Of course, it is more reliable to look for a confluence of signals (i.e. more reasons to take action on a position). Don’t fall into the trap of assuming that just because the price reached a Fibonacci level the market will automatically reverse. In the figure below, we see a retracement off a medium-term move higher in the euro/Japanese yen currency pair. Beginning on January 10, 2011, the EUR/NZD exchange rate rose to a high of 113.94 over almost two weeks.

For example, you can just take profit on half of your long position at 161.8% and then the rest at a higher target, such as 261.8% if it is reached. After the first few numbers in the sequence, the ratio between one number and the succeeding numbers will be 0.618. Also, if we measure the ratio between alternate numbers we will get 0.382.

Perfect for traders of all skill levels who what to begin trading in Forex. What I usually do is wait for retracements between 40% and 70%, estimated.

The Psychology Of Support And Resistance Zones

Fibonacci retracement working perfectly on GBP/USD daily chartNow compare it to the next chart, where the 61.8% retracement was broken. The price then proceeded to bounce but then go almost all the way to 100% retracement — and then surpass the previous highest high. We may say placing support at the 61.8% retracement level was a failure but the “theory” worked in the end — the price did proceed to nearly 100% after the 61.8% retracement was broken.

What is the 35th term of the Fibonacci sequence?

List of Fibonacci NumbersFnNumberF322178309F333524578F345702887F35922746596 more rows

As we saw previously, the market does not move in a straight line but in a zigzag pattern, creating consecutive peaks and troughs. Then from these tops and bottoms we can derive our support and resistance levels. Starting at the low currency pair price level, click and hold the mouse to draw a line up to the highest price level you selected.

How Is The Fibonacci Number Sequence Used In Forex?

Leonardo Fibonacci created a number sequence that is well known today; 1, 2, 3, 5, 8, 13 etc. Fibonacci went on to discover that every number after 3 that is divided to the consecutive number results in 0.618. It also came about that the ratio of every alternative number is 0.383 etc. Generally speaking, the Fibonacci number sequence became so well known because the ratios are all the same and it is referred to as the ‘Golden Mean’.

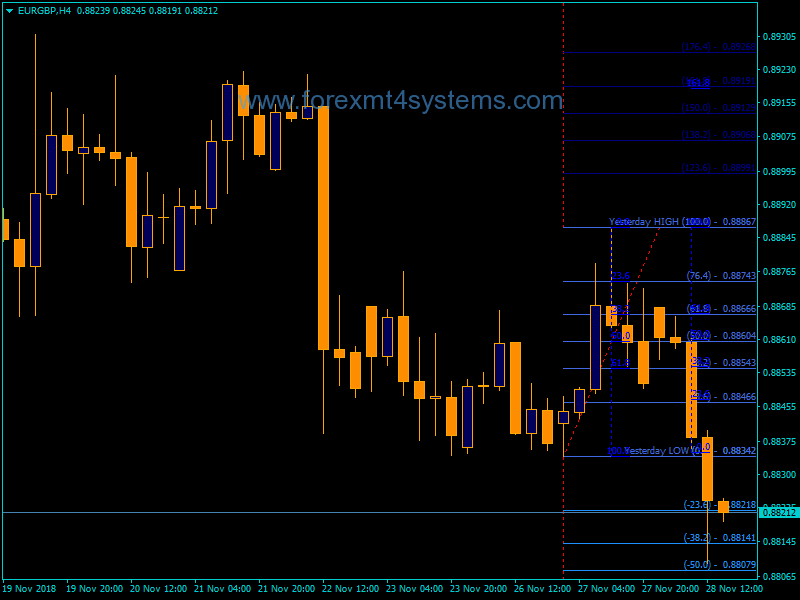

These numbers are not directly from the sequence, they are derived from mathematical relationships between numbers in the sequence. The selling pressure was eased and the pair started to recover. However the recovery remained largely contained between the 38.2% and 50% retracement levels. The below example of GBP/USD shows the significance of Fibonacci Forex retracement levels in a downtrend. Once you get the confirmation your ideal entry would be somewhere between 38.2% and 50% retracement levels. However, that’s only true if we assume a price reversal at all. Thus, both tools can be used to either identify supports or resistances, making sure we find good entry and exit points.

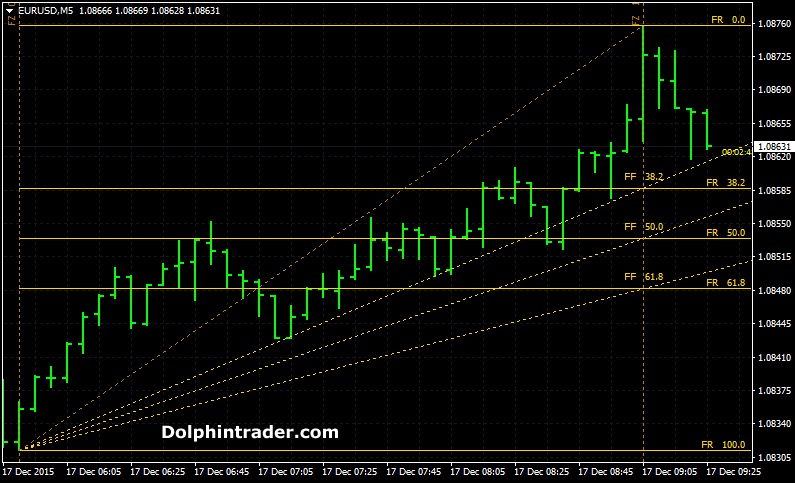

Experience Level

0.0% is the reference of the low of a move while the end of the move is identified as 100.0%. By using such levels in Forex, traders are able to project price contractions and extensions inside the market. After that, comes a part of the course dedicated to beginners in Fibonacci trading. Then follows a part of the course where we will be doing some more advanced things, such as Fibonacci clusters, combining Fibonacci with other tools and additional Fibonacci tools. After that comes the part where I will give you some useful tips which will make your Forex Trading with Fibonacci easier. Likewise, for a downward trend, you can place your sell entry after the price finds resistance at 38.2% and 50% retracement levels. Once again the confirmation would be when the price finally starts to move below the 50% level towards its original direction.

You will note that this levels are shown above the price , giving an indication of the profit taking areas. From the example used, working on expansion 100, a healthy profit would have been generated. Good advice would be to practice your strategies and hone your skills in this area. You can do this by finding a Forex chart and plotting your way to a profit, something you should quickly be able to do in real time. There is no one tool or method that will work 100 percent of the time. The theories about market movement, using technical analysis, are based on pure mathematical analysis.

Fibonacci retracement is a common form of technical analysis in the trading world, using ancient mathematical scripts as a template for evaluating price movements and identifying possible levels of support and resistance. Use the fibonacci tool and click and drage at the start where the trend has started to where the trend has started to reverse back up and that would give you the fib retracement levels to watch out for. Use the fibonacci tool and click and drage at the start where the trend has started to where the trend has started to reverse back down and that would give you the fib retracement levels to watch out for.

The Fibonacci retracements are used to point out and confirm support and resistance levels, set stop-loss orders, or target prices, and use them as a primary tool in a counter-trend trading plan. Every trader, especially beginners, dreams of mastering the Fibonacci theory. A lot of traders use it to identify potential support and resistance levels on a price chart which suggests reversal is likely. Many enter the market just because the price has reached one of the Fibonacci ratios on the chart. It is better to look for more signals before entering the market, such as reversal Japanese Candlestick formations or Oscillators crossing the base line or even a Moving Average confirming your decision. For this reason, applying Fibonacci retracements over a short timeframe is ineffective. The shorter the timeframe, the less reliable the retracement levels.

Advantages Of The Fibonacci Forex Trading Strategy With Reversal Candlesticks

Last but not least, traders can also incorporate fib retracement levels as a means for managing their positions, and unwinding positions as the prices near these important points within the trade. There are a myriad of technical studies that one can utilize in attempting to find the strongest fib retracement levels. One of the more common price analysis tools used by market traders is Fibonacci retracements. In this lesson, we will look into the origins of the Fibonacci ratios, the most practical uses of retracements, and the process of building a trading strategy around it. The average retail forex trader should be familiar with Fibonacci retracement levels, and may even use it regularly within their trading program.

Let’s start with plotting Fibonacci retracements in an uptrending market. Now that you have a basic understanding of Fibonacci retracement levels, let’s now dive in a bit deeper to study the origins of the Fibonacci sequence of numbers. The Fibonacci numbers are a set of numbers starting with zero and one wherein the sum of the next number in the series is the result of adding the two prior numbers. Whatever combination of techniques are utilized, the primary goal in using Fibonacci retracements is to anticipate a potential termination point for a correction. The Fibonacci retracement tool is equally valuable for both shorter-term, and longer-term traders.

As mentioned below, a pullback is also possible to traders at 50%. The ratios used to determine retracement levels, also known as support and resistance levels, are 0.236, 0.382, 0.500, 0.618 and 0.764. In an uptrend or downtrend, traders wait for the currency pair price to touch a retracement level before entering a trade. Keep in mind that retracement levels often occur at 0.382, 0.500 and 0.618.

However if price achieves a deeper retracement, say to the 61.8% or 78.6% Fibonacci level of AB, then one should expect point D to complete around the 127.2% extension of BC. Of course this would not be a valid Favourite Fibo entry, since the retracement was greater than 50%. If the entry is based on a higher time frame like the 4 hour chart, the trader may wish to hold fire and zoom into a 5 or 10 minute chart and wait until price closes above point B on the lower time frame before buying . Entry via a market or limit order allows the trader some time to determine whether or not the breakout above point B is genuine or false.

Fibonacci levels can help you spot areas of interest that may play a key role in future price action. However, using time, traders can “time” the moment they go long for the 5th wave. The result will give an educated guess about the 4th wave time. On the MT4 trading platform, select the Fibonacci time zones tool from the dedicated Fibonacci tab.

What you need to know is that there are different ratios we can calculate from the Fibonacci number sequence and they care called the golden ratio. And the reason these ratios are important for us in technical analysis is that they give us the important Fibonacci retracement levels and extension levels. Use your online Forex trading account to plot Fibonacci levels on your chart.

In this article, we will dive into a somewhat lesser known Fibonacci tool that you can also use to find hidden levels of support and resistance. We will introduce you to the Fibonacci extension tool and discuss some technique on how to incorporate it in your own trading. The relationship between the numbers in this sequence (i.e. the ratio) is not just interesting on a theoretical level.