Table of Contents

- Forex (fx) Futures

- Forex Definitions: The Industrys Most Important Terms Explained

- The Ins And Outs Of Forex Scalping

- Spot Foreign Exchange Swaps And Rollover Rates

- Learn To Trade

When trading currencies, they are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY. These represent the U.S. dollar versus the Canadian dollar , the Euro versus the USD and the USD versus the Japanese Yen .

She writes regularly for the Financial Times, Forbes and a range of financial industry publications. Her writing has featured in The Economist, the New York Times and the Wall Street Journal. She is a frequent commentator on TV, radio and online news media including the BBC and RT TV.

Forex (fx) Futures

Practically speaking, what you do is speculate on the exchange rate. The “bid” is the price at which we sell and the “ask” is the price at which we buy a base currency when trading. A spread is the difference between the bid and the ask price and is used to measure the liquidity of the market. The smaller the spread, the more liquid the market is. You may have heard the term “buy a bounce”. Traders that buy bounces focus on buying securities after the price has fallen and reached a support level.

- It can refer to the daily opening of an exchange, and an order or position that has not yet been filled or closed.

- Good ’til cancelled order An order to buy or sell at a specified price that remains open until filled or until the client cancels.

- It can come in many forms, including interest on margins or the loans used to make the trade, or the cost of storage and insurance associated with holding a commodity.

- SHGA.X Symbol for the Shanghai A index.

- Since the market failed to record a new high, a resistance may have been formed and a possible reversal may be in place.

- Bid – The exchange rate that the market maker is willing to purchase the base currency in a currency pair at.

Step by step programming instructions on how to carry out trading orders in electronic financial markets. Discipline and emotion- free trades are the advantages of this type of trading. Foreign Exchange Volatility – The level of fluctuation of a currency pair, or a measure of how dramatic/unpredictable its price movement can be. This is generally an indicator of how risky a currency pair can be to trade. Ask – The price at which the market maker/broker is willing to sell the currency pair.

Forex Definitions: The Industrys Most Important Terms Explained

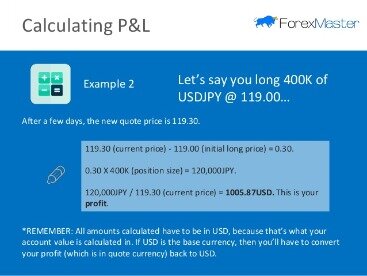

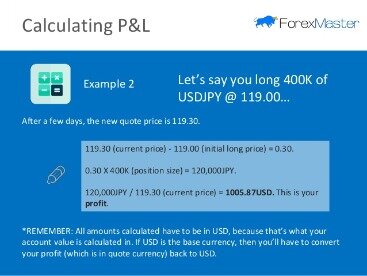

Going long simply means to buy, while going short means to sell. In equity markets, most traders are long in anticipation of rising prices. Forex refers to the marketplace where various currencies and currency derivatives are traded, as well as to the currencies and currency derivatives traded there. Forex is a portmanteau of “foreign exchange.” The forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. It has no centralized location, rather the forex market is an electronic network of banks, brokers, institutions, and individual traders .

The biggest geographic trading center is the United Kingdom, primarily London. In April 2019, trading in the United Kingdom accounted for 43.1% of the total, making it by far the most important center for foreign exchange trading in the world. Owing to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day.

The Ins And Outs Of Forex Scalping

Foreign Exchange, also known as Forex or FX, is an over-the-counter market. Forex trading is how individuals, banks, and businesses convert one currency into another. It is considered the largest liquid market in the world. The word ‘forex’ is itself an example, being a contraction of ‘foreign exchange’. Currency speculation is considered a highly suspect activity in many countries.[where? For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona.

The highest point represents the high price and the lowest point on the vertical line represents the low price. A tick to the left represents the opening price whereas a tick to the right represents the closing price.

Spot Foreign Exchange Swaps And Rollover Rates

The business day calculation excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. During the Christmas and Easter season, some spot trades can take as long as six days to settle. Funds are exchanged on the settlement date, not the transaction date.

Discover a wealth of financial terms and definitions that every trader should know. The Forex Glossary currently contains a vast number of terms relating to online currency trading, financial and investment and is regularly updated. This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade.

A major currency that is lightly traded due to major market interest being in another currency pair. The identification and acceptance or offsetting of the risks threatening the profitability or existence of an organisation. With respect to foreign exchange involves among others consideration of market, sovereign, country, transfer, delivery, credit, and counterparty risk.

Large hedge funds and other well capitalized “position traders” are the main professional speculators. According to some economists, individual traders could act as “noise traders” and have a more destabilizing role than larger and better informed actors. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Other economists, such as Joseph Stiglitz, consider this argument to be based more on politics and a free market philosophy than on economics. Internal, regional, and international political conditions and events can have a profound effect on currency markets. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Main foreign exchange market turnover, 1988–2007, measured in billions of USD.

The bullish move is running out of steam as shown by the presence of the Doji, which signals uncertainty as it is contained by the previous long body. The weakness of the bullish market to push prices higher and the presence of the pattern at the end of an upward move, signals possible bearish implications. A small candlestick body of either color follows a candlestick of a long black body. The color of the small candlestick is not important. The bearish decline is running out of steam as shown by the presence of the small candle which signals uncertainty, as it is contained by the previous long body. The weakness of the market to push prices lower and the presence of the pattern at the end of a decline, signals possible bullish implications.

What is the best forex strategy?

One of the latest Forex trading strategies to be used is the 50-pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. The GBPUSD and EURUSD currency pairs are some of the best currencies to trade using this particular strategy.

A market order is an instruction from a trader to a broker to execute a trade immediately at the best available price. When used in trading, long refers to a position that makes profit if an asset’s market price increases. Usually used in context as ‘taking a long position’, or ‘going long’.

Fx Glossary: The Ultimate Dictionary Of Forex Terms You Should Know

The broker would then quote the next best available price, seeking the trader’s confirmation to fill the order. A continuation price pattern, when prices are trading in a confined area between two parallel flat lines. It is also known as range or consolidation. Even though it is expected to break out in the direction of the prevailing trend, it is not unusual to break out in the opposite direction. If volume information is available, it may hint in the break out direction well before it happens, as price movement tends to be higher or heavier in the direction of the breakout.

An example of a currency pair is the EUR/USD pair. When we buy the EUR/USD pair, we’re actually buying the euro and selling the US dollar.

Although not seen as frequently, reversal patterns sometimes take the shape of saucers . The saucer bottom shows a very slow and very gradual turn from down to sideways to up. It is difficult to tell exactly when the saucer has been completed or to measure how far prices will travel in the opposite direction.

A graph that illustrates the intraday movements of a financial instrument. A technical analysis tool that draws vertical lines at equal intervals on the price chart to forecast future cycles. Digital currency in which encryption is used to regulate the generation of units of currency. It operates independently of the traditional banking system. Bitcoin, Ethereum and Litecoin are the most popular cryptocurrencies. The interest rate as a percentage of the face value paid on a fixed income security -for example, bonds. The currency of the People’s Republic of China.