Table of Contents

- Abcd Chart Pattern

- Xabcd Tradingview

- Wanting The Market To See Your Pattern

- The Roadmap To Successful Trading + Best Curated Resources

- The Abcd Pattern

At the completion of the pattern , place a sell order and look to profit from a price reversal. At point B, the price changes direction and backtracks to form the B-C leg – ideally a 61.8% or 78.6% retracement of the price increase between points A and B. The target of the pattern is usually in the price range between A and B and is generally the 38.2-61.8% retracement of the BC movement that can extend to 161.8%. Structure of a Shark pattern tries to take advantage of an over-extended price movement. To validate the pattern, it is necessary that after it is formed , the price must be turned quickly, initiating a new trend in the opposite direction. This harmonic pattern closely resembles the traditional M and W-shaped patterns. It is made up of 5 points (X-A-B-C-D), with point D being the entry area.

To use the method, a trader will benefit from a chart platform that allows them to plot multiple Fibonacci retracements to measure each wave. although others have contributed or found patterns and levels that enhance performance. Please make sure you set the proper input for zigzag, otherwise you may not be able to detect the desired patterns. XABCD 5-point chart patterns are very common and popular in technical analysis, some of them have already been named, such as Gartley, Butterfly, Bat, Crab, Shark and Cypher. The automatic way, and the manual way of finding and drawing XABCD patterns both have their unique purposes. If you can use them both at once, that is going to be the best way.

Abcd Chart Pattern

If the price does break out lower, those who went long will have their stops triggered, traders will short the breakout to the downside, and I can expect lower prices to come. Imagine price consolidates before breaking out lower repeatedly. During the consolidation, it tells me that there are traders taking profits and traders who are long with stops below the low of the consolidation. In order to trade profitably, I must be confident of my trading strategy that can extract an “edge” in the markets. The trading strategy has to make sense to me before I even dare to use it.

Is IML a pyramid scheme?

iMarketsLive (IML) is a modern day pyramid scheme that gets your attention through FOMO. Once you have reached out to an IML person and signed up, they do a bait and switch to recruiting. IML’s trading platform is a means to an end, which is ultimately recruiting.

This is so because the general move is XC, which is bigger than the partial BC. Bearish Bat is tilted W pattern as depicted in above image. SL is just above the high (PRZ – Potential Resistance Zone). Bullish Bat is tilted M pattern as depicted in above image. SL is just below the low (PSZ – Potential Support Zone). Bearish Gartley is tilted W pattern as depicted in above image.

Xabcd Tradingview

i am using it as well i m providing signals to more than 2000++++ peoples . but in one months trading daily 3 calls our only 1 or max 2 stop loss hits but till now we are in green only . Harmonics on its own wont be enough… you need more tools and indicators… use harmonics to look for things like head and shoulders and double/triple tops. The Third pattern which “may” be a Gartley could have been a winner depending on where your stops were placed. The second pattern is not even a Gartley pattern, not even close. Just because it has an “M” shape doesn’t make it a Gartley Pattern.

The closer together the cluster of Fibonacci levels, the better it is. When that happens, you have an edge, and it’s time to trade. Even small differences in price can lead to significant differences in the ratios which might kick a pattern out of the acceptable range. So we end up with the situation where we see a particular pattern with data from one broker, but we do not see that pattern when using data from a different broker. Being aware of Pending patterns is critical since it gives you the option of taking a position before the pattern is confirmed.

Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Any investment decision you make in your self-directed account is solely your responsibility. Access to real-time market data is conditioned on acceptance of the exchange agreements. Professional access differs and subscription fees may apply. Futures and forex accounts are not protected by the Securities Investor Protection Corporation . Futures and futures options trading is speculative and is not suitable for all investors.

See the Settings section for detailed information on all of the parameter options. After a few tests of the 127.2% Fibonacci extension, GBP/USD price starts increasing.

Wanting The Market To See Your Pattern

Although these patterns are not 100% accurate, the situations have been historically proven. If these setups are identified correctly, it is possible to identify significant opportunities with very limited risk.

But I’ll be doing my own research, finding the optimal use of patterns, optimal tp and sl, and maybe revamping the points and conditions. Harmonics takes a lot of studying and practice to learn it properly. For me it took 2 and a half months including 1 month full live trade to get a fine grip on Harmonics. I learned harmonics from the Youtube channel AKATheGrower by Federico Villareal.

The price moves up to A, it then corrects and B is a 0.618 retracement of wave A. The price moves up via BC and is a 0.382 to 0.886 retracement of AB. The next move is down via CD, and it is an extension of 1.13 to 1.618 of AB. Many traders look for CD to extend 1.27 to 1.618 of AB. Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points.

The Roadmap To Successful Trading + Best Curated Resources

But for such prophecy to work, the patterns should be very clear and objective. Harmonic patterns however are rather subjective, as you said. So, my conclusion is that harmonic patterns simply do not work, they are not profitable over long term, they provide no edge. Toconclude, harmonic price patterns is all about being able to spot those “perfect” patterns and buying or selling on their completion. Harmonics is the process of identifying the market’s rhythm or its pulse, and then exploiting its trading opportunities. They provide us with visual occurrences that have tendencies to repeat themselves over and over again.

Basically it’s doing what it has to do and that is finding patterns. I think you’re looking at something to automatically find patterns? If so I’d prefer to keep it simple to start off but you’re ideas are good so let me know – pm me. in the image you`ve attached – the fib based pattern.However,my idea was to use one tick range chart,and just to connect the Highs/Lows/Close dots.

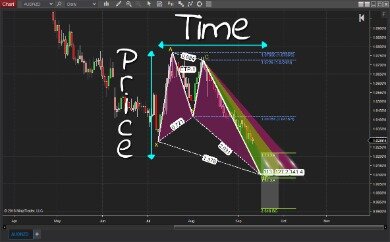

Pattern Trading Software Using Both Fibonacci Price And Fibonacci Time

The White Swan harmonic pattern name is given due the sudden increase that comes when this pattern forms. Draw a new Fibonacci retracement from point A to D or C to D of the pattern which is complete. In an uptrend, the first leg (A-B) is formed as the price rises from A to B. The pattern begins at the beginning of an extended price move. The important consideration of this pattern is that the BC move goes beyond XA and it is an extension of AB. Therefore, we measure CD with a retracement of XC and not on BC.

There are a few factors that come into play with the decision making process based off larger vs. smaller time frames, but this can be easily adaptable once you decide what to look for.

Consquently, if move BC is .886 of move AB, then CD should extend 2.618 of move BC. Move BC can be either .382 or .886 retracement of move AB. If the retracement of BC is .382 of AB, then CD should be 1.272 of BC. If BC is .886 of AB, then CD should extend 1.618 of BC. You can also use this indicator to capture any XABCD pattern as well as the ones that already been named.

Each of the five points show an important low or high in terms of price on the chart. Thus, the four previously mentioned legs represent different trends or price movements which move in opposite directions. Regression Line/Channel – Added options to create alerts for values crossing the line or top/bottom channel lines. Channel – Added alert option for values crossing the middle line Rotate Ellipse – Added the ability to Rotate an Ellipse by 90 degrees.

A Fibonacci fan is a charting technique using trendlines keyed to Fibonacci retracement levels to identify key levels of support and resistance. The key benefit of these types of chart patterns is that they provide specific insights into both the timing and magnitude of price movements rather than just look at one or the other. Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. These numbers help establish where support, resistance, and price reversals may occur. The Phi-Ellipse is a Fibonacci-based technical analysis tool used by traders to identify general market trends. Here we will look at the bearish example to break down the numbers.

There are numerous ways that you could manage your exit for the Butterfly extension pattern. One effective way is to set the price target at the 161.8% extension of the CD move. You may consider closing a portion of your position prior to this level as price approaches key swing points within the structure. These important levels include the price swings at points B, C, and A. As such, you should carefully watch the way that price interacts at these levels to determine if you should stay in the trade further or exit. If a breakout through the A level occurs, then you can be fairly confident that the projected target at the 161.8% extension of the CD leg should be achieved. The patterns may exist within other patterns, and it is also possible that non-harmonic patterns may exist within the context of harmonic patterns.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.