Table of Contents

- #16 Bullish Engulfing

- Stock Order Types: Each Order Explained

- Trading Candlestick Patterns

- How To Interpret Price Movement On A Candlestick Chart

- Bullish Candlestick Patterns

They indicate that a trend is likely to continue in a particular direction. Three white soldiers signify the continuation of an uptrend. Three black crows signify the continuation of a downtrend. The hammer and inverted hammer are close cousins of the dragonfly doji and gravestone doji respectively. The difference in these cases is that the candlesticks have small real bodies as opposed to no bodies at all like the doji. The Rising Method consists of two strong white lines bracketing 3 or 4 small declining black candlesticks.

The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. If you don’t feel ready to trade on live markets, you can develop your skills in a risk-free environment by opening an IG demo account. The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern. It comprises of three short reds sandwiched within the range of two long greens.

This indicates that longs were anxious to take proactive measure and sell their positions even as new highs were being made. Dark cloud cover candles should have bodies that close below the mid-point of the prior candlestick body. This is what distinguishes from a doji, shooting star or hanging man bearish reversal pattern. The prior candle, dark cloud candle and the following confirmation candle compose the three-candle pattern. The preceding candlesticks should be at least three consecutive green candles leading up the dark cloud cover candlestick. In modern charting software, volume can be incorporated into candlestick charts by increasing or decreasing candlesticks width according to the relative volume for a given time period.

#16 Bullish Engulfing

The second candle opens below the body of the first but closes above the 50% line of the first candle. The opposite is the dark cloud cover, which we’ll cover next. In this example, the price eventually broke down, but not until after several more candles and a new high. The fourth candle will retrace the progress of the first three candles. It must open below the previous close, then close above the first candle’s open. If a candle goes against the trend, it might be considered a non-trending candle. The patterns don’t always look exactly the same … But they look similar enough that when you see them over and over, you realize they can repeat.

Even today, this aspect is something difficult to grasp for most aspiring traders. Homma’s edge, so to say what helped him predict the future prices, was his understanding that there is a vast difference between the value of something and its price. The same difference between price and value is valid today with currencies, as it was with rice in Japan centuries ago. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. This formation suggests that the previous trend is coming to an end.

Stock Order Types: Each Order Explained

It is prudent to time the entry with a momentum indicator like a MACD, stochastic or RSI. The hammer candle family is another single candlestick pattern. Hammers have a long upper or lower candlewick and a small candle body at the opposite side. Each hammer candle is a reminder that a price reversal might be on its way. A candlestick pattern is a particular sequence of candlesticks on a candlestick chart, which is mainly used to identify trends.

The default color of the bullish Japanese candlestick is green. You can see the direction the price moved during the time frame of the candle by the color and positioning of the candlestick.

Trading Candlestick Patterns

In either case, support and resistance lines or indicators could be used as additional confirmation of the pattern and a potential reversal. A candlestick chart is a method of showing prices — namely open, high, low and close — of an asset for a defined period. Candlestick charts are thought to have originated from Japanese rice traders in the 18th century. They are still one of the most popular ways of displaying prices of financial markets. Today, candlestick charts are used to track trading prices in allfinancial markets.

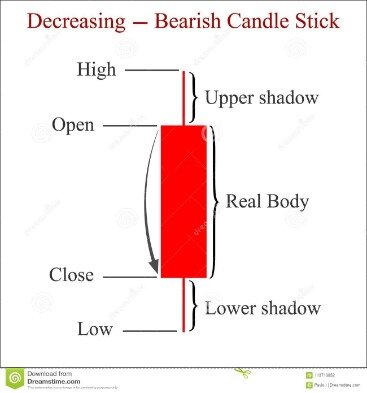

- The candlestick range is defined by the extreme high of the top wick above the body and the extreme low of the bottom wick.

- An important consideration is the location of where these engulfing patterns are situated in the context of an overall price trend.

- When a candle has long wicks with a relatively small real body the candles appear “spiky”.

- Notice the lines above and below the main body of the candle.

- For technical analysis to be carried out, prices need to be represented graphically on a chart.

- With close at the bottom, the falling price may be displayed with the down color.

The dark cloud cover is a two-candle bearish reversal pattern. The first candle is red, long, and part of an overall downtrend.

How To Interpret Price Movement On A Candlestick Chart

The black one is bearish candle while the one on the right is the bullish candle. The black and white parts of the candles are known as the body while the two lines are known as shadows. This pattern strongly suggests that the current situation will reverse.

What does a white candlestick mean?

What Is a White Candlestick? A white candlestick depicts a period where the security’s price has closed at a higher level than where it had opened. It is a point on a security’s candlestick chart representing a bullish period.

Wicks illustrate the highest and lowest traded prices of an asset during the time interval represented. Candlestick charts are most often used in technical analysis of equity and currency price patterns. They are visually similar to box plots, though box plots show different information. Traders can use candlestick signals to analyze any and all periods of trading including daily or hourly cycles—even for minute-long cycles of the trading day. Candlestick charts display the high, low, open, and closing prices of a security for a specific period.

Bullish Candlestick Patterns

When evaluating candlestick patterns, you can evaluate individual candlesticks or groups of candlesticks. Before you learn how to read candlestick charts, let us explain the benefits of them. Japanese candlestick chart analysis, so called because the candlestick lines resemble candles, have been refined by generations of use in the Far East. Candlestick charts are now used internationally by swing traders, day traders, investors and premier financial institutions. • It is extremely relevant in Bitcoin and cryptocurrency trading, as candlestick patterns can indicate bullish or bearish reversals. Candlestick charts are especially helpful in identifying market trend changes.

Business address, 200 West Jackson Blvd., Suite 1450, Chicago, IL 60606. IG is a registered RFED and IB with the Commodities Futures Trading Commission and member of the National Futures Association . Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Stay on top of upcoming market-moving events with our customisable economic calendar.

A long body followed by a much shorter candlestick with a short body indicates the market has lost direction. A Hammer candlestick is a bullish signal in a down-trend but is called a Hanging Man when it occurs in an up-trend and is traditionally considered a bearish signal. Thomas Bulkowski tested the pattern extensively and concludes on his website that the Hanging Man pattern resolves in bullish continuation 59% of the time.

The hanging man has a small body, lower shadow that is larger than the body and a very small upper shadow. It is differs from a doji since it has a body that is formed at the top of the range. However, the truth hits when the next candle closes under the hanging man as selling accelerates. Like a massive tidal wave that completely engulfs an island, the bearish engulfing candlestick completely swallows the range of the preceding green candlestick. The bearish engulfing candlestick body eclipses the body of the prior green candle.

Candlestick Patterns Every Trader Should Know

In the first chart above, you can see that a line chart is pretty basic. Unlike a line chart, a candlestick has more parts that help traders know when to buy and when to sell. There are many more candlesticks that have names attached to them but they are not as important. If you spent all of your time memorizing candlestick names and all of the different types, then you would be missing the point. The hammer is where the price opens and the goes down a bit and back up to close just below the opening price. This pattern is closely related to the dragonfly candle type.

Any trading decisions you make are solely your responsibility and at your own risk. Past performance is not necessarily indicative of future results. None of the material on nadex.com is to be construed as a solicitation, recommendation or offer to buy or sell any financial instrument on Nadex or elsewhere. Nadex is subject to U.S. regulatory oversight by the CFTC. a long white real body visually displays the bulls are in charge.

Practise trading risk-free with virtual funds on our Next Generation platform. Unlock our full range of products and trading tools with a live account. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. A long black line shows that sellers are in control – definitely bearish. Securities trading is offered to self-directed customers by Robinhood Financial.