Table of Contents

- What Is Crypto Com? Is It Safe To Use?

- Different Time Frames For Crypto Charts

- Crypto Blog

- Cryptocurrency Masterclass: Technical Analysis For Beginners

- Tradingviews Pricing

Mudrex supports ByBit Coinbase Pro, OKEx, Binance, Deribit, and more. It has a market indicator that helps you to allocate funds with ease.

Leonard , This is because the exchange is cryptocurrency-only. There is something you need to be aware of when it comes to market orders — slippage.

What Is Crypto Com? Is It Safe To Use?

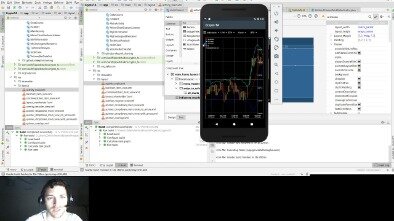

For those looking for intermediate or expert trading tips, Philakone might be a good choice for you to watch. However, most of his videos work out trends and price movements of Bitcoin . The analysis itself uses Trading View for chart explanations.

By contrast, if the volume during those declines goes up, then the upward trend will probably end soon. Volume can also give you similar information but as the opposite in the case of a downtrend.

Different Time Frames For Crypto Charts

Once you know what your personal preferences are, the next step is to find trade setups that are suitable for your trading style. You should also set reasonable goals and know what you want to achieve from trading, whether it is to earn x amount of money, or to be your own boss and set your own schedule. But don’t fall into the trap thinking that trading is easy money, because it most definitely isn’t, and in fact is probably one of the toughest jobs out there and requires tremendous discipline. For the last part of this article, we’ll go through what makes up a trading strategy, and explain how you can devise your own strategy that is personal and profitable. Coingecko is a coin market ranking chart app that ranks digital currencies by developer activity, community, and liquidity. Their social data shows, for every listed coin, the number of Reddit subscribers, Twitter followers, Telegram users, and Facebook Likes, as well as an overall social score on the Gecko page. Santiment calls itself your one-stop source for clarity in crypto.

When I first started looking into charts, I was overwhelmed… It took me a while to understand what all the different bits meant and how to make use of those. I needed something that would get me started, and would allow me to improve my skills as I improved.

Crypto Blog

By default, the bullish candlesticks are represented by green candles, which indicates that the price has increased during the selected time frame. For example, if the closing price of a 5 minute candle is higher than the opening price, that’s a bullish candlestick.

Some traders may use only one or the other, while other traders will use both — depending on the circumstances. Their goal is to make a profit by selling those assets at a higher how to buy mcap cryptocurrency why is bitcoin on coinbase in the future. This is the level where you say that your initial idea was wrong, meaning that you should exit the market to prevent further losses. Once a trader knows his strategy, the previously learned technical chart analysis will help him to find buy and sell areas in the specific market environment. Forex traders will typically use day trading strategies, such as scalping with leverage, to amplify their returns. The MACD is one of the most popular technical indicators out there to measure market momentum.

Cryptocurrency Masterclass: Technical Analysis For Beginners

You can recognize a tweezer bottom when the first candle shows rejection of lower prices, while the second candle re-tests the low of the previous candle and closes higher. After a strong price advance or decline, spinning tops and dojis can signal a potential price reversal, if the candle that follows confirms. A candle with a spinning top and doji by itself is neutral. It shows indecision between the bulls and bears and it is telling you that the market can go either way. They should be interpreted in relation to the candles preceding and immediately after it, for example in the morning star and evening star pattern, which will be discussed later. If you’d like to learn more, here’s a simple tutorial by Babypips about Support and Resistance, as well as another useful resource from The Forex Guy.

- The reports can be prepared and extracted with accountants and tax officers in mind.

- For the last part of this article, we’ll go through what makes up a trading strategy, and explain how you can devise your own strategy that is personal and profitable.

- Coingecko also has a more macro-level quantitative scoring method where they consider well over 50 factors.

- When you start to see a stock slowing down and not hitting the top or bottom of the channel after a strong and steady climb, it’s time to get out.

- It’s a good way to decide whether cryptocurrency trading is right for you and can help you decide whether you want to switch to another type of trading.

- One thing to keep in mind is that this indicator works best when used in a trending market.

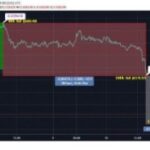

You will often find situations where fundamental analysis plays out just as you would expect. If you research an asset that has a big market cap, you may determine that the asset is highly overvalued. You are researching your investments to determine their future value. You should be aiming to identify projects you believe have a strong chance of success. Then when you invest and the team proves it’s capabilities, other investors should notice and the price action should be favorable. Fundamental analysis looks at the fundamentals of an asset, or in other words, every aspect of an asset that contributes to its overall value. BTC started the day on the rise, but big offers @ 60k absorbed the move and then prices dropped off rapidly.

Get out too early and you’ll cut your profits short, get out too late and you’ll end up giving your paper-profits back to the market or even worse end up with a loss. Markets are 99% watching/planning and 1% executing, so practice patience when trading, and wait for the “right time” to enter/exit a trade and you will be rewarded handsomely. In this strategy, we enter the market when the price breaks out of the cloud, and closes above the cloud. This signals a new uptrend, and we will enter in the direction of the breakout in an attempt to catch the trend. There are mainly two types of trading strategies, momentum strategies for trading breakouts and trends, and mean reversion strategies for ranging markets.

For a trend to be considered healthy, there needs to be steady price action with increasing or maintained volume. Another useful resource is this library of video tutorials by The Inner Circle Trader, commonly known as ICT. Therefore, it is imperative that you know how whales operate in the market, and you can learn a good deal from our dear friend Wolong in his eBook about “The Game of Deception” that is trading.

Their Pro plan costs around $150 a year, pro+ costs less than $300 a year, and the premium plan costs less than $600 a year. The annual fee is cheaper than the monthly fee, which is pretty standard, and both the pro and pro+ look very reasonably priced given what the tool enables us to do. The current pricing plans on TradingView.It’s great that they have a free version.

Technical Analysis for crypto can be confusing to learn at first, but this is an easy read to get started. It’s always best to consult several indicators when attempting to confirm future price movement and we give you some tips on that in the video in this article. Learn more about the best cryptocurrency wallets you can buy to protect and store your Bitcoin, Ethereum, Litecoin, and other altcoins. Check out the best crypto wallets to use, or our guide on which crypto portfolio is best for you. Why didn’t the Bitcoin price continue to grow above $20,000? This lack of liquidity diminishes the potential of cryptocurrencies, which leads to situations like the Bitcoin drop in 2018.

In a green candle, the upper shadow is the close price while the lower shadow in the open price and vice-versa for red candlesticks. Finally, we have the short swing or minor movement varies according to market speculation from hours to a month or more.

Does technical analysis work on Cryptocurrency?

Technical analysts observe patterns of price movements, trading signal and other analytical tools to evaluate the strength and weakness of an asset. Technical Analysis can be applied to any security with historical trading data such as cryptocurrencies, forex, commodities and stocks.

Only authoritative sources like academic associations or journals are used for research references while creating the content. In other cases, the transaction can involve the exchange of goods and services between the trading parties. Financial instruments have various types based on different classification methods. The bid-ask spread can also be considered as a measure of supply and demand for a given asset. Typically, traders will pick two significant price points on a chart, and pin the 0 and values of the Fib Retracement tool to those points.

This trading website enables you to buy and sell trading strategies with ease. It allows you to buy or sell a large volume of crypto without any hassle. You can launch trading bots with a short and long strategy with ease. Coinrule is an automated trading platform that enables you to trade for Binance, Kraken, Coinbase Pro, and more exchanges. This application offers 130+ trading strategies templates. Smart Trade terminal allows traders to set up stop-loss, take profit, trailing in one trade. Whilst having spent a lot of his life in Asia, John DeCleene has lived and studied all over the world – including spells in Hong Kong, Mexico, The U.S. and China.

In the future, one of them might be the equivalent of a Microsoft or Apple, but with Blockchain technology. Later in the same month and the following month, the price of gold slips further, below those previous lows.

Once the markdown phase begins in earnest, chartist should wait for flat consolidations or oversold bounces. Wyckoff referred to flat consolidations as re-distribution periods. A break below consolidation support signals a continuation of the markdown phase. In contrast to a consolidation, an oversold bounce is a corrective advance that retraces a portion of the prior decline.