Table of Contents

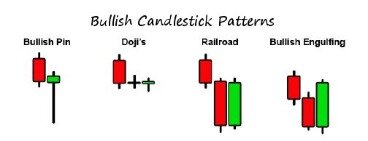

These emotional swings in traders can be shown through patterns that we will dig deeper into later. Now that you know what a bullish engulfing pattern is, you can probably deduce what a bearish engulfing pattern is. If you guessed that a bearish engulfing pattern signifies the downward movement of a security, you’d be right. A bearish engulfing pattern occurs at the top of the market, and signifies a move down. This means the sellers have overpowered the buyers and identifies a bear market. Outlined above are some of the most useful candlestick patterns, including the Hammer, the Shooting Star, Belt Hold Lines, Dojis and the Marubozu.

This is caused when buyers in the markets require a little rest before taking the market higher. What this means is that during the trading sessions the bears managed to pull the price down lower, generating a session low, then it aggressively moves back up caused by a rush of bulls.

My book,Encyclopedia of Candlestick Charts, pictured on the left, takes an in-depth look at candlesticks, including performance statistics. One of the reasons the morning star is a strong signal is because it is like the two candle reversals, but with an extra candle in the middle that is a spinning top. It all combines to create an incredibly strong reversal signal. To create the One-White Soldier, the stock has been in a bearish swing, and it reveals a strong black candle at or near support. Then, the next morning, the stock gaps up, and a large white candle is revealed. These last two patterns are by far my favorite two reversal signals. For me, when I see a Bullish Harami, I adjust stops and take note.

Forex Trading Costs

The creation of candlestick charts is widely credited to an 18th century Japanese rice trader Munehisa Homma. It is believed his candlestick methods were further modified and adjusted through the ages to become more applicable to current financial markets. Steven Nison introduced candlesticks to the Western world with his book “Japanese Candlestick Charting Techniques”. Candlesticks have become a staple of every trading platform and charting program for literally every financial trading vehicle. The depth of information and the simplicity of the components make candlestick charts a favorite among traders.

We have several significantcharting features, such as drawing tools and price projection tools, ensuring that your trades are set up as clearly as possible. It is a simple and easy process to set up an account with us to start candlestick trading. These are the four Doji candlestick types you can meet on the chart. However, despite of its four different types, the Doji candle has only one meaning on the chart – reversal.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Please see the further, important disclosures about the risks and costs of trading, and client responsibilities for maintenance of an account through our firm, available on this website. Day trading is subject to significant risks and is not suitable for all investors. Any active trading strategy will result in higher trading costs than a strategy that involves fewer transactions. Commentary and opinions expressed are those of the author/speaker and not necessarily those of Mint Global.

The preceding candlesticks should be at least three consecutive green candles leading up the dark cloud cover candlestick. The Hammeris a bullish reversal pattern, which signals that a stock is nearing bottom in a downtrend. Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days. The reversal must also be validated through the rise in the trading volume.

Hammer Example

Candlestick charts first appeared as far back as the early 1800s, and as with anything in trading, many people claimed credit for the idea. This type of analysis is commonly thought to have been developed by a rice trader named Homma who was from the small town of Sakata in Japan. While candlestick charts are a great tool for making a short-term decision, it is always recommended that you use other studies along with candlestick charts. Whether it be a trend-line fib analysis, or another type of technical analysis, the more the merrier. It is not an end all be all type of analysis, they are best used in a small time frame where you are only taking a day or less into account. Also, as mentioned earlier, you should assess the pattern not on its own but on its relative placement in the chart. The second bullish Marubozu was formed after volatile swings in the price, where large wicks are observed for the candles preceding and following the second Marubozu.

Who gives the best stock advice?

ATTENTION: Don’t miss David Gardner’s next pick on Mar 18th and Tom’s on Apr 1st.Motley Fool Rule Breakers.

Zacks Investment Research.

Morningstar Investment Newsletters.

InvestTech Research.

Kiplinger’s Investment Newsletters:

Seeking Alpha.

8. Yahoo!

MarketWatch.

The Dragonfly Doji has a long lower shadow, the open, high, and close are at or very near the session’s high. The Doji is a candlestick in which the session’s open and close are the same, or almost the same. There are a few different varieties of Dojis, depending on where the opening and closing are in relation to the bar’s range. Candlestick charts originated in Japan during the 18th century. Since no defined currency standard existed in Japan during this time rice represented a medium of exchange. Various feudal lords deposited rice in warehouses in Osaka and would then sell or trade the coupon receipts, thus rice become the first futures market. In the 1700s legendary Japanese rice trader Homma Munehisa studied all aspects of rice trading from the fundamentals to market psychology.

The Morning Star

In this patter, the body of each candle is shorter than the previous candle in the pattern. A neutral Doji is a candle that features small wicks, demonstrating a tight range of price movement. While it can indicate a reversal, this type of Doji requires careful examination of the candles before and afterward to determine the trend direction. This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. It is a powerful signal of a reversal leading to a downward trend. The opposite of this, with the body at the top and signifying an upward trend, is called a Dragonfly Doji. The evening star doji has the same setup as the morning star doji except for the placement on the chart which is at the top of a trend instead of the bottom.

The below chart shows some distinctions between “real” and “false” dark cloud covers. While the green circled patterns fulfill all the recognition criteria, the red circled don’t. How can I deal with the fact that different charting platforms show different candlestick patterns because of their time zone? Forex market, we would suggest to use a GMT chart since most institutional volume is handled in London. This is specially valid if you work with daily charts but intraday charts superior to 1 hour will also show differences in the patterns. In any case, because of the 24 hour nature of the Forex market, the candlestick interpretation demands a certain flexibility and adaptation. You will see how some of the textbook patterns look slightly different in Forex than in other markets.

Shooting Star:

A long black body is followed by three small body days, each fully contained within the range of the high and low of the first day. A reversal pattern that can be bearish or bullish, depending upon whether it appears at the end of an uptrend or a downtrend . The first day is characterized by a small body, followed by a day whose body completely engulfs the previous day’s body. A continuation pattern with a long, black body followed by another black body that has gapped below the first one. The third day is white and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap. After a downtrend; three bullish candlesticks will create higher closes.

- Again, try using support and resistance levels or Fibonacci bands to confirm your ideas.

- The second candle opens below the previous close but closes above the previous body’s open.

- It is a bullish candlestick pattern and the rising window should be support.

- Bearish Harami Consists of an unusually large white body followed by a small black body .

- Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions.

A spinning top can move up or down and is identified by a small body. It has a shadow on both sides with the body centered between the upper and lower shadow.

Candlestick Patterns You Need To Know, With Examples

But when this line appears during an uptrend, it becomes a bearish hanging man. It signals the market has become vulnerable, but there should be bearish confirmation the next session with an open, and better is a close, under the hanging man’s real body. In principle, the hanging man’s lower shadow should be two or three times the height of the real body. An important part of utilizing the Hanging Man pattern is that the hanging man candle itself is only as strong as the confirming, immediately next candle. Meaning, with bearish confirmation, the Hanging Man is a potential bearish candle signal. But remember that this would require a little patience to understand the true meaning of this specific candle pattern.

You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Experience and common sense allow traders to read the message even if it does not exactly match the picture or definition in the book. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 53.00%-89.00% of retail investor accounts lose money when trading CFDs.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Their potency decreases rapidly three to five bars after the pattern has completed. They only work within the limitations of the chart being reviewed, whether intraday, daily, weekly or monthly.

It has a small body, a short lower candlewick and a long upper candlewick. This is why the candle is called “Shooting Star” – because it really looks like one. The Shooting Star candle could be found at the end of a bullish price move, speaking about a potential reversal. The image below will show you how do the Hammer and the Shooting Star candles work in trading. Others prefer to stick with trades for a certain period of time, or they look for a specific profit before exiting. With many different strategies and ideas all currently trading in the marketplace at the same time, the only thing guaranteed is that nothing is guaranteed. This makes the stock market one of the most fascinating natural economic forces to watch.

Blended candle analysis; day 1 plus day 2 equals a hammer candle stick. If bearish pattern following a second day bullish candlestick, then bearish hammer will follow. Draw resistance line for a bearish reversal , draw support for a bullish reversal . This is one of the particularly reliable bearish candlestick patterns. It is signalling that a top is in place and a trader should close any long positions or get ready to short the market. Furthermore, after a short corrective movement, the bullish trend gets confirmed by the Three Bullish Soldiers candle pattern, which is another confirmation that the bulls definitely dominate!

A hammer pictorially displays that the market opened near its high, sold off during the session, then rallied sharply to close well above the extreme low. Note it can close slightly above or below the open price, in both cases it would fulfill the criteria.

The bearish engulfing candle happens at the end of an uptrend, and the bullish at the end of the downtrend. The inverted hammer candle forms when a the price moves higher after the open, it then declines to close significantly lower than the low. And the last day reverses higher and should close at or above the midpoint of the first candle. A three day pattern and is associated with a bullish reversal. It can be a bearish reversal pattern, but is more often found within the downtrend, signalling that the downtrend is set to continue. The next day opens higher but trades in a very narrow price range.