Table of Contents

- What Is The Bullish Harami Pattern?

- What Do Engulfing Candlesticks Look Like ?

- What Are Bearish Engulfing Patterns And How To Trade Them?

- A Tutorial On Mastering The Engulfing Candlestick Pattern

- Stalled Candlestick Pattern: Complete Guide

- Why Are Engulfing Candlestick Patterns Formed?

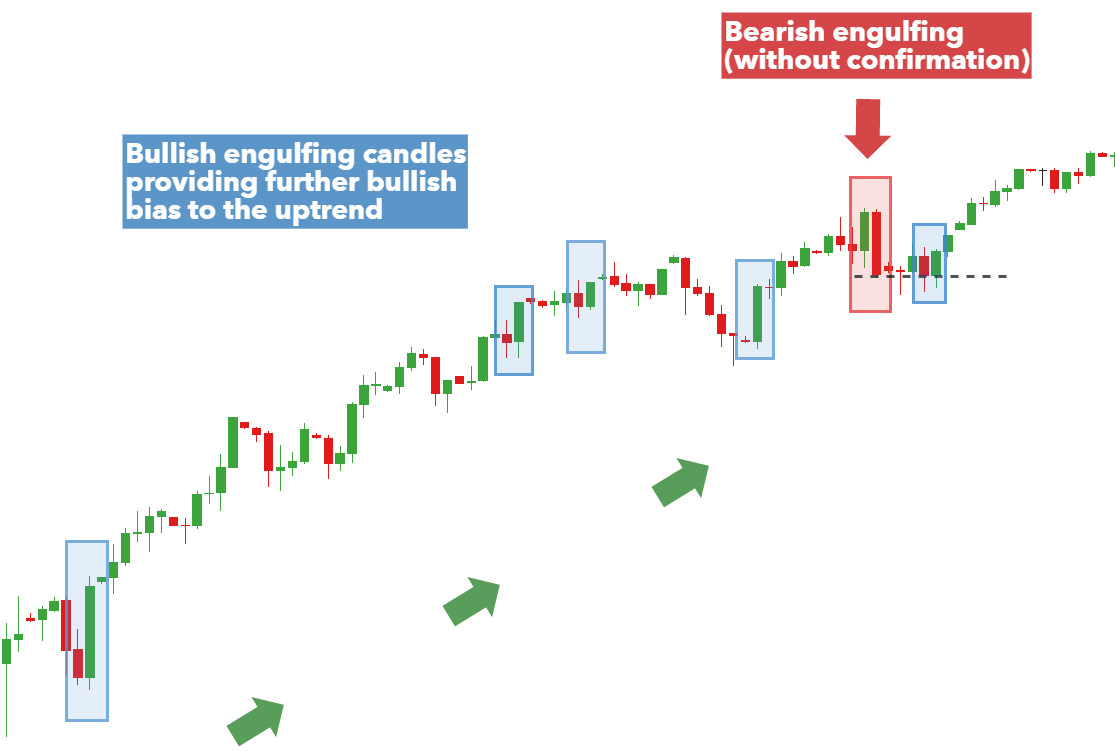

With a stronger pattern, the engulfing candlestick can “engulf” multiple trailing candles. The length of the engulfing candle can also be used as a filter as can the “depth”. Smaller engulfing candles are seen as less likely to signal a strong reversal. Resistance and support areas are also useful in deciding which to trade and which to ignore. One thing that traders tend to do wrong when it comes to trading engulfing candlesticks, is trading ones which are the wrong size. As long as this condition is satisfied, everything else is similar to the bullish engulfing, including the trade set up.

Once the upper shadow of the bearish candle reached the resistance area, the bears took charge for the rest of the day. Confirmation of resistance plus the bearish engulfing pattern were a potent combination for the bears who took the ETF downwards for the next few months. The bearish engulfing pattern in this chart was a good example of the second day candle’s real body being larger than the entire first day candle. It was also good that the bearish candlestick on the second day was so large, showing much force behind the bearish move downward. A bullish engulfing candlestick formation represents that bulls are in full control of bears.

I’ll then measure the market fall or rise if there was one just after the signal appeared. The entry itself will be made using a market order, pending orders do not tend to work well when trading engulfing candles. What I mean by this is we only want to trade engulfing candles that fit within our risk thresholds.

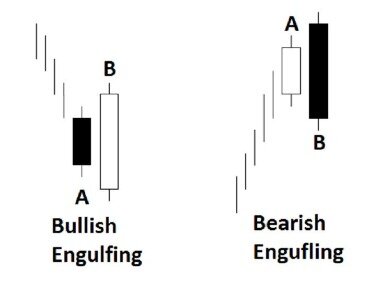

The second candle has small wick relative to the body and its range is greater than average. The second candle completely engulfs the real body of the first. Past performance is not necessarily an indication of future performance. Commodity.com shall not be liable for any special or consequential damages that result from the use of or the inability to use, the materials and information provided by this site. All 3-D charts are followed by 2-D contour charts for Profit Factor, Sharpe Ratio, CAGR, and Maximum Drawdown. The final two pictures show sensitivity of Equity Curve in $ and risk multiples.

If using a longer time frame, like hourly, 4-hour, daily or weekly chart, then place the stop loss at least several pips below the low . For the purposes of this strategy, a bullish engulfing candle occurs when the “fat” part of an Up candle completely envelops a prior Down candle. The fat part of the candle marks the distance between the open and close of that bar, while the “wicks” mark the high and low. While there is no specific size requirement, typically both bars in the pattern should be substantial, with the up bar showing a strong short-term shift in momentum. Candlestick charts have become a staple for most traders, and nearly every trading platform offers this highly visual chart style.

What Is The Bullish Harami Pattern?

Engulfing candles occur quite often, which is why we need to some sort of other filter to trade them. It is strongest if it crops up at the peak of an uptrend and there is a surge of selling pressure.

Candlesticks are formed by showing a candle “body”, a solid area between the open and close price, and “wicks”, which represent the high and low. Traders of stocks and other financial markets often use candlesticks as a great visual aid to what a particular price has done within a certain time period. This Engulfing Candlestick Scans Bundle package gives you both of our bull and bear engulfing candlestick stock scans at a fraction of their individual costs.

What Do Engulfing Candlesticks Look Like ?

Bearish engulfing candles can happen anywhere on a chart but the most powerful reversal signal is when it forms at the top . Piercing Line Consists of a black candlestick followed by a white candlestick that opens lower than the low of the preceding but closes more than halfway into the black body candlestick.

Bullish engulfing candles that appear within a third of the yearly low perform best — page 320. If you want a few bones from my Encyclopedia of candlestick charts book, here are three to chew on.

I would put my money on the bearish engulfing pattern as opposed to a dark cloud cover. This is because the bearishness in a bearish engulfing pattern is more pronounced (because it engulfs the previous day’s entire candle). On the same lines, I would choose a bullish engulfing pattern over a piercing pattern.

What Are Bearish Engulfing Patterns And How To Trade Them?

They are commonly formed by the opening, high, low, and closing prices of a financial instrument. My name is Blain Reinkensmeyer, and I am the Founder of StockTrader.com.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

A Tutorial On Mastering The Engulfing Candlestick Pattern

In addition, the colors of the candlesticks are significant. There is often a lot of confusion on whether the candle should engulf just the real body or the whole candle, including the lower and upper shadows. As long as the real bodies are engulfed in my personal experience, I would be happy to classify the candle as a bullish engulfing pattern. Of course, candlestick sticklers would object to this but what really matters is how well you hone your trading skills with a particular candlestick pattern.

Although the trend was certainly up, the swings in late 2011 were not very clear to trade. At the end of this choppy trend there was a retrace which contained a hammer reversal top and bottom. From the bottom hammer reversal, IBM transitioned into an aggressive move upwards which continued for four months. This website is intended for informational and educational purposes only and does not constitute investment advice. The Trade Risk LLC is not an investment advisory service, registered financial advisor, or registered broker-dealer. The risk of trading in securities markets can be substantial.

The use of descriptions such as “best” are only for search purposes. Optimus Futures, LLC does not imply that you cannot find better tools or opposing valid views to our opinion. We do our best to share things based on our experience and scope of expertise.

The first candlestick shows that the bears were in charge of the market. Although the second period opens lower than the first, the new bullish pressure pushes the market price upwards – often to such an extent the second candle is twice the size of the previous one.

Is heikin Ashi reliable?

Heikin-Ashi candlesticks are better deciphered than traditional candlestick charts hence its easier to identify market trends and movements. Reliability: Heikin-Ashi is a very reliable indicator, providing accurate results. It uses historical data, which is also quite dependable.

For a bullish engulfing pattern to form, the stock must open at a lower price on Day 2 than it closed at on Day 1. If the price did not gap down, the body of the white candlestick would not have a chance to engulf the body of the previous day’s black candlestick. A bullish engulfing pattern is a white candlestick that closes higher than the previous day’s opening after opening lower than the previous day’s close. A bearish engulfing pattern consists of two candlesticks that form near resistance levels where the 2nd bearish candle engulfs the smaller 1st bullish candle. Typically, when the 2nd smaller candle engulfs the first, price fails and causes a bearish reversal. Again this can be a precursor to a sharp sustained drop in price or trend change. Like a massive tidal wave that completely engulfs an island, the bearish engulfing candlestick completely swallows the range of the preceding green candlestick.

The Engulfing Candle Day

When it comes to reliability, the bullish engulfing pattern, not to mention every other pattern discussed above, has two main limitations. The first is that these patterns happen all the time, but the one that counts only happen during a trend. So when you consider the patterns in isolation, it can give off a false signal. Another thing is that you should not rely on the patterns alone.

You should only trade with funds that you can afford to lose. On average markets printed 1 Engulfing pattern every 37 candles.

The short-sell trigger forms when the next candlestick exceeds the low of the bullish engulfing candlestick. On existing downtrends, the bearish engulfing may form on a reversion bounce thereby resuming the downtrends at an accelerated pace due to the new buyers that got trapped on the bounce. As with all candlestick patterns, it is important to observe the volume especially on engulfing candles. The volume should be at least two or more times larger than the average daily trading volume to have the most impact. Algorithm programs are notorious for painting the tape at the end of the day with a mis-tick to close out with a fake engulfing candle to trap the bears. An engulfing candlestick patterns are usually identified near the tops and bottom. In other words, a bullish engulfing pattern tells us that the buyers have overwhelmed the sellers in the market, thus engulfing the entire previous day’s open and closing prices.

A more aggressive style may be reserved for the ‘A grade’ setups that have all of the foundations of strength discussed above. Newer traders, on the other hand, are best of using the conservative approach at all times, until experience dictates better. Ideally, we want our engulfing patterns to form at key horizontal support and resistance levels and other areas of interest like round numbers and long-term moving averages. The larger the number of factors in confluence at the point where the engulfing pattern forms, the stronger the setup in terms of location.