Table of Contents

- Candlesticks And Oscillators For Successful Swing Trades

- About Forexboat

- Structure Of A Bullish Engulfing Pattern

- Step #1 Spot A Sideways Market

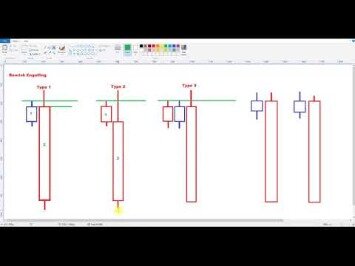

- Types Of Engulfing And Piercing Patterns

The chart shows a bullish engulfing candlestick circled in red on the daily scale. The first candle is black followed by a white one in which the body of the white candle covers, overlaps, or engulfs the body of the black candle. An engulfing pattern is also considered stronger when the body of the candlestick itself is also large and authoritative. The body is the colored part of the candlestick or the distance between the open and the close of the candlestick. This is in sharp contrast to this pattern’s close cousin the pin bar, for which we usually prefer a large wick relative to a small body. However, with the engulfing pattern, the larger body gives the pattern a more authoritative appearance that is often needed to confirm high probability trade setups. In the above example primarily, you will also note that the bearish engulfing pattern actually ‘engulfs’ more than one candlestick.

Finally, the bulls win the battle by closing the “second” candle above the “first” candle’s highest price. If you use the standard colors, the “first” candle should be red, while the “second” one should be green. While new traders think of this as the hardest part, it’s actually quite simple. Once price gets to a zone, your goal is to determine whether price is likely to reverse. While there are many ways to do this, an Engulfing Pattern will give you a good indication that the buyers or the sellers took control of the market.

Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director of the CMT® Program for the CMT Association. Cory Mitchell, CMT, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Mitchell founded Vantage Point Trading, which is a website that covers and reports all topics relating to the financial markets. He has a bachelor’s from the University of Lethbridge and attended the Canadian Securities Institute from 2002 to 2005. The Bearish Engulfing Candlestick Pattern is considered to be a bearish reversal pattern, usually occurring at the top of an uptrend.

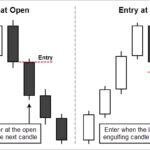

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Moving forward, let’s see the different ways how to trade the engulfing pattern. Keep in mind, as is the case when interpreting candlesticks, a trader cannot make a decision regarding what a candle might turn out to be until that candle is closed. Remember, just because a trader sees an engulfing candle does not mean that a move in the opposite direction is assured. As far as being certain goes, a trader can be certain that a candle is an engulfing candle, but we can never be certain of what may transpire on the chart going forward. By entering early we allow for the possibility that by the time the bar closes it is no longer a traditional engulfing pattern. Yet, in real-time, it exhibited the shift in momentum we were looking for, and that is all that matters.

For a bearish engulfing pattern, you’d put a stop-loss at the top of the red candle’s wick as this is the highest price the buyers were willing to pay for the asset before the downturn. The body of a candlestick represents the open-to-close range of each trading period, which can range from a second to a month or more – depending on your chart settings.

Candlesticks And Oscillators For Successful Swing Trades

Above you see a sketch which illustrates where you should place your stop loss when trading bullish and bearish Engulfing patterns. If the pattern fails to move in the desired direction causing the stop loss to be hit, it will prove the trade assumption wrong and act to protect your bankroll. A valid bearish Engulfing pattern continues with a third candle , which breaks the body of the engulfing candle downwards. A valid bullish Engulfing pattern continues with a third candle , which breaks the body of the engulfing candle upwards. This time the engulfed candle is bullish and the Engulfing candle is bearish. The body of the second candle fully contains the first candle, which completes the shape of the bearish Engulfing pattern on the chart.

Sometimes the bullish engulfing pattern is referred to as a three outside up pattern. The difference being the addition of a bullish candlestick on the third day that closes above the high of the second day’s bullish candlestick. In essence, the bullish engulfing pattern is a trading figure that consists of two candles, one bearish and one bullish, which engulfs the bearish candle. This formation illustrated in the graph below creates a powerful reversal pattern. The idea behind the bullish engulfing pattern signals that the second candle is powerful enough to initiate a new trend.

About Forexboat

Since now our trade is in green now, we look at potential profit-taking areas. For instance, the first area is the immediate horizontal resistance at $1.1270, which offers the same amount of pips that we risk . Therefore, this doesn’t represent a great risk/reward ratio, but some traders would prefer to play it safe and close the trade here. As we outlined earlier, the “second” candle should entirely engulf the “first” candle’s body.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts.

Forex examples are used below, but I also use this entry technique in stocks and futures as well. Stay in the trade for a minimum price move equal to the size of the Engulfing pattern, or use price action rules to extend the duration of the trade. Combining Support and Resistance with the Engulfing pattern is an excellent price action based trading method. You are looking at the hourly chart of the USD/CHF for Feb 19 – 24, 2016.

Structure Of A Bullish Engulfing Pattern

A stop loss should be placed above the upper candlewick of the engulfing bar. As such, your Engulfing trades should always be protected with a stop loss order.

What other indicators, trend lines, or other criteria do you need to enter the trade? Having a system in place to make you feel confident on entering the trade is very critical.

Step #1 Spot A Sideways Market

If you’d like a primer on how to trade commodities in general, please see our introduction to commodity trading. Find out more about precious metals from our expert guides on price, use cases, as well as how and where you can trade them. Precious metals have many use cases and are popular with commodity traders.

What is bullish kicker?

A bullish kicker is a candlestick pattern that’s often formed after a significant downtrend, but could also form after an uptrend. In short, a bullish kicker consists of a large bullish candlestick, that’s preceded by a gap to the upside and a bearish candle.

There are several precious metal derivatives like CFDs and futures. The majority of agricultural commodities are staple crops and animal products, including live stock. Many agricultural commodities trade on stock and derivatives markets. Commodity exchanges are formally recognized and regulated markeplaces where contracts are sold to traders. This bullish day dwarfed the prior day’s intraday range where the stock finished down marginally. The move showed that the bulls were still alive and another wave in the uptrend could occur. •Bearish Engulfing pattern outperformed the success rate of the studied population on OPEN and HIGH criteria.

Remember, we started our discussion saying how newer traders often skip the location aspects and are too keen on just spotting the large and authoritative engulfing pattern as a viable trade signal. We’ll see now how that can be detrimental to your ability to trade the engulfing pattern effectively in the long term.

It is possible that when we look back at our trades, an engulfing pattern may not be present. By entering early we allow for possibility that by the time the bar closes it is no longer a traditional pattern. Yet in real-time it exhibited the shift in momentum we were looking for, and that is all that matters. For a bearish engulfing candle in a downtrend , the stop-loss is placed just above the high of the engulfing candle. While its appearance signifies a sharp short-term change in direction, many of these patterns aren’t of concern.

To exemplify how the engulfing pattern works, we’re going to showcase how to trade a bearish engulfing pattern. Understanding the difference between bullish patterns and bearish patterns will be key to leveraging engulfing patterns to your advantage. The most common approach – and also the most conservative – is to wait for the engulfing pattern to ‘break’. That is to wait for the price to venture a few ticks beyond the high of a bullish engulfing pattern, and the low of a bearish engulfing pattern. The buffer allows for an additional confirmation that price does indeed want to travel in the direction proposed by the engulfing pattern itself. The stop loss for this conservative style goes a few ticks above the opposite end of the engulfing pattern. That is, a few ticks above the high of a bearish engulfing pattern and a few ticks below the low of the bullish engulfing pattern.

As the name of the pattern implies, the bulls have taken control from the bears. All 3-D charts are followed by 2-D contour charts for Profit Factor, Sharpe Ratio, CAGR, and Maximum Drawdown. The final two pictures show sensitivity of Equity Curve in $ and risk multiples.

The stock market offers virtually any combination of long-term opportunities for growth and income, as well as short-term investments for trading gains. MoneyShow’s weekly Virtual Learning Letter showcases a variety of on-demand webcasts and video market commentary by top financial experts covering the hottest financial topics each week. Cryptocurrencies can fluctuate widely in prices and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. To help filter which trade signals you take, and isolate the trend, you may wish to employ other indicators such as trendlines or a moving average.

A bearish engulfing pattern is the exact opposite of the bullish one. It forms during an uptrend where a smaller bullish candle is engulfed by a bigger bearish candle.

The trade should be closed out when confirmation of the Hammer pattern appears on the chart. As you see, the next candlestick is bullish and breaks the upper level of the Hammer pattern. This confirms the validity of the Hammer Reversal, which creates an exit signal for the short position. The bearish Engulfing trade should be liquidated at the close of the bullish candle which appears after the Hammer. An engulfing pattern is a reversal pattern which is found in all types of candlestick patterns. A bullish engulfing happens during a downtrend while a bearish one forms during an uptrend.

At one point, the price rebounds strongly before it reverses again to continue trading lower, and ultimately printing the new short-term low. The bearish candlestick pattern follows the same line of thought, the only difference is that it is a bearish reversal pattern that occurs at the top of an uptrend. The first candle is a bullish candle that signals the continuation of the uptrend, before the appearance of the powerful bearish candle that completely shuts down the prior candle. If there’s one downside to trading engulfing candles it would be not being able to trade them on the daily chart. If you have placed a trade based on a bearish engulfing candle, when the market makes a lower swing low you move the stop to your entry point of your trade. So, let’s see what the bullish engulfing pattern is telling us from the supply and demand perspective. Now, before we reveal the better way to trade the engulfing pattern trading strategy, it’s important to understand what’s going on behind the scene.