Table of Contents

- First Known Use Of Volatility

- How Volatility Works

- Spread Out Your Risk By Making Regular Investments

- What Is Volatility?

Volatility is an important concept for traders and investors alike. Phil is a hedge fund manager and author of 3 New York Times best-selling investment books, Invested, Rule #1, and Payback Time. He was taught how to invest using Rule #1 strategy when he was a Grand Canyon river guide in the 80’s, after a tour group member shared his formula for successful investing. Phil has a passion educating others, and has given thousands of people the confidence to start investing and retire comfortably.

Market volatility is where the changes in price in a given market become rapid. The changes in prices may include forex, commodities, and stock. When there is market volatility, it is an indication that there is either an upward or downward price movement in the market. So, when the market becomes volatile, bullish traders tend to increase prices on commodities on what they regard to be a good news day.

Trading is high risk, it does not guarantee any return and losses can exceed deposits. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. Alternatively, traders can use a volatility index to track the current market volatility, such as the VIX or CBOE volatility index. The former indicator plots two bands – one upper and one lower band – at a distance of two standard deviations from a centrally-located moving average. In general, the more the bands widen, the higher the volatility of the underlying instrument.

First Known Use Of Volatility

Given the prices of call or put options across all strikes and maturities, we may deduce the ~ which produces those prices via the full Black-Scholes- Merton equation. ~ Smiles might indicate that the market is expecting a high possibility of extreme stock price movements as result of either increased ~ in the overall market or in a particular stock. Trading low volume, high ~ swings during the holidays takes practice-start with overnight markets that have similar liquidity and price-movement. Average True Range – The Average True Range indicator was developed by J. The ATR indicator does not reflect price direction and is not used to predict price. We recently produced a chart for this column demonstrating that as the market continued to climb its proverbial wall of worry, so too did the measure of options implied ~ – aka the CBOE ~ Index .

When markets are volatile, they bring about the most opportunity. When there are record-setting rallies and crashes around every corner, there is more opportunity for traders to learn, profit, and take additional positions. Like all aspects of financial markets, and everything else in the world, there are both many advantages and disadvantages to extreme volatility. Here are the essential pros and cons of volatility, as well as how to avoid or take advantage of them. Much like politics can create a surge in volatility, comments from or the sudden change in stance from a regulatory entity can have a significant impact on asset prices and volatility. Implied volatility looks forward in time using the market price of a derivative product. There are several types of volatility, each providing traders and analysts a unique view of price action within a specific timeframe and more.

On the other hand, bearish traders, as well as short-sellers, take advantage of this to bring prices down on what they term as a bad news day. Implied volatility shows options traders the degree of stocks volatility in the future. The traders are able to tell the stocks implied volatility by looking at the variances rates in the future options prices. Where there is an increase in options prices, it may be an indication that there is an increase in implied volatility, as other things remain equal.

How Volatility Works

As a result, their equity portfolios are constructed to match the sector exposures within a benchmark index such as the S&P 500 or Russell 1000. But pure low volatility strategies are built from the bottom-up, and the lowest volatility stocks are included no matter which sector they’re in. As a result, low volatility strategies can possess large tracking error or materially deviate in their sector exposures relative to the benchmark. For this reason, the benefits of the low volatility anomaly are not priced or arbitraged away and are allowed to exist in the marketplace. Institutional investors have little incentive to arbitrage the anomaly away. Factors are measurable characteristics of a security that help explain its performance.

He uses the example of the FTSE 100, an index of the top one hundred companies that have listed their shares, otherwise known as stocks or equities, on the London Stock Exchange. Day traders work with changes that occur second-to-second, minute-to-minute. Swing traders work with a slightly longer time frame, usually days or weeks, but market volatility is still the cornerstone of their strategy. As price seesaws back and forth, short-term traders can use chart patterns and other technical indicators to help time the highs and lows. This strategy is based on the assumption that while there may be fluctuations in the market, it generally produces returns in the long-run.

Some institutions can take advantage of these movements, but most of us certainly are not in a position to do that. Individuals should mostly try to not get too wrapped up in volatility, because they can get whipsawed. We’ve just lived through a period in July, August, and September when the markets were down so much that many people got scared. Then it turned out October was one of the biggest up markets we’ve ever had. For the most part, the individual should ride through these things, buy and hold. If they do react, usually what’s happening is that their emotions work against them. They get scared and they’re driven away from the more rational behavior, which is to just settle down.

Spread Out Your Risk By Making Regular Investments

Invesco Capital Management LLC, investment adviser and Invesco Distributors, Inc., ETF distributor are indirect, wholly owned subsidiaries of Invesco Ltd. This should not be construed as investment advice nor as a recommendation of a particular strategy or product. Although factor performance isn’t guaranteed, different factors tend to outperform during different phases of the market cycle. The graph below shows which factors have the potential to perform better than the overall market as it rises and falls. If a stock loses 80%, it has to gain 500% to get back to even.

They also take into consideration more than one social identity at the same time and this is also known as cross-categorization effects. Some social categories are embedded in a larger categorical structure, which makes that subcategory even more crucial and outstanding to perceivers. Research on cross-categorization reveals that different types of categories can be activated in the mind of the social perceiver, which causes both positive and negative effects. A positive outcome is that perceivers are more open-minded despite other social stereotypes. They have more motivation to think deeply about the target and see past the most dominant social category. Bodenhausen also acknowledges that cross-categorization effects lead to social invisibility. There are two separate components that connect people to social identities.

What Is Volatility?

Breaking news impacting markets or monetary policy in some way can have a butterfly effect across markets that sends volatility soaring. When an asset’s price is trending strongly, volatility is often high as a result. This is because, during the strongest trends, price moves quickly and powerfully in one direction as a result. The standard method to calculate and measure volatility involves using a variance and a standard deviation, with the standard deviation being the square root of the variance. Estimates won’t do in this case; the data must be accurate for the formula to provide the desired results.

There’s also interest rate risk, inflation risk and political risk to name a few. One measure of ~ widely followed by investors is the Chicago Board Options Exchange Market ~ Index, or the VIX . Commonly referred to as the ‘fear index’ or ‘fear gauge’, the VIX was introduced by Robert Whaley, a then-professor at Duke University, in 1993.

Policies that touch on tax and interest rates can bring significant changes in the market, thus affecting the volatility of that particular market. For instance, lets say a central bank decides to set the short-term interest rates for overnight borrowing by regional banks. When this happens, there will be fierce reactions in their stock market. This is due to its association with periods of market uncertainty. Volatility can provide a range of opportunities for traders, especially because derivative products enable them to profit from markets that are falling in price, as well as rising. Volatility is often measured using standard deviation, or by looking at the variation between the asset’s price movements and the movements of its underlying index. My Trading Skills® is a registered trademark and trading name of PMJ Publishing Limited.

Though volatility isn’t the same as risk, volatile assets are often considered riskier because their performance is less predictable. A beta of more than one indicates that a stock has historically moved more than the S&P 500. For example, a stock with a beta of 1.2 could be expected to rise by 1.2% on average if the S&P rises by 1%. On the other hand, a beta of less than one implies a stock that is less reactive to overall market moves. And finally, a negative beta tells investors that a stock tends to move in the opposite direction from the S&P 500. For individual stocks, volatility is often encapsulated in a metric called beta.

The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Where the broker or a third party sends a notification to a trader that a securities price has hit a certain preset condition. Simply identify a squeeze in BB bands and wait for the price to close outside the Bands in either direction. An outside close triggers a trade in the direction of the price momentum. In the example above, a short position would be executed after the bearish candle closed below the Bollinger Bands, with a stop-loss placed above the recent swing high.

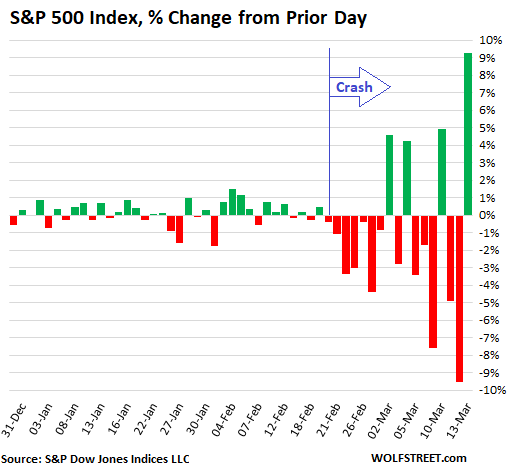

If a stock loses 50%, it has to gain 100% to get back to even. If a stock loses 10%, it has to gain 11.1% to get back to even. More recently, the financial crisis of 2008 produced a drop of nearly 7% in the DJIA on September 29. But that figure was surpassed when the COVID-19 coronavirus pandemic hit the U.S., causing the DJIA to drop by 12.9% on March 16, 2020. Black Monday caused the Dow Jones Industrial Average to drop by 22.6% on October 19, but it recovered 57% of that decline within two trading sessions. A detailed study by professors at the London Business School has found that, globally, shares have rewarded investors with a real or inflation adjusted rate of return of just over 5% since 1900.

Alternative Measures Of Volatility

Volatility is the degree of variance in an asset’s traded price within a specific timeframe and is typically measured by the standard deviation of logarithmic returns. Volatility is what makes markets move, and prices fluctuate back and forth from the underlying forces of supply and demand between buyers and sellers. The Chicago Board Options Exchange offers its signature VIX Volatility Index to institutional traders. The tool provides a measure of the S&P 500‘s expected volatility based on index options. However, it is utilized globally as a benchmark for overall financial market volatility.

- Invesco Capital Management LLC, investment adviser and Invesco Distributors, Inc., ETF distributor are indirect, wholly owned subsidiaries of Invesco Ltd.

- A stock with a price that changes quickly and regularly is more volatile.

- At the same time, you are foregoing all the magic of compounding interest.

- You alone are responsible for evaluating the merits and risks associated with the use of our systems, services or products.

- When there is stock market volatility, it’s not an excuse to buy any company because its price has fallen.

This describes the degree that a person relates to the stereotypes and norms that others associate with their specific identity. This is when a specific characteristic or trait of a person is prominent in certain situations when compared to other people. For example, as mentioned by Bodenhausen and Peery, when there is one woman in a room full of men. She sticks out because she is the only one of her gender compared to many others of the opposite gender. However, all of the men are clumped together because they do not have any specific traits that stands out among the rest of them. Comparative fit shows that people categorize others based on the comparative social context. In a certain situation, specific characteristics are made obvious due to the fact that others around that individual do not possess that characteristic.

The prices used to compute VIX Index values are midpoints of real-time S&P 500 option bid/ask price quotations. Stock with a beta greater than 1 are more volatile than the market. A beta value between 0 and 1 indicates that the stock is less volatile than the market. If beta is equal to 1, it implies that the stock is as volatile as the market.