Table of Contents

- Trading

- Find A Great Commission Free Stock Broker

- Learn To Use Market Orders And Limit Orders

- Planning And Risk Management

- Choose Your Broker Wisely

- Start Trading Stocks Online

They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds. Avoid leverage – In simple terms, leverage means using borrowed money to carry out your stock market strategy. However, it is best suited after you gain experience and confidence in your decision-making abilities.

You can share the certificate with your friends, relatives, co-workers and potential employers. Also, include it in your resume/CV, professional social media profiles and job applications. Yes, you will be required to complete a multiple-choice test online at the end of your course, you can do this test as many times as you require. Providing you have internet access you can start this course whenever you like, just go to the login page and insert your username and password and you can access the online material. No, anyone who has an interest in learning more about this subject matter is encouraged to take our course.

Trading

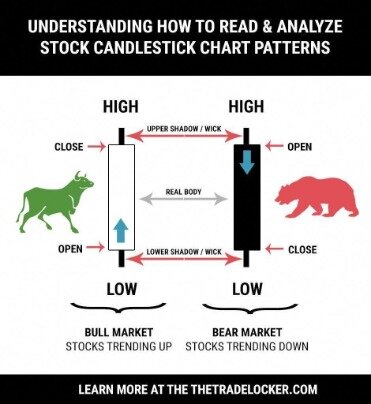

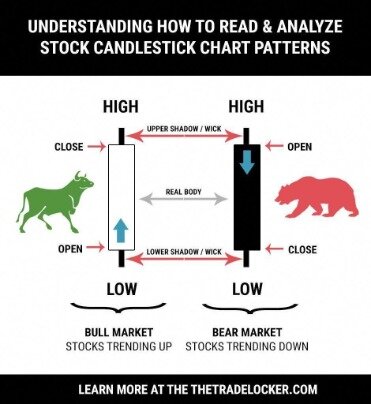

In contrast, investors typically use another type of analysis, fundamental analysis, because of its focus on the long term. Technical analysis makes use of moving averages to track security prices. Moving averages measure the average price of the security over a set of period of time. Stock trading is a risky investment and it is only wise to learn all the ropes before starting out to avoid making mistakes that might cause you your investment.

Read reviews of people who have completed the course before signing up. You can also reach out to the stock trading schools and speak with someone who teaches the class or works for the company to get a better grasp of what you’ll get out of the class. Learn the fundamentals and decide what strategy works best for you before you put your money in the market. Mentorship and skilled expertise can go a long way to help you create a strategy that works for you.

Find A Great Commission Free Stock Broker

TD Ameritrade and ETrade both have mobile apps that you can use if you hold one of their online accounts. These apps allow you to make trades and do research on the go. In addition, Robinhood is an app that offers free trades to its users and is renowned for its easy-to-use interface. A Demat account, which stands for a dematerialized account, is a type of trading account used in India. With this type of account, the stockholder holds their securities in an online account rather than physically holding the stock certificates.

If you have already started trading, then you may know that you simply want to invest in the stock market. Usually this trading requires the use of sophisticated technology and tools. For that, there are a number of top day trading software that day traders routinely rely upon. Enjoy $0 commission on online U.S. listed stock, ETF, and options trades with no account minimums. Once you do get started, don’t be afraid to take things slowly at first as you get your bearings.

Learn To Use Market Orders And Limit Orders

Courses For Success is a global course platform that started in 2008 with 5 courses, since then we have grown to over 10,000 online courses. As our courses are delivered online via the internet, we sell our courses worldwide. When it comes to fundamental traders, understanding when economic data is published is important. In the United States, most economic data is released at market open on a regular basis.

It is determined by taking the stock’s P/E ratio and comparing it to the company’s expected earnings growth. The higher the PEG ratio, the higher the company’s growth potential. Product and service reviews are conducted independently by our editorial team, but we sometimes make money when you click on links.

Planning And Risk Management

This means that you sold shares, that you didn’t have, for $1,000 total and have now replaced them for $900, netting yourself a $100 profit. Similarly, a stop order instructs the broker to buy or sell a security if the price rises above or falls below a certain point. However, the price that the stop order will be filled at is not guaranteed .

- Sorry if it seems we’re stating the obvious, but you never know!

- The most intimidating part of learning how to trade stocks online is getting used to the stock market environment.

- Think through your investment strategies and strive to make smart decisions.

- Try to detect a pattern in how the price swings, and predict when the stock price will drop.

- The ThinkorSwim platform is one of the best paper trading platforms in the industry.

- Paper trading doesn’t engage these emotions, which can only be experienced by actual profit and loss.

The borrowed money can increase your investing budget, helping you to expand your portfolio. Borrowing to trade is a great way to get yourself into debt when things go wrong. Once you’ve been trading stocks for a while, you’ll start to gain experience and thus confidence. Eventually, you may be tempted to venture into some more advanced trade strategies. Nerdwallet provides a list of free educational resources that can help you learn how to buy and trade stocks. You can also find online courses through massive open online course sites like Udemy or LinkedIn Classroom.

Current performance may be lower or higher than the performance data quoted. SpeedTrader and Centerpoint allow you to use the DasTrader platform for charting and order executions. If you’re looking to become a professional day trader then the DAS platform is the top in the industry.

As a beginner, starting with an exchange-traded fund should be a consideration. An ETF represents a bundle of stocks, which can help spread your risk.

You’ve contributed the annual maximums to a 401 and an IRA and are likely on track to meet retirement goals. You’re also willing and able to take on more risk by stock trading. In this case, you might want to open a taxable brokerage account with an online broker and trade within that account. A trader who shorts stock sells the stock first and then buys it later.

How do beginners trade stocks online?

If you’re itching to get hands-on with some active online trading, this guide will help get you started. 1. Decide if this is the right strategy for you. You might consider trading stocks if:

2. Get an education.

3. Select an online broker.

4. Start researching stocks.

5. Make a plan and stick to it.

Read our full review on Warrior Trading Pro, Best Online Stock Brokers for Beginners, Best Brokers for Penny Stocks. Get real-time market data, analysis tools and $0 commissions.

Individuals will now exchange stocks using an online trading network provided by online brokers. To be genuinely competitive in stock trading, as in any discipline, it takes zeal, hard work, and years of experience. Anyone who claims that trading the capital markets is a fast and simple way to make money is most definitely lying. This course would not have any proprietary investment strategies or a guarantee of profits. Trading stocks, analyzing investments, and following the financial markets are a part of an overall healthy financial strategy. You may not notice gains every day, but investing over the long term is a long-respected way to ensure financial stability in the future.

Or, perhaps you’re loyal to a brand and have faith that it will grow. Before you get active with online trading, you should always educate yourself first. Learning how to trade stocks online can be tricky if you don’t know how to get started. Use this beginner’s guide so that you can start trading stocks online with confidence.

These fees add up quickly and can significantly cut into your losses. Short selling is when a trader sells shares of security that they do not yet own or have borrowed. Short selling can be used to make a profit or hedge against risk, however it is very risky. You borrow 10 shares and sell them at the current market price. You are now “short,” as you have sold shares that you didn’t own and will eventually have to return them to the lender. Orders are what traders use to specify the trades that they would like their brokers to make for them.