Table of Contents

- Stocks: Fundamental Analysis

- Learn Day Trading The Right Way

- Can You Become Rich By Trading Stocks?

- Beginner Stock Market Day Trading Course By Braylen Pinkney Skillshare Course Access This Course Free For 14 Days

- The Best Day Trading Courses:

- The Importance Of Vwap Intraday

The course, which offers students a full day of live trading, costs $99 per month. TradePro Academy’s Trader Pro course focuses on futures trading and offers a daily live trading room. This course will teach you how to day trade stocks, prepare in the pre-market, scan for low and high float stocks, trade red to green moves, buy the dip, and much more. Entering the day trade room with sound knowledge of risk management strategies ensures your success. Discover four powerful strategies to master day trading. The course shows you how to analyze gaps, breakouts, candle patterns, and where to enter, exit, and place stops.

Is Day Trading Easy?

Day trading involves buying and selling stocks with the aim of earning short-term profits. It is difficult to succeed at day trading, so investors should take several precautions.

The company also offers several options for in-person training, provided at various locations around the country through educational franchising. Investopedia is the Wikipedia of finance – almost everything you could ever want to know about money, the economy, and more, can be found on Investopedia. The rules were approved by the NASD Regulation Board of Directors and then filed with the Securities and Exchange Commission . On February 18, 2000, the SEC published NASD’s proposed rules for comment in the Federal Register. The SEC also published for comment substantially similar rule changes that were proposed by the New York Stock Exchange .

Stocks: Fundamental Analysis

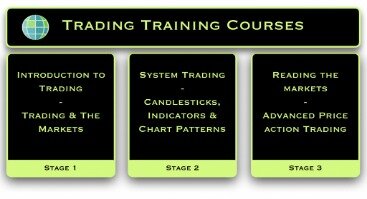

Even experienced traders discover benefits using Black Box Stocks. Black Box Stocks provides insights into nearly all trading-related topics. That’s why their fast-growing community of traders is the perfect starting point for beginners. The Black Box Stocks Trading Boot Camp is available for free to all subscribers and covers topics like how to trade options and stocks. For our beginning students, we understand that trading can be daunting. That’s why we structure our program to start with the fundamentals; establishing a solid foundation for the trader that knows nothing about the markets.

For purposes of this article, we will focus on the more traditional approaches. Because traders and learners always search for free online scalping techniques. Scalping is when a trader gain profits from small price movements of the securities.

Yes, but there is no shortcut to accumulating wealth. All in all, the most wealthiest investors have succeeded by investing over a long period of time, e.g., years or even decades. Successful investors avoid risky, short term trading strategies like day trading. Ross educates beginners about the best practices to day trade successfully. Ross mainly trades small-cap stocks, but the strategies also work for large-cap momentum stocks.

Learn Day Trading The Right Way

If you free-ride, your broker is required to place a 90-day freeze on the account. If you exceed your day-trading buying power limitations, your brokerage firm will issue a day-trading margin call to you. You will have, at most, five business days to deposit funds to meet this day-trading margin call. Until the margin call is met, your day-trading account will be restricted to day-trading buying power of only two times maintenance margin excess based on your daily total trading commitment. The minimum equity requirements on any day in which you trade is $25,000.

After Black Monday , the SEC adopted “Order Handling Rules” which required market makers to publish their best bid and ask on the NASDAQ. All product names and trademarks/wordmarks are the property of their respective owners, which are in no way associated or affiliated with Saraval Industries Corp. Product names and images are used solely for the purpose of identifying the specific products to be sold in either new or used condition. Use of these names and/or images does not imply any co-operation or endorsement.

Can You Become Rich By Trading Stocks?

This kind of movement is necessary for a day trader to make any profit. Someone has to be willing to pay a different price after you take a position. It’s paramount to set aside a certain amount of money for day trading. Don’t trade more than that amount or use the mortgage or rent money. OANDA does not charge a commission on trades once you begin live trading. Rather, the company makes money by charging a slightly higher bid/askspread—the difference between the buyer’s and the seller’s prices—to enter or exit a trade. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader.

On the other hand, traders who wish to queue and wait for execution receive the spreads . Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk .

Beginner Stock Market Day Trading Course By Braylen Pinkney Skillshare Course Access This Course Free For 14 Days

Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. Some traders might be willing to hold overnight, while others won’t and prefer to maintain a neutral position in case bad news hits before they can react.

These markets require less capital and are also great day trading markets. Many traders also find day trading difficult because the price can change direction so quickly. A short-term trend may only last 10 minutes, and timing needs to impeccable to capture the bulk of it. Capturing part of a trend that lasts for multiple days or weeks may be easier for some people. Another setback with day trading a cash account is that trades take time to settle, which can be an issue with a small account. We are buying or selling something, and that cash needs to change hands. It takes the Transaction day + 2 business days for the funds to settle.

Traders will buy a rising stock or “fade” a falling one, anticipating that the momentum will continue. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor.

- Do you want to learn the how to trade the most popular day trading strategies?

- Ultimately, you’ve got to learn to make that choice for yourself.

- Trader Executive students get to keep 70% of the profits and continue to get additional funds into their day trading accounts on a quarterly basis if they maintained profitability.

- The minimum amount that you need is $25,000 to avoid the pdt rule.

- An increasing number of people are turning to stock trading as a way to supplement their income, while those who are the most committed to acquiring the requisite knowledge can do quite well financially.

- We’ve reviewed some of the best day trading courses available, along with some tips on how to identify a great day trading course.

Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. Years ago, day trading was primarily the province of professional traders at banks or investment firms. With the advent of electronic trading, day trading has become increasingly popular with individual investors. Day Trading is one of the most common types of trading where a trader purchase and sell a security within a single trading day. Forex and stock markets are the markets where day trading occur most frequently. Day trading was originally carried out by professional traders but advancement in technology has enabled more and more non-professional traders to participate.

The Best Day Trading Courses:

There are many other strategies and nuances you can implement as you become more adept at day trading. Commissions can cost a day trader thousands of dollars annually. Becoming a profitable day trader can require years of thorough research. We update our Training Platform periodically with new lessons, so you can enhance your skills and develop new day trading strategies. If a picture is worth a thousand words, then a video is priceless. You’ll love how our easy-to-follow presentations make it easy and fun to learn even the most advanced trading strategies.

Complicated analysis and charting software are other popular additions. These types of systems can cost from tens to hundreds of dollars per month to access. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy and hold and value investing strategies.

Please assess your financial circumstances and risk tolerance prior to trading on margin. With pullback trading it’s critical to ensure that a clearly defined trend is already in place. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. A clearly defined downtrend would be two lower lows and two lower highs.

For more details on different types of trading firms, and the pros and cons of each, see How to Get Started in Day Trading. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Day trading is hard, and there’s no guarantee you will make any money at all. Day trading is the opposite of a long-term investment strategy, in which one holds stocks or securities in hopes that they appreciate in value over time. Instead, day trading is about buying the dips and selling high in the short term – the long-term prospects of a stock or security mean far less than immediate volatility.